Metals Acquisition Limited (NYSE: MTAL; ASX:MAC)

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240422290327/en/

Figure 1 – Location of Zinc and Lead

Mineralisation (Graphic: Business Wire)

Metals Acquisition Limited ARBN 671 963 198 (NYSE: MTAL; ASX:

MAC), a private limited company incorporated under the laws of

Jersey, Channel Islands (“MAC” or the “Company”) is

pleased to release its Resource and Reserve Statement (as at 31

August 2023) (“R+R”) and 3 Year Production Guidance for the

CSA Copper Mine in NSW.

In accordance with Item 1300 of Regulation S-K (17 CFR Part 229)

(“S-K 1300”), all Mineral Resources are reported exclusive

of Mineral Reserves.

Resource and Reserve Statement

Highlights from the R+R include:

- 67% increase in mine life to 11-years (end of 2034) based on

Mineral Reserves only, compared to the 6-year mine life in the 2022

Resources and Reserves Statement

- 64% increase in contained copper (“Cu”) after replacement of

depletion to 0.5Mt in Mineral Reserves (Refer Table 3 for

breakdown) at an average grade of 3.3% Cu

- Measured and Indicated Mineral Resources increased to 229

ktonnes of Cu from zero in the prior (Refer Table 2 for breakdown)

at an average grade of 4.9% Cu

- An additional 184 ktonnes of Cu in the Inferred Mineral

Resources, an approximate 5% reduction on the prior year as

Inferred material was promoted to Measured and Indicated

Categories

- 83% increase in contained Cu after replacement of depletion in

the Measured and Indicated Resources categories

- 2023 Mineral Reserve only extends 95m vertically below the

current decline position

- Above increases have come after only ten months of ownership

and based on data from two and a half months post-closing of the

acquisition with the effective date for the R+R being 31 August

2023

- All deposits (other than QTSSU-A (feasibility study), are open

in at least one direction and drilling is continuing to further

increase the R+R, subject to exploration success and economic

factors

The effective date for the R+R is 31 August 2023 and as such,

any new information received after that time has not been

incorporated into the R+R at this stage.

Work is continuing on updating the mine plans as new information

is received and importantly following on from the completion of

MAC’s dual listing on the ASX and public offer that raised A$325

million of equity the Company is pushing forward with its growth

capital spending to further optimise the mine plan.

MAC CEO, Mick McMullen commented “Whilst this Resource and

Reserve Statement is a snapshot in time based on information

available back in August 2023, it does validate our belief that the

CSA Copper Mine can be a long-life asset. Importantly, despite the

near doubling of the Mineral Reserves and a 67% increase in the

mine life, we still have 4.7Mt @ 4.9% Cu (230Kt Cu) in the Measured

and Indicated Category and 3.3Mt @ 5.5% Cu (180Kt Cu) in the

Inferred Category that are not included in the Mineral Reserves and

work is underway to convert these to our Mineral Reserve estimates

in the future.

We have always believed that the CSA Copper Mine would have a

long future and this Resource and Reserve Statement upgrade

confirms this and also provides us with the underlying Mineral

Resource base from which to put long term plans in place that

simply hasn’t been possible for the last generation when the mine

has always had a 5 to 6-year reserve mine life ahead of it. There

has perhaps been a view by some observers that the CSA Copper Mine

has a relatively short mine life, with today’s Resource and Reserve

Statement announcement we can dispel that view and now focus on

mining more Copper faster and at lower costs. We are but ten months

into our ownership of the mine and it has a lot of potential to be

uncovered still.”

Three Year Production Guidance

Based on the updated R+R, the Company is providing the following

production guidance for the next three years:

Table 1 - CSA Copper Mine Production Guidance

2024

2025

2026

Low Range

High Range

Low Range

High Range

Low Range

High Range

Cu Production (tonnes)

38,000

43,000

43,000

48,000

48,000

53,000

This three-year production guidance is based primarily on

Mineral Reserves but also on measured and indicated Mineral

Resources (as at 31 August 2023) and, given that all the deposits

are open and a large drill program is underway, MAC considers it

likely that there will be changes over the relevant period as the

Company’s overall plan to continue operational and production

improvement continues to develop.

The 42% and 64% increase in contained Cu after replacement of

depletion for Mineral Resources and Mineral Reserves respectively

in the R+R has come after ten months of ownership and based on data

from two and a half months post-closing of the acquisition.

The CSA Copper Mine has been producing for almost 60 years with

very limited exploration away from the known deposits and there is

potential to further optimise this production plan.

As discussed below, exploration in the top 850m of the deposit

is just starting and initial results highlight strong potential to

open additional mining fronts.

Mineral Resources

The Mineral Resources have been updated based on data to 31

August 2023 and allowing for depletion to that date. Total S-K 1300

Mineral Resources are shown in Table 2 below:

Table 2- CSA Copper Mine Mineral Resources

System

Resource

Category

Tonnes

Mt

Cu

%

Cu Metal

kt

Ag

g/t

Ag Metal

Moz

All Systems

Measured

3.3

5.6

182

19

2.0

Indicated

1.4

3.4

47

6

0.3

Meas + Ind

4.7

4.9

229

15

2.3

Inferred

3.3

5.5

184

21

2.2

Total

8.0

5.2

413

18

4.5

Notes:

- Mineral Resources are reported as of 31 August 2023;

- Mineral Resources are reported in accordance with S-K 1300,

including with respect to defined terms;

- Mineral Resources are reported exclusive of Mineral

Reserves;

- The Qualified Person who prepared the statement is Mike Job, of

Cube Consulting Pty Ltd;

- Price assumptions used in the estimation include US$8,279/t of

copper and US$22.60/troy ounce (“oz”) of silver; in line with long

term Broker Consensus forecast copper pricing as at August 8,

2023;

- Geological mineralization boundaries defined at a nominal 2.5%

Cu cut off for high grade lenses, and 1.5% Cu for the lower-grade

halo. Resources reported above a 1.5% Cu cut-off grade;

- Costs assumptions underlying cut-off grade calculation include

US$78/t ore mined, US$20/t ore milled and US$21/t G&A ore

milled;

- Metallurgical recovery assumptions used in the estimation were

97.5% copper recovery and 80% silver recovery;

- Mineral Resources reported as dry, raw, undiluted, in-situ

tonnes; and

- Figures are subject to rounding.

As discussed above, not only has total contained Cu in Mineral

Resources increased by 42%, the Measured and Indicated portions

available for Mineral Reserve conversion has increased by 83%. This

is a result of increased drilling and the inclusion of level

mapping data where levels have been developed through the deposits

and not previously been included in the Mineral Resource.

Overall grade has reduced from 5.3% Cu in the 2022 R+R to 4.9%

in the 2023 R+R which is predominately a result of the inclusion of

2.2Mt of material between the new cut-off grade of 1.5% Cu and the

previous cut-off grade of 2.5% Cu. In terms of contained Cu this

material had a relatively small impact to the overall change, with

the larger changes coming from the inclusion of new drilling and

level mapping data.

As evidenced by the recent drill results released by the

Company,1 including 19.2m @ 10.4% Cu in UDD23025 and 16m @ 10.5% Cu

in UDD23024 these deposits are characterised by high grade lodes

that have a long vertical extent that project well past the 2023

R+R.

In addition, whilst the mine is currently a producer of high

quality Cu concentrates, it did start life as a high grade zinc

(“Zn”) mine. As seen in the recently released QSD060 result of 4.3m

@ 14.2% Zn, 3.9% Pb and 0.8% Cu the shallower portions of the

deposits do host significant Zn mineralisation that is yet to be

modelled.

The current R+R starts at a depth of 850m below surface (except

for the small QTSS Upper-A deposit) as the data for this area has

not historically been in the digital database. A large amount of

historical data is available for these shallower portions of the

mine and approximately 70% of this has now been digitized. None of

this information has been included in the 2023 R+R. Drilling is

underway to verify the presence of the mineralisation included in

this historical dataset, with the first hole intercepting Zn and Cu

massive sulphides as predicted by the historical data at a depth

below surface of approximately 330m.

This mineralisation is vertically extensive and occurs adjacent

to existing mine development with the interval in EWDD24005 located

30m from existing development as seen in Figure 1. Figure 2 shows

the core from the most recent drilling in this area that was

targeted at the indicated position of this mineralisation based on

the historical data.

Figure 1 – Location of Zinc and Lead Mineralisation

Figure 2 - Massive Zn and Cu Mineralisation in

EWDD24005

Mineral Reserves

The Mineral Reserves have been updated based on data to 31

August 2023 and allowing for depletion to that date.

Total S-K 1300 Mineral Reserves are 14.9Mt @ 3.3% Cu and 13 g/t

Ag and are shown in Table 3 below:

Table 3 - CSA Copper Mine Mineral Reserves

CSA Copper Mine

Proved

Probable

Proved and Probable

M tonnes

8.3

6.6

14.9

Cu %

3.5

3.1

3.3

Contained Cu ktonnes

293

201

494

Ag g/t

14

11

13

Contained Ag M oz

3.9

2.4

6.2

Notes:

- Mineral Reserves are reported as of 31 August 2023 and are

reported using the definitions in S-K 1300;

- The Qualified Person who prepared the statement is Jan Coetzee,

an officer of MAC, the Registrant’s Australian subsidiary;

- Price assumptions used in the estimation include US$8,279/t of

copper and US$22.60/troy ounce (“oz”) of silver; in line with long

term Broker Consensus forecast copper pricing as at August 8,

2023;

- Mineral Reserves reported as dry, diluted, in-situ tonnes using

a Stope breakeven cut-off grade of 2.2% Cu for 2024 to 2026 and a

cut-off-grade of 1.65% for the remaining periods and a Development

breakeven cut-off grade of 1.0% Cu;

- Costs assumptions underlying cut-off grade calculation include

US$78/t ore mined, US$20/t ore milled and US$21/t G&A ore

milled;

- Metallurgical recovery assumptions used in the estimation were

97.5% copper recovery and 80% silver recovery; and

- Figures are subject to rounding.

Ore Reserves were estimated at a Cu price of US$8,279/t Cu,

which compares to a spot price of US$9,905/t Cu as at 20 April

2024.

Mineral Reserve grade at 3.3% Cu is down from 4% Cu in the prior

year which is a reflection of the lower cost base that the mine is

now operating under. This is as a result of reduced mine site

operating costs and offsite charges. Cut-off grade is variable

based on the ability to mine at higher rates once the Return Air

Rise (“RAR”) are complete and ranges from 2.2% Cu near term to

1.65% Cu for the longer term.

The mine plan strategy is somewhat determined by the requirement

for additional RAR ventilation at the bottom of QTSN, during which

time the mine plan mines the higher grade core. Once the RAR system

is in place then the mine plan reverts to a more bulk tonnage model

given the large excess processing plant capacity at the mine. At

elevated Cu prices the goal is to maximise Cu production where

possible and to defer any lower grade material to the back end of

the mine plan.

Figure 3 illustrates the changes in the Mineral Reserves from

the prior year.

Figure 3 – CSA Copper Mine Contained Cu in Reserve Changes

2022 to 2023

Spatially, the location of the 2023 Mineral Reserve compared to

the 2022 Mineral Reserve is shown in Figure 4 below. The bulk of

the increases have been in QTSN where the deposit has been

increasing in strike length and QTSC where drilling has expanded

the lateral and vertical extend of the deposit.

All deposits are open and as seen in Figures 5 and 6 below the

Mineral Reserves terminate at RL’s based on drill density with the

deposits extending significantly past the 2023 Mineral

Reserves.

Figure 4 - Location of the 2023 Mineral Reserve compared to

the 2022 Mineral Reserve

The bulk of the Mineral Reserves (84% of total contained Cu) are

from the QTSN and QTSC deposits and Figures 5 and 6 illustrate the

location of the Mineral Reserves compared to the various resource

classifications.

Figure 5 - Location of Mineral Reserves and Mineral Resource

Classification - QTSN

Mineral Reserves in QTSN have been extended to the 8300mRL, with

current stoping active on the 8430m RL and the decline at the

8395mRL. As such, the current 11 year mine life is only mining a

further 95m vertically below the bottom of the decline position at

the end of March 2024.

Figure 6- Location of Mineral Reserves and Mineral Resource

Classification – QTSC

The material R+R increase from the R+R at the time of purchase

will now enable the Company to optimise mining rates with a view to

producing more Cu sooner given the potential for even longer mine

life subject to converting the non Mineral Reserve material. This

will also be instrumental in right sizing the capital structure of

the Company.

Life of Mine (“LOM”) Plan

The LOM plan is based on Mineral Reserves only and on data from

the end of August 2023. Several of the deposits being mined or

planned to be mined still contain elevated levels of Inferred

Resources that are not included in the LOM under both the JORC and

S-K 1300 Codes.

Table 4- CSA Copper Mine Life of Mine Plan

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

Tonnes - Total Ore (t)

1,068,000

1,286,000

1,399,000

1,399,000

1,399,000

1,397,000

1,394,000

1,396,000

1,399,000

1,390,000

1,034,000

Grade - Cu (%)

3.6%

3.3%

3.6%

3.5%

3.4%

3.4%

3.1%

3.0%

3.1%

2.8%

3.2%

Grade - Ag (g/t)

16

12

14

13

13

13

12

12

13

11

14

Metal - Cu (t)

38,000

43,000

50,000

49,000

48,000

47,000

43,000

42,000

42,000

39,000

33,000

Metal - Ag (oz)

537,000

499,000

639,000

588,000

565,000

573,000

522,000

542,000

568,000

504,000

481,000

JORC

MAC is subject to the reporting requirements of both the

Securities Exchange Act of 1934 (US) and applicable Australian

securities laws (including the ASX Listing Rules), and as a result,

has separately reported its Mineral Reserves (referred to as ore

reserves for the purpose of the Australasian Joint Ore Reserve

Committee Code, 2012 edition (JORC)) and Mineral Resources

according to the standards applicable to those requirements. U.S.

reporting requirements are governed by S-K 1300, as issued by the

SEC. Australian reporting requirements are governed by JORC. Both

sets of reporting standards have similar goals in terms of

conveying an appropriate level of consistency and confidence in the

disclosures being reported, but the standards embody slightly

different approaches and definitions. All disclosure of Mineral

Resources and Mineral Reserves in this report are reported in

accordance with S-K 1300. For JORC and ASX Listing Rule compliant

disclosure of mineral reserves (Ore Reserves for the purpose of

JORC) and mineral resources, please see the Company’s separate

release to be released on ASX on 23 April 2024. In order to comply

with SEC requirements the Company expects to lodge an S-K 1300

Technical Report with the SEC in the near term.

Conference Call

The Company will host a conference call and webcast to discuss

the Company’s updated Reserve and Resource statement on Monday,

April 22, 2024 at 7:00 pm (New York time) / Tuesday, April 23, 2024

at 9:00 am (Sydney time).

Details for the conference call and webcast are included

below.

Webcast Participants can access the

webcast at the following link

https://events.q4inc.com/attendee/950238182

Conference Call Participants can

dial into the live call by dialling 800-274-8461 or +1-203-518-9783

and providing the conference ID ‘METALS’.

Replay The conference call will be

available for playback until July 22, 2024 and can be accessed by

dialling 1-888-567-0047 or +1-402-220-6953 or visiting the webcast

link https://events.q4inc.com/attendee/950238182.

This announcement is authorised for release by the Board of

Directors.

QUALIFIED PERSON STATEMENTS

Mineral Resources

The information in this announcement that relates to the

Company’s Mineral Resources is based on information compiled by

Mike Job, a Qualified Person for the purpose of S-K 1300, who is a

Fellow of the Australian Institute of Mining and Metallurgy. Mr Job

is employed by Cube Consulting Pty Ltd. Mr Job . Mr Job consents to

the inclusion in this announcement of the matters based on this

information in the form and context in which it appears.

Mineral Reserves

The information in this announcement that relates to the

Company’s Mineral Reserves is based on information compiled by Jan

Coetzee, a Qualified Person for the purpose of S-K 1300, who is a

Member of the Australian Institute of Mining and Metallurgy. Jan

Coetzee is employed by Metals Acquisition Corp. (Australia) Pty Ltd

(being a wholly owned subsidiary of Metals Acquisition Limited). Mr

Coetzee consents to the inclusion in this announcement of the

matters based on this information in the form and context in which

it appears.

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL; ASX:MAC) is a company

focused on operating and acquiring metals and mining businesses in

high quality, stable jurisdictions that are critical in the

electrification and decarbonization of the global economy.

Forward Looking Statements

This release has been prepared by Metals Acquisition Limited

(“Company” or “MAC”) and includes “forward-looking statements.” The

forward-looking information is based on the Company’s expectations,

estimates, projections and opinions of management made in light of

its experience and its perception of trends, current conditions and

expected developments, as well as other factors that management of

the Company believes to be relevant and reasonable in the

circumstances at the date that such statements are made, but which

may prove to be incorrect. Assumptions have been made by the

Company regarding, among other things: the price of copper,

continuing commercial production at the CSA Copper Mine without any

major disruption, the receipt of required governmental approvals,

the accuracy of capital and operating cost estimates, the ability

of the Company to operate in a safe, efficient and effective manner

and the ability of the Company to obtain financing as and when

required and on reasonable terms. Readers are cautioned that the

foregoing list is not exhaustive of all factors and assumptions

which may have been used by the Company. Although management

believes that the assumptions made by the Company and the

expectations represented by such information are reasonable, there

can be no assurance that the forward-looking information will prove

to be accurate.

MAC’s actual results may differ from expectations, estimates,

and projections and, consequently, you should not rely on these

forward-looking statements as predictions of future events. Words

such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believes,” “predicts,” “potential,” “continue,” and similar

expressions (or the negative versions of such words or expressions)

are intended to identify such forward- looking statements. These

forward-looking statements include, without limitation, MAC’s

expectations with respect to future performance of the CSA Copper

Mine. These forward-looking statements involve significant risks

and uncertainties that could cause the actual results to differ

materially from those discussed in the forward-looking statements.

Most of these factors are outside MAC’s control and are difficult

to predict. Factors that may cause such differences include, but

are not limited to: the supply and demand for copper; the future

price of copper; the timing and amount of estimated future

production, costs of production, capital expenditures and

requirements for additional capital; cash flow provided by

operating activities; unanticipated reclamation expenses; claims

and limitations on insurance coverage; the uncertainty in Mineral

Resource estimates; the uncertainty in geological, metallurgical

and geotechnical studies and opinions; infrastructure risks; and

other risks and uncertainties indicated from time to time in MAC’s

other filings with the SEC and the ASX. MAC cautions that the

foregoing list of factors is not exclusive. MAC cautions readers

not to place undue reliance upon any forward-looking statements,

which speak only as of the date made. MAC does not undertake or

accept any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements to reflect

any change in its expectations or any change in events, conditions,

or circumstances on which any such statement is based.

More information on potential factors that could affect MAC’s or

CSA Copper Mine’s financial results is included from time to time

in MAC’s public reports filed with the SEC and the ASX. If any of

these risks materialize or MAC’s assumptions prove incorrect,

actual results could differ materially from the results implied by

these forward-looking statements. There may be additional risks

that MAC does not presently know, or that MAC currently believes

are immaterial, that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect MAC’s expectations, plans or

forecasts of future events and views as of the date of this

communication. MAC anticipates that subsequent events and

developments will cause its assessments to change. However, while

MAC may elect to update these forward-looking statements at some

point in the future, MAC specifically disclaims any obligation to

do so, except as required by law. These forward-looking statements

should not be relied upon as representing MAC’s assessment as of

any date subsequent to the date of this communication. Accordingly,

undue reliance should not be placed upon the forward-looking

statements.

Appendix 1 – CSA Copper Mine Mineral Resources and Mineral

Reserves Mineral Resource Statement

Mineral Resources

The following summary of all information material to

understanding the reported estimates of Mineral Resources in

relation to the following matters is provided.

Geology and geological interpretation

The CSA deposit is located within the Cobar mineral field, in

the Cobar Basin. Mineralisation is hosted in the Silurian-age CSA

Siltstone, a member of the Amphitheatre Group of the Cobar

Supergroup sequence of rocks and is associated with zones of

deformation and shearing. The CSA Siltstone consists of a sequence

of rhythmic bedded siltstones and sandstones. The rock sequence was

structurally deformed during the development of the Cobar Basin in

the early Devonian period.

Interpretation of the wireframes is based on geological mapping

in the mine, drill core logging, and the structural model that has

been developed over time. CSA used a threshold of 2.5% Cu to guide

the interpretation of the high-grade lenses. These wireframes are

generally constructed manually in Datamine software. For the QTSS

Upper A however, the mineralised domains are constructed using an

implicit modelling method to create the wireframes (using the

Datamine vein modelling function). There is a new lower grade

domain which covers the five systems for QTSN, QTSC, QTSS, Eastern

and Western. These domains use a value of 1.5% Cu and form a

lower-grade halo to the high-grade lenses. The construction of

these lower-grade halo domains is different from the manual domain

interpretations traditionally used for the high-grade lenses. In

this case, a categorical indicator is applied to one metre

down-hole composited drill sample assays at 1.5% Cu, and this

indicator is estimated by Ordinary Kriging into a block model. The

low-grade halo domain wireframe is then created at an indicator

probability value of 0.4.

Sampling and sub-sampling techniques

Half core samples are mostly 1m in length with sample weights

averaging 1.9kg. The cutting and sampling process is carried out at

CSA Mine.

The sampling procedures includes interval checks, cutting

intervals, sampling intervals, inserting standards and blanks,

sampling duplicates, weighing samples and dispatching samples. All

parts of the core processing cycle are tracked and recorded

electronically.

Drilling techniques

Drilling comprised mostly NQ and NQ2 diamond drill holes using

standard tube although in 2023 all underground drilling was NQ3

size. Minor sampling from HQ, BQ, LTK48 and LTK60 sized diamond

core holes.

Criteria for classification

Mineral Resource Classification takes into account: location of

mine development, drill spacing, grade continuity, search criteria,

and copper Kriging metrics. In summary:

- Measured has a diamond drill spacing of approximately ≤20m

north-south by 37.5m vertical for QTS North and 20m north-south by

20m vertical for other systems.

- Indicated has a diamond drill spacing of approximately ≤40m

north-south by 70m vertical (QTS North) and 40m north-south by 40m

vertical (all other systems).

- Inferred has a diamond drill spacing of approximately ≥40m

north-south by 70m vertical (QTS North) and 40m north-south by 40m

vertical (all other systems). Drill density is sufficient to give

confidence that the lens persists down plunge/dip.

Sample analysis method

Samples for assay are sent to the ALS Laboratory in Orange, NSW.

All samples are assayed using ALS’ Assay Procedure – ME-OG46, Ore

Grade Elements by Aqua Regia Digestion Using Conventional ICP-AES

Analysis for a list of elements including Cu, Ag, Pb, Zn, Fe and

S.

Estimation methodology

Grade estimation is by Ordinary Kriging using 1m composites

within hard boundary domains defined using a 2.5% Cu threshold

width a lower-grade halo around the high-grade zones using a 1.5%

Cu threshold. 1m Cu composites are not top-cut as extreme values

are considered real and have been accounted for by geological

domain boundaries. However, Ag composites are top-cut due to

extreme values for certain geological domains.

Cut-off grade(s) including the basis for the selected cut-off

grade(s)

Mineral resources are reported above a 1.5 Cu (%) cut-off. The

high-grade mineralisation interpretation is based on geology and

represents a natural 2.5% Cu cut-off.

Mining and metallurgical methods and parameters (other

material modifying factors considered to date)

The mineral resource interpretations are steeply plunging and

ideal for the long hole stoping methods adopted at CSA. Stope size

and standard mining block units also influenced parent block size

selection.

Copper processing recoveries at CSA are typically 96.8 - 98.5%

producing a concentrate grade of approximately 25.98% Cu.

Mineral Reserves

The following is a summary of all information material to

understanding the reported estimates of Mineral Reserves in

relation to the following matters:

Material Assumptions

The material assumptions used in preparation of this Mineral

Reserve are as follows:

- 2023 Mineral Resource estimate;

- Heading advance and stoping rates in-line with historical

performance;

- Modifying factors are in line with historical data and industry

norms;

- Mine design principles (ie: strike length, transverse width,

level intervals, etc.) are in line with currently utilised mining

methods and design principles;

- No material changes to metallurgical recoveries are

expected;

- Production gradually ramps up from 1.1 Mtpa to 1.4 Mtpa at a

rate of approximately 0.1 Mtpa per year; and

- Price assumptions used in the estimation include US$8,279/t of

copper and US$22.60/troy ounce (“oz”) of silver; in line with long

term Broker Consensus forecast copper pricing as at August 8,

2023;

- Mineral Reserves reported as dry, diluted, in-situ tonnes using

a Stope breakeven cut-off grade of 2.2% Cu for 2024 to 2026 and a

cut-off-grade of 1.65% for the remaining periods and a Development

breakeven cut-off grade of 1.0% Cu; and

- Costs assumptions underlying cut-off grade calculation include

US$78/t ore mined, US$20/t ore milled and US$21/t G&A ore

milled.

Criteria for Classification

The criteria used for classification, including the

classification of the Mineral Resources on which the Mineral

Reserves are based and the confidence in the modifying factors

applied are as follows:

- Mineral Reserves were classified based on the ration of

contained Measured and Indicated Mineral Resources;

- Measured Mineral Resources are converted to Proved Mineral

Reserves, and Indicated Mineral Resources are converted to Probable

Mineral Reserves;

- Any contained Inferred Mineral Resource is considered as

waste;

- No Measured Mineral Resource has been downgraded to Probable

Mineral Reserve; and

- Appropriate modifying factors have been applied based on

historic performance and in line with industry norms.

Mining Methodology

The mining method selected and other mining assumptions,

including mining recovery factors and mining dilution factors are

as follows:

- The mining method used is sub-level open stoping, primary in

the form of top-down, transverse stoping with cemented paste

backfill. There is also longitudinal and modified Avoca stoping.

Some areas are mined bottom-up. There is significant operating

experience with these mining methods at CSA Mine;

- Recovery factors used are 99% for transverse stopes, 91% for

longitudinal stopes, and 97% for modified Avoca stopes; and

- Dilutions factors used are 13% for transverse stopes, 20% for

longitudinal stopes, and 26% for modified Avoca stopes.

Processing Method

The processing method selected and other processing assumptions,

including the recovery factors applied and the allowances made for

deleterious elements are as follows:

- On-site processing is using a conventional flotation

concentrator which has been in operation since 1965. This produces

concentrate which is sent off-site for smelting and refining to

produce copper cathode;

- Copper processing recoveries are expected to average 97.5% -

98.5% and silver recoveries are expected to be 80%; and

- Any deleterious elements encountered are expected to be

maintained below penalty levels by managing the ore feed blend, if

required.

Basis for cut-off grade(s) or quality parameters

applied

The basis for cut-off grade(s) or quality parameters applied are

as follow:

- A stope break-even cut-off grade of 1.65% Cu was calculated:

- Based on historical operating costs with gradually applied

efficiency improvements reasonably anticipated by MAC; and

- Copper price of US$8,250 per tonne and silver price of 21.70

per troy ounce; and

- A stope cut-off grade of 2.20% Cu was applied prior to

end-of-year 2026 with 1.65% Cu applied thereafter. This was to

manage metal production during a period of increasing mining

rate.

Estimation Methodology

The procedure used (estimation methodology) in the preparation

of the Mineral Reserve are as follows:

- Mineable shapes were generated using Deswik.SO software;

- Stope dimensions are based on existing operating

practices;

- These mineable shapes were re-evaluated against the various

Mineral Resource models with all inferred material grades set to

zero Shapes were then manually refined removing stopes below

cutoff, in isolated areas, adding pillars as required, and removing

shapes which could not practically be mined due to proximity to

voids or infrastructure;

- Cut-offs were evaluated post application of modifying

factors;

- Development designs and sequencing were completed for all areas

to generate a Deswik schedule;

- The variable cut-off grade was applied, and where possible

stope below the variable cutoff were delayed to later in the mine

life; and

- The schedule was levelled based on production and development

constraints to generate the Mineral Reserve Schedule.

Material modifying factors

Material modifying factors, including the status of

environmental approvals, mining tenements and approvals, other

government factors and infrastructure requirements for selected

mining methods and for transportation to market are as follows:

- CSA Mine is an operating mine and holds Consolidated Mining

Lease 5 (CML5) and two small mining purposes leases, 1093 and 1094

(MPL1093, MPL1094):

- CML5, MPL1093, and MPL 1094 are due to expire in 2028, 2029,

and 2029 respectively; and

- All required government approvals and licenses for operation

are in place;

- All materially required mining infrastructure is in place

on-site for the purposes of mining, processing, and shipment of

concentrate to market; and

- The mining methods used for the Mineral Reserve estimate are

currently in use at CSA mine with extensive operating history.

____________________ 1 Please refer to MAC’s Announcement dated

19 March 2024 titled ‘CSA Copper Mine Reports Drill Results’.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240422290327/en/

Mick McMullen Chief Executive Officer Metals Acquisition

Limited. investors@metalsacqcorp.com

Morne Engelbrecht Chief Financial Officer Metals Acquisition

Limited

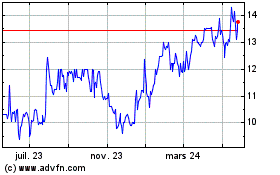

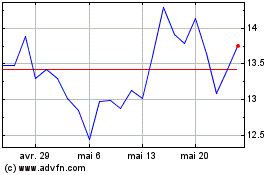

MAC Copper (NYSE:MTAL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

MAC Copper (NYSE:MTAL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025