UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

no. 5)*

MORPHOSYS

AG

(Name

of Subject Company (Issuer))

NOVARTIS BIDCO GERMANY AG

an

indirect wholly owned subsidiary of

NOVARTIS

AG

(Name

of Filing Persons (Offerors))

Ordinary

Shares, no Par Value

(Title

of Class of Securities)

617760202

(CUSIP

Number of Class of Securities)

Karen

L. Hale

Chief Legal Officer

Novartis AG

Lichstrasse 35

CH-4056 Basel

Switzerland

Telephone: +41-61-324-1111

Fax: +41-61-324-7826

(Name,

Address, and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With

a copy to:

Jenny

Hochenberg

Freshfields Bruckhaus Deringer US LLP

601 Lexington Ave.

New York, NY 10022

Telephone: +1 646 863-1626 |

|

Doug

Smith

Freshfields Bruckhaus Deringer LLP

100 Bishopsgate

London EC2P 2SR

United Kingdom

+44 20 7936 4000 |

August

13, 2024

(Date of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for

other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 617760202 | SCHEDULE

13D | |

| 1. |

|

Names of Reporting Person

Novartis BidCo Germany AG

I.R.S. Identification No. of above person (entities only) |

| |

| 2. |

|

Check the Appropriate Box if a Member of a Group |

|

(a) x |

| |

|

|

|

|

|

|

|

(b) ¨ |

| |

| 3. |

|

SEC Use Only |

|

|

|

|

|

|

| |

| 4. |

|

Source of Funds (See Instructions)

OO, AF |

| |

| 5. |

|

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) |

| |

|

|

|

|

|

|

|

¨ |

| |

| 6. |

|

Citizenship or Place of Organization

Switzerland |

| |

| |

|

|

|

|

|

|

Number of

Shares |

|

7. |

|

Sole Voting Power

0 |

|

|

| Beneficially |

|

|

Owned by

Each |

|

8. |

|

Shared Voting Power

35,608,420 | |

|

|

| Reporting |

|

|

Person

With |

|

9. |

|

Sole Dispositive Power

0 |

|

|

| |

|

|

|

|

| |

|

|

|

10. |

|

Shared Dispositive Power

35,608,420 |

|

|

| |

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

35,608,420 |

| |

| 12. |

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares |

|

|

| |

|

|

|

|

|

|

|

¨ |

| |

| 13. |

|

Percent of Class Represented by Amount in Row (11)

94.55%(1) |

| |

| 14. |

|

Type of Reporting Person (See Instructions)

CO |

| |

(1) The calculation

of the foregoing percentage is based on 37,662,738 outstanding bearer shares (“Shares”) with no-par value (and excluding

Shares held in treasury) of MorphoSys AG (the “Issuer”).

| CUSIP No. 617760202 | SCHEDULE

13D | |

| 1. |

|

Names of Reporting Person

Novartis BidCo AG

I.R.S. Identification No. of above person (entities only) |

| |

| 2. |

|

Check the Appropriate Box if a Member of a Group |

|

(a) x |

| |

|

|

|

|

|

|

|

(b) ¨ |

| |

| 3. |

|

SEC Use Only |

|

|

|

|

|

|

| |

| 4. |

|

Source of Funds (See Instructions)

OO, AF |

| |

| 5. |

|

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) |

| |

|

|

|

|

|

|

|

¨ |

| |

| 6. |

|

Citizenship or Place of Organization

Switzerland |

| |

| |

|

|

|

|

|

|

Number of

Shares |

|

7. |

|

Sole Voting Power

0 |

|

|

| Beneficially |

|

|

Owned by

Each |

|

8. |

|

Shared Voting Power

35,608,420 |

|

|

| Reporting |

|

|

Person

With |

|

9. |

|

Sole Dispositive Power

0 |

|

|

| |

|

|

|

|

| |

|

|

|

10. |

|

Shared Dispositive Power

35,608,420 |

|

|

| |

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

35,608,420 |

| |

| 12. |

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares |

|

|

| |

|

|

|

|

|

|

|

¨ |

| |

| 13. |

|

Percent of Class Represented by Amount in Row (11)

94.55%(2) |

| |

| 14. |

|

Type of Reporting Person (See Instructions)

CO |

| |

(2) The calculation of the foregoing percentage is based on 37,662,738 outstanding Shares (and excluding Shares held in treasury).

| CUSIP No. 617760202 | SCHEDULE

13D | |

| 1. |

|

Names of Reporting Person

Novartis Pharma AG

I.R.S. Identification No. of above person (entities only) |

| |

| 2. |

|

Check the Appropriate Box if a Member of a Group |

|

(a) x |

| |

|

|

|

|

|

|

|

(b) ¨ |

| |

| 3. |

|

SEC Use Only |

|

|

|

|

|

|

| |

| 4. |

|

Source of Funds (See Instructions)

OO, AF |

| |

| 5. |

|

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) |

| |

|

|

|

|

|

|

|

¨ |

| |

| 6. |

|

Citizenship or Place of Organization

Switzerland |

| |

| |

|

|

|

|

|

|

Number of

Shares |

|

7. |

|

Sole Voting Power

0 |

|

|

| Beneficially |

|

|

Owned by

Each |

|

8. |

|

Shared Voting Power

35,608,420 |

|

|

| Reporting |

|

|

Person

With |

|

9. |

|

Sole Dispositive Power

0 |

|

|

| |

|

|

|

|

| |

|

|

|

10. |

|

Shared Dispositive Power

35,608,420 |

|

|

| |

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

35,608,420 |

| |

| 12. |

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares |

|

|

| |

|

|

|

|

|

|

|

¨ |

| |

| 13. |

|

Percent of Class Represented by Amount in Row (11)

94.55%(3) |

| |

| 14. |

|

Type of Reporting Person (See Instructions)

CO |

| |

(3)

The calculation of the foregoing percentage is based on 37,662,738 outstanding Shares (and excluding Shares held in treasury).

| CUSIP No. 617760202 | SCHEDULE

13D | |

| 1. |

|

Names of Reporting Person

Novartis AG

I.R.S. Identification No. of above person (entities only) |

| |

| 2. |

|

Check the Appropriate Box if a Member of a Group |

|

(a) x |

| |

|

|

|

|

|

|

|

(b) ¨ |

| |

| 3. |

|

SEC Use Only |

|

|

|

|

|

|

| |

| 4. |

|

Source of Funds (See Instructions)

OO, AF |

| |

| 5. |

|

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) |

| |

|

|

|

|

|

|

|

¨ |

| |

| 6. |

|

Citizenship or Place of Organization

Switzerland |

| |

| |

|

|

|

|

|

|

Number of

Shares |

|

7. |

|

Sole Voting Power

0 |

|

|

| Beneficially |

|

|

Owned by

Each |

|

8. |

|

Shared Voting Power

35,608,420 |

|

|

| Reporting |

|

|

Person

With |

|

9. |

|

Sole Dispositive Power

0 |

|

|

| |

|

|

|

|

| |

|

|

|

10. |

|

Shared Dispositive Power

35,608,420 |

|

|

| |

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

35,608,420 |

| |

| 12. |

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares |

|

|

| |

|

|

|

|

|

|

|

¨ |

| |

| 13. |

|

Percent of Class Represented by Amount in Row (11)

94.55%(4) |

| |

| 14. |

|

Type of Reporting Person (See Instructions)

CO |

| |

(4)

The calculation of the foregoing percentage is based on 37,662,738 outstanding Shares (and excluding Shares held in treasury).

Explanatory Note

This

Amendment No. 5 (the “Amendment No. 5”) amends the statement on Schedule 13D originally filed by the Reporting Persons

on April 18, 2024. The Items below amend the information disclosed under the corresponding Item of the Schedule 13D as described

below. Except as specifically provided herein, this Amendment No. 5 does not modify any of the information previously reported in

the Schedule 13D. Capitalized terms used but not defined herein shall have the meanings attributed to them in the Schedule 13D.

Item 2. Identity and

Background

Item

2 of the Schedule 13D is hereby amended by supplementing it with the following:

On

August 13, 2024, the Purchaser announced the final results of the Delisting Purchase Offer and the expiration of the acceptance period

of the Delisting Purchase Offer at 24:00 hours (local time Frankfurt am Main, Germany) / 18:00 hours (local time New York, United States

of America) on August 2, 2024.

On

August 13, 2024, the Purchaser acquired 1,216,926 Shares tendered during the acceptance period of the Delisting Purchase Offer for

an aggregate price of EUR 82,750,968.

Item 5. Interest in

Securities of the Issuer

Item

5(a) of the Schedule 13D is hereby amended and restated in its entirety to read as follows:

(a) and

(b)—The information contained on the cover pages of this Schedule 13D is incorporated herein by reference. The Purchaser

is the direct beneficial owner of 35,608,420 Shares as of 9:00 a.m. New York time on August 2, 2024, representing approximately

94.55% of all Shares (including Shares represented by ADSs), which does not take into account any Shares (including Shares represented

by ADSs) tendered during the Additional Acceptance Period.

None of the

Reporting Persons nor, to the knowledge of the Reporting Persons, any person named in Item 2 hereof has beneficial ownership of any Shares,

except as set forth on Schedule B or otherwise described in this Schedule 13D.

(c)—None

of the Reporting Persons nor, to the best knowledge of the Reporting Persons, any person named in Item 2 hereof, has engaged in any transaction

during the past 60 days in, any Shares, except as set forth on Schedule B or otherwise described in this Schedule 13D.

(d)—

Except as described in this Schedule 13D, to the knowledge of the Reporting Persons, none of the Reporting Persons nor any of the persons

set forth on Schedule A hereto has the right to receive or the power to direct the receipt of dividends from, or the proceeds

from the sale of, the Shares reported herein.

(e)—Not

applicable.

Schedule B

On August 13,

2024, the Purchaser acquired a total of 1,216,926 Shares tendered in the Delisting Purchase Offer during the acceptance period of the

Delisting Purchase Offer for an aggregate price of EUR 82,750,968.

SIGNATURES

After

reasonable inquiry and to the best of their knowledge and belief, the undersigned certifies that the information set forth in this statement

is true, complete and correct.

Date:

August 15, 2024

| Novartis BidCo Germany AG |

|

| |

|

| By: |

/s/

Jan-Hendrik Petersen |

|

| |

Name: |

Jan-Hendrik Petersen |

|

| |

Title: |

As Authorized Signatory |

|

| Novartis BidCo AG |

|

|

| |

|

|

| By: |

/s/ Daniel Weiss |

|

/s/ Bertrand Bugnon |

| |

Name: |

Daniel Weiss |

|

Name: |

Bertrand Bugnon |

| |

Title: |

As Authorized Signatory |

|

Title: |

As Authorized Signatory |

| |

|

|

| Novartis Pharma AG |

|

|

| |

|

|

| By: |

/s/ Lukas Foertsch |

|

/s/ Luca Hammel |

| |

Name: |

Lukas Foertsch |

|

Name: |

Luca Hammel |

| |

Title: |

As Authorized Signatory |

|

Title: |

As Authorized Signatory |

| Novartis AG |

|

|

| |

|

|

| By: |

/s/ David Quartner |

|

/s/ Tariq ElRafie |

| |

Name: |

David Quartner |

|

Name: |

Tariq ElRafie |

| |

Title: |

As Attorney |

|

Title: |

As Attorney |

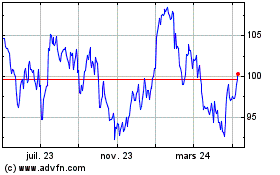

Novartis (NYSE:NVS)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

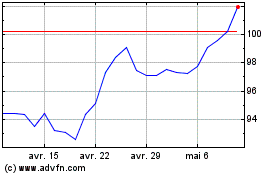

Novartis (NYSE:NVS)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025