- Accelerated engineering of Phase-2 facilities to update the

results of the Company’s integrated ore-to-anode-material

feasibility study in view of the specific requirements from

Panasonic Energy and GM, CAPEX optimization, and other project

planning developments, in preparation for FID.

- Preliminary work is ongoing at the Phase-2 Bécancour Battery

Material Plant site in preparation for the launch of

construction.

- Progress on the development of zero-emission equipment for the

Matawinie Mine by Caterpillar as a result of direct involvement

from respective technical and mining teams informing an integrated

solution tailored to NMG’s site.

- Approval by the regulatory body of the powerline path set to

connect the Matawinie Mine to the hydropower network.

- NMG was awarded a $500,000 research grant to advance the

development of versatile next-generation active anode

materials.

- Continued commercial engagement with tier-1 battery and EVs

manufacturers for the balance (approximately 15%) of the Phase-2

Bécancour Battery Material Plant active anode material

production.

- Improving market conditions exemplified by 9.9% year-to-date

increase in natural graphite prices (Benchmark Mineral

Intelligence, June 2024), increasing demand for anode materials in

the Western World, announced 25% US tariff on Chinese imports, and

sustained growth (20%) in global EV sales (Rho Motion, July

2024).

- Reappointment of the Directors and adoption of all resolutions

submitted at the Company’s Annual General and Special Meeting of

Shareholders.

- Period-end cash position of $73.9 million.

Nouveau Monde Graphite Inc. (“NMG“ or the “Company”) (NYSE: NMG,

TSX.V: NOU) reports on its progress to bring the Phase-2 Matawinie

Mine and Bécancour Battery Material Plant toward a final investment

decision (“FID”), while planning a Phase-3 expansion via its Uatnan

Mining Project and complementary value-added processing facilities.

The Company’s multiyear offtake agreements with Anchor Customers

Panasonic Energy Co., Ltd. (“Panasonic Energy”), a wholly owned

subsidiary of Panasonic Holdings Corporation (“Panasonic”) (TYO:

6752), and General Motors Holdings LLC, a wholly owned subsidiary

of General Motors Co. (collectively, “GM”) (NYSE:GM) (GM and

Panasonic being collectively the “Anchor Customers”), combined with

improved market dynamics and attractive long-term perspectives

provide solid underpinnings for scaling up operations from its

Phase-1 facilities to construction and commercial production.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240815600388/en/

NMG’s site for the Phase-2 Bécancour

Battery Material Plant during preliminary work covering tree

clearing, site leveling and construction of an onsite road. (Photo:

Business Wire)

Arne H Frandsen, Chair of NMG, declared: “The fundamentals of

NMG’s business model continue to be reaffirmed by governments and

manufacturers’ quest to secure resilient, local, and dependable

supply chains for energy autonomy, national security, and

decarbonization plans. NMG’s efforts are centered on crystallizing

our position as North America’s first and largest fully integrated

producer of natural graphite anode material and creating value for

our shareholders and stakeholders at every stage.”

Eric Desaulniers, Founder, President, and CEO of NMG, stated:

“Backing from our Anchor Customers, trade restriction from Western

governments promoting onshoring and friendshoring of battery

materials, plus a clear demand/supply deficit for anode material

looming in North America create sustained tailwinds as we near FID

for our Phase 2 and start assessing sites for our Phase-3

processing expansion. With nearly $75 million of cash position,

Team Nouveau Monde is focused on the disciplined execution of our

business strategy through updating of operational parameters of our

integrated feasibility study, optimizing CAPEX and procurement, as

well as adjusting our project financing structure to leverage tax

credits, grants and debt/equity instruments.”

Path to Commercial Production: Phase 2

Using an integrated project team (“IPT”) model, the Company is

preparing for the launch of the Phase-2 Matawinie Mine and

Bécancour Battery Material Plant once minimum financing is reached.

NMG's in-house team and strategic consultants specializing in

engineering, procurement, construction management, and project

controls are working collaboratively to advance engineering, and

finalize pre-construction deliverables (comprehensive construction

sequence, schedule, contracting strategy, programs for health,

safety, environment, and quality).

Updated cost projections reflecting the advancement in

engineering, cost optimization, and construction planning are being

prepared for the updated integrated feasibility study underway.

Outputs will support project financing in view of FID. NMG

continues to engage with governmental agencies, strategic

investors, and lenders to secure a robust capital structure.

Additionally, an external tax specialist firm has been tasked with

optimizing the Phase-2 CAPEX eligibility for the new Canadian

Investment Tax Credit for Clean Technology Manufacturing, which

offers a refundable tax credit of up to 30% of eligible capital

expenditures.

At the Phase-2 Bécancour Battery Material Plant site,

preliminary works were carried out in recent months to complete

tree clearing and the construction of an on-site road.

The Company is reporting progress on the development of

zero-emission equipment for the Matawinie Mine on the basis of

strategic agreements with Caterpillar Inc. (“Caterpillar”). Site

visits, prototypes demonstrations and modeling solutions inform

dynamically NMG’s electrification plans and the development of an

integrated tailored solution for the Matawinie Mine covering the

fleet, charging infrastructure and operating site management. In

addition, the final path for the dedicated powerline set to connect

the mining site to Hydro-Québec’s hydropower network for enabling

the full electrification of the Matawinie Mine was reviewed and

approved by the regulatory body.

Business Development & Market Perspectives

In addition to offtake agreements signed with Panasonic Energy

and GM, NMG is actively engaged with other tier-1 potential

customers for offtake agreement(s) on the balance of its Phase-2

active anode material production accompanied by strategic

investments. The Company’s Phase-1 operations support technical

marketing and product qualification efforts with said

manufacturers.

NMG is also preparing the following commercial phase with its

targeted Phase-3 expansion. In preparation for the Uatnan Mining

Project development, an initial technical and economic planning

study covering camp and logistics requirements is currently being

carried out by a local engineering firm to inform next steps. The

Company has also initiated the assessment of industrial sites for

the establishment of battery material plants to refine the future

Uatnan graphite concentrate production, including in Québec,

Europe, Middle East and the U.S., close to its potential customer

base.

Following a period of pressured market conditions, Q2-2024

generated a 9.9% year-to-date increase in natural graphite pricing

according to Benchmark Mineral Intelligence’s index (June 2024).

The anode material market is experiencing a steady rise in demand,

matched by incremental expansions in production capacities,

especially outside of China. Long-term growth is bolstered by

investments in ex-China natural anode material capacity and

recently announced reinstatement of a 25% U.S. tariff on Chinese

natural graphite imports starting in 2026.

Looking ahead, a sustained deficit in active anode material

supply is anticipated to drive price higher, with the market

expected to enter a prolonged deficit phase from 2029 onward.

Demand for active anode materials is projected to reach

approximately 1.37 million tonnes in 2024, a 32% increase from 2023

(Benchmark Mineral Intelligence, July 2024). The market is largely

driven by EVs, and secondarily by energy storage systems and

portable electronics.

Despite signs of a potential slowdown in EV adoption, the

industry, particularly for major automakers like Hyundai/Kia,

Toyota and Ford, showed robust growth with sales surging between

56% and 86% year-over-year (Bloomberg, May 2024). In the first half

of 2024, global EV sales reached 7 million units, marking a 20%

increase in comparison with the same period last year (Rho Motion,

July 2024).

Market conditions remain favorable to NMG’s business strategy,

especially with long-term incentives and trade instruments from

Western governments targeting onshoring and friendshoring of

battery materials.

Corporate Matters

In June 2024, NMG was awarded a $500,000 research grant from the

Québec Ministry of Natural Resources to develop a versatile

next-generation active anode material that meets the highest

performance standards without sacrificing production yield. This

grant directly supports NMG’s research and development portfolio to

refine its line of specialty products targeting innovation, reduced

environmental footprint, and increased competitiveness.

At the Company’s Annual General and Special Meeting of

Shareholders, shareholders reappointed each of the eight nominees

as Directors and adopted all other resolutions submitted for their

approval. The meeting was complemented with a corporate

presentation by NMG’s executive team providing an update on the

Company’s key projects, commercial engagement, and growth plan.

For the twelve-month rolling period ended June 30, 2024, NMG

reported a total recordable injury frequency rate of 2.57 and

severity rate of 0 at the Company’s facilities. There were no

environmental incidents during this period. The period-end cash

position is $73.9 million.

About Nouveau Monde Graphite

Nouveau Monde Graphite is an integrated company developing

responsible mining and advanced manufacturing operations to supply

the global economy with carbon-neutral active anode material to

power EV and renewable energy storage systems. The Company is

developing a fully integrated ore-to-battery-material source of

graphite-based active anode material in Québec, Canada. With

enviable ESG standards and structuring partnerships with anchor

customers, NMG is set to become a strategic supplier to the world’s

leading lithium-ion battery and EV manufacturers, providing

high-performing and reliable advanced materials while promoting

sustainability and supply chain traceability. www.NMG.com

Subscribe to our news feed: https://bit.ly/3UDrY3X

Cautionary Note

All statements, other than statements of historical fact,

contained in this press release including, but not limited to those

describing the update of the feasibility study for its Phase 2

reflecting the technological advancements, specific requirements of

the Anchor Customers, budget optimization, and other project

planning developments, to support project financing, and the

discussions with various governmental agencies, strategic

investors, and lenders, as well as the advantages of its project

execution model to ensure greater control over the project’s

direction and reduction project management and engineering costs,

the active discussions and positive outcome with other tier-1

potential customers for the balance of its Phase-2 active anode

material production, strategic investments and the potential of the

Phase 3 Uatnan project to meet the western market growth, the

assessment of industrial sites for the establishment of production

plants for such production, and the intended results of the

initiatives described in this press release and those statements

which are discussed under the “About Nouveau Monde” paragraph and

elsewhere in the press release which essentially describe the

Company’s outlook and objectives, constitute “forward-looking

information” or “forward-looking statements” (collectively,

“forward-looking statements”) within the meaning of Canadian and

United States securities laws, and are based on expectations,

estimates and projections as of the time of this press release.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions that, while considered reasonable by the

Company as of the time of such statements, are inherently subject

to significant business, economic and competitive uncertainties and

contingencies. These estimates and assumptions may prove to be

incorrect. Moreover, these forward-looking statements were based

upon various underlying factors and assumptions, including the

current technological trends, the business relationship between the

Company and its stakeholders, the ability to obtain sufficient

financing for the development of the Matawinie Mine and the

Bécancour Battery Material Plant, the Company’s ability to provide

high-performing and reliable advanced materials while promoting

sustainability and supply chain traceability, the consumers demand

for components in lithium-ion batteries for EVs and energy storage

solutions, the ability to operate in a safe and effective manner,

the timely delivery and installation at estimated prices of the

equipment supporting the production, assumed sale prices for

graphite concentrate, the accuracy of any Mineral Resource

estimates, future currency exchange rates and interest rates,

political and regulatory stability, prices of commodity and

production costs, the receipt of governmental, regulatory and third

party approvals, licenses and permits on favorable terms, sustained

labor stability, stability in financial and capital markets,

availability of equipment and critical supplies, spare parts and

consumables, the various tax assumptions, CAPEX and OPEX estimates,

all economic and operational projections relating to the project,

local infrastructures, the Company’s business prospects and

opportunities and estimates of the operational performance of the

equipment, and are not guarantees of future performance.

Forward-looking statements are subject to known or unknown risks

and uncertainties that may cause actual results to differ

materially from those anticipated or implied in the forward-looking

statements. Risk factors that could cause actual results or events

to differ materially from current expectations include, among

others, those risks, delays in the scheduled delivery times of the

equipment, the ability of the Company to successfully implement its

strategic initiatives and whether such strategic initiatives will

yield the expected benefits, the availability of financing or

financing on favorable terms for the Company, the dependence on

commodity prices, the impact of inflation on costs, the risks of

obtaining the necessary permits, the operating performance of the

Company’s assets and businesses, competitive factors in the

graphite mining and production industry, changes in laws and

regulations affecting the Company’s businesses, including the

changes in China’s policy regarding restrictions on Chinese

graphite materials exportations, political and social acceptability

risk, environmental regulation risk, currency and exchange rate

risk, technological developments, and general economic conditions,

as well as earnings, capital expenditure, cash flow and capital

structure risks and general business risks. A further description

of risks and uncertainties can be found in NMG’s Annual Information

Form dated March 27, 2024, including in the section thereof

captioned “Risk Factors”, which is available on SEDAR+ at

www.sedarplus.ca and on EDGAR at www.sec.gov. Unpredictable or

unknown factors not discussed in this Cautionary Note could also

have material adverse effects on forward-looking statements.

Many of these uncertainties and contingencies can directly or

indirectly affect, and could cause, actual results to differ

materially from those expressed or implied in any forward-looking

statements. There can be no assurance that forward-looking

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Forward-looking statements are provided for the purpose

of providing information about management’s expectations and plans

relating to the future. The Company disclaims any intention or

obligation to update or revise any forward-looking statements or to

explain any material difference between subsequent actual events

and such forward-looking statements, except to the extent required

by applicable law.

The market and industry data contained in this press release is

based upon information from independent industry publications,

market research, analyst reports and surveys and other publicly

available sources. Although the Company believes these sources to

be generally reliable, market and industry data is subject to

interpretation and cannot be verified with complete certainty due

to limits on the availability and reliability of raw data, the

voluntary nature of the data-gathering process and other

limitations and uncertainties inherent in any survey. The Company

has not independently verified any of the data from third-party

sources referred to in this press release and accordingly, the

accuracy and completeness of such data is not guaranteed.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Further information regarding the Company is available in the

SEDAR+ database (www.sedarplus.ca), and for United States readers

on EDGAR (www.sec.gov), and on the Company’s website at:

www.NMG.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240815600388/en/

MEDIA Julie Paquet VP Communications & ESG Strategy

+1-450-757-8905 #140 jpaquet@nmg.com

INVESTORS Marc Jasmin Director, Investor Relations

+1-450-757-8905 #993 mjasmin@nmg.com

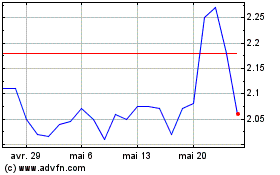

Nouveau Monde Graphite (NYSE:NMG)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Nouveau Monde Graphite (NYSE:NMG)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024