RiverNorth Opportunistic Municipal Income Fund, Inc. Declares Monthly Distributions of $0.0917 Per Share

02 Avril 2019 - 11:43PM

Business Wire

RiverNorth Opportunistic Municipal Income Fund, Inc. (the

“Fund”) (NYSE: RMI) announced the declaration of monthly

distributions of $0.0917 per common share for the months of April,

May and June 2019, payable on the dates noted below. In accordance

with the level distribution policy, the rate has been set equal to

5.50% based on the Fund’s initial public offering price of $20.00

per share (as of market close on October 26, 2018), the

distributions represent an annualized distribution rate of

5.50%.

The following dates apply to the distributions declared:

Ex Date Record Date

Payable Date Per Share April 17,

2019 April 18, 2019 April 30, 2019

$0.0917 May 15, 2019 May 16, 2019

May 31, 2019 $0.0917 June 12, 2019

June 13, 2019 June 28, 2019

$0.0917

With each distribution that does not consist solely of net

investment income, the Fund will issue a notice to shareholders and

an accompanying press release that will provide detailed

information regarding the amount and composition of the

distribution and other related information. The amounts and sources

of distributions reported in the notice to shareholders are only

estimates and are not being provided for tax reporting purposes.

The actual amounts and sources of the amounts for tax reporting

purposes will depend upon the Fund’s investment experience during

its full fiscal year and may be subject to changes based on tax

regulations. The Fund will send shareholders a Form 1099-DIV for

the calendar year that will tell them how to report these

distributions for federal income tax purposes.

The Fund may at times distribute more than its net investment

income and net realized capital gains; therefore, a portion of the

distribution may result in a return of capital. A return of capital

occurs when some or all of the money that shareholders invested in

the Fund is paid back to them. A return of capital does not

necessarily reflect the Fund’s investment performance and should

not be confused with ‘yield’ or ‘income.’ Any such returns of

capital will decrease the Fund’s total assets and, therefore, could

have the effect of increasing the Fund’s expense ratio. In

addition, in order to make the level of distributions called for

under its plan, the Fund may have to sell its portfolio securities

at a less than opportune time.

About RiverNorth

RiverNorth Capital Management, LLC is an investment management

firm founded in 2000. With $3.5 billion1 in assets under management

as of February 28, 2019, RiverNorth specializes in opportunistic

investment strategies in niche markets where the potential to

exploit inefficiencies is greatest. RiverNorth is an institutional

investment manager to registered funds, private funds and

separately managed accounts.

1 Firm AUM reflects Managed Assets, which includes assets

attributable to leverage.

This data is for information only and should not be construed as

an official tax form, nor should it be considered tax or investment

advice. RiverNorth is not a tax advisor and investors should

consult a tax professional for guidance regarding their specific

tax situation. When preparing your tax return, please refer to your

Form 1099-DIV and consult your legal or tax advisor.

A portion of the distribution may be treated as paid from

sources other than net income, including but not limited to

short‐term capital gain, long‐term capital gain and return of

capital.

Past performance is no guarantee of future results.

Investors should consider the Fund's investment objective,

risks, charges and expenses carefully before investing. The

prospectus should be read carefully before investing. For more

information, please read the prospectus, call your financial

professional or call 844.569.4750.

The Fund is a closed-end fund, and closed-end funds do not

continuously issue shares for sale as open-end mutual funds do.

Since the initial public offering has closed, the Fund now trades

in the secondary market. Investors wishing to buy or sell shares

need to place orders through an intermediary or broker. The share

price of a closed-end fund is based on the market's value.

Shares of closed-end investment companies frequently trade at a

discount to their net asset value and initial offering price. The

risk of loss due to this discount may be greater for initial

investors expecting to sell their shares in a relatively short

period after completion of the initial public offering.

An investment in the Fund is not appropriate for all investors

and is not intended to be a complete investment program. The Fund

is designed as a long-term investment and not as a trading

vehicle.

Risk is inherent in all investing. Investing in any investment

company security involves risk, including the risk that you may

receive little or no return on your investment or even that you may

lose part or all of your investment. Therefore, before investing in

the common shares of the Fund, you should consider the risks as

well as the other information in the prospectus.

1 Firm AUM reflects Managed Assets, which includes assets

attributable to leverage.

Not FDIC Insured | May Lose Value | No Bank Guarantee

RiverNorth® is a registered trademark of RiverNorth Capital

Management, LLC.

©2000-2019 RiverNorth Capital Management, LLC. All rights

reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190402006102/en/

Investor ContactAllen Webb,

CFA312.445.2266awebb@rivernorth.com

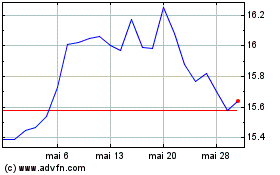

RiverNorth Opportunistic... (NYSE:RMI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

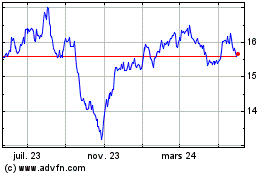

RiverNorth Opportunistic... (NYSE:RMI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025