Sea Limited (NYSE: SE) (“Sea” or the “Company”) today announced

its financial results for the third quarter ended September 30,

2023.

“Our strategy for e-commerce is driven by the principle that

maximizing the long-term profitability of the business will

generate the greatest returns to our shareholders in the long run,”

said Forrest Li, Sea’s Chairman and Group Chief Executive Officer.

“And maximizing long-term profitability requires scale and strong

market leadership. To achieve this long-term objective, we look at

three key operational factors: growth, current profitability, and

market share gain.”

“In this current period, we will prioritize investing in the

business to increase our market share and further strengthen our

market leadership. We now have scale, a deep understanding of our

markets, and strong localized execution across diverse geographies.

This gives us a wide competitive moat, and we intend to grow it

further. Our move to self-sufficiency and profitability in the past

quarters has significantly improved both our cash reserves and

operational efficiency and we see a very good opportunity to build

our e-commerce content ecosystem efficiently especially in live

streaming.”

“We are committed to maintaining a strong cash position, not

relying on external funding, and investing within our means at a

time and pace of our choosing. At the same time, given that

e-commerce penetration remains low in most of our markets, we as

the market leader have a responsibility to help grow the whole

e-commerce ecosystem. Shopee will remain committed to doing so in a

healthy and sustainable way and driving value creation for all

stakeholders.”

Third Quarter 2023 Highlights

- Group

- Total GAAP revenue was US$3.3 billion, up 4.9%

year-on-year.

- Total gross profit was US$1.4 billion, up 17.4%

year-on-year.

- Total net loss was US$(144.0) million, as compared to total net

loss of US$(569.3) million for the third quarter of 2022.

- Total adjusted EBITDA1 was US$35.3 million, as compared to a

loss of US$(357.7) million for the third quarter of 2022.

- As of September 30, 2023, cash, cash equivalents, short-term

and other treasury investments2 were US$7.9 billion, representing a

net increase of US$274.0 million from June 30, 2023.

- E-commerce

- GAAP revenue was US$2.2 billion, up 16.2% year-on-year.

- GAAP revenue included US$1.9 billion of GAAP marketplace

revenue, which consists of core marketplace revenue and value-added

services revenue and increased by 18.2% year-on-year.

- Core marketplace revenue, mainly consisting of

transaction-based fees and advertising revenues, was up 31.7%

year-on-year to US$1.3 billion.

- Value-added services revenue, mainly consisting of revenues

related to logistics services, was down 4.2% year-on-year to

US$592.8 million.

- Adjusted EBITDA1 was US$(346.5) million, as compared to

US$(495.7) million for the third quarter of 2022.

- Asia markets recorded adjusted EBITDA of US$(306.2) million in

the quarter, as compared to US$(216.8) million for the third

quarter of 2022.

- Other markets recorded adjusted EBITDA of US$(40.3) million in

the quarter, as compared to US$(279.0) million for the third

quarter of 2022.

- In Brazil, unit economics continued to improve, with

contribution margin loss per order improving 90.7% year-on-year to

reach US$0.10 for the quarter.

- Gross orders totaled 2.2 billion for the quarter, increasing by

13.2% year-on-year and 23.6% quarter-on-quarter.

- GMV was US$20.1 billion for the quarter, increasing by 5.1%

year-on-year and 11.2% quarter-on quarter.

- Digital Entertainment

- GAAP revenue was US$592.2 million, up 11.9%

quarter-on-quarter.

- Bookings3 were US$447.9 million, as compared to US$443.1

million for the previous quarter.

- Adjusted EBITDA1 was US$234.0 million, as compared to US$239.5

million for the previous quarter.

- Adjusted EBITDA represented 52.2% of bookings for the third

quarter of 2023, as compared to 54.0% for the previous

quarter.

- Quarterly active users were 544.1 million, as compared to 544.5

million for the previous quarter.

- Quarterly paying users were 40.5 million, as compared to 43.1

million for the previous quarter. Paying user ratio was 7.5%, as

compared to 7.9% for the previous quarter.

- Average bookings per user were US$0.82, increased slightly

quarter-on-quarter.

- Digital Financial Services

- GAAP revenue was US$446.2 million, up 36.5% year-on-year.

- Adjusted EBITDA1 was US$165.7 million, as compared to a loss of

US$(67.7) million for the third quarter of 2022.

- As of September 30, 2023, gross loans receivable increased by

5.3% sequentially to US$2.4 billion, before netting off allowance

for credit losses of US$288.1 million. Non-performing loans past

due by more than 90 days as a percentage of our gross loans

receivable was 1.6%, improving quarter-on-quarter.

1

For a discussion of the use of non-GAAP

financial measures, see “Non-GAAP Financial Measures”.

2

Other treasury investments currently

consist of available-for-sale sovereign bonds and corporate bonds

excluding those at our banking entities, with maturities over one

year, classified as part of long-term investments.

3

GAAP revenue for the digital entertainment

segment plus change in digital entertainment deferred revenue. This

operating metric is used as an approximation of cash spent by our

users in the applicable period that is attributable to our digital

entertainment segment.

Unaudited Summary of Financial

Results

(Amounts are expressed in thousands of US

dollars “$” except for per share data)

For the Three Months

ended September 30,

2022

2023

$

$

YOY%

Revenue

Service revenue

Digital Entertainment

892,879

592,153

(33.7

)%

E-commerce and other services

1,976,743

2,417,036

22.3

%

Sales of goods

286,329

300,979

5.1

%

3,155,951

3,310,168

4.9

%

Cost of revenue

Cost of service

Digital Entertainment

(264,833

)

(177,086

)

(33.1

)%

E-commerce and other services

(1,405,749

)

(1,403,975

)

(0.1

)%

Cost of goods sold

(257,651

)

(287,815

)

11.7

%

(1,928,233

)

(1,868,876

)

(3.1

)%

Gross profit

1,227,718

1,441,292

17.4

%

Other operating income

65,972

46,614

(29.3

)%

Sales and marketing expenses

(816,662

)

(918,046

)

12.4

%

General and administrative expenses

(405,177

)

(273,575

)

(32.5

)%

Provision for credit losses

(146,523

)

(143,514

)

(2.1

)%

Research and development expenses

(420,972

)

(280,511

)

(33.4

)%

Total operating expenses

(1,723,362

)

(1,569,032

)

(9.0

)%

Operating loss

(495,644

)

(127,740

)

(74.2

)%

Non-operating (loss) income, net

(9,173

)

45,875

(600.1

)%

Income tax expense

(65,279

)

(61,676

)

(5.5

)%

Share of results of equity investees

821

(437

)

(153.2

)%

Net loss

(569,275

)

(143,978

)

(74.7

)%

Basic and diluted loss per share

attributable to Sea Limited’s ordinary

shareholders

(1.01

)

(0.26

)

(74.3

)%

Change in deferred revenue of Digital

Entertainment

(228,207

)

(144,253

)

(36.8

)%

Adjusted EBITDA for Digital Entertainment

(1)

289,879

233,998

(19.3

)%

Adjusted EBITDA for E-commerce (1)

(495,735

)

(346,495

)

(30.1

)%

Adjusted EBITDA for Digital Financial

Services (1)

(67,746

)

165,731

(344.6

)%

Adjusted EBITDA for Other Services (1)

(76,530

)

(8,771

)

(88.5

)%

Unallocated expenses (2)

(7,520

)

(9,179

)

22.1

%

Total adjusted EBITDA (1)

(357,652

)

35,284

(109.9

)%

(1)

For a discussion of the use of non-GAAP

financial measures, see “Non-GAAP Financial Measures”.

(2)

Unallocated expenses within total adjusted

EBITDA are mainly related to general and corporate administrative

costs such as professional fees and other miscellaneous items that

are not allocated to segments. These expenses are excluded from

segment results as they are not reviewed by the Chief Operating

Decision Maker (“CODM”) as part of segment performance.

Three Months Ended September 30, 2023 Compared to Three

Months Ended September 30, 2022

Revenue

Our total GAAP revenue increased by 4.9% to US$3.3 billion in

the third quarter of 2023 from US$3.2 billion in the third quarter

of 2022.

- Digital Entertainment: GAAP revenue was US$592.2 million

compared to US$892.9 million in the third quarter of 2022,

primarily attributable to moderation in user engagement and

monetization year-on-year.

- E-commerce and other services: GAAP revenue increased by 22.3%

to US$2.4 billion in the third quarter of 2023 from US$2.0 billion

in the third quarter of 2022, primarily driven by the improved

monetization in our e-commerce business and the growth of our

credit business year-on-year.

- Sales of goods: GAAP revenue increased by 5.1% to US$301.0

million in the third quarter of 2023 from US$286.3 million in the

third quarter of 2022.

Cost of Revenue

Our total cost of revenue was US$1.9 billion in the third

quarter of 2023, flat year-on-year.

- Digital Entertainment: Cost of revenue decreased by 33.1% to

US$177.1 million in the third quarter of 2023 from US$264.8 million

in the third quarter of 2022.

- E-commerce and other services: Cost of revenue for e-commerce

and other services segment combined was US$1.4 billion in the third

quarter of 2023, flat year-on-year. Improvement in gross profit

margins was driven by increased monetization and greater cost

efficiencies in our e-commerce and digital financial services

business.

- Cost of goods sold: Cost of goods sold increased by 11.7% to

US$287.8 million in the third quarter of 2023 from US$257.7 million

in the third quarter of 2022.

Other Operating Income

Other operating income was US$46.6 million and US$66.0 million

in the third quarter of 2023 and 2022, respectively. Other

operating income mainly consists of rebates from e-commerce related

logistics services providers.

Sales and Marketing Expenses

Our total sales and marketing expenses increased by 12.4% to

US$918.0 million in the third quarter of 2023 from US$816.7 million

in the third quarter of 2022. The table below sets forth breakdown

of the sales and marketing expenses of our major reporting

segments. Amounts are expressed in thousands of US dollars

(“$”).

For the Three Months

ended September 30,

2022

2023

YOY%

Sales and Marketing Expenses

$

$

Digital Entertainment

60,521

24,712

(59.2

)%

E-commerce

575,676

861,540

49.7

%

Digital Financial Services

130,824

25,152

(80.8

)%

General and Administrative Expenses

Our general and administrative expenses decreased by 32.5% to

US$273.6 million in the third quarter of 2023 from US$405.2 million

in the third quarter of 2022.

Provision for Credit Losses

Our provision for credit losses decreased by 2.1% to US$143.5

million in the third quarter of 2023 from US$146.5 million in the

third quarter of 2022.

Research and Development Expenses

Our research and development expenses decreased by 33.4% to

US$280.5 million in the third quarter of 2023 from US$421.0 million

in the third quarter of 2022.

Non-operating Income or Losses, Net

Non-operating income or losses mainly consist of interest

income, interest expense, investment gain (loss) and foreign

exchange gain (loss). We recorded a net non-operating income of

US$45.9 million in the third quarter of 2023, as compared to a net

non-operating loss of US$9.2 million in the third quarter of 2022.

The year-on-year improvement was mainly due to higher interest

income in the third quarter of 2023.

Income Tax Expense

We had a net income tax expense of US$61.7 million and US$65.3

million in the third quarter of 2023 and 2022, respectively.

Net Loss

As a result of the foregoing, we had net losses of US$144.0

million and US$569.3 million in the third quarter of 2023 and 2022,

respectively.

Basic and Diluted Loss Per Share Attributable to Sea

Limited’s Ordinary Shareholders

Basic and diluted loss per share attributable to Sea Limited’s

ordinary shareholders was US$0.26 in the third quarter of 2023, as

compared to US$1.01 in the third quarter of 2022.

Webcast and Conference Call Information

The Company’s management will host a conference call today to

review Sea’s business and financial performance.

Details of the conference call and webcast are as follows:

Date and time:

7:30 AM U.S. Eastern Time on November 14,

2023 8:30 PM Singapore / Hong Kong Time on November 14, 2023

Webcast link:

https://events.q4inc.com/attendee/547645719

A replay of the conference call will be available at the

Company’s investor relations website (www.sea.com/investor/home).

An archived webcast will be available at the same link above.

About Sea Limited

Sea Limited (NYSE: SE) is a leading global consumer internet

company founded in Singapore in 2009. Its mission is to better the

lives of consumers and small businesses with technology. Sea

operates three core businesses across digital entertainment,

e-commerce, as well as digital payments and financial services,

known as Garena, Shopee and SeaMoney, respectively. Garena is a

leading global online games developer and publisher. Shopee is the

largest pan-regional e-commerce platform in Southeast Asia and

Taiwan. SeaMoney is a leading digital payments and financial

services provider in Southeast Asia.

Forward-Looking Statements

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“may,” “could,” “will,” “expect,” “anticipate,” “aim,” “future,”

“intend,” “plan,” “believe,” “estimate,” “likely to,” “potential,”

“confident,” “guidance,” and similar statements. Among other

things, statements that are not historical facts, including

statements about Sea’s beliefs and expectations, the business,

financial and market outlook, and projections from its management

in this announcement, as well as Sea’s strategic and operational

plans, contain forward-looking statements. Sea may also make

written or oral forward-looking statements in its periodic reports

to the U.S. Securities and Exchange Commission (the “SEC”), in its

annual report to shareholders, in press releases, and other written

materials, and in oral statements made by its officers, directors,

or employees to third parties. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to the

following: Sea’s goals and strategies; its future business

development, financial condition, financial results, and results of

operations; the expected growth in, and market size of, the digital

entertainment, e-commerce and digital financial services industries

in the markets where it operates, including segments within those

industries; expected changes or guidance in its revenue, costs or

expenditures; its ability to continue to source, develop and offer

new and attractive online games and to offer other engaging digital

entertainment content; the expected growth of its digital

entertainment, e-commerce and digital financial services

businesses; its expectations regarding growth in its user base,

level of engagement, and monetization; its ability to continue to

develop new technologies and/or upgrade its existing technologies;

its expectations regarding the use of proceeds from its financing

activities, including its follow-on equity offerings and

convertible notes offerings; growth and trends of its markets and

competition in its industries; government policies and regulations

relating to its industries, including the effects of any government

orders or actions on its businesses; general economic, political,

social and business conditions in its markets; and the impact of

widespread health developments, including the COVID-19 pandemic,

and the responses thereto (such as voluntary and in some cases,

mandatory quarantines as well as shut downs and other restrictions

on travel and commercial, social and other activities, and the

availability of effective vaccines or treatments) and the impact of

economies reopening further to the COVID-19 pandemic. Further

information regarding these and other risks is included in Sea’s

filings with the SEC. All information provided in this press

release and in the attachments is as of the date of this press

release, and Sea undertakes no obligation to update any

forward-looking statement, except as required under applicable

law.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with U.S. GAAP, we use the

following non-GAAP financial measures to help evaluate our

operating performance:

- “Adjusted EBITDA” for our digital entertainment segment

represents operating income (loss) plus (a) depreciation and

amortization expenses, and (b) the net effect of changes in

deferred revenue and its related cost for our digital entertainment

segment. We believe that the segment adjusted EBITDA helps to

identify underlying trends in our operating results, enhancing

their understanding of the past performance and future

prospects.

- “Adjusted EBITDA” for our e-commerce segment, digital financial

services segment and other services segment represents operating

income (loss) plus depreciation and amortization expenses. We

believe that the segment adjusted EBITDA helps to identify

underlying trends in our operating results, enhancing their

understanding of the past performance and future prospects.

- “Total adjusted EBITDA” represents the sum of adjusted EBITDA

of all our segments combined, plus unallocated expenses. We believe

that the total adjusted EBITDA helps to identify underlying trends

in our operating results, enhancing their understanding of the past

performance and future prospects.

These non-GAAP financial measures have limitations as analytical

tools. None of the above financial measures should be considered in

isolation or construed as an alternative to revenue, net

loss/income, or any other measure of performance or as an indicator

of our operating performance. These non-GAAP financial measures

presented here may not be comparable to similarly titled measures

presented by other companies. Other companies may calculate

similarly titled measures differently, limiting their usefulness as

comparative measures to Sea’s data. We compensate for these

limitations by reconciling the non-GAAP financial measures to their

nearest U.S. GAAP financial measures, all of which should be

considered when evaluating our performance. We encourage you to

review our financial information in its entirety and not rely on

any single financial measure.

The tables below present selected financial information of our

reporting segments, the non-GAAP financial measures that are most

directly comparable to GAAP financial measures, and the related

reconciliations between the financial measures. Amounts are

expressed in thousands of US dollars (“$”) except for number of

shares & per share data.

For the Three Months ended

September 30, 2023

Digital Entertainment

E- commerce

Digital Financial Services

Other Services(1)

Unallocated expenses(2)

Consolidated

$

$

$

$

$

$

Operating income (loss)

345,760

(428,183

)

150,470

(11,704

)

(184,083

)

(127,740

)

Net effect of changes in deferred revenue

and its related cost

(119,058

)

-

-

-

-

(119,058

)

Depreciation and Amortization

7,296

81,688

15,261

2,933

-

107,178

Share-based compensation

-

-

-

-

174,904

174,904

Adjusted EBITDA

233,998

(346,495

)

165,731

(8,771

)

(9,179

)

35,284

For the Three Months ended

September 30, 2022

Digital Entertainment

E- commerce

Digital Financial Services

Other Services(1)

Unallocated expenses(2)

Consolidated

$

$

$

$

$

$

Operating income (loss)

456,952

(586,148

)

(82,462

)

(80,711

)

(203,275

)

(495,644

)

Net effect of changes in deferred revenue

and its related cost

(177,874

)

-

-

-

-

(177,874

)

Depreciation and Amortization

10,801

90,413

14,716

4,181

-

120,111

Share-based compensation

-

-

-

-

195,755

195,755

Adjusted EBITDA

289,879

(495,735

)

(67,746

)

(76,530

)

(7,520

)

(357,652

)

(1)

A combination of multiple business

activities that does not meet the quantitative thresholds to

qualify as reportable segments are grouped together as “Other

Services”.

(2)

Unallocated expenses are mainly related to

share-based compensation, and general and corporate administrative

costs such as professional fees and other miscellaneous items that

are not allocated to segments. These expenses are excluded from

segment results as they are not reviewed by the CODM as part of

segment performance.

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS

Amounts expressed in thousands of US

dollars (“$”) except for number of shares & per share

data

For the Nine Months

ended September 30,

2022

2023

$

$

Revenue

Service revenue

Digital Entertainment

2,928,306

1,661,236

E-commerce and other services

5,232,040

6,999,109

Sales of goods

837,775

786,587

Total revenue

8,998,121

9,446,932

Cost of revenue

Cost of service

Digital Entertainment

(834,547

)

(511,121

)

E-commerce and other services

(3,911,891

)

(3,908,825

)

Cost of goods sold

(763,719

)

(718,126

)

Total cost of revenue

(5,510,157

)

(5,138,072

)

Gross profit

3,487,964

4,308,860

Operating income (expenses)

Other operating income

210,731

162,497

Sales and marketing expenses

(2,795,603

)

(1,811,790

)

General and administrative expenses

(1,085,291

)

(902,121

)

Provision for credit losses

(338,587

)

(473,954

)

Research and development expenses

(1,132,306

)

(884,320

)

Impairment of goodwill

(177,280

)

(117,875

)

Total operating expenses

(5,318,336

)

(4,027,563

)

Operating (loss) income

(1,830,372

)

281,297

Interest income

61,179

240,361

Interest expense

(34,587

)

(30,946

)

Investment loss, net

(84,327

)

(45,377

)

Foreign exchange gain

9,737

11,924

(Loss) Income before income tax and

share of results of equity investees

(1,878,370

)

457,259

Income tax expense

(211,856

)

(185,786

)

Share of results of equity investees

9,616

2,824

Net (loss) income

(2,080,610

)

274,297

Net loss (income) attributable to

non-controlling interests

2,391

(13,831

)

Net (loss) income attributable to Sea

Limited’s ordinary shareholders

(2,078,219

)

260,466

(Loss) Earnings per share:

Basic

(3.73

)

0.46

Diluted

(3.73

)

0.44

Weighted average shares used in (loss)

earnings per share computation:

Basic

557,376,415

565,630,521

Diluted

557,376,415

597,718,238

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US

dollars (“$”)

As of December

31,

As of September

30,

2022

2023

$

$

ASSETS

Current assets

Cash and cash equivalents

6,029,859

3,219,873

Restricted cash

1,549,574

1,515,596

Accounts receivable, net of allowance for

credit losses of $12,818 and $7,382, as of

December 31, 2022 and September 30, 2023

respectively

268,814

190,788

Prepaid expenses and other assets

1,798,651

2,046,368

Loans receivable, net of allowance for

credit losses of $236,797 and $286,250, as of

December 31, 2022 and September 30, 2023

respectively

2,053,767

2,110,587

Inventories, net

109,668

116,320

Short-term investments

864,258

2,762,748

Amounts due from related parties

13,421

11,666

Total current assets

12,688,012

11,973,946

Non-current assets

Property and equipment, net

1,387,895

1,229,015

Operating lease right-of-use assets,

net

957,840

1,014,768

Intangible assets, net

65,019

61,455

Long-term investments

1,253,593

3,162,710

Prepaid expenses and other assets

135,616

114,172

Loans receivable, net of allowance for

credit losses of $2,022 and $1,886, as of

December 31, 2022 and September 30, 2023

respectively

21,663

19,841

Restricted cash

17,724

26,207

Deferred tax assets

245,226

311,044

Goodwill

230,208

111,952

Total non-current assets

4,314,784

6,051,164

Total assets

17,002,796

18,025,110

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US

dollars (“$”)

As of December

31,

As of September

30,

2022

2023

$

$

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities

Accounts payable

258,648

267,852

Accrued expenses and other payables

1,396,613

1,597,125

Deposits payable

1,316,395

1,397,420

Escrow payables and advances from

customers

1,862,325

2,001,361

Amounts due to related parties

415

422

Borrowings

88,410

91,563

Operating lease liabilities

269,968

288,632

Convertible notes

31,237

–

Deferred revenue

1,535,083

1,192,213

Income tax payable

176,598

194,235

Total current liabilities

6,935,692

7,030,823

Non-current liabilities

Accrued expenses and other payables

87,072

80,181

Borrowings

–

96,514

Operating lease liabilities

756,818

794,652

Deferred revenue

63,566

101,057

Convertible notes

3,338,750

3,343,230

Deferred tax liabilities

9,967

502

Unrecognized tax benefits

107

107

Total non-current liabilities

4,256,280

4,416,243

Total liabilities

11,191,972

11,447,066

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US

dollars (“$”)

As of December

31,

As of September

30,

2022

2023

$

$

Shareholders’ equity

Class A Ordinary shares

258

261

Class B Ordinary shares

23

23

Additional paid-in capital

14,559,690

15,153,621

Accumulated other comprehensive loss

(111,215

)

(213,995

)

Statutory reserves

12,490

13,119

Accumulated deficit

(8,745,541

)

(8,485,704

)

Total Sea Limited shareholders’

equity

5,715,705

6,467,325

Non-controlling interests

95,119

110,719

Total shareholders’ equity

5,810,824

6,578,044

Total liabilities and shareholders’

equity

17,002,796

18,025,110

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

Amounts expressed in thousands of US

dollars (“$”)

For the Nine Months ended

September 30,

2022

2023

$

$

Net cash (used in) generated from

operating activities

(1,375,383

)

1,800,855

Net cash used in investing activities

(2,480,331

)

(4,755,908

)

Net cash generated from financing

activities

913,967

182,626

Effect of foreign exchange rate changes on

cash, cash equivalents and restricted cash

(252,623

)

(76,281

)

Net decrease in cash, cash equivalents and

restricted cash

(3,194,370

)

(2,848,708

)

Cash, cash equivalents and restricted cash

at beginning of the period(1)

10,838,140

7,610,384

Cash, cash equivalents and restricted cash

at end of the period

7,643,770

4,761,676

(1)

As of December 31, 2022, cash and cash

equivalents of US$13,227 was included in assets held for sale

within prepaid expenses and other assets.

Net cash used in investing activities amounted to US$4,756

million for the nine months ended September 30, 2023. This was

primarily attributable to net placement of US$3,979 million in

securities purchased under agreements to resell, time deposits and

liquid investment products, for better cash yield management,

increase in loans receivable of US$548 million and purchase of

property and equipment of US$177 million to support the existing

operations.

UNAUDITED SEGMENT INFORMATION

The Company has three reportable segments, namely digital

entertainment, e-commerce and digital financial services. The Chief

Operating Decision Maker (“CODM”) reviews the performance of each

segment based on revenue and certain key operating metrics of the

operations and uses these results for the purposes of allocating

resources to and evaluating the financial performance of each

segment. Amounts are expressed in thousands of US dollars

(“$”).

For the Three Months ended

September 30, 2023

Digital Entertainment

E- commerce

Digital Financial Services

Other Services(1)

Unallocated expenses(2)

Consolidated

$

$

$

$

$

$

Revenue

592,153

2,231,954

446,249

39,812

-

3,310,168

Operating income (loss)

345,760

(428,183

)

150,470

(11,704

)

(184,083

)

(127,740

)

Non-operating income, net

45,875

Income tax expense

(61,676

)

Share of results of equity investees

(437

)

Net loss

(143,978

)

For the Three Months ended

September 30, 2022

Digital Entertainment

E- commerce

Digital Financial Services

Other Services(1)

Unallocated expenses(2)

Consolidated

$

$

$

$

$

$

Revenue

892,879

1,920,126

326,853

16,093

-

3,155,951

Operating income (loss)

456,952

(586,148

)

(82,462

)

(80,711

)

(203,275

)

(495,644

)

Non-operating loss, net

(9,173

)

Income tax expense

(65,279

)

Share of results of equity investees

821

Net loss

(569,275

)

(1)

A combination of multiple business

activities that does not meet the quantitative thresholds to

qualify as reportable segments are grouped together as “Other

Services”.

(2)

Unallocated expenses are mainly related to

share-based compensation, and general and corporate administrative

costs such as professional fees and other miscellaneous items that

are not allocated to segments. These expenses are excluded from

segment results as they are not reviewed by the CODM as part of

segment performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231113446652/en/

For enquiries: Investors / analysts: ir@sea.com Media:

media@sea.com

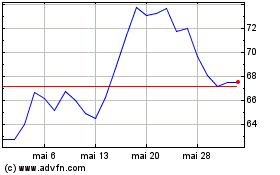

Sea (NYSE:SE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Sea (NYSE:SE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025