ISS Recommends That OSI Restaurant Partners' Stockholders Vote 'FOR' Merger

26 Avril 2007 - 10:08PM

PR Newswire (US)

TAMPA, Fla., April 26 /PRNewswire-FirstCall/ -- OSI Restaurant

Partners, Inc. (NYSE:OSI) today announced that Institutional

Shareholder Services (ISS) has recommended that OSI's stockholders

vote "FOR" adoption of OSI's merger agreement with Kangaroo

Holdings, Inc. and Kangaroo Acquisition, Inc. at its May 8, 2007

Special Meeting of Stockholders. Kangaroo Holdings and Kangaroo

Acquisition are controlled by an investor group comprised of

investment funds affiliated with Bain Capital Partners LLC and

Catterton Management Company LLC, which are private equity firms,

and expected to include OSI's founders and certain members of OSI's

senior management. ISS is a leading independent U.S. proxy advisory

firm and its voting analyses and recommendations are relied upon by

hundreds of major institutional investment funds, mutual funds and

fiduciaries throughout the country. In recommending that OSI's

stockholder vote "FOR" adoption of the merger agreement, ISS stated

in part that: "Based on reasonable premium and valuation multiples,

lack of interest from competing bidders and a normal arbitrage

spread for the company's stock price, we believe that the current

offer represents a more favorable alternative for shareholders."*

*Permission to use quotations from the ISS report was neither

sought nor obtained. As announced on November 6, 2006, OSI entered

into a merger agreement with Kangaroo Holdings and Kangaroo

Acquisition pursuant to which OSI's stockholders will be entitled

to receive $40.00 in cash for each share they own, subject to

closing of the transaction. The merger consideration represents a

23% premium over the closing price of shares of OSI common stock on

November 3, 2006, the last trading day prior to announcement of the

merger. OSI's stockholders are encouraged to read the definitive

proxy statement relating to the merger in its entirety as it

provides, among other things, a detailed discussion of the process

that led to execution of the merger agreement. A special committee

comprised of all of OSI's independent directors and OSI's board of

directors recommended that OSI stockholders vote "FOR" adoption of

the merger agreement. The vote of each OSI stockholder is very

important regardless of the number of shares of common stock that a

stockholder owns. A failure to vote will have the same legal effect

as a vote against adoption of the merger agreement. Stockholders

who have questions about the merger, need assistance in submitting

their proxy or voting their shares should contact OSI's proxy

solicitor, MacKenzie Partners, Inc., 105 Madison Avenue, New York,

NY 10016, 1-800-322-2885 toll-free) or 212-929-5500 (call-collect),

Email: . OSI Restaurant Partners' portfolio of brands consists of

Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill,

Fleming's Prime Steakhouse & Wine Bar, Roy's, Lee Roy Selmon's,

Blue Coral Seafood & Spirits and Cheeseburger in Paradise. It

has operations in 50 states and 20 countries internationally.

Additional Information and Where to Find It A definitive proxy

statement of OSI Restaurant Partners and other materials has been

filed with the Securities and Exchange Commission (the "SEC"). WE

URGE INVESTORS TO READ THE PROXY STATEMENT AND THESE OTHER

MATERIALS CAREFULLY BECAUSE THEY CONTAIN IMPORTANT INFORMATION

ABOUT OSI RESTAURANT PARTNERS AND THE PROPOSED TRANSACTION.

Investors may obtain free copies of the definitive proxy statement

as well as other filed documents containing information about OSI

Restaurant Partners at http://www.sec.gov/, the SEC's free internet

site. Free copies of OSI Restaurant Partners' SEC filings are also

available on OSI Restaurant Partners' internet site at

http://www.osirestaurantpartners.com/. Participants in the

Solicitation OSI Restaurant Partners and its executive officers and

directors may be deemed, under SEC rules, to be participants in the

solicitation of proxies from OSI Restaurant Partners' stockholders

with respect to the special meeting of stockholders. Information

regarding the officers and directors of OSI Restaurant Partners is

included in its definitive proxy statement for its 2006 annual

meeting filed with the SEC on March 30, 2006. More detailed

information regarding the identity of potential participants, and

their direct or indirect interests, by securities, holdings or

otherwise, is set forth in the proxy statement and other materials

filed with SEC in connection with the proposed transaction.

DATASOURCE: OSI Restaurant Partners, Inc. CONTACT: Lisa Hathcoat or

Dirk Montgomery, of OSI Restaurant Partners, Inc., +1-813-282-1225

Web site: http://www.osirestaurantpartners.com/

Copyright

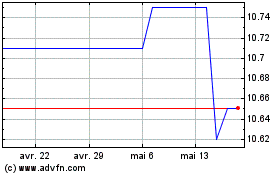

Osiris Acquisition (NYSE:OSI)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Osiris Acquisition (NYSE:OSI)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024