Shapeways Holdings, Inc. (NYSE: SHPW) (“Shapeways” or the

“Company”), a leader in the large and fast-growing digital

manufacturing industry, announced today that its Board of Directors

approved a 1-for-8 reverse stock split of its common stock that

will become effective at 4:01 p.m. Eastern Time on June 22, 2023

(the “Effective Time”). The Company’s common stock is expected to

begin trading on a split-adjusted basis on the New York Stock

Exchange (“NYSE”) when the markets open on June 23, 2023, under the

existing trading symbol “SHPW” and new CUSIP number 81947T201.

The reverse stock split was approved by the Company’s

stockholders at its 2023 Annual Meeting of Stockholders, held on

June 15, 2023, with the final ratio determined by the Company’s

Board of Directors. The Company will file an amendment to its

Certificate of Incorporation to implement the reverse stock split

as of the Effective Time. The primary goal of the reverse stock

split is to increase the per share market price of the Company’s

common stock to meet the minimum $1.00 average closing price

requirement for continued listing on the NYSE.

At the Effective Time, every eight issued and outstanding shares

of the Company’s common stock will be converted automatically into

one share of the Company’s common stock without any change in the

par value per share. Once effective, the reverse stock split will

reduce the number of shares of common stock issued and outstanding

from approximately 50.9 million to approximately 6.4 million. The

reverse stock split will not reduce the number of authorized shares

of the Company’s common stock.

No fractional shares will be issued in connection with the

reverse stock split. Instead, each stockholder will be entitled to

receive a cash payment in lieu thereof at a price equal to the

fraction of one share to which the stockholder would otherwise be

entitled multiplied by the closing price per share of the Company’s

common stock on the NYSE on June 22, 2023. The reverse stock split

will affect all stockholders uniformly and will not alter any

stockholder’s percentage interest in the Company’s equity, except

to the extent that the reverse stock split would result in any

stockholders receiving fractional shares. In addition, the terms of

all outstanding options, warrants, and restricted stock units are

being proportionately adjusted, in accordance with the terms of the

applicable agreement.

The Company currently has warrants listed to purchase a total of

18,410,000 shares of common stock, with each whole warrant being

exercisable for one share of common stock at $11.50 per share. Upon

the effectiveness of the reverse stock split, every 8 shares of

common stock that may be purchased pursuant to the warrants

immediately prior to the reverse stock split will represent one

share of common stock that may be purchased pursuant to such

warrants immediately following the reverse stock split.

Correspondingly, the exercise price per share of common stock

attributable to such warrants immediately prior to the reverse

stock split will be proportionately increased, such that the

warrant price immediately following the reverse stock split will be

$92.00, which equals the product of 8 multiplied by $11.50, the

exercise price per share immediately prior to the reverse stock

split. The number of shares of common stock subject to the warrants

will be proportionately decreased by 8 times, to an aggregate of

2,301,250 shares. The terms of Shapeways’ outstanding warrants do

not permit issuance of fractional shares upon exercise of such

warrants. Instead, the number of shares issuable shall be rounded

up or down to the nearest whole number upon exercise of the

warrants. The redemption trigger price of the warrants will also be

correspondingly proportionately increased, such that the redemption

trigger price immediately following the reverse stock split will be

$144, which equals the product of 8 multiplied by $18.00, the

redemption trigger price immediately prior to the reverse stock

split.

Continental Stock Transfer & Trust Company is acting as

transfer and exchange agent for the reverse stock split, and is

also the Company’s warrant agent. Registered stockholders who hold

shares of the Company’s common stock are not required to take any

action to receive post-reverse split shares. Stockholders owning

shares via a broker, bank, trust or other nominee will have their

positions automatically adjusted to reflect the reverse stock

split, subject to such broker's particular processes, and will not

be required to take any action in connection with the reverse stock

split.

Additional information regarding the reverse stock split can be

found in the Company’s definitive proxy statement filed with the

Securities and Exchange Commission on May 1, 2023, as supplemented

on May 15, 2023, which is available free of charge on the SEC’s

website at www.sec.gov and on the Company’s website at

https://www.shapeways.com.

About Shapeways

Shapeways is a leader in the large and fast-growing digital

manufacturing industry combining high quality, flexible on-demand

manufacturing powered by purpose-built proprietary software which

enables customers to rapidly transform digital designs into

physical products, globally. Shapeways makes industrial-grade

additive manufacturing accessible by fully digitizing the

end-to-end manufacturing process, and by providing a broad range of

solutions utilizing 12 additive manufacturing technologies and

approximately 120 materials and finishes, with the ability to

easily scale new innovation. To date, Shapeways has delivered over

24 million parts to 1 million customers in over 180 countries. To

learn more, please visit https://www.shapeways.com.

Special Note Regarding Forward-Looking Statements

Certain statements included in this press release are not

historical facts and are forward-looking statements for purposes of

the safe harbor provisions under the United States Private

Securities Litigation Reform Act of 1995. Forward-looking

statements generally are accompanied by words such as "believe,"

"may," "will," "estimate," "continue," "anticipate," "intend,"

"expect," "should," "would," "plan," "predict," "potential,"

"seem," "seek," "future," "outlook," and similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters. All statements, other than

statements of present or historical fact included in this press

release, regarding the reverse stock split and timing thereof and

Shapeways’ intention with respect to compliance with the price

requirements for maintaining its listing on the NYSE are

forward-looking statements. These statements are based on various

assumptions, whether or not identified in this press release, and

on the current expectations of management and are not predictions

of actual performance. These forward-looking statements are

provided for illustrative purposes only and are not intended to

serve as, and must not be relied on as, a guarantee, an assurance,

a prediction, or a definitive statement of fact or probability.

Actual events and circumstances are difficult or impossible to

predict and will differ from assumptions. Many actual events and

circumstances are beyond the control of the Company. These

forward-looking statements are subject to a number of risks and

uncertainties, including those factors discussed under the heading

"Risk Factors" in Shapeways’ most recent Form 10-K, most recent

Form 10-Q, and other documents Shapeways has filed, or will file,

with the SEC. If any of these risks materialize or the Company’s

assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. There

may be additional risks that the Company does not presently know,

or that the Company currently believes are immaterial, that could

also cause actual results to differ from those contained in

forward-looking statements. In addition, forward-looking statements

reflect the Company’s expectations, plans, or forecasts of future

events and views as of the date of this press release. The Company

anticipates that subsequent events and developments will cause its

assessments to change. However, while the Company may elect to

update these forward-looking statements at some point in the

future, it specifically disclaims any obligation to do so. These

forward-looking statements should not be relied upon as

representing the Company’s assessments of any date subsequent to

the date of this press release. Accordingly, undue reliance should

not be placed upon forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230616791951/en/

Investor Relations investors@shapeways.com

Media Relations press@shapeways.com

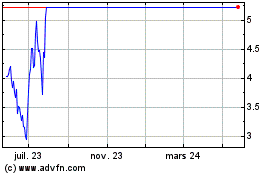

Shapeways (NYSE:SHPW)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

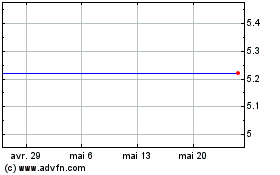

Shapeways (NYSE:SHPW)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025