Vicarious Surgical Announces Reverse Stock Split

10 Juin 2024 - 10:15PM

Business Wire

Vicarious Surgical Inc. (“Vicarious Surgical” or the “Company”)

(NYSE: RBOT, RBOT WS), a next-generation robotics technology

company seeking to improve lives through the transformation of

surgical robotics, today announced it will effect a 1-for-30

reverse stock split of the Company’s issued and outstanding Class A

common stock, par value $0.0001 per share, and Class B common

stock, par value $0.0001 per share.

The reverse stock split was approved by Vicarious Surgical’s

shareholders at the Company’s annual shareholder meeting held on

June 10, 2024, with the final ratio determined by the Company’s

Board of Directors within the ratio range authorized by

shareholders. The reverse split is primarily intended to increase

the Company’s per share trading price and bring the Company into

compliance with the New York Stock Exchange’s listing requirement

regarding minimum share price.

The Company anticipates that the 1-for-30 reverse stock split

will be effective as of 4:15 p.m. on June 12, 2024 and the

Company's Class A common stock will open for trading through the

New York Stock Exchange on a post-split basis on June 13, 2024

under the Company's existing trading symbol "RBOT". The new CUSIP

number for the Class A common stock following the reverse stock

split will be 92561V208. The Company’s publicly-traded warrants

will continue to be traded under the symbol “RBOT WS" and the CUSIP

identifier for the warrants will remain unchanged.

At the time of the reverse stock split, every 30 shares of the

Company's common stock issued and outstanding will be combined into

1 share of common stock issued and outstanding, with no change to

the par value of $0.0001 per share. This will reduce the number of

shares of Class A common stock issued and outstanding from

approximately 156,762,690 to approximately 5,225,423 and the number

of shares of Class B common stock issued and outstanding from

approximately 19,619,760 to approximately 653,992. The total

authorized number of shares of common stock will remain the

same.

No fractional shares will be issued in connection with the

reverse stock split. Each stockholder who would otherwise be

entitled to receive a fraction of a share of Vicarious Surgical’s

common stock will be entitled to receive cash. All outstanding

options, warrants, restricted stock units, and similar securities

entitling their holders to receive or purchase shares of common

stock will be adjusted as a result of the reverse stock split, as

required by the terms of each security, and the number of shares of

common stock available for issuance under the Company’s equity

incentive plans will be adjusted in accordance with the terms of

each plan.

Prior to the reverse stock split, the Company has outstanding

(i) publicly issued warrants listed on the New York Stock Exchange

to purchase a total of 17,248,601 shares of Class A common stock

(the “public warrants”) and (ii) privately placed warrants to

purchase a total of 10,400,000 shares of Class A common stock (the

“private placement warrants” and, together with the public

warrants, the “Warrants”), with each whole Warrant being

exercisable to purchase one share of Class A common stock at $11.50

per share. After giving effect to the reverse stock split, the

Warrants will be exercisable for a total of approximately 921,620

shares of Class A common stock with an exercise price of $345.00

per share.

The reverse stock split will affect all stockholders uniformly

and will not alter any stockholder’s percentage ownership interest

in the Company, except for adjustments that may result from the

treatment of fractional shares.

About Vicarious Surgical

Founded in 2014, Vicarious Surgical is a next generation

robotics company, developing a unique disruptive technology with

the multiple goals of substantially increasing the efficiency of

surgical procedures, improving patient outcomes, and reducing

healthcare costs. The Company’s novel surgical approach uses

proprietary human-like surgical robots to virtually transport

surgeons inside the patient to perform minimally invasive surgery.

The Company is led by an experienced team of technologists, medical

device professionals and physicians, and is backed by technology

luminaries including Bill Gates, Vinod Khosla’s Khosla Ventures,

Innovation Endeavors, Jerry Yang’s AME Cloud Ventures, Sun Hung Kai

& Co. Ltd and Philip Liang’s E15 VC. The Company is

headquartered in Waltham, Massachusetts. Learn more at

www.vicarioussurgical.com.

Forward-Looking Statements

This press release includes “forward-looking statements'' within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. The company’s

actual results may differ from its expectations, estimates, and

projections and, consequently, you should not rely on these

forward-looking statements as predictions of future events. All

statements other than statements of historical facts contained

herein, including without limitation statements about the Company’s

intention to regain compliance with the New York Stock Exchange’s

listing requirement regarding minimum share price, among other

things, are forward-looking statements that reflect the current

beliefs and expectations of management. These forward-looking

statements involve significant risks and uncertainties that could

cause the actual results to differ materially from those discussed

in the forward-looking statements. Most of these factors are

outside Vicarious Surgical’s control and are difficult to predict.

Factors that may cause such differences include, but are not

limited to: changes in applicable laws or regulations; the ability

of Vicarious Surgical to raise financing in the future; the

success, cost and timing of Vicarious Surgical’s product and

service development activities; the potential attributes and

benefits of Vicarious Surgical’s product candidates and services;

Vicarious Surgical’s ability to obtain and maintain regulatory

approval for the Vicarious System on the timeline it expects, and

any related restrictions and limitations of any approved product;

the size and duration of human clinical trials for the Vicarious

Surgical; Vicarious Surgical’s ability to identify, in-license or

acquire additional technology; Vicarious Surgical’s ability to

maintain its existing license, manufacture, supply and distribution

agreements and scale manufacturing of the Vicarious Surgical System

and any future product candidates to commercial quantities;

Vicarious Surgical’s ability to compete with other companies

currently marketing or engaged in the development of products and

services that Vicarious Surgical is currently marketing or

developing, as well as with the use of open surgeries; the size and

growth potential of the markets for Vicarious Surgical’s product

candidates and services, and its ability to serve those markets,

either alone or in partnership with others; the pricing of

Vicarious Surgical’s product candidates and services and

reimbursement for medical procedures conducted using its product

candidates and services; the company’s ability to meet its

estimates regarding expenses, revenue, capital requirements, cash

runway and needs for additional financing; Vicarious Surgical’s

financial performance; Vicarious Surgical’s intellectual property

rights, its ability to protect or enforce these rights, and the

impact on its business, results and financial condition if it is

unsuccessful in doing so; economic downturns, political and market

conditions and their potential to adversely affect Vicarious

Surgical’s business, financial condition and results of operations;

and other risks and uncertainties indicated from time to time in

Vicarious Surgical’s filings with the SEC. Vicarious Surgical

cautions that the foregoing list of factors is not exclusive. The

company cautions readers not to place undue reliance upon any

forward-looking statements, which speak only as of the date made.

Vicarious Surgical does not undertake or accept any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements to reflect any change in its

expectations or any change in events, conditions or circumstances

on which any such statement is based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240610435281/en/

Investor Contact Kaitlyn Brosco Vicarious Surgical

Kbrosco@vicarioussurgical.com

Marissa Bych Gilmartin Group Marissa@gilmartinir.com

Media Inquiries media@vicarioussurgical.com

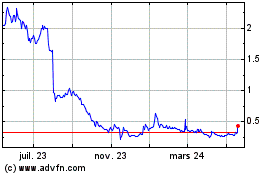

Vicarious Surgical (NYSE:RBOT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

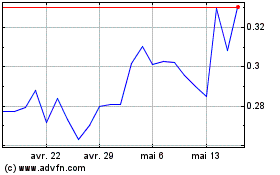

Vicarious Surgical (NYSE:RBOT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025