Exhibit 99.1

JOINT FIDELITY BOND AGREEMENT

As of March 15, 2023

W I T N E S S E T H

WHEREAS, Brookfield Real Assets Income Fund Inc.,

Center Coast Brookfield MLP & Energy Infrastructure Fund, Oaktree Diversified Income Fund Inc. and Brookfield Investment Funds and

its separate series, Brookfield Global Listed Infrastructure Fund, Brookfield Global Listed Real Estate Fund, Brookfield Global Renewables

& Sustainable Infrastructure Fund, Brookfield Real Assets Securities Fund, Center Coast Brookfield Midstream Focus Fund and Oaktree

Emerging Markets Equity Fund as parties to this Agreement (the "Insureds") are named insureds under a financial institution

fidelity bond issued by Great American Insurance Company (the "Policy");

NOW, THEREFORE, the parties hereto, in consideration

of the premises and the mutual covenants contained herein, hereby agree as follows:

1. Joint Insured Bond. The Insureds

shall maintain in effect the Policy or a substitute fidelity insurance policy providing comparable coverage from one or more reputable

fidelity insurance companies which shall be authorized to do business in the place where the Policy is issued.

2. Allocation of Premium. The Insureds

shall pay the portion of the total premium for the Policy set forth in Schedule A hereto.

3. Allocation of Proceeds.

(a) If one or more Insureds sustain a single loss

for which recovery is received under the Policy, each Insured shall receive that portion of the recovery which is sufficient in amount

to indemnify that Insured in full for the loss sustained by it (other than the portion thereof subject to a deductible), unless the recovery

is inadequate to fully indemnify all Insureds for such single loss.

(b) If the recovery is inadequate to indemnify

fully each Insured for such single loss (other than the portion thereof subject to a deductible), the recovery shall be allocated among

the Insureds as follows:

(i) Each Insured shall be allocated an amount equal

to the lesser of its actual loss (net of any deductible) and the minimum amount of coverage allocated to it in accordance with Schedule

A attached hereto; and

(ii) The remaining portion of the recovery (if

any) shall be allocated to each Insured for the portion of the loss not fully indemnified by the allocation under subparagraph (i) in

the same proportion as the portion of each Insured's loss which is not fully indemnified bears to the sum of the unindemnified loss of

itself and the other Insured. If such allocation would result in either Insured's receiving a portion of the recovery in excess of the

loss actually sustained by it, the aggregate of such excess portion shall be reallocated to the other Insured if its losses would not

be fully indemnified as a result of the foregoing allocation.

(c) If the recovery made pursuant to subparagraphs

(a) and (b) hereof reduces the total amount of coverage provided by the Policy because recovery is made from a portion of the Policy written

on an "annual aggregate" basis:

(i) The Insureds agree to seek additional coverage

to reinstate the reduction in coverage; or

(ii) In the event any subsequent loss is sustained,

any recovery by an Insured in excess of the minimum amount allocated to it in accordance with Schedule A from coverage written on an "annual

aggregate" basis shall be reallocated in the event of subsequent single loss among the Insured or Insureds sustaining the earlier

loss(es) and other Insureds in accordance with subparagraphs (a) and (b) above; or

(iii) Any recovery in excess of the minimum amount

allocated in accordance with Schedule A from coverage written on an "annual aggregate" basis shall be paid into an escrow account

and allocated in accordance with subparagraphs (a) and (b) above upon final determination of the aggregate losses for the policy year.

(d) In the event that a recovery by an Insured

is less than its actual loss because of the applicability of a deductible clause that is applicable on an "annual aggregate"

rather than a "per occurrence" basis and one or more other Insureds sustain a subsequent loss or losses to which none or only

the remaining portion of the deductible amount applies, the Insured(s) that sustained the earlier loss(es) shall be entitled to a portion

of the recovery with respect to the later loss(es) such that the total burden of the deductible amount is borne between the Insureds in

accordance with the percentages set forth in Schedule A hereto.

4. Claims and Settlements. Each

Insured shall, within ten days after the making of any claim under the Policy, provide the other Insureds with written notice of the amount

and nature of such claim. Each Insured shall, within ten days after the receipt thereof, provide the other Insureds with written notice

of the terms of settlement of any claim made under the Policy by such Insured.

5. Withdrawal. Any Insured may

withdraw from this Agreement at any time and cease to be a party hereto (except with respect to losses occurring prior to such withdrawal)

by giving not less than 10 days' prior written notice to the other Insureds of such withdrawal. Upon withdrawal, such Insured shall cease

to be named insured on the Policy and shall be entitled to receive any premium rebated by the insurance company with respect to such withdrawal.

6. Governing Law. This Agreement shall

be construed in accordance with the laws of the State of New York.

7. No Assignment. This Agreement

is not assignable.

8. Notices. All notices and other

communications hereunder shall be in writing and shall be addressed to the appropriate party at Brookfield Place, 250 Vesey Street, 15th

Floor, New York, NY 10281-1023.

IN WITNESS WHEREOF, each of the parties hereto has

duly executed this Agreement as of the day and year first written above.

| Brookfield

REAL ASSETS Income Fund Inc. |

|

| |

|

| By: |

/s/ Craig Ruckman |

|

| |

Craig Ruckman, Secretary |

|

| |

|

| CENTER COAST BROOKFIELD MLP & ENERGY INFRASTRUCTURE FUND |

| |

|

| By: |

/s/ Craig Ruckman |

|

| |

Craig Ruckman, Secretary |

|

| |

|

| OAKTREE DIVERSIFIED INCOME FUND INC. |

|

| |

|

| By: |

/s/ Craig Ruckman |

|

| |

Craig Ruckman, Secretary |

|

| |

|

| Brookfield Investment

Funds |

|

| |

|

| By: |

/s/ Craig Ruckman |

|

| |

Craig Ruckman, Secretary |

|

Exhibit 99.2

OFFICER’S CERTIFICATE

I, Craig Ruckman, Secretary of Brookfield Real Assets Income Fund Inc.,

Center Coast Brookfield MLP & Energy Infrastructure Fund, Oaktree Diversified Income Fund Inc., and Brookfield Investment Funds and

each of its separate series (collectively, the “Funds”), hereby certifies that the following is a true and correct copy of

the recitals and resolutions adopted by the Boards of Directors/Trustees (the “Boards,” or the “Boards of Directors”)

of the Funds at the combined meeting of the Boards held on February 22-23, 2023, and that the resolutions remain in full force and effect.

********

WHEREAS, the joint

fidelity bond coverage between Brookfield Real Assets Income Fund Inc. Center Coast Brookfield MLP & Energy Infrastructure Fund, Oaktree

Diversified Income Fund Inc., and the Brookfield Investment Funds and each of its separate series (collectively, the “Funds”)

is expiring on March 15, 2023; and

WHEREAS, it is

proposed that in connection with the fidelity bond coverage requirements of Rule 17g-1 under the 1940 Act, the Funds enter into a Joint

Fidelity Bond Agreement (the “Joint Fidelity Bond Agreement”) providing for the allocation of premiums and minimum levels

of recoveries among the Funds; and

WHEREAS, it is

proposed that the Joint Fidelity Bond be approved for a one-year period from March 15, 2023 through March 15, 2024, and that the Funds

satisfy their fidelity bond coverage requirements under the 1940 Act, through participation in the Joint Fidelity Bond.

NOW, THEREFORE, BE

IT RESOLVED, that the Boards of Directors/Trustees have determined that the participation by the Funds and other funds, series or

accounts managed by PSG in the joint fidelity bond which provides for equitable sharing of recoveries, including payment of any reserve

premiums, is in the best interests of each Fund; and it is

FURTHER RESOLVED,

that the agreement between the Funds and other funds, series or accounts managed by PSG to enter into the joint fidelity bond (the “Joint

Insured Agreement”), be, and it hereby is, adopted and approved substantially in the form attached hereto as Exhibit A, together

with such changes and modifications as the officers of the Funds deem advisable; and it is

FURTHER RESOLVED,

that the Boards of Directors/Trustees, including a majority of the “non-interested” Directors/Trustees, or PSG, shall review

such Joint Insured Agreement at least annually in order to ascertain whether or not such policy continues to be in the best interests

of each Fund, and whether or not the premiums to be paid by each Fund is fair and reasonable; and it is

FURTHER RESOLVED,

that in accordance with Rule 17g-1(h) under the 1940 Act, the Secretary of each Fund is hereby designated as the officer of such Fund

who is authorized and directed to make the filings with the SEC and give the notices required by Rule 17g-1(g); and it is

FURTHER RESOLVED,

that the proper officers of the Funds be, and they hereby are, authorized and directed at all times to take all actions necessary to assure

compliance with these resolutions and said Rule 17g-1; and it is

FURTHER RESOLVED,

that the Boards of Directors/Trustees hereby approve the renewal of the Fidelity Bond Coverage, which coverage is maintained jointly on

behalf of the Funds and which will provide coverage in the amount as the officers of the Funds may deem appropriate; and it is

FURTHER RESOLVED,

that the portion of the premium for the aforementioned joint insured bond paid by the Funds is hereby approved, taking into consideration,

among other things, the number of parties named as insureds, the nature of the business activities of such other parties, the amount of

the joint insured bond, the amount of the premium for such bond, the ratable allocation of the premium among all parties named as insureds,

and the extent to which the share of the premium allocated to each Fund is less than the premium such Fund would have had to pay if it

had provided and maintained a single insured bond; and it is

FURTHER RESOLVED,

that the participation of the Funds as a party in the Joint Insured Agreement be, and hereby is, approved; and it is

FURTHER RESOLVED,

that an officer of each Fund is hereby authorized and directed to prepare, execute and file such fidelity bond and any supplements thereto,

and to take such action as may be necessary or appropriate in order to conform the terms of the Fidelity Bond Coverage to the provisions

of the 1940 Act.

IN WITNESS WHEREOF, I have hereunto signed my name this 22nd

day of March, 2023.

| |

/s/ Craig Ruckman |

| |

Craig Ruckman |

Exhibit 99.3

Schedule A - Additional Statements

Required by Rule 17g-1(g)(1)

The below chart reflects the premium allocation for the joint insured

bond among the Funds that was approved by the Boards of Directors/Trustees. The premium on the joint insured bond has been paid through

March 15, 2024.

FIDELITY BOND PREMIUM AMOUNT 2023

| Fund Name | |

Identifier | | |

Average Net Assets as

of 01/31/23 | | |

Allocation | | |

Fidelity Bond | |

| Brookfield Real Assets Income Fund Inc. | |

RA | | |

$ | 885,024,073.46 | | |

| 29.83 | % | |

$ | 4,184 | |

| Brookfield Global Listed Infrastructure Fund | |

BGL | | |

| 239,266,102.25 | | |

| 8.06 | % | |

| 1,131 | |

| Brookfield Global Listed Real Estate Fund | |

BLR | | |

| 460,007,092.41 | | |

| 15.50 | % | |

| 2,174 | |

| Brookfield Real Assets Securities Fund | |

RAS | | |

| 51,328,112.51 | | |

| 1.73 | % | |

| 243 | |

| Brookfield Global Renewables & Sustainable Infrastructure Fund | |

GRSI | | |

| 17,983,978.07 | | |

| 0.61 | % | |

| 85 | |

| Oaktree Diversified Income Fund Inc. | |

ODIF | | |

| 154,706,931.83 | | |

| 5.21 | % | |

| 731 | |

| Oaktree Emerging Markets Equity Fund | |

EME | | |

| 134,939,078.90 | | |

| 4.55 | % | |

| 638 | |

| Center Coast Brookfield Midstream Focus Fund | |

CCC | | |

| 918,171,718.34 | | |

| 30.95 | % | |

| 4,340 | |

| Center Coast Brookfield MLP & Energy Infrastructure Fund | |

CEN | | |

| 105,407,679.33 | | |

| 3.55 | % | |

| 498 | |

| Total | |

| | |

$ | 2,966,834,767.09 | | |

| 100.00 | % | |

$ | 14,024 | |

This regulatory filing also includes additional resources:

tm2310222d1_4017g.pdf

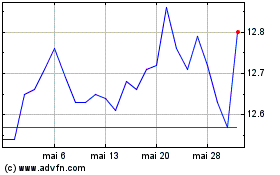

Brookfield Real Assets I... (NYSE:RA)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Brookfield Real Assets I... (NYSE:RA)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024