Form 8-K - Current report

20 Août 2024 - 11:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) August 20, 2024

PIMCO High Income Fund

(Exact Name of Registrant as Specified in Its Charter)

Massachusetts

(State or Other Jurisdiction of Incorporation)

|

|

|

| 811-21311 |

|

383676799 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

| 1633 Broadway, New York, NY |

|

10019 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(844) 337-4626

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common shares |

|

PHK |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 8.01 Other Events.

On August 15, 2024, the Board approved the addition of a non-fundamental investment guideline for the Fund to

invest at least 50% of the Fund’s total assets in corporate debt obligations and other corporate securities, effective September 20, 2024. The supplement to the Fund’s prospectus disclosing this change is attached hereto as Exhibit

99.1.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| PIMCO High Income Fund |

|

|

| By: |

|

/s/ Ryan G. Leshaw |

| Name: |

|

Ryan G. Leshaw |

| Title: |

|

Chief Legal Officer and Secretary |

Date: August 20, 2024

PIMCO HIGH INCOME FUND

(the “Fund”)

Supplement dated August 20, 2024 to the Fund’s Prospectus Supplement and Prospectus, each dated May 31, 2022, as supplemented

from time to time

(respectively, the “Prospectus Supplement” and the “Prospectus”)

On August 15, 2024, the Fund’s Board of Trustees (the “Board”) approved the addition of a non-fundamental investment guideline for the Fund to invest at least 50% of the Fund’s total assets in corporate securities.

Accordingly, effective September 20, 2024, the following sentence is added (i) after the third sentence of the

first paragraph of the “Portfolio Contents” section on the cover pages of the Prospectus; (ii) after the third sentence of the first paragraph of the “Prospectus Summary—Portfolio Contents” section of the Prospectus;

and (iii) after the third sentence of the first paragraph of the “Portfolio Contents” section of the Prospectus:

The Fund normally invests at least 50% of its total assets in corporate debt obligations and other corporate securities,

including fixed-, variable- and floating-rate bonds, debentures, notes and other similar types of corporate debt instruments, such as preferred shares, convertible securities, bank loans and loan participations and assignments, payment-in-kind securities, step-ups, zero-coupon bonds, bank capital securities, bank

certificates of deposit, fixed time deposits and bankers’ acceptances, stressed debt securities, structured notes and other hybrid instruments, common stocks and other equity securities.

Investors Should Retain This Supplement for Future Reference

PHK_SUPP4_082024

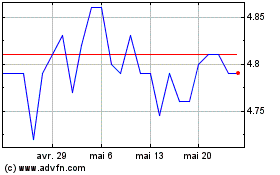

Pimco High Income (NYSE:PHK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Pimco High Income (NYSE:PHK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024