OSI Postpones Special Meeting of Stockholders to May 15, 2007

08 Mai 2007 - 5:45PM

PR Newswire (US)

TAMPA, Fla., May 8 /PRNewswire-FirstCall/ -- OSI Restaurant

Partners, Inc. (NYSE:OSI) today announced that it has postponed the

special meeting of stockholders regarding the proposed merger with

an investor group comprised of investment funds associated with

Bain Capital Partners, LLC and investment funds affiliated with

Catterton Management Company, LLC, OSI's founders and certain

members of its management. The meeting has been postponed to permit

the solicitation of additional votes. The special meeting of

stockholders, previously scheduled for May 8, 2007, will now be

held on May 15, 2007, at 11 a.m., Eastern Daylight Time, at A La

Carte Event Pavilion, 4050-B Dana Shores Drive, Tampa, Florida

33634. The polls will remain open during the postponement. The

record date for stockholders entitled to vote at the special

meeting remains March 28, 2007. The board of directors, on the

unanimous recommendation of the special committee of independent

directors, has approved the merger agreement and recommends that

OSI's stockholders vote "FOR" adoption of the merger agreement. The

Company also noted that leading proxy advisory firms Institutional

Shareholder Services and Glass Lewis recommended that OSI's

stockholders vote "FOR" the adoption of the merger agreement. As

announced on November 6, 2006, OSI entered into a merger agreement

with Kangaroo Holdings, Inc. and Kangaroo Acquisition, Inc.

pursuant to which OSI's stockholders will be entitled to receive

$40.00 in cash for each share they own, subject to closing of the

transaction. Stockholders who have questions about the merger, need

assistance in submitting their proxy or voting their shares should

contact OSI's proxy solicitor, MacKenzie Partners, Inc., 105

Madison Avenue, New York, NY 10016, 1-800-322-2885 (toll-free) or

212-929-5500 (call-collect), Email: . The vote of each OSI

stockholder is very important regardless of the number of shares of

common stock that a stockholder owns. A failure to vote will have

the same legal effect as a vote against adoption of the merger

agreement. About OSI Restaurant Partners OSI Restaurant Partners,

Inc. portfolio of brands consists of Outback Steakhouse, Carrabba's

Italian Grill, Bonefish Grill, Fleming's Prime Steakhouse &

Wine Bar, Roy's, Lee Roy Selmon's, Blue Coral Seafood & Spirits

and Cheeseburger in Paradise restaurants with operations in 50

states and 20 countries internationally. About Bain Capital Bain

Capital, LLC (http://www.baincapital.com/) is a global private

investment firm that manages several pools of capital including

private equity, venture capital, public equity and leveraged debt

assets with approximately $40 billion in assets under management.

Since its inception in 1984, Bain Capital has made private equity

investments and add-on acquisitions in over 230 companies around

the world, including such restaurant and retail concepts as

Domino's Pizza, Dunkin' Donuts and Burger King, and retailers

including Toys "R" Us, AMC Entertainment, Staples and Burlington

Coat Factory. Headquartered in Boston, Bain Capital has offices in

New York, London, Munich, Tokyo, Hong Kong and Shanghai. About

Catterton Partners With more than $2 billion under management,

Catterton Partners is a leading private equity firm in the U.S.

focused exclusively on the consumer industry. Since its founding in

1990, Catterton has leveraged its investment capital, strategic and

operating skills, and network of industry contacts to establish one

of the strongest investment track records in the consumer industry.

Catterton invests in all major consumer segments, including Food

and Beverage, Retail and Restaurants, Consumer Products and

Services, and Media and Marketing Services. Catterton has led

investments in companies such as Build-A-Bear Workshop, Cheddar's

Restaurant Holdings Inc., P.F. Chang's China Bistro, Baja Fresh

Mexican Grill, First Watch Restaurants, Frederic Fekkai, Kettle

Foods, Farley's and Sathers Candy Co., and Odwalla, Inc., More

information about the firm can be found at

http://www.cpequity.com/. Additional Information and Where to Find

It In connection with the proposed transaction, OSI has filed a

definitive proxy statement and other materials with the Securities

and Exchange Commission (the "SEC"). WE URGE INVESTORS TO READ THE

PROXY STATEMENT AND THESE OTHER MATERIALS CAREFULLY BECAUSE THEY

CONTAIN IMPORTANT INFORMATION ABOUT OSI AND THE PROPOSED

TRANSACTION. Investors can obtain free copies of the definitive

proxy statement as well as other filed documents containing

information about OSI at http://www.sec.gov/, the SEC's free

internet site. Free copies of OSI's SEC filings are also available

on OSI's internet site at http://www.osirestaurantpartners.com/.

Participants in the Solicitation OSI and its executive officers and

directors may be deemed, under SEC rules, to be participants in the

solicitation of proxies from OSI's stockholders with respect to the

proposed transaction. Information regarding the identity of

potential participants, and their direct or indirect interests, by

securities, holdings or otherwise, is set forth in the definitive

proxy statement and other materials filed with the SEC in

connection with the proposed transaction. DATASOURCE: OSI

Restaurant Partners, Inc. CONTACT: Dirk Montgomery, Chief Financial

Officer of OSI Restaurant Partners, Inc., +1-813-282-1225 Web site:

http://www.osirestaurantpartners.com/ http://www.baincapital.com/

http://www.cpequity.com/

Copyright

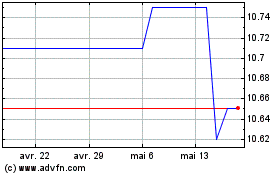

Osiris Acquisition (NYSE:OSI)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Osiris Acquisition (NYSE:OSI)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024