| |

Barings

Participation

Investors |

|

| |

Report

for the

Three

Months Ended March 31, 2020

|

|

| |

|

|

|

| |

|

|

| |

|

|

| |

Beginning

on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s

annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the

reports. Instead, the reports will be made available on the Fund’s website http://www.barings.com/MPV, and you will be notified

by mail each time a report is posted and provided with a website link to access the report.

If

you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take

any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting

your financial intermediary (such as a broker-dealer or bank).

You

may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact

your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to

receive reports in paper will apply to all funds held in your account.

|

|

| |

|

|

Adviser

Barings LLC

300 S Tryon St., Suite 2500

Charlotte, NC 28202

Independent Registered

Public Accounting Firm

KPMG LLP

Boston, Massachusetts 02110

Counsel to the Trust

Ropes & Gray LLP

Boston, Massachusetts 02111

Custodian

State Street Bank and Trust Company

Boston, Massachusetts 02110

|

Transfer Agent & Registrar

DST Systems, Inc.

P.O. Box 219086

Kansas City, Missouri 64121-9086

1-800-647-7374

Internet Website

www.barings.com/mpv

|

|

Barings Participation Investors

c/o Barings LLC

300 S Tryon St., Suite 2500

Charlotte, NC 28202

1-866-399-1516

|

Investment Objective and

Policy

Barings Participation Investors (the “Trust”)

is a closed-end management investment company, first offered to the public in 1988, whose shares are traded on the New York Stock

Exchange under the trading symbol “MPV”. The Trust’s share price can be found in the financial section of most

newspapers under either the New York Stock Exchange listings or Closed-End Fund Listings.

The Trust’s investment objective

is to maintain a portfolio of securities providing a current yield and, when available, an opportunity for capital gains. The Trust’s

principal investments are privately placed, below investment grade, long-term debt obligations including bank loans and mezzanine

debt instruments. Such private placement securities may, in some cases, be accompanied by equity features such as common stock,

preferred stock, warrants, conversion rights, or other equity features. The Trust typically purchases these investments, which

are not publicly tradable, directly from their issuers in private placement transactions. These investments are typically made

to small or middle market companies. In addition, the Trust may invest, subject to certain limitations, in marketable debt securities

(including high yield and/or investment grade securities) and marketable common stock. Below investment grade or high yield securities

have predominantly speculative characteristics with respect to the capacity of the issuer to pay interest and repay capital.

The Trust distributes substantially all

of its net income to shareholders each year. Accordingly, the Trust pays dividends to shareholders in January, May, August, and

November. All registered shareholders are automatically enrolled in the Dividend Reinvestment and Cash Purchase Plan unless cash

distributions are requested.

Form N-PORT

The Trust files its complete schedule

of portfolio holdings with the U.S. Securities and Exchange Commission (“SEC”) for the first and third quarters

of each fiscal year on part F of Form N-PORT. This information is available (i) on the SEC’s website at http://www.sec.gov;

and (ii) at the SEC’s Public Reference Room in Washington, DC (which information on their operation may be obtained

by calling 1-800-SEC-0330). A complete schedule of portfolio holdings as of each quarter-end is available upon request by calling,

toll-free, 866-399-1516.

|

|

Proxy Voting Policies &

Procedures; Proxy Voting Record

The Trustees of the Trust have delegated

proxy voting responsibilities relating to the voting of securities held by the Trust to Barings LLC (“Barings”). A

description of Barings’ proxy voting policies and procedures is available (1) without charge, upon request, by calling,

toll-free 866-399-1516; (2) on the Trust’s website at www.barings.com/mpv; and (3) on the SEC’s website at

http://www.sec.gov. Information regarding how the Trust voted proxies relating to portfolio securities during the most recent 12-month

period ended June 30 is available (1) on the Trust’s website at www.barings.com/mpv; and (2) on the SEC’s

website at http://www.sec.gov.

Legal Matters

The Trust has entered into contractual

arrangements with an investment adviser, transfer agent and custodian (collectively “service providers”) who each provide

services to the Trust. Shareholders are not parties to, or intended beneficiaries of, these contractual arrangements, and these

contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek

any remedy under them against the service providers, either directly or on behalf of the Trust.

Under the Trust’s Bylaws, any claims

asserted against or on behalf of the Trust, including claims against Trustees and officers must be brought in courts located within

the Commonwealth of Massachusetts.

The Trust’s registration statement

and this shareholder report are not contracts between the Trust and its shareholders and do not give rise to any contractual rights

or obligations or any shareholder rights other than any rights conferred explicitly by federal or state securities laws that may

not be waived.

|

Barings Participation Investors

TO OUR SHAREHOLDERS

April 30, 2020

We are pleased to present the March 31,

2020 Quarterly Report of Barings Participation Investors (the “Trust”).

The Board of Trustees declared a quarterly

dividend of $0.20 per share, payable on May 15, 2020 to shareholders of record on May 4, 2020. This dividend represents a 26% reduction

from the $0.27 per share quarterly dividend for the past year and reflects an assessment of current market conditions as well as

an increased level of non-accrual investments. The Trust earned $0.27 per share of net investment income for the first quarter

of 2020, compared to $0.21 per share in the previous quarter. Of the $0.27 per share earned in the first quarter, $0.22 per share

was recurring in nature and approximately $0.05 per share was related to non-recurring past due interest received.

During the first quarter, the net assets

of the Trust decreased to $137,864,088 or $13.00 per share compared to $146,082,130 or $13.80 per share on December 31, 2019. This

translates to a -5.8% total return for the quarter, based on the change in the Trust’s net assets assuming the reinvestment

of all dividends. Longer term, the Trust returned 3.4%, 6.6%, 6.7%, 10.5% and 11.8% for the 1, 3, 5, 10, and 25-year periods, respectively,

based on the change in the Trust’s net assets assuming the reinvestment of all dividends.

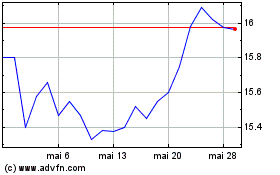

The Trust’s share price decreased

27.8% during the quarter, from $16.13 per share as of December 31, 2019 to $11.64 per share as of March 31, 2020. The Trust’s

market price of $11.61 per share equates to a 10.5% discount to the March 31, 2020 net asset value per share of $13.00. The Trust’s

average quarter-end premium for the 3, 5 and 10-year periods was 8.2%, 6.2% and 8.9%, respectively. U.S. equity markets, as approximated

by the Russell 2000 Index, decreased 30.6% for the quarter. U.S. fixed income markets, as approximated by the Bloomberg Barclays

U.S. Corporate High Yield Index and the Credit Suisse Leverage Loan Index, decreased 12.7% and 13.2% for the quarter, respectively.

The Trust closed six new private placement

investments and seven add-on investments to existing portfolio companies during the first quarter. The total amount invested by

the Trust in these transactions was $6,546,068. Of note, all of the new platform and add-on investments were floating rate term

loans with one small equity co-investment.

Middle market merger and acquisition activity

slowed during the first quarter of 2020 as a result of economic stress and uncertainty caused by COVID-19 in March 2020. The lower

M&A activity and increased need for internal portfolio company liquidity led to lower new investment activity compared to prior

quarters. With fewer opportunities in the market, we anticipate a continued competitive environment. As always, we continue to

be selective in our investment choices and maintain our underwriting discipline.

Due to COVID-19, the Trust’s current

portfolio is experiencing an increased level of economic stress. During the first quarter, four mezzanine debt issuers missed their

quarterly interest payments and were placed on non-accrual. Additionally, one senior term loan issuer was designated as a PIK non-accrual

due to the company only paying a partial cash interest payment during the quarter. The new non-accrual investments represent approximately

$0.02 in quarterly income for the Trust. On a go forward basis, we do anticipate a rise in non-accrual loans.

Realization activity continued through

the first quarter with four private investment exits during the quarter, all of which resulted in favorable results. In addition,

three companies fully prepaid their debt held by the Trust. These realizations all occurred prior to March 2020. Based on COVID-19

and its underlying economic impact, we would anticipate realizations to slow as a result of lower M&A activity.

As has been mentioned in prior reports

and investor communications since 2013, recurring investment income alone has generally not been sufficient to fully fund the dividend

rate, which has been supplemented by non-recurring income and earnings carry forwards. This is due principally to the reduction

in the number of higher yielding junior debt investment opportunities to replace prepayments and realizations in the portfolio,

combined with generally lower investment returns available due to declining interest rates and market dynamics in recent years.

To the extent the Trust’s portfolio companies are adversely impacted by the effects of the COVID-19 pandemic, it may have

a material adverse impact on the Trust’s future net investment income, the value of its portfolio investments, its financial

condition and the results of operations and financial condition of the Trust’s portfolio companies.

(Continued)

Thank you for your continued interest

in and support of Barings Participation Investors.

Sincerely,

Christina Emery

President

* Based

on market value of total investments

Cautionary

Notice: Certain statements contained in this report may be “forward looking” statements. Investors are cautioned not

to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect

management’s current estimates, projections, expectations or beliefs, and which are subject to risks and uncertainties that

may cause actual results to differ materially. These statements are subject to change at any time based upon economic, market

or other conditions and may not be relied upon as investment advice or an indication of the Trust’s trading intent. References

to specific securities are not recommendations of such securities, and may not be representative of the Trust’s current

or future investments. We undertake no obligation to publicly update forward looking statements, whether as a result of new information,

future events, or otherwise.

Barings Participation Investors

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES

March 31, 2020

(Unaudited)

| | |

| |

| Assets: | |

| |

Investments

(See Consolidated Schedule of Investments) | |

| | |

Corporate restricted securities at fair value

(Cost - $122,559,524) | |

$ | 113,863,500 | |

Corporate restricted securities at market value

(Cost - $14,094,735) | |

| 12,469,269 | |

Corporate public securities at market value

(Cost - $8,781,883) | |

| 6,772,666 | |

| Short-term securities at amortized cost | |

| 998,227 | |

| | |

| | |

| Total investments (Cost - $146,434,369) | |

| 134,103,662 | |

| | |

| | |

| Cash | |

| 18,849,538 | |

| Interest receivable | |

| 1,243,396 | |

| Receivable for investments sold | |

| 50,329 | |

| Other assets | |

| 19,871 | |

| | |

| | |

| Total assets | |

| 154,266,796 | |

| | |

| | |

| | |

| | |

| Liabilities: | |

| | |

| Note payable | |

| 15,000,000 | |

| Payable for investments purchased | |

| 522,633 | |

| Tax payable | |

| 399,039 | |

| Investment advisory fee payable | |

| 310,194 | |

| Interest payable | |

| 27,267 | |

| Accrued expenses | |

| 143,575 | |

| | |

| | |

| Total liabilities | |

| 16,402,708 | |

| | |

| | |

| Commitments and Contingencies (See Note 8) | |

| | |

| | |

| | |

| Total net assets | |

$ | 137,864,088 | |

| | |

| | |

| Net Assets: | |

| | |

| Common shares, par value $.01 per share | |

$ | 106,017 | |

| Additional paid-in capital | |

| 142,250,117 | |

| Total distributable earnings | |

| (4,492,046 | ) |

| | |

| | |

| Total net assets | |

$ | 137,864,088 | |

| | |

| | |

| Common shares issued and outstanding (14,787,750 authorized) | |

| 10,601,700 | |

| | |

| | |

| Net asset value per share | |

$ | 13.00 | |

See Notes to Consolidated

Financial Statements

CONSOLIDATED STATEMENT OF OPERATIONS

For the three months ended March 31,

2020

(Unaudited)

| Investment Income: | |

| | |

| Interest | |

$ | 3,423,614 | |

| Dividends | |

| 90,322 | |

| Other | |

| 4,467 | |

| | |

| | |

| Total investment income | |

| 3,518,403 | |

| | |

| | |

| | |

| | |

| Expenses: | |

| | |

| Investment advisory fees | |

| 310,194 | |

| Interest | |

| 153,375 | |

| Trustees’ fees and expenses | |

| 120,000 | |

| Professional fees | |

| 73,565 | |

| Custodian fees | |

| 6,000 | |

| Other | |

| 66,974 | |

| | |

| | |

| Total expenses | |

| 730,108 | |

| | |

| | |

| Investment income - net | |

| 2,788,295 | |

| | |

| | |

| | |

| | |

| Net realized and unrealized loss on investments: | |

| | |

| Net realized gain on investments before taxes | |

| 1,272,557 | |

| | |

| | |

| Net realized gain on investments after taxes | |

| 1,272,557 | |

| | |

| | |

| Net increase (decrease) in unrealized appreciation (depreciation) of investments before taxes | |

| (12,506,437 | ) |

| | |

| | |

| Net increase (decrease) in unrealized appreciation (depreciation) of investments after taxes | |

| (12,506,437 | ) |

| | |

| | |

| Net loss on investments | |

| (11,233,880 | ) |

| | |

| | |

| Net decrease in net assets resulting from operations | |

$ | (8,445,585 | ) |

See Notes to Consolidated

Financial Statements

Barings Participation Investors

CONSOLIDATED STATEMENT OF CASH FLOWS

For the three months ended March 31,

2020

(Unaudited)

| Net increase in cash: | |

| | |

| Cash flows from operating activities: | |

| | |

| Purchases/Proceeds/Maturities from short-term portfolio securities, net | |

$ | 4,822,038 | |

| Purchases of portfolio securities | |

| (14,784,362 | ) |

| Proceeds from disposition of portfolio securities | |

| 16,091,480 | |

| Interest, dividends and other income received | |

| 2,966,035 | |

| Interest expense paid | |

| (153,375 | ) |

| Operating expenses paid | |

| (568,281 | ) |

| Income taxes paid | |

| (14,800 | ) |

| | |

| | |

| Net cash provided by operating activities | |

| 8,358,735 | |

| | |

| | |

| | |

| | |

| Cash flows from financing activities: | |

| | |

| Cash dividends paid from net investment income | |

| (2,858,552 | ) |

| Receipts for shares issued on reinvestment of dividends | |

| 227,533 | |

| | |

| | |

| Net cash used for financing activities | |

| (2,631,019 | ) |

| | |

| | |

| Net increase in cash | |

| 5,727,716 | |

| Cash - beginning of period | |

| 13,121,822 | |

| | |

| | |

| Cash - end of period | |

$ | 18,849,538 | |

| | |

| | |

| | |

| | |

Reconciliation of net decrease in net assets to

net cash used for operating activities: | |

| | |

| | |

| | |

| Net decrease in net assets resulting from operations | |

$ | (8,445,585 | ) |

| | |

| | |

| Decrease in investments | |

| 16,523,410 | |

| Increase in interest receivable | |

| (271,773 | ) |

| Decrease in receivable for investments sold | |

| 54,294 | |

| Increase in other assets | |

| (17,896 | ) |

| Increase in payable for investments purchased | |

| 522,633 | |

| Decrease in tax payable | |

| (14,800 | ) |

| Decrease in investment advisory fee payable | |

| (18,491 | ) |

| Increase in accrued expenses | |

| 26,943 | |

| | |

| | |

| Total adjustments to net assets from operations | |

| 16,804,320 | |

| | |

| | |

| Net cash provided by operating activities | |

$ | 8,358,735 | |

See Notes to Consolidated

Financial Statements

CONSOLIDATED STATEMENTS OF CHANGES IN NET

ASSETS

| | |

For the three

months ended

3/31/2020

(Unaudited) | | |

For the

year ended

12/31/2019 | |

| Increase / (decrease) in net assets: | |

| | | |

| | |

| Operations: | |

| | | |

| | |

| Investment income - net | |

$ | 2,788,295 | | |

$ | 10,575,402 | |

| Net realized gain on investments after taxes | |

| 1,272,557 | | |

| 769,899 | |

| Net change in unrealized appreciation (depreciation) of investments after taxes | |

| (12,506,437 | ) | |

| 6,464,660 | |

| | |

| | | |

| | |

| Net (decrease) / increase in net assets resulting from operations | |

| (8,445,585 | ) | |

| 17,809,961 | |

| | |

| | | |

| | |

| Increase from common shares issued on reinvestment of dividends | |

| | | |

| | |

| Common shares issued (2020 - 14,472; 2019 - 60,330) | |

| 227,533 | | |

| 933,680 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Dividends to shareholders from: | |

| | | |

| | |

| Distributable earnings to Common Stock Shareholders (2020 - $nil per share; 2019 - $1.08 per share) | |

| — | | |

| (11,410,602 | ) |

| | |

| | | |

| | |

| Total (decrease) / increase in net assets | |

| (8,218,052 | ) | |

| 7,333,039 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Net assets, beginning of period | |

| 146,082,140 | | |

| 138,749,101 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Net assets, end of period | |

$ | 137,864,088 | | |

$ | 146,082,140 | |

See Notes to Consolidated

Financial Statements

Barings Participation Investors

CONSOLIDATED SELECTED FINANCIAL HIGHLIGHTS

Selected data for each share of beneficial

interest outstanding:

| | |

For the three

months ended

3/31/2020 | | |

For the years ended December 31, | |

| | |

(Unaudited) | | |

2019 | | |

2018 | | |

2017 | | |

2016 | |

| Net asset value: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Beginning of period / year | |

$ | 13.80 | | |

$ | 13.18 | | |

$ | 13.91 | | |

$ | 13.15 | | |

$ | 13.10 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net investment income (a) | |

| 0.26 | | |

| 1.00 | | |

| 1.03 | | |

| 1.09 | | |

| 1.00 | |

| Net realized and unrealized gain (loss) on investments | |

| (1.06) | | |

| 0.69 | | |

| (0.68) | | |

| 0.75 | | |

| 0.13 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total from investment operations | |

| (0.80) | | |

| 1.69 | | |

| 0.35 | | |

| 1.84 | | |

| 1.13 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dividends from net investment income to common shareholders | |

| — | | |

| (1.08) | | |

| (1.08) | | |

| (1.08) | | |

| (1.08) | |

| (Decrease) / Increase from dividends reinvested | |

| 0.00(b) | | |

| 0.01(b) | | |

| (0.00)(b) | | |

| (0.00)(b) | | |

| (0.00)(b) | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total dividends | |

| 0.00 | | |

| (1.07) | | |

| (1.08) | | |

| (1.08) | | |

| (1.08) | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net asset value: End of period / year | |

$ | 13.00 | | |

$ | 13.80 | | |

$ | 13.18 | | |

$ | 13.91 | | |

$ | 13.15 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Per share market value: | |

| | | |

| | | |

| | | |

| | | |

| | |

| End of period /year | |

$ | 11.64 | | |

$ | 16.13 | | |

$ | 15.05 | | |

$ | 14.10 | | |

$ | 14.20 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total investment return | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net asset value (c) | |

| (5.80%) | | |

| 13.21% | | |

| 2.53% | | |

| 14.29% | | |

| 8.75% | |

| Market value (c) | |

| (27.84%) | | |

| 14.72% | | |

| 15.02% | | |

| 7.21% | | |

| 11.45% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net assets (in millions): | |

| | | |

| | | |

| | | |

| | | |

| | |

| End of period / year | |

$ | 137.86 | | |

$ | 146.08 | | |

$ | 138.75 | | |

$ | 145.48 | | |

$ | 136.61 | |

| Ratio of total expenses to average net assets (d) | |

| 2.03%(e) | | |

| 2.26% | | |

| 2.76% | | |

| 3.23% | | |

| 2.26% | |

| Ratio of operating expenses to average net assets | |

| 1.60%(e) | | |

| 1.45% | | |

| 1.56% | | |

| 1.49% | | |

| 1.35% | |

| Ratio of interest expense to average net assets | |

| 0.43%(e) | | |

| 0.42% | | |

| 0.42% | | |

| 0.43% | | |

| 0.44% | |

| Ratio of income tax expense to average net assets | |

| 0.00%(e) | | |

| 0.39% | | |

| 0.78% | | |

| 1.31% | | |

| 0.47% | |

| Ratio of net investment income to average net assets | |

| 7.73%(e) | | |

| 7.30% | | |

| 7.47% | | |

| 7.92% | | |

| 7.45% | |

| Portfolio turnover | |

| 11% | | |

| 22% | | |

| 48% | | |

| 24% | | |

| 31% | |

| (a) | | Calculated using average shares. |

| (b) | | Rounds to less than $0.01 per share. |

| (c) | | Net asset value return represents portfolio returns based on change in the Trust’s net asset

value assuming the reinvestment of all dividends and distributions which differs from the total investment return based on the

Trust’s market value due to the difference between the Trust’s net asset value and the market value of its shares outstanding;

past performance is no guarantee of future results. |

| (d) | | Total expenses include income tax expense. |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| |

| Senior borrowings: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total principal amount (in millions) | |

$ | 15 | | |

$ | 15 | | |

$ | 15 | | |

$ | 15 | | |

$ | 15 | |

| Asset coverage per $1,000 of indebtedness | |

$ | 10,191 | | |

$ | 10,739 | | |

$ | 10,250 | | |

$ | 10,699 | | |

$ | 10,107 | |

See Notes to Consolidated

Financial Statements

CONSOLIDATED SCHEDULE OF INVESTMENTS

March 31, 2020

(Unaudited)

| Corporate Restricted Securities - 91.64%: (A) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| |

| Private Placement Investments - 82.59%: (C) |

| |

| 1A Smart Start, Inc. |

| A designer, distributor and lessor of ignition interlock devices (“IIDs”). IIDs are sophisticated breathalyzers wired to a vehicles ignition system. |

9.32% Second Lien Term Loan due 08/21/2022

(LIBOR + 8.250%) | |

$ | 1,725,000 | | |

12/21/17 | |

$ | 1,707,335 | | |

$ | 1,664,367 | |

| | |

| | | |

| |

| | | |

| | |

|

| 1WorldSync, Inc. |

|

| A product information sharing platform that connects manufacturers/suppliers and key retailers via the Global Data Synchronization Network. |

| 9.10% Term Loan due 6/24/2025 (LIBOR + 7.250%) | |

$ | 1,782,389 | | |

07/01/19 | |

| 1,686,109 | | |

| 1,620,877 | |

| | |

| | | |

| |

| | | |

| | |

|

| Accelerate Learning |

|

| A provider of standards-based, digital science education content of K-12 schools. |

| 5.57% Term Loan due 12/31/2024 (LIBOR + 4.500%) | |

$ | 974,753 | | |

12/19/18 | |

| 959,400 | | |

| 885,654 | |

| | |

| | | |

| |

| | | |

| | |

|

| Advanced Manufacturing Enterprises LLC |

|

| A designer and manufacturer of large, custom gearing products for a number of critical customer applications. |

| Limited Liability Company Unit (B) | |

| 1,945

uts. | | |

* | |

| 207,911 | | |

| — | |

| * 12/07/12, 07/11/13 and 06/30/15. | |

| | | |

| |

| | | |

| | |

| | |

| | | |

| |

| | | |

| | |

|

| AFC - Dell Holding Corporation |

|

| A distributor and provider of inventory management services for “C-Parts” used by OEMs in their manufacturing and production facilities. |

13% (1% PIK) Senior Subordinated Note

due 02/28/2022 | |

$ | 1,911,637 | | |

* | |

| 1,898,552 | | |

| 1,905,909 | |

| Preferred Stock (B) | |

| 73

shs. | | |

** | |

| — | | |

| 7,272 | |

| Preferred Stock Series A (B) | |

| 1,194 shs. | | |

** | |

| 112,153 | | |

| 176,800 | |

| Preferred Stock Series V (B) | |

| 53

shs. | | |

12/31/19 | |

| 5,251 | | |

| 5,847 | |

| Common Stock (B) | |

| 407

shs. | | |

** | |

| 363 | | |

| 22,149 | |

| Common Stock Series B (B) | |

| 44

shs. | | |

** | |

| — | | |

| 2,688 | |

| * 03/27/15, 11/16/18, 07/1/19, 08/21/19 and 12/05/19. | |

| | | |

| |

| 2,016,319 | | |

| 2,120,665 | |

| ** 03/27/15, 11/15/18 and 12/31/19. | |

| | | |

| |

| | | |

| | |

| | |

| | | |

| |

| | | |

| | |

|

| Aftermath, Inc. |

|

| A provider of crime scene cleanup and biohazard remediation services. |

| 7.58% Term Loan due 04/10/2025 (LIBOR + 5.750%) | |

$ | 1,249,996 | | |

04/09/19 | |

| 1,226,452 | | |

| 1,179,474 | |

| | |

| | | |

| |

| | | |

| | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

March 31, 2020

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| |

| American Scaffold, Inc. |

| A provider of scaffolding and environmental containment solutions. |

| 6.85% Term Loan due 09/06/2025 (LIBOR + 5.250%) | |

$ | 1,297,326 | | |

09/06/19 | |

$ | 1,270,906 | | |

$ | 1,221,895 | |

| | |

| | | |

| |

| | | |

| | |

|

| AMS Holding LLC |

|

| A leading multi-channel direct marketer of high-value collectible coins and proprietary-branded jewelry and watches. |

Limited Liability Company Unit Class A

Preferred (B)(F) | |

| 114

uts. | | |

10/04/12 | |

| 113,636 | | |

| 104,517 | |

| | |

| | | |

| |

| | | |

| | |

| ASC Holdings, Inc. | |

| | | |

| |

| | | |

| | |

|

| A manufacturer of capital equipment used by corrugated box manufacturers. |

13% (1% PIK) Senior Subordinated Note

due 05/18/2021 | |

$ | 887,177 | | |

11/19/15 | |

| 883,207 | | |

| 798,459 | |

| Limited Liability Company Unit (B) | |

| 111,100

uts. | | |

11/18/15 | |

| 111,100 | | |

| 6,111 | |

| | |

| | | |

| |

| 994,307 | | |

| 804,570 | |

| ASPEQ Holdings | |

| | | |

| |

| | | |

| | |

|

| A manufacturer of highly-engineered electric heating parts and equipment for a range of industrial, commercial, transportation and marine applications. |

| 6.25% Term Loan due 10/31/2025 (LIBOR + 5.250%) | |

$ | 1,208,525 | | |

11/08/19 | |

| 1,191,601 | | |

| 1,148,275 | |

| | |

| | | |

| |

| | | |

| | |

| Audio Precision | |

| | | |

| |

| | | |

| | |

|

| A provider of high-end audio test and measurement sensing instrumentation software and accessories. |

| 7.45% Term Loan due 10/31/2024 (LIBOR + 6.000%) | |

$ | 1,777,500 | | |

10/30/18 | |

| 1,750,736 | | |

| 1,645,520 | |

| | |

| | | |

| |

| | | |

| | |

| Aurora Parts & Accessories LLC | |

| | | |

| |

| | | |

| | |

|

| A distributor of aftermarket over-the-road semi-trailer parts and accessories sold to customers across North America. |

| 14% Junior Subordinated Note due 08/17/2022 | |

$ | 12,892 | | |

08/30/18 | |

| 12,892 | | |

| 12,857 | |

| 11% Senior Subordinated Note due 02/17/2022 | |

$ | 1,515,400 | | |

08/17/15 | |

| 1,504,714 | | |

| 1,515,400 | |

| Preferred Stock (B) | |

| 210

shs. | | |

08/17/15 | |

| 209,390 | | |

| 209,390 | |

| Common Stock (B) | |

| 210

shs. | | |

08/17/15 | |

| 210 | | |

| 9,909 | |

| | |

| | | |

| |

| 1,727,206 | | |

| 1,747,556 | |

| Avantech Testing Services LLC | |

| | | |

| |

| | | |

| | |

|

| A manufacturer of custom Non-Destructive Testing

(“NDT”) systems and provider of NDT and inspections services primarily to the oil country tubular goods

market. |

15% (3.75% PIK) Senior Subordinated Note

due 03/31/2021 (D) | |

$ | 6,777 | | |

07/31/14 | |

| 6,650 | | |

| — | |

Limited Liability Company Unit Class C

Preferred (B)(F) | |

| 78,358

uts. | | |

09/29/17 | |

| 484,578 | | |

| — | |

| * 07/31/14 and 10/14/15. | |

| | | |

| |

| 491,228 | | |

| — | |

| | |

| | | |

| |

| | | |

| | |

| | |

| | | |

| |

| | | |

| | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

March 31, 2020

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| | |

| | |

| |

| | |

| |

| BBB Industries LLC | |

| | |

| |

| | |

| |

| A supplier of re-manufactured parts to the North American automotive aftermarket. | |

| | |

| |

9.49% Second Lien Term Loan due 08/02/2026

(LIBOR + 8.500%) | |

$ | 1,725,000 | | |

08/02/18 | |

$ | 1,683,941 | | |

$ | 1,605,619 | |

| | |

| | | |

| |

| | | |

| | |

| BCC Software, Inc. | |

| | | |

| |

| | | |

| | |

|

| A provider of software and data solutions which enhance mail processing to help direct mail marketers realize discounts from the U.S. Postal Service, avoid penalties associated with mailing errors, and improve the accuracy and efficiency of marketing campaigns. |

12% (1% PIK) Senior Subordinated Note

due 04/11/2023 | |

$ | 1,925,102 | | |

* | |

| 1,900,403 | | |

| 1,913,071 | |

| Preferred Stock Series A (B) | |

| 27

shs. | | |

* | |

| 272,163 | | |

| 272,200 | |

| Common Stock Class A (B) | |

| 783

shs. | | |

* | |

| 861 | | |

| 528,863 | |

| * 10/11/17 and 01/28/19. | |

| | | |

| |

| 2,173,427 | | |

| 2,714,134 | |

| | |

| | | |

| |

| | | |

| | |

| BDP International, Inc. | |

| | | |

| |

| | | |

| | |

|

| A provider of transportation and related services to the chemical and life sciences industries. |

| 6.20% Term Loan due 12/14/2024 (LIBOR + 4.750%) | |

$ | 2,434,188 | | |

12/18/18 | |

| 2,395,944 | | |

| 2,264,556 | |

| | |

| | | |

| |

| | | |

| | |

| Beacon Pointe Advisors, LLC | |

| | | |

| |

| | | |

| | |

|

| An integrated wealth management platform with comprehensive financial planning capabilities for high net worth clients with complex financial needs. |

| 7.25% Term Loan due 03/31/2026 | |

| | | |

| |

| | | |

| | |

| Term Loan (LIBOR + 5.000%) | |

$ | 1,000,000 | | |

03/31/20 | |

| 613,870 | | |

| 613,941 | |

| | |

| | | |

| |

| | | |

| | |

| BEI Precision Systems & Space Company, Inc. | |

| | | |

| |

| | | |

| | |

|

| A provider of advanced design, manufacturing, and testing for custom optical encoder-based positioning systems, precision accelerometers, and micro scanners. |

12% (1% PIK) Senior Subordinated Note

due 04/28/2024 | |

$ | 1,491,908 | | |

04/28/17 | |

| 1,472,134 | | |

| 1,481,721 | |

| Limited Liability Company Unit (B)(F) | |

| 4,167

uts. | | |

* | |

| 416,654 | | |

| 304,726 | |

| * 04/28/17 and 02/07/19. | |

| | | |

| |

| 1,888,788 | | |

| 1,786,447 | |

| | |

| | | |

| |

| | | |

| | |

| Blue Wave Products, Inc. | |

| | | |

| |

| | | |

| | |

| A distributor of pool supplies. | |

| | | |

| |

| | | |

| | |

13% (1% PIK) Senior Subordinated Note

due 09/30/2020 | |

$ | 84,787 | | |

10/12/12 | |

| 84,779 | | |

| 63,591 | |

| Common Stock (B) | |

| 51,064

shs. | | |

10/12/12 | |

| 51,064 | | |

| — | |

Warrant, exercisable until 2022, to purchase

common stock at $.01 per share (B) | |

| 20,216

shs. | | |

10/12/12 | |

| 20,216 | | |

| — | |

| | |

| | | |

| |

| 156,059 | | |

| 63,591 | |

| | |

| | | |

| |

| | | |

| |

|

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

March 31, 2020

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| | |

| | |

| |

| | |

| |

| BlueSpire Holding, Inc. | |

| | |

| |

| | |

| |

| A marketing services firm that integrates strategy, technology, and content to deliver customized marketing solutions for clients in the senior living, financial services and healthcare end markets. |

| Common Stock (B) | |

| 2,956

shs. | | |

06/30/15 | |

$ | 937,438 | | |

$ | 14,553.00 | |

| | |

| | | |

| |

| | | |

| | |

| Brown Machine LLC | |

| | | |

| |

| | | |

| | |

|

| A designer and manufacturer of thermoforming equipment used in the production of plastic packaging containers within the food and beverage industry. |

| 6.70% Term Loan due 10/04/2024 (LIBOR + 5.250%) | |

$ | 680,840 | | |

10/03/18 | |

| 674,445 | | |

| 621,853 | |

| | |

| | | |

| |

| | | |

| | |

| Cadence, Inc. | |

| | | |

| |

| | | |

| | |

|

| A full-service contract manufacturer (“CMO”) and supplier of advanced products, technologies, and services to medical device, life science, and industrial companies. |

5.50% First Lien Term Loan due 04/30/2025

(LIBOR + 4.500%) | |

$ | 895,325 | | |

* | |

| 882,136 | | |

| 844,296 | |

| * 05/14/18 and 05/31/19. | |

| | | |

| |

| | | |

| | |

| | |

| | | |

| |

| | | |

| | |

| Cadent, LLC | |

| | | |

| |

| | | |

| | |

|

| A provider of advertising solutions driven by data and technology. |

| 6.70% Term Loan due 09/07/2023 (LIBOR + 5.250%) | |

$ | 1,013,213 | | |

09/04/18 | |

| 1,006,209 | | |

| 960,592 | |

| | |

| | | |

| |

| | | |

| | |

| CHG Alternative Education Holding Company | |

| | | |

| |

| | | |

| | |

|

| A leading provider of publicly-funded, for profit pre-K-12 education services targeting special needs children at therapeutic day schools and “at risk” youth through alternative education programs. |

13.5% (1.5% PIK) Senior Subordinated Note

due 03/31/2023 | |

$ | 819,319 | | |

01/19/11 | |

| 818,858 | | |

| 811,982 | |

14% (2% PIK) Senior Subordinated Note

due 03/31/2023 | |

$ | 218,936 | | |

08/03/12 | |

| 218,777 | | |

| 208,712 | |

| Common Stock (B) | |

| 375

shs. | | |

01/19/11 | |

| 37,500 | | |

| 19,760 | |

Warrant, exercisable until 2021, to purchase

common stock at $.01 per share (B) | |

| 295

shs. | | |

01/19/11 | |

| 29,250 | | |

| 15,533 | |

| | |

| | | |

| |

| 1,104,385 | | |

| 1,055,987 | |

| Clarion Brands Holding Corp. | |

| | | |

| |

| | | |

| | |

|

| A portfolio of six over-the-counter (OTC) pharmaceutical brands whose products are used to treat tinnitus or ringing of the ear, excessive sweating, urinary tract infections, muscle pain, and skin conditions. |

| Limited Liability Company Unit (B) | |

| 1,853

uts. | | |

07/18/16 | |

| 189,267 | | |

| 304,511 | |

| | |

| | | |

| |

| | | |

| | |

| Claritas Holdings, Inc. | |

| | | |

| |

| | | |

| | |

|

| A market research company that provides market segmentation insights to customers engaged in direct-to-consumer and business-to-business marketing activities. |

| 7.45% Term Loan due 12/31/2023 (LIBOR + 6.000%) | |

$ | 1,605,844 | | |

12/20/18 | |

| 1,575,965 | | |

| 1,452,385 | |

| | |

| | | |

| |

| | | |

| | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

March 31, 2020

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| | |

| | |

| |

| | |

| |

| Clubessential LLC | |

| | |

| |

| | |

| |

| A leading SaaS platform for private clubs and resorts. |

7.83% (1% PIK) Senior Subordinated Note due

11/30/2023 (LIBOR + 6.250%) | |

$ | 1,725,000 | | |

01/09/20 | |

$ | 1,698,180 | | |

$ | 1,579,713 | |

| | |

| | | |

| |

| | | |

| | |

| Concept Machine Tool Sales, LLC | |

| | | |

| |

| | | |

| | |

|

| A full-service distributor of high-end machine tools and metrology equipment, exclusively representing a variety of global manufacturers in the Upper Midwest. |

| 6.78% Term Loan 01/31/2025 (LIBOR +5.000%) | |

$ | 628,407 | | |

01/31/20 | |

| 616,258 | | |

| 592,542 | |

| Limited Liability Company Unit (F) | |

| 1,159

shs. | | |

01/31/20 | |

| 46,434 | | |

| 46,430 | |

| | |

| | | |

| |

| 662,692 | | |

| 638,972 | |

| | |

| | | |

| |

| | | |

| | |

| CORA Health Services, Inc. | |

| | | |

| |

| | | |

| | |

| A provider of outpatient rehabilitation therapy services. | |

| | | |

| |

| | | |

| | |

| 12.45% (1% PIK) Term Loan due 05/05/2025 | |

$ | 2,003,964 | | |

* | |

| 1,223,961 | | |

| 996,279 | |

| Preferred Stock Series A (B) | |

| 758

shs. | | |

06/30/16 | |

| 2,647 | | |

| 109,671 | |

| Common Stock Class A (B) | |

| 3,791

shs. | | |

06/30/16 | |

| 3,791 | | |

| 91,096 | |

| * 05/01/18 and 06/28/19. | |

| | | |

| |

| 1,230,399 | | |

| 1,197,046 | |

| | |

| | | |

| |

| | | |

| | |

| Dart Buyer, Inc. | |

| | | |

| |

| | | |

| | |

|

| A manufacturer of helicopter aftermarket equipment and OEM Replacement parts for rotorcraft operators, providers and OEMs. |

| 6.32% Term Loan due 04/01/2025 (LIBOR + 5.250%) | |

$ | 1,716,164 | | |

04/01/19 | |

| 1,403,524 | | |

| 1,314,131 | |

| | |

| | | |

| |

| | | |

| | |

| Del Real LLC | |

| | | |

| |

| | | |

| | |

|

| A manufacturer and distributor of fully-prepared fresh refrigerated Hispanic entrees as well as side dishes that are typically sold on a heat-and-serve basis at retail grocers. |

| 11% Senior Subordinated Note due 04/06/2023 (D) | |

$ | 1,420,588 | | |

10/07/16 | |

| 1,403,759 | | |

| 1,278,529 | |

| Limited Liability Company Unit (B)(F) | |

| 368,799

uts. | | |

* | |

| 368,928 | | |

| 156,887 | |

| * 10/07/16, 07/25/18, 03/13/19 and 06/17/19. | |

| | | |

| |

| 1,772,687 | | |

| 1,435,416 | |

| | |

| | | |

| |

| | | |

| | |

| Discovery Education, Inc. | |

| | | |

| |

| | | |

| | |

|

| A provider of standards-based, digital education content for K-12 schools. |

| 4.99% Term Loan due 04/30/2024 (LIBOR + 4.250%) | |

$ | 1,907,033 | | |

04/20/18 | |

| 1,881,107 | | |

| 1,790,933 | |

| | |

| | | |

| |

| | | |

| | |

| DPL Holding Corporation | |

| | | |

| |

| | | |

| | |

|

| A distributor and manufacturer of aftermarket undercarriage parts for medium and heavy duty trucks and trailers. |

| Preferred Stock (B) | |

| 25

shs. | | |

05/04/12 | |

| 252,434 | | |

| 249,480 | |

| Common Stock (B) | |

| 25

shs. | | |

05/04/12 | |

| 28,048 | | |

| — | |

| | |

| | | |

| |

| 280,482 | | |

| 249,480 | |

| | |

| | | |

|

|

| | | |

| | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

March 31, 2020

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| | |

| | |

| |

| | |

| |

| Dunn Paper | |

| | |

| |

| | |

| |

| A provider of specialty paper for niche product applications. |

9.75%

Second Lien Term Loan due 08/26/2023

(LIBOR + 8.750%) | |

$ | 1,725,000 | | |

09/28/16 | |

$ | 1,707,908 | | |

$ | 1,466,250 | |

| | |

| | | |

| |

| | | |

| | |

| Electronic Power Systems | |

| | | |

| |

| | | |

| | |

|

| A provider of electrical testing services for apparatus equipment and protection & controls infrastructure. |

| 6.20% Term Loan due 12/21/2024 (LIBOR + 4.750%) | |

$ | 1,684,075 | | |

12/21/18 | |

| 1,664,132 | | |

| 1,591,535 | |

| Common Stock (B) | |

| 52

shs. | | |

12/28/18 | |

| 52,176 | | |

| 54,478 | |

| | |

| | | |

| |

| 1,716,308 | | |

| 1,646,013 | |

| Elite Sportwear Holding, LLC | |

| | | |

| |

| | | |

| | |

|

| A designer and manufacturer of gymnastics, competitive cheerleading and swimwear apparel in the U.S. and internationally. |

11.5% (1% PIK) Senior Subordinated Note

due 09/20/2022 (D) | |

$ | 1,588,640 | | |

10/14/16 | |

| 1,568,694 | | |

| 1,032,616 | |

| Limited Liability Company Unit (B)(F) | |

| 101

uts. | | |

10/14/16 | |

| 159,722 | | |

| — | |

| | |

| | | |

| |

| 1,728,416 | | |

| 1,032,616 | |

| English Color & Supply LLC | |

| | | |

| |

| | | |

| | |

|

| A distributor of aftermarket automotive paint and related products to collision repair shops, auto dealerships and fleet customers through a network of stores in the Southern U.S. |

11.5% (0.5% PIK) Senior Subordinated Note

due 12/31/2023 | |

$ | 1,345,670 | | |

06/30/17 | |

| 1,328,601 | | |

| 1,328,379 | |

| Limited Liability Company Unit (B)(F) | |

| 397,695

uts. | | |

06/30/17 | |

| 397,695 | | |

| 384,503 | |

| | |

| | | |

| |

| 1,726,296 | | |

| 1,712,882 | |

| E.S.P. Associates, P.A. | |

| | | |

| |

| | | |

| | |

|

| A professional services firm providing engineering, surveying and planning services to infrastructure projects. |

| Limited Liability Company Unit (B) | |

| 229

uts. | | |

04/04/18 | |

| 228,955 | | |

| 343,425 | |

| | |

| | | |

| |

| | | |

| | |

| F G I Equity LLC | |

| | | |

| |

| | | |

| | |

|

| A manufacturer of a broad range of filters and related products that are used in commercial, light industrial, healthcare, gas turbine, nuclear, laboratory, clean room, hotel, educational system, and food processing settings. |

| Limited Liability Company Unit Class B-1 (B) | |

| 65,789

uts. | | |

12/15/10 | |

| 56,457 | | |

| 640,642 | |

| Limited Liability Company Unit Class B-2 (B) | |

| 8,248

uts. | | |

12/15/10 | |

| 7,078 | | |

| 80,318 | |

| Limited Liability Company Unit Class B-3 (B) | |

| 6,522

uts. | | |

08/30/12 | |

| 13,844 | | |

| 65,203 | |

| Limited Liability Company Unit Class C (B) | |

| 1,575

uts. | | |

12/20/10 | |

| 8,832 | | |

| 89,532 | |

| | |

| | | |

| |

| 86,211 | | |

| 875,695 | |

| | |

| | | |

| |

| | | |

| | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

March 31, 2020

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| | |

| | |

| |

| | |

| |

| GD Dental Services LLC | |

| | |

| |

| | |

| |

| A provider of convenient “onestop” general, specialty, and cosmetic dental services with 21 offices located throughout South and Central Florida. |

| Limited Liability Company Unit Preferred (B) | |

| 76

uts. | | |

10/05/12 | |

$ | 75,920 | | |

$ | 51,281 | |

| Limited Liability Company Unit Common (B) | |

| 767

uts. | | |

10/05/12 | |

| 767 | | |

| — | |

| | |

| | | |

| |

| 76,687 | | |

| 51,281 | |

| gloProfessional Holdings, Inc. | |

| | | |

| |

| | | |

| | |

|

| A marketer and distributor of premium mineral-based cosmetics, cosmeceuticals and professional hair care products to the professional spa and physician’s office channels. |

14% (2% PIK) Senior Subordinated Note

due 11/30/2021 (D) | |

$ | 1,380,135 | | |

03/27/13 | |

| 989,505 | | |

| 1,230,638 | |

| Preferred Stock (B) | |

| 295

shs. | | |

03/29/19 | |

| 295,276 | | |

| 332,336 | |

| Common Stock (B) | |

| 1,181

shs. | | |

03/27/13 | |

| 118,110 | | |

| 23,004 | |

| | |

| | | |

| |

| 1,402,891 | | |

| 1,585,978 | |

| GraphPad Software, Inc. | |

| | | |

| |

| | | |

| | |

|

| A provider of data analysis, statistics and graphing software solution for scientific research applications, with a focus on the life sciences and academic end-markets. |

| 7.83% Term Loan due 12/21/2023 (LIBOR + 6.000%) | |

$ | 2,434,048 | | |

* | |

| 2,403,865 | | |

| 2,356,508 | |

| * 12/19/17 and 04/16/19. | |

| | | |

| |

| | | |

| | |

| | |

| | | |

| |

| | | |

| | |

| GTI Holding Company | |

| | | |

| |

| | | |

| | |

|

| A designer, developer, and marketer of precision specialty hand tools and handheld test instruments. |

| Common Stock (B) | |

| 1,046

shs. | | |

* | |

| 104,636 | | |

| 98,127 | |

Warrant, exercisable until 2027, to purchase

common stock at $.01 per share (B) | |

| 397

shs. | | |

02/05/14 | |

| 36,816 | | |

| 37,243 | |

| * 02/05/14 and 11/22/17. | |

| | | |

| |

| 141,452 | | |

| 135,370 | |

| | |

| | | |

| |

| | | |

| | |

| Handi Quilter Holding Company (Premier Needle Arts) | |

| | | |

| |

| | | |

| | |

|

| A designer and manufacturer of long-arm quilting machines and related components for the consumer quilting market. |

| Limited Liability Company Unit Preferred (B) | |

| 372

uts. | | |

* | |

| 371,644 | | |

| 385,283 | |

| Limited Liability Company Unit Common Class A (B) | |

| 3,594

uts. | | |

12/19/14 | |

| — | | |

| — | |

| *12/19/14 and 04/29/16. | |

| | | |

| |

| 371,644 | | |

| 385,283 | |

| | |

| | | |

| |

| | | |

| | |

| Happy Floors Acquisition, Inc. | |

| | | |

| |

| | | |

| | |

|

| A wholesale importer and value-added distributor of premium European flooring tile to residential and commercial end markets. |

12.5% (1% PIK) Senior Subordinated Note

due 01/01/2023 | |

$ | 390,951 | | |

07/01/16 | |

| 387,544 | | |

| 380,176 | |

| Common Stock (B) | |

| 150

shs. | | |

07/01/16 | |

| 149,500 | | |

| 254,376 | |

| | |

| | | |

| |

| 537,044 | | |

| 634,552 | |

| | |

| | | |

| |

| | | |

| | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

March 31, 2020

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| | |

| | |

| |

| | |

| |

| Hartland Controls Holding Corporation | |

| | |

| |

| | |

| |

| A manufacturer and distributor of electronic and electromechanical components. | |

14% (2% PIK) Senior Subordinated Note

due 08/14/2020 | |

$ | 1,180,491 | | |

02/14/14 | |

$ | 1,178,813 | | |

$ | 1,180,491 | |

| 12% Senior Subordinated Note due 08/14/2020 | |

$ | 431,250 | | |

06/22/15 | |

| 430,864 | | |

| 431,250 | |

| Common Stock (B) | |

| 821

shs. | | |

02/14/14 | |

| 822 | | |

| 219,306 | |

| | |

| | | |

| |

| 1,610,499 | | |

| 1,831,047 | |

| HHI Group, LLC | |

| | | |

| |

| | | |

| | |

|

| A developer, marketer, and distributor of hobby-grade radio control products. |

| Limited Liability Company Unit (B)(F) | |

| 102

uts. | | |

01/17/14 | |

| 101,563 | | |

| 271,579 | |

| | |

| | | |

| |

| | | |

| | |

| Hollandia Produce LLC | |

| | | |

| |

| | | |

| | |

|

| A hydroponic greenhouse producer of branded root vegetables. |

11% (3.25% PIK) Senior Subordinated Note

due 03/31/2021 | |

$ | 1,506,151 | | |

* | |

| 1,501,073 | | |

| 1,500,915 | |

| 9.52% Term Loan due 12/12/2020 (LIBOR + 8.000%) | |

$ | 109,916 | | |

04/06/18 | |

| 109,916 | | |

| 108,797 | |

| 9.52% Term Loan due 12/11/2020 (LIBOR + 8.000%) | |

$ | 146,780 | | |

04/06/18 | |

| 146,780 | | |

| 145,286 | |

| * 12/30/15 and 12/23/16. | |

| | | |

| |

| 1,757,769 | | |

| 1,754,998 | |

| | |

| | | |

| |

| | | |

| | |

| Holley Performance Products | |

| | | |

| |

| | | |

| | |

|

| A provider of automotive aftermarket performance products. |

| 6.78% Term Loan due 10/24/2025 (LIBOR + 5.000%) | |

$ | 2,440,350 | | |

10/24/18 | |

| 2,411,112 | | |

| 2,222,631 | |

| | |

| | | |

| |

| | | |

| | |

| HOP Entertainment LLC | |

| | | |

| |

| | | |

| | |

|

| A provider of post production equipment and services to producers of television shows and motion pictures. |

| Limited Liability Company Unit Class F (B)(F) | |

| 47

uts. | | |

10/14/11 | |

| — | | |

| — | |

| Limited Liability Company Unit Class G (B)(F) | |

| 114

uts. | | |

10/14/11 | |

| — | | |

| — | |

| Limited Liability Company Unit Class H (B)(F) | |

| 47

uts. | | |

10/14/11 | |

| — | | |

| — | |

| Limited Liability Company Unit Class I (B)(F) | |

| 47

uts. | | |

10/14/11 | |

| — | | |

| — | |

| | |

| | | |

| |

| — | | |

| — | |

| Hyperion Materials & Technologies, Inc. | |

| | | |

| |

| | | |

| | |

|

| A producer of specialty hard materials and precision tool components that are used to make precision cutting, grinding and other machining tools used by tool manufacturers and final product manufacturers. |

| 6.5% Term Loan due 08/14/2026 (LIBOR + 5.500%) | |

$ | 1,605,487 | | |

08/16/19 | |

| 1,577,833 | | |

| 1,531,597 | |

| | |

| | | |

| |

| | | |

| | |

| Industrial Service Solutions | |

| | | |

| |

| | | |

| | |

|

| A provider of maintenance, repair and overhaul services for process equipment within the industrial, energy and power end-markets. |

| 7.22% Term Loan due 01/31/2026 (LIBOR + 5.500%) | |

$ | 905,753 | | |

02/05/20 | |

| 888,102 | | |

| 823,882 | |

| | |

| | | |

| |

| | | |

| | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

March 31, 2020

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| | |

| | |

| |

| | |

| |

| IM Analytics Holdings, LLC | |

| | |

| |

| | |

| |

| A provider of test and measurement equipment used for vibration, noise, and shock testing. |

| 7.57% Term Loan due 11/22/2023 (LIBOR + 6.500%) | |

$ | 1,065,922 | | |

11/21/19 | |

$ | 1,056,196 | | |

$ | 903,645 | |

Warrant, exercisable until 2026, to purchase

common stock at $.01 per share (B) | |

| 8,885

shs. | | |

11/25/19 | |

| — | | |

| — | |

| | |

| | | |

| |

| 1,056,196 | | |

| 903,645 | |

| K P I Holdings, Inc. | |

| | | |

| |

| | | |

| | |

| The largest player in the U.S. non-automotive, non-ferrous die casting segment. | |

| Limited Liability Company Unit Class C Preferred (B) | |

| 40

uts. | | |

06/30/15 | |

| — | | |

| — | |

| Common Stock (B) | |

| 353

shs. | | |

07/15/08 | |

| 285,619 | | |

| — | |

| | |

| | | |

| |

| 285,619 | | |

| — | |

| | |

| | | |

| |

| | | |

| | |

| LAC Acquisition LLC | |

| | | |

| |

| | | |

| | |

|

| A provider of center-based applied behavior analysis treatment centers for children diagnosed with autism spectrum disorder. |

| 6.82% Term Loan due 10/01/2024 (LIBOR + 5.750%) | |

$ | 1,761,846 | | |

10/01/18 | |

| 1,098,240 | | |

| 933,768 | |

| Limited Liability Company Unit Class A (F) | |

| 22,222

uts. | | |

10/01/18 | |

| 22,222 | | |

| 23,136 | |

| | |

| | | |

| |

| 1,120,462 | | |

| 956,904 | |

| Manhattan Beachwear Holding Company | |

| | | |

| |

| | | |

| | |

| A designer and distributor of women’s swimwear. | |

| 12.5% Senior Subordinated Note due 05/30/2022 (D) | |

$ | 419,971 | | |

01/15/10 | |

| 404,121 | | |

| — | |

15% (2.5% PIK) Senior Subordinated Note

due 05/30/2022 (D) | |

$ | 115,253 | | |

10/05/10 | |

| 114,604 | | |

| — | |

| Common Stock (B) | |

| 35

shs. | | |

10/05/10 | |

| 35,400 | | |

| — | |

| Common Stock Class B (B) | |

| 118

shs. | | |

01/15/10 | |

| 117,647 | | |

| — | |

| Warrant, exercisable until 2023, to purchase | |

| | | |

| |

| | | |

| — | |

| common stock at $.01 per share (B) | |

| 104

shs. | | |

10/05/10 | |

| 94,579 | | |

| — | |

| | |

| | | |

| |

| 766,351 | | |

| — | |

| Master Cutlery LLC | |

| | | |

| |

| | | |

| | |

| A designer and marketer of a wide assortment of knives and swords. | |

| 13% Senior Subordinated Note due 07/31/2020 (D) | |

$ | 868,102 | | |

04/17/15 | |

| 867,529 | | |

| — | |

| Limited Liability Company Unit | |

| 5

uts. | | |

04/17/15 | |

| 678,329 | | |

| — | |

| | |

| | | |

| |

| 1,545,858 | | |

| — | |

| Media Recovery, Inc. | |

| | | |

| |

| | | |

| | |

|

| A global manufacturer and developer of shock, temperature, vibration and other condition indicators and monitors for in-transit and storage applications. |

7.40%

First Out Term Loan due 11/22/2025

(LIBOR + 5.750%) | |

$ | 371,810 | | |

11/25/19 | |

| 364,808 | | |

| 345,638 | |

| | |

| | | |

| |

| | | |

| | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

March 31, 2020

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| | |

| | |

| |

| | |

| |

| MES Partners, Inc. | |

| | |

| |

| | |

| |

| An industrial service business offering an array of cleaning and environmental services to the Gulf Coast region of the U.S. |

12% (1% PIK) Senior Subordinated Note

due 09/30/2021 (D) | |

$ | 1,140,295 | | |

09/30/14 | |

$ | 1,133,062 | | |

$ | 570,148 | |

12% (1% PIK) Senior Subordinated Note

due 09/30/2021 (D) | |

$ | 306,338 | | |

02/28/18 | |

| 303,093 | | |

| 153,169 | |

| Preferred Stock Series A (B) | |

| 30,926

shs. | | |

07/25/19 | |

| 12,412 | | |

| — | |

| Common Stock Class B (B) | |

| 259,252

shs. | | |

* | |

| 244,163 | | |

| — | |

| * 09/30/14 and 02/28/18. | |

| | | |

| |

| 1,692,730 | | |

| 723,317 | |

| | |

| | | |

| |

| | | |

| | |

| MeTEOR Education LLC | |

| | | |

| |

| | | |

| | |

|

| A leading provider of classroom and common area design services, furnishings, equipment and instructional support to K-12 schools. |

| 12% Senior Subordinated Note due 06/20/2023 | |

$ | 915,819 | | |

03/09/18 | |

| 903,667 | | |

| 884,579 | |

| Limited Liability Company Unit (B)(F) | |

| 182

uts. | | |

03/09/18 | |

| 183,164 | | |

| 79,531 | |

| | |

| | | |

| |

| 1,086,831 | | |

| 964,110 | |

| Motion Controls Holdings | |

| | | |

| |

| | | |

| | |

|

| A manufacturer of high performance mechanical motion control and linkage products. |

| Limited Liability Company Unit Class B-1 (B)(F) | |

| 75,000

uts. | | |

11/30/10 | |

| — | | |

| 47,926 | |

| Limited Liability Company Unit Class B-2 (B)(F) | |

| 6,801

uts. | | |

11/30/10 | |

| — | | |

| 4,346 | |

| | |

| | | |

| |

| — | | |

| 52,272 | |

| New Mountain Learning, LLC | |

| | | |

| |

| | | |

| | |

|

| A leading provider of blended learning solutions to the K-12 and post-secondary school market. |

| 7.45% Term Loan due 03/16/2024 (LIBOR + 6.000%) | |

$ | 1,646,705 | | |

03/15/18 | |

| 1,623,252 | | |

| 1,198,801 | |

| 9.45% Super Priority Delayed Draw Term Loan (LIBOR + 6.000% Cash & 2.000% PIK) | |

$ | 430,866 | | |

01/08/20 | |

| 287,321 | | |

| 270,994 | |

| | |

| | | |

| |

| 1,910,573 | | |

| 1,469,795 | |

| Options Technology Ltd | |

| | | |

| |

| | | |

| | |

|

| A provider of vertically focused financial technology managed services and IT infrastructure products for the financial services industry. |

| 5.57% Term Loan due 12/18/2025 (LIBOR + 4.500%) | |

$ | 1,943,416 | | |

12/23/19 | |

| 1,241,137 | | |

| 1,183,061 | |

| | |

| | | |

| |

| | | |

| | |

| PANOS Brands LLC | |

| | | |

| |

| | | |

| | |

|

| A marketer and distributor of branded consumer foods in the specialty, natural, better-for-you,“free from” healthy and gluten-free categories. |

12% (1% PIK) Senior Subordinated Note

due 08/17/2022 | |

$ | 1,775,705 | | |

02/17/17 | |

| 1,759,970 | | |

| 1,657,281 | |

| Common Stock Class B (B) | |

| 380,545

shs. | | |

* | |

| 380,545 | | |

| 345,047 | |

| * 01/29/16 and 02/17/17. | |

| | | |

| |

| 2,140,515 | | |

| 2,002,328 | |

| | |

| | | |

| |

| | | |

| | |

| | |

| | | |

| |

| | | |

| | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

March 31, 2020

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| | |

| | |

| |

| | |

| |

| PB Holdings LLC | |

| | |

| |

| | |

| |

| A designer, manufacturer and installer of maintenance and repair parts and equipment for industrial customers. |

| 6.45% Term Loan due 03/06/2025 (LIBOR + 5.000%) | |

$ | 857,969 | | |

03/06/19 | |

$ | 844,304 | | |

$ | 787,974 | |

| | |

| | | |

| |

| | | |

| | |

| Pegasus Transtech Corporation | |

| | | |

| |

| | | |

| | |

|

| A provider of end-to-end document, driver and logistics management solutions, which enable its customers (carriers, brokers, and drivers) to operate more efficiently, reduce manual overhead, enhance compliance, and shorten cash conversion cycles. |

| 7.32% Term Loan due 11/17/2024 (LIBOR + 6.250%) | |

$ | 1,894,364 | | |

11/14/17 | |

| 1,863,038 | | |

| 1,815,024 | |

| | |

| | | |

| |

| | | |

| | |

| Petroplex Inv Holdings LLC | |

| | | |

| |

| | | |

| | |

|

| A leading provider of acidizing services to E&P customers in the Permian Basin. |

| Limited Liability Company Unit | |

| 0.40%

int. | | |

* | |

| 174,669 | | |

| 18,802 | |

| * 11/29/12 and 12/20/16. | |

| | | |

| |

| | | |

| | |

| | |

| | | |

| |

| | | |

| | |

| Polytex Holdings LLC | |

| | | |

| |

| | | |

| | |

|

| A manufacturer of water based inks and related products serving primarily the wall covering market. |

| 13.9% (7.9% PIK)

Senior Subordinated Note due 12/31/2020 (D) | |

$ | 1,069,985 | | |

07/31/14 | |

| 1,064,183 | | |

| 802,489 | |

| Limited Liability Company Unit | |

| 148,096

uts. | | |

07/31/14 | |

| 148,096 | | |

| — | |

| Limited Liability Company Unit Class F | |

| 36,976

uts. | | |

* | |

| 24,802 | | |

| — | |

| * 09/28/17 and 02/15/18. | |

| | | |

| |

| 1,237,081 | | |

| 802,489 | |

| | |

| | | |

| |

| | | |

| | |

| PPC Event Services | |

| | | |

| |

| | | |

| | |

|

| A special event equipment rental business. |

14% (2% PIK) Senior Subordinated Note

due 05/28/2023 (D) | |

$ | 1,238,864 | | |

11/20/14 | |

| 1,233,372 | | |

| 1,036,407 | |

| Limited Liability Company Unit (B) | |

| 3,450

uts. | | |

11/20/14 | |

| 172,500 | | |

| 275,177 | |

| Limited Liability Company Unit Series A-1 (B) | |

| 339

uts. | | |

03/16/16 | |

| 42,419 | | |

| 22,379 | |

| | |

| | | |

| |

| 1,448,291 | | |

| 1,333,963 | |

| ReelCraft Industries, Inc. | |

| | | |

| |

| | | |

| | |

|

| A designer and manufacturer of heavy-duty reels for diversified industrial, mobile equipment OEM, auto aftermarket, government/military and other end markets. |

| Limited Liability Company Unit Class B | |

| 293,617

uts. | | |

11/13/17 | |

| 184,688 | | |

| 550,799 | |

| | |

| | | |

| |

| | | |

| | |

| REVSpring, Inc. | |

| | | |

| |

| | | |

| | |

|

| A provider of accounts receivable management and revenue cycle management services to customers in the healthcare, financial and utility industries. |

9.19% Second Lien Term Loan due 10/11/2026

(LIBOR + 8.250%) | |

$ | 1,725,000 | | |

10/11/18 | |

| 1,682,778 | | |

| 1,605,170 | |

| | |

| | | |

| |

| | | |

| | |

| | |

| | | |

| |

| | | |

| | |

Barings Participation Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

March 31, 2020

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| | |

| | |

| |

| | |

| |

| Rock-it Cargo | |

| | |

| |

| | |

| |

| A provider of specialized international logistics solutions to the music touring, performing arts, live events, fine art and specialty industries. |

6.42% Term Loan due 06/22/2024 (G)

(LIBOR + 2.000% Cash & 2.750% PIK) | |

$ | 2,428,025 | | |

07/30/18 | |

$ | 2,384,216 | | |

$ | 1,920,568 | |

| | |

| | | |

| |

| | | |

| | |

| ROI Solutions | |

| | | |

| |

| | | |

| | |

|

| Call center outsourcing and end user engagement services provider. |

| 7.06% Term Loan due 07/31/2024 (LIBOR + 5.000%) | |

$ | 1,624,581 | | |

07/31/18 | |

| 634,213 | | |

| 544,037 | |

| | |

| | | |

| |

| | | |

| | |

| Ruffalo Noel Levitz | |

| | | |

| |

| | | |

| | |

|

| A provider of enrollment management, student retention and career services, and fundraising management for colleges and universities. |

| 7.45% Term Loan due 05/29/2022 (LIBOR + 6.000%) | |

$ | 1,248,091 | | |

01/08/19 | |

| 1,236,165 | | |

| 1,205,274 | |

| | |

| | | |

| |

| | | |

| | |

| Sandvine Corporation | |

| | | |

| |

| | | |

| | |

|

| A provider of active network intelligence solutions. |

9.00% Second Lien Term Loan due 11/02/2026

(LIBOR + 8.000%) | |

$ | 1,725,000 | | |

11/01/18 | |

| 1,689,491 | | |

| 1,613,974 | |

| | |

| | | |

| |

| | | |

| | |

| Sara Lee Frozen Foods | |

| | | |

| |

| | | |

| | |

|

| A provider of frozen bakery products, desserts and sweet baked goods. |

5.50% Lien Term Loan due 07/30/2025

(LIBOR + 4.500%) | |

$ | 1,514,122 | | |

07/27/18 | |

| 1,489,546 | | |

| 1,415,229 | |

| | |

| | | |

| |

| | | |

| | |

| Scaled Agile, Inc. | |

| | | |

| |

| | | |

| | |

|

| A provider of training and certifications for IT professionals focused on software development. |

| 5.75% Term Loan due 06/28/2024 (LIBOR + 4.750%) | |

$ | 662,480 | | |

06/27/19 | |

| 656,695 | | |

| 631,460 | |

| | |

| | | |

| |

| | | |

| | |

| Soliant Holdings, LLC | |

| | | |

| |

| | | |

| | |

|

| A healthcare staffing platform focused on placing highly skilled professionals in the education, nursing/allied health, life sciences and pharmacy end-markets. |

| 6.49% Term Loan due 11/30/2026 (LIBOR + 5.500%) | |

$ | 1,015,879 | | |

12/27/19 | |

| 996,292 | | |

| 959,914 | |

| | |

| | | |

| |

| | | |

| | |

| Specified Air Solutions | |

| | | |

| |

| | | |

| | |

|

| A manufacturer and distributor of heating, dehumidification and other air quality solutions. |

| 10.5% (0.5% PIK) Senior Subordinated Note due 06/19/2024 | |

$ | 1,232,691 | | |

12/19/18 | |

| 1,222,636 | | |

| 1,245,018 | |

| Limited Liability Company Unit | |

| 531,730

uts. | | |

02/20/19 | |

| 539,795 | | |

| 1,186,899 | |

| | |

| | | |

| |

| 1,762,431 | | |

| 2,431,917 | |

| | |

| | | |

| |

| | | |

| | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

March 31, 2020

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) | |

Principal Amount,

Shares, Units or

Ownership

Percentage | | |

Acquisition

Date | |

Cost | | |

Fair Value | |

| | |

| | |

| |

| | |

| |

| Springbrook Software | |

| | |

| |

| | |

| |

| A provider of vertical-market enterprise resource planning software and payments platforms focused on the local government end-market. |

| 7.20% Term Loan due 12/20/2026 (LIBOR + 5.750%) | |

| | | |

| |

$ | 1,178,717 | | |

$ | 1,119,892 | |

| | |

| | | |

| |

| | | |

| | |

| SR Smith LLC | |

| | | |

| |

| | | |

| | |

| A manufacturer of mine and tunneling ventilation products in the United States. | |

| 11% Senior Subordinated Note due 03/27/2022 (D) | |

$ | 1,084,565 | | |

* | |

| 1,078,968 | | |

| 1,021,019 | |

| Limited Liability Company Unit Series A | |

| 1,072

uts. | | |

* | |