RenaissanceRe Appoints David Marra Group Chief Underwriting Officer and Ross Curtis Chief Portfolio Officer

09 Novembre 2022 - 10:15PM

Business Wire

RenaissanceRe Holdings Ltd. (NYSE: RNR) (the “Company” or

“RenaissanceRe”) today announced the appointments of David Marra to

EVP, Group Chief Underwriting Officer and Chief Executive Officer

of Renaissance Reinsurance U.S. Inc. and Ross Curtis to EVP, Chief

Portfolio Officer. These changes are effective January 1, 2023.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20221109005690/en/

David Marra (Photo: Business Wire)

As Group Chief Underwriting Officer, Mr. Marra will be

responsible for developing and executing the Company’s underwriting

strategy, including risk appetite, client engagement, and business

and product development. Mr. Marra will also join RenaissanceRe’s

Governance Committee.

In the newly created role of Chief Portfolio Officer, Mr. Curtis

will be responsible for the execution of RenaissanceRe’s

gross-to-net strategy, advancing the Company’s ability to create

attractive portfolios and match those portfolios with the most

appropriate capital. Mr. Curtis will oversee risk tolerance,

portfolio optimization, deployed underwriting capital, and the

Claims function. He will remain a member of RenaissanceRe’s

Governance Committee.

Kevin J. O’Donnell, President and Chief Executive Officer of

RenaissanceRe, commented: “We believe we are entering one of the

most attractive markets in decades. The appointment of two of our

most seasoned leaders to these crucial roles positions us to

capitalize on market opportunities and optimize our gross-to-net

strategy across underwriting cycles.”

Mr. O’Donnell continued, “These appointments reflect our deep

bench strength. In his 15 years at RenaissanceRe, David has grown

our Casualty & Specialty business into an industry-leading

franchise and built our U.S. platform from the ground up. His

client and broker relationships stretch across our underwriting

book, and his risk acumen, coupled with his ability to bring

together all aspects of the Integrated System, make him an

excellent choice for this critical role. Ross is one of our most

seasoned executives, and his underwriting expertise, combined with

his deep understanding of our Integrated System, will ensure we

remain at the forefront of portfolio construction and capital

efficiency as we execute into this attractive market.”

Mr. Marra is currently the Chief Underwriting Officer for the

Casualty & Specialty segment and President of Renaissance

Reinsurance U.S. Inc. He has been with RenaissanceRe since 2008.

Mr. Curtis is currently the Group Chief Underwriting Officer for

RenaissanceRe and has held underwriting roles of increasing

leadership since 1999.

About RenaissanceRe

RenaissanceRe is a global provider of reinsurance and insurance

that specializes in matching well-structured risks with efficient

sources of capital. The Company provides property, casualty and

specialty reinsurance and certain insurance solutions to customers,

principally through intermediaries. Established in 1993,

RenaissanceRe has offices in Bermuda, Australia, Ireland,

Singapore, Switzerland, the United Kingdom and the United

States.

Cautionary Statement Regarding Forward-Looking

Statements

Any forward-looking statements made in this press release

reflect RenaissanceRe’s current views with respect to future events

and financial performance and are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

These statements are subject to numerous factors that could cause

actual results to differ materially from those set forth in or

implied by such forward-looking statements, including the

following: the Company’s exposure to natural and non-natural

catastrophic events and circumstances and the variance it may cause

in the Company’s financial results; the effect of climate change on

the Company’s business, including the trend towards increasingly

frequent and severe climate events; the effectiveness of the

Company’s claims and claim expense reserving process; the effect of

emerging claims and coverage issues; the historically cyclical

nature of the (re)insurance industries; collection on claimed

retrocessional coverage, and new retrocessional reinsurance being

available on acceptable terms; the ability of the Company’s ceding

companies and delegated authority counterparties to accurately

assess the risks they underwrite; the Company’s ability to maintain

its financial strength ratings; the performance of the Company’s

investment portfolio and financial market volatility; the effects

of inflation; the highly competitive nature of the Company’s

industry, resulting in consolidation of competitors, customers and

(re)insurance brokers, and the Company’s reliance on a small and

decreasing number of brokers; the impact of large non-recurring

contracts and reinstatement premiums on the Company’s financial

results; the Company’s ability to attract and retain key executives

and employees; the effect of cybersecurity risks, including

technology breaches or failure; the Company’s ability to

successfully implement its business strategies and initiatives, and

the success of any of the Company’s strategic investments or

acquisitions, including its ability to manage its operations as its

product and geographical diversity increases; the Company’s

exposure to credit loss from counterparties; the Company’s need to

make many estimates and judgments in the preparation of its

financial statements; the Company’s ability to effectively manage

capital on behalf of investors in joint ventures or other entities

it manages; changes to the accounting rules and regulatory systems

applicable to the Company’s business, including changes in Bermuda

laws or regulations or as a result of increased global regulation

of the insurance and reinsurance industries; other political,

regulatory or industry initiatives adversely impacting the Company;

the Company’s ability to comply with covenants in its debt

agreements; a contention by the U.S. Internal Revenue Service that

any of the Company’s Bermuda subsidiaries are subject to taxation

in the U.S.; the effects of possible future tax reform legislation

and regulations, including changes to the tax treatment of the

Company’s shareholders or investors in its joint ventures or other

entities it manages; the Company’s ability to determine any

impairments taken on its investments; the uncertainty of the

continuing and future impact of the COVID-19 pandemic, including

measures taken in response thereto and the effect of legislative,

regulatory and judicial influences on the Company’s potential

reinsurance, insurance and investment exposures, or other effects

that it may have; foreign currency exchange rate fluctuations; the

Company’s ability to raise capital if necessary; the Company’s

ability to comply with applicable sanctions and foreign corrupt

practices laws; the Company’s dependence on the ability of its

operating subsidiaries to declare and pay dividends; aspects of the

Company’s corporate structure that may discourage third-party

takeovers and other transactions; difficulties investors may have

in serving process or enforcing judgments against the Company in

the U.S.; and other factors affecting future results disclosed in

RenaissanceRe’s filings with the SEC, including its Annual Reports

on Form 10-K and Quarterly Reports on Form 10-Q.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221109005690/en/

INVESTOR CONTACT: RenaissanceRe Holdings Ltd. Keith McCue

Senior Vice President, Finance & Investor Relations (441)

239-4830

MEDIA CONTACT: RenaissanceRe Holdings Ltd. Hayden Kenny

Vice President, Investor Relations & Communications (441)

239-4946 or Kekst CNC Dawn Dover (212) 521-4800

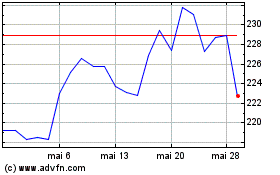

RenaissanceRe (NYSE:RNR)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

RenaissanceRe (NYSE:RNR)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025