Form 8-K - Current report

22 Février 2024 - 11:09PM

Edgar (US Regulatory)

0000071829false00000718292024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 22, 2024

Newpark Resources, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-02960 | 72-1123385 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 9320 Lakeside Boulevard, | Suite 100 | |

| The Woodlands, | Texas | 77381 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (281) 362-6800

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | NR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Newpark Resources, Inc. (the “Company”) has prepared presentation materials (the “Presentation Materials”) that management intends to use from time to time, on February 22, 2024, and thereafter, in presentations about the Company’s operations and performance. The Company may use the Presentation Materials, possibly with modifications, in presentations to current and potential investors, lenders, creditors, insurers, vendors, customers, employees, and others with an interest in the Company and its business.

The information contained in the Presentation Materials is summary information that should be considered in the context of the Company’s filings with the Securities and Exchange Commission and other public announcements that the Company may make by press release or otherwise from time to time. The Presentation Materials speak as of the date of this Current Report on Form 8-K. While the Company may elect to update the Presentation Materials in the future or reflect events and circumstances occurring or existing after the date of this Current Report on Form 8-K, the Company specifically disclaims any obligation to do so. The Presentation Materials are furnished as Exhibit 99.1 to this Current Report on Form 8-K and are incorporated herein by reference. The Presentation Materials will also be posted in the Investors section of the Company’s website, http://www.newpark.com for up to 90 days.

The information referenced under Item 7.01 (including Exhibit 99.1 referenced in Item 9.01 below) of this Current Report on Form 8-K is being “furnished” under “Item 7.01. Regulation FD Disclosure” and, as such, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information set forth in this Current Report on Form 8-K (including Exhibit 99.1 referenced in Item 9.01 below) shall not be incorporated by reference into any registration statement, report or other document filed by the Company pursuant to the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such filing.

Use of Non-GAAP Financial Information

To help understand the Company’s financial performance, the Company has supplemented its financial results that it provides in accordance with generally accepted accounting principles (“GAAP”) with non-GAAP financial measures. Such financial measures include earnings before interest, taxes, depreciation and amortization (“EBITDA”), Adjusted EBITDA, Free Cash Flow, Adjusted EBITDA Margin, Net Debt, and Net Leverage.

We believe these non-GAAP financial measures are frequently used by investors, securities analysts and other parties in the evaluation of our performance and liquidity with that of other companies in our industry. Management uses these measures to evaluate our operating performance, liquidity and capital structure. In addition, our incentive compensation plan measures performance based on our consolidated EBITDA, along with other factors. The methods we use to produce these non-GAAP financial measures may differ from methods used by other companies. These measures should be considered in addition to, not as a substitute for, financial measures prepared in accordance with GAAP. Applicable reconciliations to the nearest GAAP financial measure of each non-GAAP financial measure are included in the attached Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | NEWPARK RESOURCES, INC. |

| | | (Registrant) |

| | | | |

| Date: | February 22, 2024 | By: | /s/ Gregg S. Piontek |

| | | Gregg S. Piontek |

| | | | Senior Vice President and Chief Financial Officer |

| | | | (Principal Financial Officer) |

February 2024 Investor Presentation Positioned for Sustainable Growth

Notice to Investors Forward Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical facts are forward-looking statements. Words such as “will,” “may,” “could,” “would,” “should,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” and similar expressions are intended to identify these forward-looking statements but are not the exclusive means of identifying them. These statements are not guarantees that our expectations will prove to be correct and involve a number of risks, uncertainties, and assumptions. Many factors, including those discussed more fully elsewhere in this release and in documents filed with the Securities and Exchange Commission by Newpark, particularly its Annual Report on Form 10-K, and its Quarterly Reports on Form 10-Q, as well as others, could cause actual plans or results to differ materially from those expressed in, or implied by, these statements. These risk factors include, but are not limited to, risks related to our exploration of strategic alternatives for the long-term positioning of our Fluids Systems division; divestitures; the worldwide oil and natural gas industry; our ability to generate internal growth; economic and market conditions that may impact our customers’ future spending; our customer concentration and reliance on the U.S. exploration and production market; our international operations; the ongoing conflicts in Europe and the Middle East; operating hazards present in the oil and natural gas and utilities industries and substantial liability claims, including catastrophic well incidents; our contracts that can be terminated or downsized by our customers without penalty; our product offering and market expansion; our ability to attract, retain, and develop qualified leaders, key employees, and skilled personnel; expanding our services in the utilities sector, which may require unionized labor; the price and availability of raw materials; inflation; capital investments and business acquisitions; market competition; technological developments and intellectual property; severe weather, natural disasters, and seasonality; public health crises, epidemics, and pandemics; our cost and continued availability of borrowed funds, including noncompliance with debt covenants; environmental laws and regulations; legal compliance; the inherent limitations of insurance coverage; income taxes; cybersecurity incidents or business system disruptions; activist stockholders that may attempt to effect changes at our Company or acquire control over our Company; share repurchases; and our amended and restated bylaws, which could limit our stockholders’ ability to obtain what such stockholders believe to be a favorable judicial forum for disputes with us or our directors, officers or other employees. We assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities laws. Newpark's filings with the Securities and Exchange Commission can be obtained at no charge at www.sec.gov, as well as through our website at www.newpark.com. Non-GAAP Financial Measures This presentation includes references to financial measurements that are supplemental to the Company’s financial performance as calculated in accordance with generally accepted accounting principles (“GAAP”). These non-GAAP financial measures include earnings before interest, taxes, depreciation and amortization (“EBITDA”), Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Net Debt, and Net Leverage. We believe these non-GAAP financial measures are frequently used by investors, securities analysts and other parties in the evaluation of our performance and liquidity with that of other companies in our industry. Management uses these measures to evaluate our operating performance, liquidity and capital structure. In addition, our incentive compensation plan measures performance based on our consolidated EBITDA, along with other factors. The methods we use to produce these non- GAAP financial measures may differ from methods used by other companies. These measures should be considered in addition to, not as a substitute for, financial measures prepared in accordance with GAAP. Disclaimers 2

Agenda Introduction End-Market Overview Summary of Key Financial Data 3

4 Introduction

Transformation Strategy Aligning Portfolio to Maximize Value Creation Through Accelerated Growth in Power & Infrastructure Markets Disciplined Strategy Aligned with Long-Term Global Megatrends

O&G Exploration & ProductionMidstream Company Overview Newpark Resources, Inc. headquartered in The Woodlands, TX, is a global company operating two independent business units, Industrial Solutions and Fluids Systems, supporting energy and infrastructure markets. We built a reputation for innovating and adapting to the changing needs of our customers, delivering sustainable technologies that enable society to prosper. • NYSE Stock Symbol: NR • Operating in more than 20 countries worldwide; ~55% of 2023 revenues derived from U.S. • Earnings primarily driven by utilities and industrial end-markets, while exposure to O&G reduced through recent dives tures • Strong financial profile with modest debt burden and no significant near-term maturities 6 Specialty Rental & Services Company Supporting Power and Infrastructure Markets NEWPARK RESOURCES GLOBAL FOOTPRINT Diverse End-Market Coverage Renewable Generation Transmission & Distribution Petrochemical Infrastructure Construction Launched sale process for Fluids Systems in Q3 2023; expect substantial completion by mid-2024

Leader in Power and Energy Infrastructure Solutions INDUSTRIAL SOLUTIONS Power Infrastructure, O&G, Construction and Renewables Leading provider of specialty rental and services, redefining safety & efficiency standards Unique business model includes integrated manufacturing of 100% recyclable DURA-BASE composite matting, which offers economic and ESG benefits vs. traditional access products Longstanding, blue-chip customer relationships across T&D utility owners and infrastructure contractors Consistent FCF generation, strong EBITDA margin, and solid ROI FLUID SYSTEMS Oil, Natural Gas, and Geothermal #1 rated** drilling and reservoir fluids solutions provider in overall performance globally Leading portfolio of sustainable water-based technologies delivering outstanding performance and reducing carbon footprint*** Globally positioned in long-term markets with established customers supported by current O&G global demand tailwinds Improved margin and FCF generation profile through recent divestitures and focused asset-light operating model 7 Providing Innova ve Product & Service Solu ons for Power T&D and O&G Infrastructure 70% OF SEGMENT ADJ. EBITDA (2023)* * Adjusted EBITDA is a non-GAAP financial measure. See earnings release and reconciliation to the most comparable GAAP measure in “Non-GAAP Financial Measures” slides within this presentation ** 2022 Drilling Fluids Supplier Performance Report, Kimberlite International Oilfield Research *** Relative to hydrocarbon-based fluids 30% OF SEGMENT ADJ. EBITDA (2023)* 92% OF SEGMENT CAPEX (2023) 8% OF SEGMENT CAPEX (2023)

Projected Invest & Grow Segment Approach Supports Growth & Shareholder Return 8 ApproachTTM ADJ EBITDA**Net Assets* Fl ui ds S ys te m s $74M $32M * Net Assets represents segment net assets, excluding cash and debt, as of December 31, 2023. ** Adjusted EBITDA is a non-GAAP financial measure. See earnings release and reconciliation to the most comparable GAAP measure in “Non-GAAP Financial Measures” slides within this presentation. *** Transmission investment - Edison Electric Institute Business Analytics Group, Jan 2024 ; Global Oil Demand – IEA, June 2023 Market Outlook In du st ria l S ol ut io ns Optimize for Cash Generation Sale Process Launched $202M Inventory AR, net of AP Long-lived assets and other, net $239M Inventory AR, net of AP Rental fleet Other long-lived assets, net Actual & Projected Transmission Investment*** Actual Projected YEARS BI LL IO N S M IL LI O N S O F BA RR EL S PE R D AY Global Oil Demand*** Actual YEARS

29% YoY reduction in Fluids Systems net working capital Fluid Systems Net Working Capital 13% YoY growth in Industrial Solutions EBITDA (TTM) Industrial Solutions EBITDA* (TTM) 12% YoY growth from Industrial Solutions Rental and Services revenues (TTM) Key Opera onal Highlights Aligned with Strategy 9 Disciplined Execu on Delivering Shareholder Value Crea on 8% YoY reduction in weighted average shares outstanding Rental and Service Revenue (TTM) Weighted Average Shares Outstanding * Adjusted EBITDA is a non-GAAP financial measure. See reconciliation to the most comparable GAAP measure in “Non-GAAP Financial Measures” slides within this presentation.

Well Positioned in Substantial Energy Megatrends 10 Multi-Trillion Dollar Markets Provide Long-Term Opportunities $14T+ Electrification $1T+ Renewables $12T+ Global Oil & Gas Investment in global electrical grid to enable “electrification of everything” Renewable Generation tie- ins and grid hardening driving long-term infrastructure development O&G Investment is projected to meet demand in Sustainable Development Scenario over next 30 years Source: US Energy Information Administration 2021/EEI//International Energy Agency Fuel Report, Jan 2021/Industry Consulting Estimates/Bloomberg NEF & S&P Global Market Intelligence, Feb 2021

Differentiated Model Exploiting Competitive Advantages • Self-funding organic expansion in high-growth, high-returning infrastructure markets • Focused capital light Fluid Systems positioned to generate cash through cycles • Technology, scale, and service drive customer loyalty and productivity • Global presence in diversified end markets with blue-chip customers • Modest leverage provides stability and potential inorganic growth funding • Capable of balancing growth, returns, and FCF to maximize long-term value creation for our shareholders 11 Over 50 Years of Technology & Service Innova on Posi oning Us for Tomorrow’s Opportuni es Balancing growth, returns & FCF for shareholders Investing in higher returning, more stable specialty rentals & servicesCash generation via global, capital-light, returns-focused Fluids portfolio

Change20232019 -2%$80M Adjusted EBITDA* $82M Adjusted EBITDA* Maintaining Adjusted EBITDA as we reposition the Company +15%70% % of Segment Adj. EBITDA* generated from Industrial Solutions 61% % of Segment Adj. EBITDA* generated from Industrial Solutions Increasing Adjusted EBITDA generation from more stable Industrial Solutions segment -33%$452M Net Assets** (EOY) $675M Net Assets** (BOY) Reducing capital employed to drive agility in cyclical O&G focused operations +50%54% % of Segment Net Assets** deployed in Industrial Solutions 35% % of Segment Net Assets** deployed in Industrial Solutions Redeploying capital toward higher-returning segment -6%85M Shares Outstanding (Average) 90M Shares Outstanding (Average) Returning value to shareholders through share repurchases -56% (-100%)$75M ($0) Total Principal Outstanding (Equity-Linked) $172M ($100M) Total Principal Outstanding (Equity-Linked) Reducing total debt and eliminated equity-linked debt Meaningful Progress in our Transformation Strategic Focus on Growth in More Stable, Higher-Margin Industrial Markets Key to Long-Term Value Creation 12* Adjusted EBITDA is a non-GAAP financial measure. See reconciliation to the most comparable GAAP measure in “Non-GAAP Financial Measures” slides within this presentation. ** Net Assets represents consolidated net assets, excluding cash and debt, as of December 31.

13 End-Market Overview

Utilities Infrastructure Megatrend Powering Growth The $1.2 trillion Infrastructure Investment and Jobs Act (IIJA) is investing significantly over next decade, including ~ $70B for electric grid and hardened energy infrastructure $300B federal clean energy tax package over next 10 years from Inflation Reduction Act (IRA) Aging infrastructure, system hardening, grid reliability, and renewable energy projects are key drivers for approximately $30B transmission infrastructure spend 14 Significant Long-term Capital Investment in Innovation & Infrastructure Enhanced by Legislation Data Sources: Whitehouse.gov/ Brookings.edu, Feb. 1, 2023, Edison Electric Institute Business Analytics Group, Jan 2024 Infrastructure Investment and Jobs Act (IIJA) is investing significantly over next decade U.S. investor-owned utilities are expected to make about $140B+ annual capital investments with ~8% CAGR for clean energy technologies and decarbonization Projected annual U.S. utility transmission investment with ~10% of spend on temporary access specialty rental & services $1.2T+ $140B+ $30B+

Positioned for Growth in Multi-Billion Dollar Temporary Access Market Specialty Rental and Services Supporting Infrastructure Megatrends Utilities O&G PipelineConstruction Rail & Other Our Footprint What We Do Leading manufacturer and rental provider of composite temporary worksite access solutions with a diversified customer base, which primarily compete against access alternatives such as wood, gravel, or permanent surfaces Industries We Serve 12% YoY growth in Rental & Service Revenue (TTM) 13% YoY growth in Industrial Solutions EBITDA (TTM) 34% Average Adjusted Industrial Solutions EBITDA Margin 2021 – 2023 53% 2023 rental revenue as % of avg. fleet cost 12 year Estimated useful life of mat deployed into rental fleet 15

Industrial Solutions End-to-End Operating Model 16 Differentiated by Optimizing Across the Value Chain Providing Strong Results Product Engineering & Design Materials Sourcing & Procurement Precision Manufacturing Product Direct Sales Mat Fleet Rental & Services Belief in Innovation • High performance, safety, and service-centric culture • Introduced DURA-BASE to the world over 25 years ago as the 100% recyclable composite matting solution • Committed R&D, Project Technical Support team with industry-leading experience • Strategically located in Carencro, LA, close to suppliers using proprietary compounds of resins, with expanding use of alternative and recycled material inputs • 50,000 sq ft automated manufacturing plant with over half a million 8’ x 14’ mats manufactured • Quality management compliant with ISO 9001:2015 Scaled to Succeed With Proven Record of Delivering • Supplying small- and large-scale requests domestically and abroad • Most experienced composite matting industry sales and operations team • Dedicated to new and longstanding customer relationships • Long asset life with low maintenance leveraging technology, and large scalable operating footprint • Operate the largest composite DURA-BASEmatting fleet in the world

Utilities O&G General Construction Pipeline Rail Other 2023 REVENUE BY INDUSTRY $50 $60 $70 $80 2021 2022 2023 M IL LI O N S Industrial Solutions • Strategic investments in technology, scale, and service to drive specialty rental differentiation • Expansion of specialty rental fleet to meet long-term infrastructure build-out in multiple industries • 15% average revenue CAGR from Utilities & Industrial end-markets since 2016; contribute ~75% of 2023 segment revenues • Leverage R&D to launch higher-margin products focused on driving operating efficiency and sustainability • Robust rental unit economics drive strong EBITDA margin and ROIC profile 17 Strategic Progress Supported by Strong Infrastructure Trends Rental & Service (R&S) Product Sales 2023 REVENUE MIX * Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. See reconciliation to the most comparable GAAP measure in “Non-GAAP Financial Measures” slides within this presentation. ADJUSTED EBITDA* 52% 53% 53% 48% 52% 56% 60% $- $20 $40 $60 $80 $100 2021 2022 2023 RE N TA L RE VE N U E (M IL ) Rental Revenue Rental Revenue as % of Avg. Fleet Cost RENTAL REV AS % AVG FLEET COST

Global Demand for Oil and Gas Remains Resilient $12T+ Investment in Oil & Gas projected to meet global demand in Sustainable Development Scenario over next 30 years Access to affordable and reliable energy critical for developing economies Geopolitical instability heightens global focus on energy security during the transition to alternative energy sources 18 Emergence of Alternative Energy Lags Global Demand World’s Energy which comes from fossil fuels today Renewables demand growth requiring new infrastructure construction and related services Total demand results in an increase of global Oil/Liquids/Natural Gas demand calling for efficient, innovative, and sustainable drilling and reservoir solutions 80%+ 70%+ 20%+ Source: US Energy Information Administration 2021/EEI//International Energy Agency Fuel Report, Jan 2021/Jefferies Estimates/Bloomberg NEF & S&P Global Market Intelligence, Feb 2021 OUTLOOK BY 2050

Int'l U.S. Canada • Recent divestitures driving shift to international markets; 60% of 2023 revenues generated outside of U.S. • Global footprint aligned to long-term, strategic markets • Reshaping balance sheet to drive “Capital-Light” model, and reduce return cyclicality • FCF generation to support higher-returning growth and return to shareholders • In September 2023, sale process launched for Fluids Systems; anticipate substantial completion by mid-2024 $100 $200 $300 $400 2021 2022 2023 M IL LI O N S Fluids Systems Agile, Capital-Light Technology & Services Capable of Cash Generation Through Cycles 2023 REVENUE MIX 2023 CASH GENERATION FROM RECENT DIVESTITURES $34M NET ASSETS* 19 * Net Assets represents segment net assets, excluding cash and debt, as of December 31.

Long-Term Capital Allocation Strategy 20 Disciplined Approach Balances Growth Investments with Return of Capital Maintain Target Leverage Invest in Growth Return Excess Cash to Investors Organic M&A• Target net leverage range of 0.5x–1.5x • Net leverage*: 0.5x • Total liquidity**: $99M • Maintaining sufficient liquidity to support strategic growth • ABL Facility matures 2027 • 2023 Free Cash Flow generation of $74M * Net leverage ratio calculated as Net Debt divided by Q4 2023 TTM Adjusted EBITDA. ** Reflects ABL Facility availability plus cash and cash equivalents as of December 31, 2023. • Continued organic investment in high returning opportunities • > 80% of 2023 CAPEX deployed to expand rental fleet and support infrastructure market penetration • Continually evaluate opportunities to accelerate Industrial strategy • Disciplined execution based on strategic value, size, risk and appropriate economics • Improving equity value key to inorganic strategy & shareholder value • Committed to programmatic return of capital through share repurchase program • 7% YoY reduction in full year weighted average shares outstanding

0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 2019 2020 2021 2022 2023 Total Company TRIR Sustainability Embedded in Our DNA Environmental Social Governance 21 2022 Sustainability Report Including SASB & TCFD Disclosures Available on Website Shareholder Approval Rate of Executive Compensation * Reflects internal estimates of impact of DURA-BASE® Composite Matting System. Board Independence Independent Board Diversity Safety Drives Everything We Do Committed to Local Personnel Across Our Operations

Why Invest in Newpark Resources? Meaningful growth opportunity tied to the energy transition and critical infrastructure Global presence in large-scale energy markets Proven technologies with economic and ESG benefits Demonstrated ability to adapt and grow Balancing investment in growth with return of capital Capital structure to support growth plans 22 Leading Provider of Sustainable Technologies and Services

23 Summary of Key Financial Data

Business Segment Overview Industrial Solutions Fluids Systems 24 $40 $60 $80 $100 $100 $120 $140 $160 $180 $200 $220 $240 2021 2022 2023 AD JU ST ED E BI TD A (M IL LI O N S) RE VE N U E (M IL LI O N S) Revenues Adjusted EBITDA* $0 $20 $40 $60 $300 $375 $450 $525 $600 $675 $750 2021** 2022** 2023 AD JU ST ED E BI TD A (M IL LI O N S) RE VE N U E (M IL LI O N S) Revenues Adjusted EBITDA* Rental & Service (R&S) Product Sales U.S. U.K. 2023 REVENUES Int'l U.S. Canada 2023 REVENUES * Adjusted EBITDA is a non-GAAP financial measure. See reconciliation to the most comparable GAAP measure in “Non-GAAP Financial Measures” slides within this presentation. ** Includes operations of Gulf of Mexico and U.S. Mineral Grinding operations, both of which were exited in Q4 2022. Divested units contributed $83 million of revenues, $5 million of depreciation expense, and a $40 million operating loss in 2022, including $29 million impairment charge, and $62 million of revenues, $7 million of depreciation expense and $7 million operating loss in 2021. • Delivering double-digit annual revenue growth • Strong Energy Transition market tailwinds • Consistent cash flow and solid ROI • Reshaping portfolio to monetize working capital and improve returns • ~ 80% of asset base comprised of receivables, inventory, and other working capital

Consolidated Statements of Operations (unaudited) 25

Operating Segment Results (unaudited) 26

Impact of 2022 Divestitures (unaudited) 27

Consolidated Balance Sheets (unaudited) 28

Consolidated Statements of Cash Flows (unaudited) 29

Non-GAAP Financial Measures (unaudited) 30

Non-GAAP Financial Measures (unaudited) 31

32 Non-GAAP Financial Measures (unaudited)

Non-GAAP Financial Measures (unaudited) 33

Non-GAAP Financial Measures (unaudited) 34

v3.24.0.1

Cover Page

|

Feb. 22, 2024 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0000071829

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 22, 2024

|

| Entity Registrant Name |

Newpark Resources, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-02960

|

| Entity Tax Identification Number |

72-1123385

|

| Entity Address, Address Line One |

9320 Lakeside Boulevard,

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

The Woodlands,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77381

|

| City Area Code |

281

|

| Local Phone Number |

362-6800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

NR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

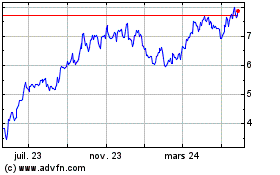

Newpark Resources (NYSE:NR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

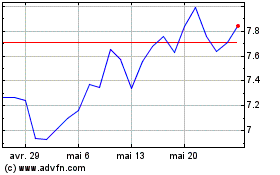

Newpark Resources (NYSE:NR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024