- Hurricane Ian and certain other catastrophe events contributed

to a $648.4 million net negative impact on net loss attributable to

common shareholders, and added 57.2 percentage points to the

combined ratio.

- 101.6% growth in net investment income compared to Q3

2021.

- 95.7% Casualty and Specialty combined ratio, an improvement of

3.9 percentage points from Q3 2021.

- 22.6% growth in net premiums written; driven by 39.7% growth in

Casualty and Specialty.

- $641.5 million of net realized and unrealized losses on

investments, primarily driven by the impact of increasing interest

rates on the fixed maturity portfolio.

RenaissanceRe Holdings Ltd. (NYSE: RNR) (“RenaissanceRe” or the

“Company”) today announced its financial results for the third

quarter of 2022.

Net Loss Attributable to

Common Shareholders per Diluted Common Share: $(19.27)

Operating Loss Attributable to

Common Shareholders per Diluted Common Share*: $(9.27)

Underwriting Loss

$(683.1)M

Fee Income

$25.7M

Net Investment Income

$157.8M

Change in Book Value per

Common Share: (16.8)%

Change in Tangible Book Value

per Common Share Plus Change in Accum. Dividends*: (17.4)%

* Operating Return on Average Common Equity, Operating Income

(Loss) Available (Attributable) to Common Shareholders, Operating

Income (Loss) Available (Attributable) to Common Shareholders per

Diluted Common Share and Change in Tangible Book Value per Common

Share Plus Change in Accumulated Dividends are non-GAAP financial

measures; see “Comments on Regulation G” for a reconciliation of

non-GAAP financial measures.

Kevin J. O’Donnell, President and

Chief Executive Officer, said, “Hurricane Ian’s arrival in the

final days of the quarter was both a stark reminder of our value

proposition to our customers and a catalyst for change in the

reinsurance marketplace. RenaissanceRe’s strategic focus on

reinsurance, strong capital and industry leadership uniquely

situate us to drive transformative change during the upcoming

renewal period. As a result, we are positioned to deliver an

attractive return to our investors through materially increased

underwriting profit, robust fee income and significantly higher

investment income.”

Consolidated Financial

Results

Consolidated Highlights

Three months ended September

30,

(in thousands, except per share amounts

and percentages)

2022

2021

Gross premiums written

$

2,220,661

$

1,774,180

Net premiums written

1,821,711

1,486,440

Underwriting income (loss)

(683,114

)

(678,825

)

Combined ratio

138.7

%

145.1

%

Net Income (Loss)

Available (attributable) to common

shareholders

(825,344

)

(450,222

)

Available (attributable) to common

shareholders per diluted common share

$

(19.27

)

$

(9.75

)

Operating Income (Loss) (1)

Available (attributable) to common

shareholders

(396,674

)

(414,538

)

Available (attributable) to common

shareholders per diluted common share

$

(9.27

)

$

(8.98

)

Book value per common share

$

94.55

$

128.91

Change in book value per share

(16.8

)%

(7.5

)%

Tangible book value per common share plus

accumulated dividends (1)

$

113.29

$

146.40

Change in tangible book value per common

share plus change in accumulated dividends (1)

(17.4

)%

(7.6

)%

Return on average common equity -

annualized

(72.4

)%

(28.4

)%

Operating return on average common equity

- annualized (1)

(34.8

)%

(26.1

)%

- See “Comments on Regulation G” for a reconciliation of non-GAAP

financial measures.

Net Negative Impact

Net negative impact on underwriting result includes the sum of

(1) net claims and claim expenses incurred, (2) assumed and ceded

reinstatement premiums earned and (3) earned and lost profit

commissions. Net negative impact on net income (loss) available

(attributable) to RenaissanceRe common shareholders is the sum of

(1) net negative impact on underwriting result and (2) redeemable

noncontrolling interest, both before consideration of any related

income tax benefit (expense).

The Company’s estimates of net negative impact are based on a

review of our potential exposures, preliminary discussions with

certain counterparties and actuarial modeling techniques. Our

actual net negative impact, both individually and in the aggregate,

may vary from these estimates, perhaps materially. Changes in these

estimates will be recorded in the period in which they occur.

Meaningful uncertainty remains regarding the estimates and the

nature and extent of the losses from these catastrophe events,

driven by the magnitude and recent nature of each event, the

geographic areas impacted by the events, relatively limited claims

data received to date, the contingent nature of business

interruption and other exposures, potential uncertainties relating

to reinsurance recoveries and other factors inherent in loss

estimation, among other things.

Weather-Related Large Losses

Net negative impact on the consolidated financial

statements

Three months

ended September 30, 2022

Hurricane Ian

Other Q3 2022 Catastrophe

Events (1)

Aggregate Losses (2)

Total Q3 2022 Weather-Related

Large Losses (3)

(in thousands)

Net claims and claims expenses

incurred

$

(990,382

)

$

(152,418

)

$

(9,695

)

$

(1,152,495

)

Assumed reinstatement premiums earned

221,799

14,105

9

235,913

Ceded reinstatement premiums earned

(57,733

)

(283

)

—

(58,016

)

Earned (lost) profit commissions

(1,487

)

(1,285

)

(49

)

(2,821

)

Net negative impact on underwriting

result

(827,803

)

(139,881

)

(9,735

)

(977,419

)

Redeemable noncontrolling interest

288,383

40,621

—

329,004

Net negative impact on net income (loss)

available (attributable) to RenaissanceRe common shareholders

$

(539,420

)

$

(99,260

)

$

(9,735

)

$

(648,415

)

Net negative impact on the segment underwriting results and

consolidated combined ratio

Three months

ended September 30, 2022

Hurricane Ian

Other Q3 2022 Catastrophe

Events (1)

Aggregate Losses (2)

Total Q3 2022 Weather-Related

Large Losses (3)

(in thousands, except percentages)

Net negative impact on Property segment

underwriting result

$

(820,765

)

$

(137,881

)

$

(9,735

)

$

(968,381

)

Net negative impact on Casualty and

Specialty segment underwriting result

(7,038

)

(2,000

)

—

(9,038

)

Net negative impact on underwriting

result

$

(827,803

)

$

(139,881

)

$

(9,735

)

$

(977,419

)

Percentage point impact on consolidated

combined ratio

47.7

7.7

0.6

57.2

- “Other Q3 2022 Catastrophe Events” includes the severe weather

in France in May and June of 2022, and typhoons in Asia and

Hurricane Fiona during the third quarter of 2022.

- “Aggregate Losses” includes loss estimates associated with

certain aggregate loss contracts triggered during 2022 as a result

of weather-related catastrophe events.

- “Q3 2022 Weather-Related Large Losses” includes Hurricane Ian,

Other Q3 2022 Catastrophe Events and the Aggregate Losses described

above.

Three Drivers of Profit:

Underwriting, Fee and Investment Income

Underwriting Results - Property Segment: Q3 2022

Weather-Related Large Losses contributed 123.0 percentage points to

the combined ratio

Property Segment

Three months ended September

30,

Q/Q Change

(in thousands, except percentages)

2022

2021

Gross premiums written

$

800,330

$

773,692

3.4

%

Net premiums written

696,520

681,095

2.3

%

Underwriting income (loss)

(722,599

)

(681,929

)

Underwriting Ratios

Net claims and claim expense ratio -

current accident year

166.3

%

180.0

%

(13.7) pts

Net claims and claim expense ratio - prior

accident years

(2.9

)%

(17.9

)%

15.0 pts

Net claims and claim expense ratio -

calendar year

163.4

%

162.1

%

1.3 pts

Underwriting expense ratio

22.6

%

21.4

%

1.2 pts

Combined ratio

186.0

%

183.5

%

2.5 pts

- Gross premiums written increased by $26.6 million, or

3.4%, driven by growth of $55.9 million within the catastrophe

class of business, partially offset by a reduction of $29.2 million

within the other property class of business. – Reinstatement

premiums from the Q3 2022 Weather-Related Large Losses were $234.0

million compared to $254.9 million of reinstatement premiums from

the weather related large losses in the third quarter of 2021.

- Net premiums written increased by $15.4 million, or

2.3%, driven by the increase in gross premiums written, slightly

offset by an increase in ceded premiums written of $11.2

million.

- Net claims and claim expense ratio - current accident

year decreased 13.7 percentage points, primarily due to a lower

impact from weather-related large losses. – Q3 2022 Weather-Related

Large Losses contributed 127.9 percentage points to the current

accident year net claims and claim expense ratio, compared to the

weather-related large losses in the third quarter of 2021, which

contributed 143.1 percentage points to the current accident year

net claims and claim expense ratio.

- Net claims and claim expense ratio - prior accident

years reflects net favorable development primarily from

weather-related large losses in the 2017 to 2020 accident

years.

- Underwriting loss of $722.6 million in the Property

segment included a $968.4 million net negative impact from the Q3

2022 Weather-Related Large Losses with significant impacts in both

the catastrophe and other property classes of business. – Combined

ratio of 186.0% included 123.0 percentage points from the Q3 2022

Weather-Related Large Losses.

Underwriting Results - Casualty and Specialty Segment:

Combined ratio of 95.7% and growth in net premiums written of

39.7%

Casualty and Specialty Segment

Three months ended September

30,

Q/Q Change

(in thousands, except percentages)

2022

2021

Gross premiums written

$

1,420,331

$

1,000,488

42.0

%

Net premiums written

1,125,191

805,345

39.7

%

Underwriting income (loss)

39,485

3,104

Underwriting Ratios

Net claims and claim expense ratio -

current accident year

65.0

%

69.0

%

(4.0) pts

Net claims and claim expense ratio - prior

accident years

(0.8

)%

(0.2

)%

(0.6) pts

Net claims and claim expense ratio -

calendar year

64.2

%

68.8

%

(4.6) pts

Underwriting expense ratio

31.5

%

30.8

%

0.7 pts

Combined ratio

95.7

%

99.6

%

(3.9) pts

- Gross premiums written increased 42.0% across various

lines of business, principally in the financial lines classes of

business, which grew $237.0 million.

- Net premiums written increased 39.7%, primarily driven

by growth in the financial lines classes of business, consistent

with the changes in gross premiums written.

- Net claims and claim expense ratio - current accident

year improved by 4.0 percentage points, primarily due to a

lower impact from the Q3 2022 Weather-Related Large Losses compared

to the weather related large losses in the third quarter of

2021.

- Net claims and claim expense ratio - prior accident year

improved by 0.6 percentage points, reflecting higher favorable

prior accident year loss development compared to the third quarter

of 2021.

- Underwriting expense ratio increased 0.7 percentage

points, principally due to a 1.6 percentage point increase in the

net acquisition expense ratio due to higher costs and changes in

mix of business. This was largely offset by a 0.9 percentage point

improvement in the operating expense ratio, driven by improved

operating leverage.

Fee Income: $25.7 million of fee income; management fees

stable while performance fees impacted by Q3 2022 Weather-Related

Large Losses

Fee Income

Three months ended September

30,

Q/Q Change

(in thousands, except percentages)

2022

2021

Total management fee income

$

24,989

$

23,854

$

1,135

Total performance fee income (loss)

(1)

739

4,481

(3,742

)

Total fee income

$

25,728

$

28,335

$

(2,607

)

- Performance fees are based on the performance of the individual

vehicles or products, and may be negative in a particular period

if, for example, large losses occur, which can potentially result

in no performance fees or the reversal of previously accrued

performance fees.

- Management fee income was relatively stable in

comparison to the third quarter of 2021, reflecting increased

capital managed at DaVinciRe Holdings Ltd. (“DaVinci”), Vermeer

Reinsurance Ltd. (“Vermeer”), RenaissanceRe Medici Fund Ltd.

(“Medici”), and Fontana Holdings L.P. and its subsidiaries, largely

offset by reductions in the Company’s structured reinsurance

products.

- Performance fee income was lower in the third quarter of

2022 compared to the third quarter of 2021, primarily due to the

impact of the Q3 2022 Weather-Related Large Losses.

Investment Results: Net investment income up $79.5 million;

total investment result driven by net realized and unrealized

losses, primarily in the fixed maturity investments

portfolio

Investment Results

Three months ended September

30,

Q/Q Change

(in thousands, except percentages)

2022

2021

Net investment income

$

157,793

$

78,267

$

79,526

Net realized and unrealized gains (losses)

on investments

(641,500

)

(42,071

)

(599,429

)

Total investment result

$

(483,707

)

$

36,196

$

(519,903

)

Total investment return - annualized

(8.9

)%

0.7

%

(9.6) pts

- Net investment income increased $79.5 million, primarily

driven by higher investment yields from:

– Portfolio management to take advantage of

rising interest rates and increase the book yield within the fixed

maturity trading and short term investment portfolios, and

– Higher average invested assets and yields

in private credit fund investments.

- Net realized and unrealized losses on investments

increased $599.4 million principally driven by:

– Net realized and unrealized losses on fixed

maturity investments trading of $424.2 million as a result of the

significant increase in interest rates on the fixed maturity

portfolio, compared to net realized and unrealized losses of $29.4

million in the third quarter of 2021 resulting from a smaller

increase in interest rates.

– Net realized and unrealized losses on

catastrophe bonds of $127.0 million (primarily held in the Medici

portfolio, the majority of which is owned by third party

investors), principally as a result of the impact of Hurricane Ian,

compared to net realized and unrealized losses of $6.0 million in

the third quarter of 2021.

- Total investments were $20.9 billion at September 30, 2022

(December 31, 2021 - $21.4 billion). Weighted average yield to

maturity and duration on the Company’s investment portfolio (which

excludes investments that have no final maturity, yield to maturity

or duration) was 5.1% and 2.5 years.

Other Items of Note

- Net loss attributable to redeemable noncontrolling

interests of $372.4 million was primarily driven by:

– Impact of the Q3 2022 Weather-Related Large

Losses on the performance of DaVinci, Medici and Vermeer; and

– Realized and unrealized losses on

investments in the Company’s joint ventures driven by the

significant increase in interest rates.

- Raised capital of $122.1 million in the third

quarter of 2022 through Vermeer and Medici.

- Share repurchases of 175.7 thousand common shares at an

aggregate cost of $25.3 million and an average price of $144.07 per

common share from July 1, 2022 through July 22, 2022.

Conference Call Details and

Additional Information

Non-GAAP Financial Measures and Additional Financial

Information

This Press Release includes certain financial measures that are

not calculated in accordance with generally accepted accounting

principles in the U.S. (“GAAP”) including “operating income (loss)

available (attributable) to RenaissanceRe common shareholders,”

“operating income (loss) available (attributable) to RenaissanceRe

common shareholders per common share - diluted,” “operating return

on average common equity - annualized,” “tangible book value per

common share” and “tangible book value per common share plus

accumulated dividends.” A reconciliation of such measures to the

most comparable GAAP figures in accordance with Regulation G is

presented in the attached supplemental financial data.

Please refer to the “Investors - Financial Reports - Financial

Supplements” section of the Company’s website at www.renre.com for

a copy of the Financial Supplement which includes additional

information on the Company’s financial performance.

Conference Call Information

RenaissanceRe will host a conference call on Wednesday, November

2, 2022 at 11:00 a.m. ET to discuss this release. Live broadcast of

the conference call will be available through the “Investors -

Webcasts & Presentations” section of the Company’s website at

www.renre.com.

About RenaissanceRe

RenaissanceRe is a global provider of reinsurance and insurance

that specializes in matching well-structured risks with efficient

sources of capital. The Company provides property, casualty and

specialty reinsurance and certain insurance solutions to customers,

principally through intermediaries. Established in 1993,

RenaissanceRe has offices in Bermuda, Australia, Ireland,

Singapore, Switzerland, the United Kingdom and the United

States.

Cautionary Statement Regarding Forward-Looking

Statements

Any forward-looking statements made in this Press Release

reflect RenaissanceRe’s current views with respect to future events

and financial performance and are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

These statements are subject to numerous factors that could cause

actual results to differ materially from those set forth in or

implied by such forward-looking statements, including the

following: the Company’s exposure to natural and non-natural

catastrophic events and circumstances and the variance it may cause

in the Company’s financial results; the effect of climate change on

the Company’s business, including the trend towards increasingly

frequent and severe climate events; the effectiveness of the

Company’s claims and claim expense reserving process; the effect of

emerging claims and coverage issues; the historically cyclical

nature of the (re)insurance industries; collection on claimed

retrocessional coverage, and new retrocessional reinsurance being

available on acceptable terms; the ability of the Company’s ceding

companies and delegated authority counterparties to accurately

assess the risks they underwrite; the Company’s ability to maintain

its financial strength ratings; the performance of the Company’s

investment portfolio and financial market volatility; the effects

of inflation; the highly competitive nature of the Company’s

industry, resulting in consolidation of competitors, customers and

(re)insurance brokers, and the Company’s reliance on a small and

decreasing number of brokers; the impact of large non-recurring

contracts and reinstatement premiums on the Company’s financial

results; the Company’s ability to attract and retain key executives

and employees; the effect of cybersecurity risks, including

technology breaches or failure; the Company’s ability to

successfully implement its business strategies and initiatives, and

the success of any of the Company’s strategic investments or

acquisitions, including its ability to manage its operations as its

product and geographical diversity increases; the Company’s

exposure to credit loss from counterparties; the Company’s need to

make many estimates and judgments in the preparation of its

financial statements; the Company’s ability to effectively manage

capital on behalf of investors in joint ventures or other entities

it manages; changes to the accounting rules and regulatory systems

applicable to the Company’s business, including changes in Bermuda

laws or regulations or as a result of increased global regulation

of the insurance and reinsurance industries; other political,

regulatory or industry initiatives adversely impacting the Company;

the Company’s ability to comply with covenants in its debt

agreements; a contention by the U.S. Internal Revenue Service that

any of the Company’s Bermuda subsidiaries are subject to taxation

in the U.S.; the effects of possible future tax reform legislation

and regulations, including changes to the tax treatment of the

Company’s shareholders or investors in its joint ventures or other

entities it manages; the Company’s ability to determine any

impairments taken on its investments; the uncertainty of the

continuing and future impact of the COVID-19 pandemic, including

measures taken in response thereto and the effect of legislative,

regulatory and judicial influences on the Company’s potential

reinsurance, insurance and investment exposures, or other effects

that it may have; foreign currency exchange rate fluctuations; the

Company’s ability to raise capital if necessary; the Company’s

ability to comply with applicable sanctions and foreign corrupt

practices laws; the Company’s dependence on the ability of its

operating subsidiaries to declare and pay dividends; aspects of the

Company’s corporate structure that may discourage third-party

takeovers and other transactions; difficulties investors may have

in serving process or enforcing judgments against the Company in

the U.S.; and other factors affecting future results disclosed in

RenaissanceRe’s filings with the SEC, including its Annual Reports

on Form 10-K and Quarterly Reports on Form 10-Q.

RenaissanceRe Holdings

Ltd.

Summary Consolidated

Statements of Operations

(in thousands of United States

Dollars, except per share amounts and percentages)

(Unaudited)

Three months ended

Nine months ended

September 30,

2022

September 30,

2021

September 30,

2022

September 30,

2021

Revenues

Gross premiums written

$

2,220,661

$

1,774,180

$

7,628,264

$

6,520,780

Net premiums written

$

1,821,711

$

1,486,440

$

5,850,544

$

4,822,815

Decrease (increase) in unearned

premiums

(54,690

)

19,825

(1,140,715

)

(969,924

)

Net premiums earned

1,767,021

1,506,265

4,709,829

3,852,891

Net investment income

157,793

78,267

348,695

238,996

Net foreign exchange gains (losses)

(1,383

)

(4,755

)

(67,690

)

(24,309

)

Equity in earnings (losses) of other

ventures

1,739

5,305

2,732

8,479

Other income (loss)

2,834

1,692

4,950

4,449

Net realized and unrealized gains (losses)

on investments

(641,500

)

(42,071

)

(1,968,624

)

(196,616

)

Total revenues

1,286,504

1,544,703

3,029,892

3,883,890

Expenses

Net claims and claim expenses incurred

1,967,931

1,798,045

3,515,903

3,185,117

Acquisition expenses

417,644

328,048

1,155,389

880,872

Operational expenses

64,560

58,997

204,987

172,511

Corporate expenses

10,384

10,196

35,238

30,726

Interest expense

12,101

11,919

35,951

35,664

Total expenses

2,472,620

2,207,205

4,947,468

4,304,890

Income (loss) before taxes

(1,186,116

)

(662,502

)

(1,917,576

)

(421,000

)

Income tax benefit (expense)

(2,814

)

23,630

64,427

29,284

Net income (loss)

(1,188,930

)

(638,872

)

(1,853,149

)

(391,716

)

Net (income) loss attributable to

redeemable noncontrolling interests

372,429

198,495

335,010

131,801

Net income (loss) attributable to

RenaissanceRe

(816,501

)

(440,377

)

(1,518,139

)

(259,915

)

Dividends on preference shares

(8,843

)

(9,845

)

(26,531

)

(24,423

)

Net income (loss) available

(attributable) to RenaissanceRe common shareholders

$

(825,344

)

$

(450,222

)

$

(1,544,670

)

$

(284,338

)

Net income (loss) available (attributable)

to RenaissanceRe common shareholders per common share – basic

$

(19.27

)

$

(9.75

)

$

(35.84

)

$

(5.94

)

Net income (loss) available (attributable)

to RenaissanceRe common shareholders per common share – diluted

$

(19.27

)

$

(9.75

)

$

(35.84

)

$

(5.94

)

Operating (loss) income (attributable)

available to RenaissanceRe common shareholders per common share -

diluted (1)

$

(9.27

)

$

(8.98

)

$

(0.16

)

$

(2.77

)

Average shares outstanding - basic

42,837

46,223

43,121

47,988

Average shares outstanding - diluted

42,837

46,223

43,121

47,988

Net claims and claim expense ratio

111.4

%

119.4

%

74.7

%

82.7

%

Underwriting expense ratio

27.3

%

25.7

%

28.9

%

27.3

%

Combined ratio

138.7

%

145.1

%

103.6

%

110.0

%

Return on average common equity -

annualized

(72.4

)%

(28.4

)%

(40.5

)%

(5.8

)%

Operating return on average common equity

- annualized (1)

(34.8

)%

(26.1

)%

(0.2

)%

(2.7

)%

- See Comments on Regulation G for a reconciliation of non-GAAP

financial measures.

RenaissanceRe Holdings

Ltd.

Summary Consolidated Balance

Sheets

(in thousands of United States

Dollars, except per share amounts)

September 30,

2022

December 31,

2021

Assets

(Unaudited)

(Audited)

Fixed maturity investments trading, at

fair value

$

12,671,098

$

13,507,131

Short term investments, at fair value

4,935,960

5,298,385

Equity investments trading, at fair

value

950,393

546,016

Other investments, at fair value

2,263,164

1,993,059

Investments in other ventures, under

equity method

72,535

98,068

Total investments

20,893,150

21,442,659

Cash and cash equivalents

1,204,241

1,859,019

Premiums receivable

5,479,305

3,781,542

Prepaid reinsurance premiums

1,233,551

854,722

Reinsurance recoverable

4,969,244

4,268,669

Accrued investment income

84,508

55,740

Deferred acquisition costs and value of

business acquired

1,181,156

849,160

Receivable for investments sold

298,346

380,442

Other assets

353,147

224,053

Goodwill and other intangible assets

239,187

243,496

Total assets

$

35,935,835

$

33,959,502

Liabilities, Noncontrolling Interests

and Shareholders’ Equity

Liabilities

Reserve for claims and claim expenses

$

15,662,955

$

13,294,630

Unearned premiums

5,046,150

3,531,213

Debt

1,169,917

1,168,353

Reinsurance balances payable

4,158,610

3,860,963

Payable for investments purchased

589,886

1,170,568

Other liabilities

251,485

755,441

Total liabilities

26,879,003

23,781,168

Redeemable noncontrolling interests

4,174,960

3,554,053

Shareholders’ Equity

Preference shares

750,000

750,000

Common shares

43,702

44,445

Additional paid-in capital

465,565

608,121

Accumulated other comprehensive income

(loss)

(16,773

)

(10,909

)

Retained earnings

3,639,378

5,232,624

Total shareholders’ equity attributable

to RenaissanceRe

4,881,872

6,624,281

Total liabilities, noncontrolling

interests and shareholders’ equity

$

35,935,835

$

33,959,502

Book value per common share

$

94.55

$

132.17

RenaissanceRe Holdings

Ltd.

Supplemental Financial Data -

Segment Information

(in thousands of United States

Dollars, except percentages)

(Unaudited)

Three months ended September

30, 2022

Property

Casualty and Specialty

Other

Total

Gross premiums written

$

800,330

$

1,420,331

$

—

$

2,220,661

Net premiums written

$

696,520

$

1,125,191

$

—

$

1,821,711

Net premiums earned

$

839,817

$

927,204

$

—

$

1,767,021

Net claims and claim expenses incurred

1,372,583

595,348

—

1,967,931

Acquisition expenses

141,675

275,969

—

417,644

Operational expenses

48,158

16,402

—

64,560

Underwriting income (loss)

$

(722,599

)

$

39,485

$

—

(683,114

)

Net investment income

157,793

157,793

Net foreign exchange gains (losses)

(1,383

)

(1,383

)

Equity in earnings of other ventures

1,739

1,739

Other income (loss)

2,834

2,834

Net realized and unrealized gains (losses)

on investments

(641,500

)

(641,500

)

Corporate expenses

(10,384

)

(10,384

)

Interest expense

(12,101

)

(12,101

)

Income (loss) before taxes and redeemable

noncontrolling interests

(1,186,116

)

Income tax benefit (expense)

(2,814

)

(2,814

)

Net (income) loss attributable to

redeemable noncontrolling interests

372,429

372,429

Dividends on preference shares

(8,843

)

(8,843

)

Net income (loss) available (attributable)

to RenaissanceRe common shareholders

$

(825,344

)

Net claims and claim expenses incurred –

current accident year

$

1,396,842

$

602,995

$

—

$

1,999,837

Net claims and claim expenses incurred –

prior accident years

(24,259

)

(7,647

)

—

(31,906

)

Net claims and claim expenses incurred –

total

$

1,372,583

$

595,348

$

—

$

1,967,931

Net claims and claim expense ratio –

current accident year

166.3

%

65.0

%

113.2

%

Net claims and claim expense ratio – prior

accident years

(2.9

)%

(0.8

)%

(1.8

)%

Net claims and claim expense ratio –

calendar year

163.4

%

64.2

%

111.4

%

Underwriting expense ratio

22.6

%

31.5

%

27.3

%

Combined ratio

186.0

%

95.7

%

138.7

%

Three months ended September

30, 2021

Property

Casualty and Specialty

Other

Total

Gross premiums written

$

773,692

$

1,000,488

$

—

$

1,774,180

Net premiums written

$

681,095

$

805,345

$

—

$

1,486,440

Net premiums earned

$

816,376

$

689,889

$

—

$

1,506,265

Net claims and claim expenses incurred

1,323,678

474,367

—

1,798,045

Acquisition expenses

134,179

193,869

—

328,048

Operational expenses

40,448

18,549

—

58,997

Underwriting income (loss)

$

(681,929

)

$

3,104

$

—

(678,825

)

Net investment income

78,267

78,267

Net foreign exchange gains (losses)

(4,755

)

(4,755

)

Equity in earnings of other ventures

5,305

5,305

Other income (loss)

1,692

1,692

Net realized and unrealized gains (losses)

on investments

(42,071

)

(42,071

)

Corporate expenses

(10,196

)

(10,196

)

Interest expense

(11,919

)

(11,919

)

Income (loss) before taxes and redeemable

noncontrolling interests

(662,502

)

Income tax benefit (expense)

23,630

23,630

Net (income) loss attributable to

redeemable noncontrolling interests

198,495

198,495

Dividends on preference shares

(9,845

)

(9,845

)

Net income (loss) available (attributable)

to RenaissanceRe common shareholders

$

(450,222

)

Net claims and claim expenses incurred –

current accident year

$

1,469,613

$

476,082

$

—

$

1,945,695

Net claims and claim expenses incurred –

prior accident years

(145,935

)

(1,715

)

—

(147,650

)

Net claims and claim expenses incurred –

total

$

1,323,678

$

474,367

$

—

$

1,798,045

Net claims and claim expense ratio –

current accident year

180.0

%

69.0

%

129.2

%

Net claims and claim expense ratio – prior

accident years

(17.9

)%

(0.2

)%

(9.8

)%

Net claims and claim expense ratio –

calendar year

162.1

%

68.8

%

119.4

%

Underwriting expense ratio

21.4

%

30.8

%

25.7

%

Combined ratio

183.5

%

99.6

%

145.1

%

RenaissanceRe Holdings

Ltd.

Supplemental Financial Data -

Segment Information

(in thousands of United States

Dollars, except percentages)

(Unaudited)

Nine months ended September

30, 2022

Property

Casualty and Specialty

Other

Total

Gross premiums written

$

3,362,159

$

4,266,105

$

—

$

7,628,264

Net premiums written

$

2,474,661

$

3,375,883

$

—

$

5,850,544

Net premiums earned

$

2,081,989

$

2,627,840

$

—

$

4,709,829

Net claims and claim expenses incurred

1,804,268

1,711,635

—

3,515,903

Acquisition expenses

406,338

749,051

—

1,155,389

Operational expenses

144,717

60,270

—

204,987

Underwriting income (loss)

$

(273,334

)

$

106,884

$

—

(166,450

)

Net investment income

348,695

348,695

Net foreign exchange gain (loss)

(67,690

)

(67,690

)

Equity in earnings of other ventures

2,732

2,732

Other income (loss)

4,950

4,950

Net realized and unrealized gain (loss) on

investments

(1,968,624

)

(1,968,624

)

Corporate expenses

(35,238

)

(35,238

)

Interest expense

(35,951

)

(35,951

)

Income (loss) before taxes and redeemable

noncontrolling interests

(1,917,576

)

Income tax benefit (expense)

64,427

64,427

Net (income) loss attributable to

redeemable noncontrolling interests

335,010

335,010

Dividends on preference shares

(26,531

)

(26,531

)

Net income (loss) available (attributable)

to RenaissanceRe common shareholders

$

(1,544,670

)

Net claims and claim expenses incurred –

current accident year

$

1,880,337

$

1,728,262

$

—

$

3,608,599

Net claims and claim expenses incurred –

prior accident years

(76,069

)

(16,627

)

—

(92,696

)

Net claims and claim expenses incurred –

total

$

1,804,268

$

1,711,635

$

—

$

3,515,903

Net claims and claim expense ratio –

current accident year

90.3

%

65.8

%

76.6

%

Net claims and claim expense ratio – prior

accident years

(3.6

)%

(0.7

)%

(1.9

)%

Net claims and claim expense ratio –

calendar year

86.7

%

65.1

%

74.7

%

Underwriting expense ratio

26.4

%

30.8

%

28.9

%

Combined ratio

113.1

%

95.9

%

103.6

%

Nine months ended September

30, 2021

Property

Casualty and Specialty

Other

Total

Gross premiums written

$

3,574,067

$

2,946,713

$

—

$

6,520,780

Net premiums written

$

2,492,890

$

2,329,925

$

—

$

4,822,815

Net premiums earned

$

1,981,939

$

1,870,952

$

—

$

3,852,891

Net claims and claim expenses incurred

1,919,660

1,265,457

—

3,185,117

Acquisition expenses

356,171

524,701

—

880,872

Operational expenses

114,710

57,801

—

172,511

Underwriting income (loss)

$

(408,602

)

$

22,993

$

—

(385,609

)

Net investment income

238,996

238,996

Net foreign exchange gain (loss)

(24,309

)

(24,309

)

Equity in earnings of other ventures

8,479

8,479

Other income (loss)

4,449

4,449

Net realized and unrealized gain (loss) on

investments

(196,616

)

(196,616

)

Corporate expenses

(30,726

)

(30,726

)

Interest expense

(35,664

)

(35,664

)

Income (loss) before taxes and redeemable

noncontrolling interests

(421,000

)

Income tax benefit (expense)

29,284

29,284

Net (income) loss attributable to

redeemable noncontrolling interests

131,801

131,801

Dividends on preference shares

(24,423

)

(24,423

)

Net income (loss) available (attributable)

to RenaissanceRe common shareholders

$

(284,338

)

Net claims and claim expenses incurred –

current accident year

$

2,121,740

$

1,272,088

$

—

$

3,393,828

Net claims and claim expenses incurred –

prior accident years

(202,080

)

(6,631

)

—

(208,711

)

Net claims and claim expenses incurred –

total

$

1,919,660

$

1,265,457

$

—

$

3,185,117

Net claims and claim expense ratio –

current accident year

107.1

%

68.0

%

88.1

%

Net claims and claim expense ratio – prior

accident years

(10.2

)%

(0.4

)%

(5.4

)%

Net claims and claim expense ratio –

calendar year

96.9

%

67.6

%

82.7

%

Underwriting expense ratio

23.7

%

31.2

%

27.3

%

Combined ratio

120.6

%

98.8

%

110.0

%

RenaissanceRe Holdings

Ltd.

Supplemental Financial Data -

Gross Premiums Written

(in thousands of United States

Dollars)

(Unaudited)

Three months ended

Nine months ended

September 30,

2022

September 30,

2021

September 30,

2022

September 30,

2021

Property Segment

Catastrophe

$

391,347

$

335,493

$

2,080,771

$

2,227,941

Other property

408,983

438,199

1,281,388

1,346,126

Property segment gross premiums

written

$

800,330

$

773,692

$

3,362,159

$

3,574,067

Casualty and Specialty Segment

General casualty (1)

$

397,818

$

346,754

$

1,200,693

$

976,610

Professional liability (2)

380,125

329,848

1,378,645

950,607

Financial lines (3)

365,863

128,586

844,447

359,147

Other (4)

276,525

195,300

842,320

660,349

Casualty and Specialty segment gross

premiums written

$

1,420,331

$

1,000,488

$

4,266,105

$

2,946,713

(1)

Includes automobile liability, casualty

clash, employer’s liability, umbrella or excess casualty, workers’

compensation and general liability.

(2)

Includes directors and officers, medical

malpractice, and professional indemnity.

(3)

Includes financial guaranty, mortgage

guaranty, political risk, surety and trade credit.

(4)

Includes accident and health, agriculture,

aviation, cyber, energy, marine, satellite and terrorism. Lines of

business such as regional multi-line and whole account may have

characteristics of various other classes of business, and are

allocated accordingly.

RenaissanceRe Holdings

Ltd.

Supplemental Financial Data -

Total Investment Result

(in thousands of United States

Dollars, except percentages)

(Unaudited)

Three months ended

Nine months ended

September 30,

2022

September 30,

2021

September 30,

2022

September 30,

2021

Fixed maturity investments trading

$

107,182

$

56,825

$

246,146

$

179,268

Short term investments

11,601

514

17,134

1,869

Equity investments trading

6,120

1,823

13,390

4,940

Other investments

Catastrophe bonds

25,748

17,184

63,343

48,333

Other

11,258

7,571

23,704

20,711

Cash and cash equivalents

1,386

(38

)

1,250

223

163,295

83,879

364,967

255,344

Investment expenses

(5,502

)

(5,612

)

(16,272

)

(16,348

)

Net investment income

157,793

78,267

348,695

238,996

Net investment income return -

annualized

3.2

%

1.4

%

2.3

%

1.5

%

Net realized gains (losses) on fixed

maturity investments trading

(213,493

)

27,501

(621,799

)

81,060

Net unrealized gains (losses) on fixed

maturity investments trading

(210,665

)

(56,869

)

(824,662

)

(289,872

)

Net realized and unrealized gains (losses)

on investments-related derivatives

(55,580

)

(2,056

)

(161,946

)

3,476

Net realized gains (losses) on equity

investments trading

3,066

52,604

38,638

255,902

Net unrealized gains (losses) on equity

investments trading

(46,301

)

(74,284

)

(222,074

)

(279,938

)

Other investments

Net realized and unrealized gains (losses)

on other investments - catastrophe bonds

(126,992

)

(5,994

)

(159,913

)

(25,075

)

Net realized and unrealized gains (losses)

on other investments - other

8,465

17,027

(16,868

)

57,831

Net realized and unrealized gains

(losses) on investments

(641,500

)

(42,071

)

(1,968,624

)

(196,616

)

Total investment result

$

(483,707

)

$

36,196

$

(1,619,929

)

$

42,380

Total investment return -

annualized

(8.9

)%

0.7

%

(10.1

)%

0.3

%

Comments on Regulation

G

In addition to the GAAP financial measures set forth in this

Press Release, the Company has included certain non-GAAP financial

measures within the meaning of Regulation G. The Company has

provided these financial measures in previous investor

communications and the Company’s management believes that these

measures are important to investors and other interested persons,

and that investors and such other persons benefit from having a

consistent basis for comparison between quarters and for comparison

with other companies within or outside the industry. These measures

may not, however, be comparable to similarly titled measures used

by companies within or outside of the insurance industry. Investors

are cautioned not to place undue reliance on these non-GAAP

measures in assessing the Company’s overall financial

performance.

Operating Income (Loss) Available (Attributable) to

RenaissanceRe Common Shareholders and Operating Return on Average

Common Equity - Annualized

The Company uses “operating income (loss) available

(attributable) to RenaissanceRe common shareholders” as a measure

to evaluate the underlying fundamentals of its operations and

believes it to be a useful measure of its corporate performance.

“Operating income (loss) available (attributable) to RenaissanceRe

common shareholders” as used herein differs from “net income (loss)

attributable to RenaissanceRe common shareholders,” which the

Company believes is the most directly comparable GAAP measure, by

the exclusion of net realized and unrealized gains and losses on

investments, excluding other investments - catastrophe bonds, net

foreign exchange gains and losses, corporate expenses associated

with the acquisition of TMR and the subsequent sale of

RenaissanceRe (UK) Limited (“RenaissanceRe UK”), the income tax

expense or benefit associated with these adjustments and the

portion of these adjustments attributable to the Company’s

redeemable noncontrolling interests. The Company’s management

believes that “operating income (loss) available (attributable) to

RenaissanceRe common shareholders” is useful to investors because

it more accurately measures and predicts the Company’s results of

operations by removing the variability arising from: fluctuations

in the fair value of the Company’s fixed maturity investment

portfolio, equity investments trading, other investments (excluding

catastrophe bonds) and investments-related derivatives;

fluctuations in foreign exchange rates; corporate expenses

associated with the acquisition of TMR and the subsequent sale of

RenaissanceRe UK; the associated income tax expense or benefit of

these adjustments; and the portion of these adjustments

attributable to the Company’s redeemable noncontrolling interests.

The Company also uses “operating income (loss) available

(attributable) to RenaissanceRe common shareholders” to calculate

“operating income (loss) available (attributable) to RenaissanceRe

common shareholders per common share - diluted” and “operating

return on average common equity - annualized.” The following table

is a reconciliation of: (1) net income (loss) attributable to

RenaissanceRe common shareholders to “operating income (loss)

available (attributable) to RenaissanceRe common shareholders”; (2)

net income (loss) attributable to RenaissanceRe common shareholders

per common share - diluted to “operating income (loss) available

(attributable) to RenaissanceRe common shareholders per common

share - diluted”; and (3) return on average common equity -

annualized to “operating return on average common equity -

annualized.” Comparative information for all prior periods has been

updated to conform to the current methodology and presentation.

Three months ended

Nine months ended

(in thousands of United States Dollars,

except per share amounts and percentages)

September 30,

2022

September 30,

2021

September 30,

2022

September 30,

2021

Net income (loss) available (attributable)

to RenaissanceRe common shareholders

$

(825,344

)

$

(450,222

)

$

(1,544,670

)

$

(284,338

)

Adjustment for net realized and unrealized

losses (gains) on investments, excluding other investments -

catastrophe bonds

514,508

36,077

1,808,711

171,541

Adjustment for net foreign exchange losses

(gains)

1,383

4,755

67,690

24,309

Adjustment for corporate expenses

associated with the acquisition of TMR and the subsequent sale of

RenaissanceRe UK

—

—

—

135

Adjustment for income tax expense

(benefit) (1)

7,269

286

(77,331

)

(7,893

)

Adjustment for net income (loss)

attributable to redeemable noncontrolling interests (2)

(94,490

)

(5,434

)

(260,997

)

(35,847

)

Operating income (loss) available

(attributable) to RenaissanceRe common shareholders

$

(396,674

)

$

(414,538

)

$

(6,597

)

$

(132,093

)

Net income (loss) available (attributable)

to RenaissanceRe common shareholders per common share - diluted

$

(19.27

)

$

(9.75

)

$

(35.84

)

$

(5.94

)

Adjustment for net realized and unrealized

losses (gains) on investments, excluding other investments -

catastrophe bonds

12.01

0.78

41.95

3.57

Adjustment for net foreign exchange losses

(gains)

0.03

0.10

1.57

0.51

Adjustment for corporate expenses

associated with the acquisition of TMR and the subsequent sale of

RenaissanceRe UK

—

—

—

—

Adjustment for income tax expense

(benefit) (1)

0.17

0.01

(1.79

)

(0.16

)

Adjustment for net income (loss)

attributable to redeemable noncontrolling interests (2)

(2.21

)

(0.12

)

(6.05

)

(0.75

)

Operating income (loss) available

(attributable) to RenaissanceRe common shareholders per common

share - diluted

$

(9.27

)

$

(8.98

)

$

(0.16

)

$

(2.77

)

Return on average common equity -

annualized

(72.4

)%

(28.4

)%

(40.5

)%

(5.8

)%

Adjustment for net realized and unrealized

losses (gains) on investments, excluding other investments -

catastrophe bonds

45.2

%

2.3

%

47.3

%

3.5

%

Adjustment for net foreign exchange losses

(gains)

0.1

%

0.3

%

1.8

%

0.5

%

Adjustment for corporate expenses

associated with the acquisition of TMR and the subsequent sale of

RenaissanceRe UK

—

%

—

%

—

%

—

%

Adjustment for income tax expense

(benefit) (1)

0.6

%

—

%

(2.0

)%

(0.2

)%

Adjustment for net income (loss)

attributable to redeemable noncontrolling interests (2)

(8.3

)%

(0.3

)%

(6.8

)%

(0.7

)%

Operating return on average common equity

- annualized

(34.8

)%

(26.1

)%

(0.2

)%

(2.7

)%

- Represents the income tax (expense) benefit associated with the

adjustments to net income (loss) available (attributable) to

RenaissanceRe common shareholders. The income tax impact is

estimated by applying the statutory rates of applicable

jurisdictions, after consideration of other relevant factors.

- Represents the portion of the adjustments above that are

attributable to the Company’s redeemable noncontrolling interests,

including the income tax impact of those adjustments.

Tangible Book Value Per Common Share and Tangible Book Value

Per Common Share Plus Accumulated Dividends

The Company has included in this Press Release “tangible book

value per common share” and “tangible book value per common share

plus accumulated dividends.” “Tangible book value per common share”

is defined as book value per common share excluding goodwill and

intangible assets per share. “Tangible book value per common share

plus accumulated dividends” is defined as book value per common

share excluding goodwill and intangible assets per share, plus

accumulated dividends. The Company’s management believes “tangible

book value per common share” and “tangible book value per common

share plus accumulated dividends” are useful to investors because

they provide a more accurate measure of the realizable value of

shareholder returns, excluding the impact of goodwill and

intangible assets. The following table is a reconciliation of book

value per common share to “tangible book value per common share”

and “tangible book value per common share plus accumulated

dividends.”

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

September 30,

2021

Book value per common share

$

94.55

$

113.69

$

121.44

$

132.17

$

128.91

Adjustment for goodwill and other

intangibles (1)

(5.89

)

(5.90

)

(5.89

)

(5.90

)

(5.67

)

Tangible book value per common share

88.66

107.79

115.55

126.27

123.24

Adjustment for accumulated dividends

24.63

24.26

23.89

23.52

23.16

Tangible book value per common share plus

accumulated dividends

$

113.29

$

132.05

$

139.44

$

149.79

$

146.40

Quarterly change in book value per common

share

(16.8

)%

(6.4

)%

(8.1

)%

2.5

%

(7.5

)%

Quarterly change in tangible book value

per common share plus change in accumulated dividends

(17.4

)%

(6.4

)%

(8.2

)%

2.8

%

(7.6

)%

Year to date change in book value per

common share

(28.5

)%

(14.0

)%

(8.1

)%

(4.5

)%

(6.9

)%

Year to date change in tangible book value

per common share plus change in accumulated dividends

(28.9

)%

(14.0

)%

(8.2

)%

(4.0

)%

(6.6

)%

- At September 30, 2022, June 30, 2022, March 31, 2022, December

31, 2021, and September 30, 2021, the adjustment for goodwill and

other intangibles included $18.0 million, $18.3 million, $18.4

million, $18.6 million, and $19.0 million, respectively, of

goodwill and other intangibles included in investments in other

ventures, under equity method.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221101006170/en/

INVESTOR CONTACT: RenaissanceRe Holdings Ltd. Keith McCue

Senior Vice President, Finance & Investor Relations (441)

239-4830 MEDIA CONTACT: RenaissanceRe Holdings Ltd. Hayden

Kenny Vice President, Investor Relations & Communications (441)

239-4946 or Kekst CNC Dawn Dover (212) 521-4800

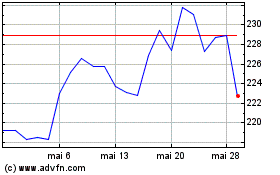

RenaissanceRe (NYSE:RNR)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

RenaissanceRe (NYSE:RNR)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025