UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year ended December 31, 2022

Or

| | | | | |

¨

| TRANSITION REPORT PURSUANT TO SECTION 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________

Commission File Number: 001-35764

A. Full title of the plan and the address of the plan if different from that of the issuer named below:

PBF ENERGY RETIREMENT SAVINGS PLAN

B. Name of the issuer of the securities held pursuant to the plan and the address of its principal executive office:

PBF ENERGY INC.

One Sylvan Way, Second Floor

Parsippany, New Jersey 07054

PBF ENERGY RETIREMENT SAVINGS PLAN

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

Notes to Financial Statements | |

| |

Supplemental Schedules* | |

| |

| |

| |

| |

| |

| |

| |

| Exhibit Index | |

| |

| |

*All other schedules required by 29 CFR. §2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974, as amended, have been omitted because they are not applicable.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Participants and the PBF Holding Company LLC Retirement Plan Committee

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the PBF Energy Retirement Savings Plan (the “Plan”) as of December 31, 2022, the related statements of changes in net assets available for benefits for the year ended December 31, 2022, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2022, and the changes in net assets available for benefits for the year ended December 31, 2022, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Predecessor Auditor

The financial statements of the Plan as of December 31, 2021 were audited by other auditors whose report thereon dated June 29, 2022, expressed an unqualified opinion on those statements.

Supplemental Information

The supplemental information in the accompanying Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2022 and Schedule H, Line 4a - Schedule of Delinquent Participant Contributions for the year ended December 31, 2022, have been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information, is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ Rosenberg Rich Baker Berman, P.A.

We have served as the Plan’s auditor since 2023.

Somerset, NJ

June 29, 2023

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Participants and the PBF Holding Company LLC Retirement Plan Committee

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the PBF Energy Retirement Savings Plan (the “Plan”) as of December 31, 2021, and the related notes (collectively, the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan at December 31, 2021, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/s/ Friedman LLP

We have served as the Plan’s auditor since 2012 through 2022.

East Hanover, NJ

June 29, 2022

| | | | | | | | | | | |

| PBF ENERGY RETIREMENT SAVINGS PLAN |

| STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS |

| | | |

| December 31, |

| 2022 | | 2021 |

| ASSETS | | | |

| Investments, at fair value | $ | 649,630,610 | | | $ | 712,419,250 | |

| | | |

| Receivables: | | | |

| Employer contributions | 2,028,035 | | | 751,597 | |

| | | |

| Notes receivable from participants | 16,805,754 | | | 16,104,921 | |

| 18,833,789 | | | 16,856,518 | |

| | | |

| Total assets | 668,464,399 | | | 729,275,768 | |

| | | |

| Contingencies (Note 7) | | | |

| | | |

| Net assets available for benefits | $ | 668,464,399 | | | $ | 729,275,768 | |

| | | |

See notes to financial statements.

3

| | | | | |

| PBF ENERGY RETIREMENT SAVINGS PLAN |

| STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS |

| YEAR ENDED DECEMBER 31, 2022 |

| |

| |

| Additions | |

| Interest income on notes receivable from participants | $ | 787,930 | |

| |

| Contributions: | |

| Participants | 53,126,214 | |

| Employer | 31,631,403 | |

| Other employer | 3,037,893 | |

| Rollover | 8,489,710 | |

| |

| Total contributions | 96,285,220 | |

| |

| Total additions | 97,073,150 | |

| |

| Deductions | |

| Investment loss (gain): | |

| Net depreciation in fair value of investments | 122,280,283 | |

| Interest and dividends | (10,470,370) | |

| Total investment loss | 111,809,913 | |

| |

| Benefits paid to participants | 45,680,513 | |

| Administrative expenses | 394,093 | |

| Total deductions | 157,884,519 | |

| |

| |

| |

| Net decrease in net assets available for benefits | (60,811,369) | |

| |

| Net assets available for benefits: | |

| Beginning of year | 729,275,768 | |

| End of year | $ | 668,464,399 | |

See notes to financial statements.

4

PBF ENERGY RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

1 - DESCRIPTION OF PLAN

General

The PBF Energy Retirement Savings Plan (the “Plan”) is a qualified retirement plan covering certain of PBF Energy Inc.’s and its subsidiaries’ employees in the United States of America (“U.S.”).

The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). As used in this report, the term “PBF Energy” or the “Company” may refer, depending upon the context, to PBF Energy Inc., one or more of its consolidated subsidiaries, or all of them taken as a whole.

The description of the Plan included in these notes to financial statements provides only general information. Participants should refer to the plan document for a complete description of the Plan’s provisions, which was most recently amended on December 20, 2022.

Plan Administration

PBF Holding Company LLC (“PBF Holding”), a subsidiary of PBF Energy, is the Plan sponsor. PBF Energy is a publicly traded independent petroleum refining company and, as of December 31, 2022 owns six refineries (two of which are operated as a single unit) and related logistics assets in the U.S. with approximately 3,616 employees.

The PBF Holding Company LLC Retirement Plan Committee (the “Administrative Committee”), which consists of persons selected by PBF Holding, serves as the Plan Administrator. The members of the Administrative Committee are employees of the Company who serve without compensation for services in that capacity. Vanguard Fiduciary Trust Company (“Vanguard” or the “Trustee”) is the trustee and record keeper of the Plan and has custody of the securities and investments of the Plan through a trust. On January 1, 2022, PBF Holding and Resources Investment Advisors, LLC entered into a Retirement Plan Investment Advisory Agreement in which StoneStreet Equity, LLC was appointed as the new investment advisor.

Eligibility and Participation

Employees at PBF Energy’s U.S. locations are eligible to participate in the Plan on the first day of the month following the completion of thirty days of service with the Company. The Plan has an automatic enrollment feature for new eligible employees with the initial contribution rate set at 3% of eligible compensation, (as defined in the Plan), contributed on a pre-tax basis. Participants can change these options and can also elect not to contribute to the Plan. If participants are contributing less than 7% of compensation, their pre-tax contribution percentage will be automatically increased 1% each July until they are contributing 7% of compensation in total to the Plan. Participants may opt out of this auto-increase feature if they do not want to have their contribution rate automatically increased. Leased Employees (as defined in the Plan) and co-ops/interns, are excluded from participating in the Plan.

PBF ENERGY RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

Contributions

Eligible employees may make pre-tax contributions of a percentage of their eligible compensation, as defined by the Plan, and subject to Internal Revenue Code (the “Code”) limitations. Participants may also make designated Roth 401(k) (“Roth”) contributions to the Plan. The Code established a combined annual pre-tax and Roth contribution limit of $20,500 for the year ended December 31, 2022 and $19,500 for the year ended December 31, 2021. Participants 50 years of age or older can contribute an additional catch-up contribution of up to $6,500 for the years ended December 31, 2022 and 2021. Additionally, the Plan offers participants the option to make traditional after-tax contributions. Participants have the ability to contribute up to 50% of their eligible compensation on a combined pre-tax, Roth and/or traditional after-tax basis.

The Plan sponsor makes safe-harbor matching contributions in the amount of 200% of each participant’s pre-tax and Roth elective deferral, up to 3% of eligible compensation for the plan year, as defined by the Plan. The safe-harbor matching contributions are 100% vested immediately. The Plan sponsor does not match traditional after-tax contributions. Eligible employees may also elect to roll over distributions from a former employer’s qualified retirement plan into the Plan.

Investment Options

Participants direct 100% of their contributions into investments offered by the Plan. The Plan offers, as investment options, various Vanguard mutual fund accounts, common collective trusts and PBF Energy Inc. Class A common stock. Participants can elect to allocate up to 10% of their contributions to PBF Energy Inc. Class A common stock. Participants may change their investment options in accordance with the Plan’s provisions.

The Pension Protection Act created the Qualified Default Investment Alternative (the “QDIA”), which provides employers a safe harbor from fiduciary risk when selecting an investment for a participant or beneficiary who fails to elect his or her own investment. The Plan Administrator selected the Vanguard Target Retirement Fund with the target date closest to the participant’s estimated retirement date as its QDIA.

Participant Accounts

Individual accounts are maintained for each participant. Each participant’s account is adjusted to reflect the Company’s matching contributions, participant’s contributions and withdrawals, income, expenses and investment gains and losses attributable to the participant’s account. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Vesting

Participants are immediately 100% vested in their participant accounts.

PBF ENERGY RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

Notes Receivable from Participants

Participants may borrow from their account balance up to the lesser of 50% of the vested balance or $50,000. The interest rate on loans is established based on the prime rate plus 1%. The interest rate as of December 31, 2022 was 8.00% for general purpose and principal residence loans. The loan repayment schedule can generally be no longer than 60 months, except in the case of a loan for the purchase of a participant’s principal residence, which can be up to 120 months. Generally, principal and interest is paid ratably through payroll deductions. The Plan’s loan policy also allows participants to make repayments directly to Vanguard outside of payroll deductions.

Payment of Benefits

Participants receive the full amount of their vested account balances in the event of normal retirement, termination of service, death or disability. Early withdrawals are permitted at the participant’s request after the age of 59½. Certain hardship withdrawals are also permitted, as further discussed below. Distributions may be made in a lump-sum payment or in partial payments at the Participant’s election. Generally, participants with vested balances greater than $5,000 can elect to defer distribution of their account until the minimum required distributions rules apply, in accordance with the terms of the Plan and the Code. Required minimum distributions must begin for participants in the Plan upon attainment of age 72.

Hardship Withdrawals

The Plan provides for hardship withdrawals, not to exceed the lesser of (i) the portion of the participant’s account constituting participant contributions, and (ii) an amount required to meet the immediate need created by the hardship, and then only to the extent such immediate need cannot be satisfied by other sources readily available to the participant, as determined by the Plan Administrator, in accordance with the terms of the Plan.

2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The financial statements are prepared on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles (“GAAP”).

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates that affect the reported amounts of assets, reported changes in net assets available for benefits and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

PBF ENERGY RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

Notes Receivable from Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance. Interest income on notes receivable from participants is recorded when earned. Related fees are recorded as administrative expenses and are expensed when incurred. If a participant ceases to make loan repayments and the Plan Administrator deems the participant loan to be a distribution, the participant loan balance is reduced and a deemed distribution is recorded.

Investment Valuation

The Plan investments are presented at their fair value. A fair value hierarchy is used that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels as follows:

| | | | | |

| Level 1: | Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| Level 2: | Inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly. These include quoted prices for similar assets or liabilities in markets that are not active. |

| Level 3: | Unobservable inputs that reflect management’s own assumptions. |

The valuation methods used to value the Plan investments are as follows:

Mutual funds –Valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-end mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily net asset value (“NAV”) and to transact at that value. The mutual funds are deemed to be actively traded and are classified as Level 1 investments.

Common stock –Valued at the daily closing price as reported by the applicable stock exchange. PBF Energy Inc. Class A common stock actively trades on the New York Stock Exchange and is classified as a Level 1 investment.

Common collective trusts – Fair value for these investments is determined by the NAV based on the fair value of the underlying funds. The NAV, as provided by the Trustee, is used as a practical expedient to estimate fair value. The NAV is based on the fair value of the underlying investments held by the fund less its liabilities. There are no imposed restrictions as to the redemption of this investment.

Income Recognition

Net appreciation (depreciation) in the fair value of investments includes realized gains and losses on the sale of investments and the net unrealized appreciation (depreciation) of investments, based on the value of assets at the beginning of the year or at the time of purchase during the year. Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are allocated based upon participant account holdings on the record date and are recorded on the ex-dividend date.

PBF ENERGY RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

Payment of Benefits

Benefits are recorded when paid.

Administrative Expenses

Plan expenses not paid by the Company are paid out of the Plan’s assets provided that such payment is consistent with ERISA.

Management Fees and Operating Expenses

Management fees to the Trustee and operating expenses charged to the Plan for investments in mutual funds are deducted from income earned on a daily basis and are not separately reflected. Consequently, management fees are reflected in the net appreciation in fair value of such investments.

PBF ENERGY RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

3 - FAIR VALUE MEASUREMENTS

The valuation methods used to measure the Plan’s financial instruments at fair value are as follows:

•Common stocks and mutual funds are measured at fair value using a market approach based on quotations from national securities exchanges or published NAVs and are categorized in Level 1 of the fair value hierarchy.

•Common collective trusts: Fair value for these investments is determined by the NAV based on the fair value of the underlying funds. In accordance with FASB ASC 820-10, certain investments that are measured at fair value using NAV per share (or its equivalent) practical expedient have not been classified in the fair value hierarchy.

The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the line items presented in the statement of net assets available for benefits.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2022 |

| Fair Value Hierarchy | | | | Total Fair Value |

| Level 1 | | Level 2 | | Level 3 | | Other | |

| Total Mutual Funds | $ | 327,258,351 | | | $ | — | | | $ | — | | | $ | — | | | $ | 327,258,351 | |

| | | | | | | | | |

| Common Collective Trusts | — | | | — | | | — | | | 300,890,450 | | | 300,890,450 | |

| | | | | | | | | |

| PBF Energy Inc. Class A common stock | 21,481,809 | | | — | | | — | | | — | | | 21,481,809 | |

| | | | | | | | | |

| Investments, at fair value | $ | 348,740,160 | | | $ | — | | | $ | — | | | $ | 300,890,450 | | | $ | 649,630,610 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2021 |

| Fair Value Hierarchy | | | | Total Fair Value |

| Level 1 | | Level 2 | | Level 3 | | Other | |

| Total Mutual Funds | $ | 339,422,398 | | | $ | — | | | $ | — | | | $ | — | | | $ | 339,422,398 | |

| | | | | | | | | |

| Common Collective Trusts | — | | | — | | | — | | | 363,473,861 | | | 363,473,861 | |

| | | | | | | | | |

| PBF Energy Inc. Class A common stock | 9,522,991 | | | — | | | — | | | — | | | 9,522,991 | |

| | | | | | | | | |

| Investments, at fair value | $ | 348,945,389 | | | $ | — | | | $ | — | | | $ | 363,473,861 | | | $ | 712,419,250 | |

PBF ENERGY RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

4 - RISKS AND UNCERTAINTIES

The Plan invests in various investment securities. Investment securities are exposed to various risks, such as interest rate, market and credit risks that may be impacted by external financial, business and other factors including economic downturns, natural disasters, geopolitical conflicts or pandemic illness. Due to the level of risk associated with certain investment securities, it is at least possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the statements of net assets available for benefits. Additionally, the investments the Plan invests in may change their distribution or dividend policies, which could have an effect on the value of the investment securities.

The Plan may invest in securities with contractual cash flows, such as asset-backed securities, collateralized mortgage obligations and commercial mortgage-backed securities, including securities backed by subprime mortgage loans. The value, liquidity and related income of these securities are sensitive to changes in economic conditions, including impact from external factors such as natural disasters, pandemic illness, real estate value, delinquencies or defaults, or both, and may be adversely affected by shifts in the market’s perception of the issuers and changes in interest rates.

5 - INCOME TAX STATUS

The Company adopted a pre-approved prototype plan offered by the Trustee. The Internal Revenue Service (the “IRS”) has determined that the prototype plan, by letter dated June 30, 2020, is designed in accordance with applicable sections of the Code. Although the Plan has been amended since receiving the opinion letter, the Plan is designed and currently being operated in compliance with the applicable requirements of the Code.

GAAP requires the Plan’s Administrative Committee to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain tax position that more likely than not would not be sustained upon examination by the IRS. The Plan’s Administrative Committee, with the assistance and advice of PBF Energy’s tax department, the Trustee and other external advisors, as applicable, has analyzed the tax positions taken by the Plan and has concluded that, as of December 31, 2022, there are no uncertain positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

6 - PLAN TERMINATION

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA.

7 - PARTY-IN-INTEREST TRANSACTIONS

The Plan holds units of mutual fund accounts and common collective trusts managed by the Trustee. For the year ended December 31, 2022, $394,093 was paid to the Trustee for plan administrative services, which included recordkeeping, trustee and investment management services. In addition, the Plan allows for loans to participants and investment in PBF Energy Inc. Class A common stock. These transactions are covered by an exemption from the “prohibited transactions” provisions of ERISA and the Code.

PBF ENERGY RETIREMENT SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

Certain officers and employees of the Company (who may also be participants in the Plan) perform administrative services related to the operation, record-keeping and financial reporting of the Plan. The Company pays the salaries of these individuals and also pays other administrative expenses on behalf of the Plan. Certain fees, to the extent not paid by the Company, are paid by the Plan.

During the year ended December 31, 2021, the Company did not timely remit certain participant contributions totaling $42 within the period prescribed by the Department of Labor (“DOL”) regulations. The Company made contributions to the affected participants’ accounts to compensate those participants for potential lost income due to these delays. The delinquent contributions which occurred in the plan year ending in 2021 were fully corrected in the first quarter of 2022.

Additionally, during the year ended December 31, 2021, the Company identified an error in the safe harbor matching contributions applicable for plan years 2017 through 2021. The collective true-up amount for the safe harbor matching contributions and corresponding lost earnings amounted to a total of $3,037,893 for plan years 2017 through 2021. The Company made contributions to the affected participants’ accounts to compensate those participants for potential lost income due to this error. The corrected true-up amounts were deposited into the affected participants’ accounts in December 2022 and the related lost earnings contributions were deposited in January 2023. The Company submitted a Voluntary Correction Program compliance statement to the IRS regarding the error in the safe harbor matching contributions. The compliance statement was accepted by the IRS in April 2023.

8 - CONCENTRATION

As of December 31, 2022, only one investment within the Plan, Vanguard Institutional Index Fund Institutional Shares accounted for 10% or more of the Plan’s net assets available for benefits (approximately 12.6%). As of December 31, 2021, only one investment within the plan, Vanguard Institutional Index Fund Institutional Shares accounted for 10% or more of the Plan’s net assets available for benefits (approximately 11.2%).

9 - SUBSEQUENT EVENTS

The Company has evaluated subsequent events for potential recognition or disclosure through the date that this report was available to be issued, June 29, 2023.

| | | | | | | | | | | | | | |

| PBF ENERGY RETIREMENT SAVINGS PLAN |

| | | | |

| EIN 27-2198168 PLAN NO. 002 |

| | | | |

| SCHEDULE H, PART IV, LINE 4i - |

| SCHEDULE OF ASSETS (HELD AT END OF YEAR) |

| | | | |

| December 31, 2022 |

| | | | |

| | (c) Description of investment, including | | |

| (b) Identity of issuer, borrower, | maturity date, rate of interest, | | (e) Current |

| (a) lessor, or similar party | collateral, par or maturity value | (d) Cost | Value |

| Common Stock | | |

| * | PBF Energy Inc. | Class A Common Stock | ** | $ | 21,481,809 | |

| Mutual Funds | | | |

| * | Metropolitan West Asset Management LLC | Metropolitan West Total Return Bond Fund; Class M | ** | 94,901 | |

| * | PIMCO | PIMCO Income Fund; Institutional Class | ** | 96,253 | |

| * | The Vanguard Group | Vanguard Federal Money Market Fund | ** | 34,717,040 | |

| * | The Vanguard Group | Vanguard Institutional Index Fund Institutional Shares | ** | 81,807,377 | |

| * | The Vanguard Group | Vanguard International Growth Fund Admiral Shares | ** | 22,431,855 | |

| * | The Vanguard Group | Vanguard Mid-Cap Growth Fund | ** | 20,040,425 | |

| * | The Vanguard Group | Vanguard Mid-Cap Index Fund Admiral Shares | ** | 332,535 | |

| * | The Vanguard Group | Vanguard Small-Cap Index Fund Institutional Shares | ** | 35,456,623 | |

| * | The Vanguard Group | Vanguard Total Bond Market Index Fund Admiral Shares | ** | 36,651,797 | |

| * | The Vanguard Group | Vanguard Total International Stock Index Fund Admiral Shares | ** | 32,091,193 | |

| * | The Vanguard Group | Vanguard U.S. Growth Fund Admiral Shares | ** | 22,268,466 | |

| * | The Vanguard Group | Vanguard Wellington Fund Admiral Shares | ** | 21,664,651 | |

| * | The Vanguard Group | Vanguard Windsor II Fund Admiral Shares | ** | 18,922,092 | |

| * | The Vanguard Group | Victory Sycamore Est Value Fund, Cl R6 | ** | 683,143 | |

| Common Collective Trusts | | |

| * | The Vanguard Group | Vanguard Target Retirement 2020 Trust II | ** | 14,541,087 | |

| * | The Vanguard Group | Vanguard Target Retirement 2025 Trust II | ** | 31,716,962 | |

| * | The Vanguard Group | Vanguard Target Retirement 2030 Trust II | ** | 48,461,763 | |

| * | The Vanguard Group | Vanguard Target Retirement 2035 Trust II | ** | 43,242,936 | |

| * | The Vanguard Group | Vanguard Target Retirement 2040 Trust II | ** | 42,588,639 | |

| * | The Vanguard Group | Vanguard Target Retirement 2045 Trust II | ** | 40,288,945 | |

| * | The Vanguard Group | Vanguard Target Retirement 2050 Trust II | ** | 35,064,857 | |

| * | The Vanguard Group | Vanguard Target Retirement 2055 Trust II | ** | 22,503,595 | |

| * | The Vanguard Group | Vanguard Target Retirement 2060 Trust II | ** | 9,806,948 | |

| * | The Vanguard Group | Vanguard Target Retirement 2065 Trust II | ** | 2,595,857 | |

| * | The Vanguard Group | Vanguard Target Retirement 2070 Trust II | ** | 1,401 | |

| * | The Vanguard Group | Vanguard Target Retirement Income Trust II | ** | 10,077,460 | |

| | | | $ | 649,630,610 | |

| | | | |

| * | Participants | Participant loans maturing 2023 to 2032 at interest rates of 4.25% - 8.00% | ** | 16,805,754 | |

| | | | $ | 666,436,364 | |

| | | | |

| * | Denotes party-in-interest to the Plan. |

| ** | Omitted all participant-directed transactions under an individual account plan. |

See accompanying report of independent registered accounting firm.

13

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| PBF ENERGY RETIREMENT SAVINGS PLAN |

| | | | | | | | |

| EIN 27-2198168 PLAN NO. 002 |

| | | | | | | | |

| FORM 5500, SCHEDULE H, PART IV, LINE 4a - SCHEDULE OF DELINQUENT PARTICIPANT CONTRIBUTIONS |

| | | | | | | | |

| YEAR ENDED DECEMBER 31, 2022 |

| | | | | | | | |

| | | | | Total that Constitutes Nonexempt Prohibited Transactions | Total Fully Corrected Under VFCP and PTE 2002-51 |

| Identity of Party Involved | Relationship to Plan | Description of Transaction | Participant Contributions Transferred Late to Plan | Late Participant Loan Repayments Included | Contributions Not Corrected | Contributions Corrected Outside of VFCP | Contributions Pending Correction in VFCP |

| PBF Energy Retirement Savings Plan | Plan Sponsor | For the year ended December 31, 2021, the Plan Sponsor failed to remit timely to the Plan’s Trustee multiple participant salary deferrals for one pay period totaling $42. | $ | 42 | | N/A | $ | — | | $ | — | | $ | — | | $ | 42 | |

See accompanying report of independent registered accounting firm.

14

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the PBF Holding Company LLC Retirement Plan Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | PBF Energy Retirement Savings Plan |

| | | | |

| Date: | June 29, 2023 | | By: | /s/ Joseph Marino |

| | | | Joseph Marino Chairman of the PBF Holding Company LLC Retirement Plan Committee Treasurer, PBF Energy Inc. |

| | | | |

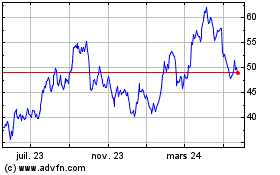

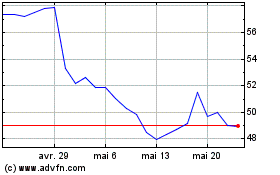

PBF Energy (NYSE:PBF)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

PBF Energy (NYSE:PBF)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024