- Reiterates Full Year 2023 Guidance

-

Stevanato Group S.p.A. (NYSE: STVN), a leading global provider

of drug containment, drug delivery, and diagnostic solutions to the

pharmaceutical, biotechnology, and life sciences industries, today

announced its financial results for the third quarter of 2023.

Third Quarter 2023 Highlights (compared with the same period

last year)

- Third quarter revenue increased 11% to €271.4 million.

- Revenue from high-value solutions increased to 32% of total

revenue.

- Net profit increased 4% to €37.9 million, and diluted earnings

per share were €0.14.

- Adjusted net profit increased 6% to €40.1 million, and adjusted

diluted earnings per share were €0.15.

- Adjusted EBITDA margin increased 70 basis points to 27.5%.

- The Company is reiterating its full year 2023 guidance and

continues to expect revenue in the range of €1.085 billion to

€1.115 billion, adjusted EBITDA in the range of €291.8 million to

€303.8 million, and adjusted diluted EPS between €0.58 and

€0.62.

Third Quarter 2023 Results

Revenue for the third quarter of 2023 increased 11% to €271.4

million (approximately 13% on a constant currency basis), compared

with the same period last year, driven by growth in both of the

Company's business segments. This was lower than expected due to

the timing of revenue on certain engineering projects, and the

Company expects to recognize revenue from these projects in the

fourth quarter of 2023.

For the third quarter of 2023, revenue from high-value solutions

increased to 32% of total revenue, compared with 30% in the same

period last year, driven by demand for high-performance and

ready-to-use products. For the third quarter of 2023, revenue

related to Covid-19 decreased 84% and represented approximately 2%

of revenue, compared with approximately 13% of revenue for the same

period last year. Excluding revenue contributions from Covid-19,

revenue grew approximately 25% in the third quarter of 2023.

For the third quarter of 2023, gross profit margin decreased to

30.5%, resulting from lower marginality on certain engineering

projects, the ongoing start-up activities related to the Company's

new EZ-fill® manufacturing plants, and higher depreciation. This

decrease was partially offset by the increased mix of more

accretive high-value solutions. Operating profit margin for the

third quarter of 2023 decreased 60 basis points to 18.8%, and

adjusted operating profit margin was 20%, which was consistent with

the same period last year.

Adjusted EBITDA margin increased 70 basis points to 27.5% in the

third quarter of 2023, compared with the third quarter of 2022.

For the third quarter of 2023, net profit increased to €37.9

million, or €0.14 of diluted earnings per share, and on an adjusted

basis, net profit increased 6% to €40.1 million, or €0.15 of

diluted earnings per share, compared with the same period last

year.

Franco Moro, Chief Executive Officer, stated, “While Engineering

Segment revenue was below our internal expectations due to the

timing on specific projects, the Biopharmaceutical and Diagnostics

Solutions Segment continues to perform well. In our core drug

containment business, current demand remains robust and our

capacity expansion investments in high-value solutions are designed

to capitalize on the demand in biologics and satisfy customers'

needs. We continue to expect that the increase in biologics,

including GLP1s, monoclonal antibodies, mRNA applications, and

biosimilars will help drive durable organic revenue growth."

Biopharmaceutical and Diagnostic Solutions Segment

(BDS)

For the third quarter of 2023, BDS Segment revenue grew 6% to

€218.9 million (approximately 8% on a constant currency basis),

compared with the same period last year, driven by growth in the

Company's core Drug Containment Solutions (DCS) business. For the

third quarter of 2023, revenue from high-value solutions increased

16% to €86.2 million, while revenue from other containment and

delivery solutions was €132.8 million and consistent with the same

period last year.

As expected, growth in high-value solutions partially offset the

temporary effect of the Company's start-up activities and

associated costs for its new EZ-fill® manufacturing plants and

higher depreciation. This led to gross profit margin of 32.7% and

operating profit margin of 21.2% for the third quarter of 2023.

Engineering Segment

Revenue from the Engineering Segment increased 37% to €52.5

million for the third quarter of 2023, compared with the same

period last year, driven by growth in all business lines. This was

below the Company's expectations due to the timing of revenue on

certain engineering projects.

A combination of increased demand and the gradual recovery in

the supply chain for electronic components, has created a temporary

bottleneck of work, which unfavorably impacted margins on certain

projects in the third quarter of 2023. For the third quarter of

2023, gross profit margin for the Engineering Segment decreased to

18.5%, and operating profit margin was 11.2%, driven by lower

marginality on certain projects.

Balance Sheet and Cash Flow

As of September 30, 2023, the Company had net debt of €227.5

million, and cash and cash equivalents of €64.8 million. As

expected, capital expenditures for the third quarter increased to

€107.2 million, as the Company advances its strategic growth

investments in capacity expansion for high-value solutions to meet

customer demand.

For the third quarter of 2023, cash flow from operating

activities was €33.5 million. Cash flow used for the purchase of

property, plant, and equipment, and intangible assets totaled

€132.3 million, which resulted in negative free cash flow of €97.8

million in the third quarter of 2023.

New Order Intake and Backlog

For the third quarter of 2023, new order intake increased 4% to

approximately €256 million, compared with €247 million in the same

period last year. As of September 30, 2023, committed backlog

totaled approximately €924 million.

2023 Guidance

The Company is reiterating its full year 2023 guidance and still

expects:

- Revenue in the range of €1.085 billion to €1.115 billion,

- Adjusted EBITDA in the range of €291.8 million to €303.8

million, and

- Adjusted diluted EPS in the range of €0.58 to €0.62.

The Company continues to expect capital expenditures in the

range of 35% to 40% of total revenue for fiscal 2023, net of

contributions from third parties including the U.S. government’s

Biomedical Advanced Research and Development Authority (BARDA),

based on the mid-point of its revenue guidance range.

Executive Chairman, Franco Stevanato, concluded, "The

fundamentals of our business remain strong, and we are reiterating

guidance for the full year. For more than 50 years we have been

fully dedicated to serving pharmaceutical customers worldwide. We

are currently benefiting from macro trends such as aging

populations, the rise in biologics and biosimilars, and the shift

towards the self-administration of medicine. We operate in growing

end markets, particularly biologics where we have built a

leadership position. We currently expect that these favorable

tailwinds will fuel sustainable double-digit revenue growth in the

years to come."

Conference Call

The Company will host a conference call and webcast at 8:30 a.m.

(ET) on Tuesday, October 31, 2023 to discuss financial results.

During the call, management will refer to a slide presentation

which will be available on the day of the call on the “Financial

Results” page under the Company's Investor Relations section of its

website.

Pre-registration: Participants who pre-register will be

given a conference passcode and unique PIN to gain immediate access

to the call and bypass the live operator. We encourage participants

to pre-register for the call using the following link:

http://services.choruscall.it/DiamondPassRegistration/register?confirmationNumber=4544003&linkSecurityString=514976446

Webcast: A live, listen-only webcast of the call will be

available at the following link:

https://87399.choruscall.eu/links/stevanato231031.html

Dial in: Those who are unable to pre-register may dial in

by calling: Italy: +39 02 802 09 11 United Kingdom: +44 1 212

818004 United States: +1 718 705 8796 United States Toll Free: +1

855 265 6958

Participants who wish to ask questions during the call are

encouraged to use an HD webphone link:

https://hditalia.choruscall.com/?$Y2FsbHR5cGU9MiZpbmZvPWNvbXBhbnk=

Replay: The webcast will be archived for three months on

the Company’s Investor Relations section of its website at:

https://ir.stevanatogroup.com/financial-results.

Forward-Looking Statements

This press release may include forward-looking statements. The

words "expects," "reiterating,” “strong,” “expected,” "continues,"

"continue," “favorable,” "growth," "durable," “remain”,

“benefiting”, “expect”, “remains”, “demand”, “are designed”,

“drive”, “increased”, “created”, “advances”, “rise”, “shift”,

“growing”, “sustainable”, and similar expressions (or their

negative) identify certain of these forward-looking statements.

These forward-looking statements are statements regarding the

Company's intentions, beliefs or current expectations concerning,

among other things, investments the Company expects to make or

receive, the expansion of manufacturing capacity, the Company’s

plans regarding its presence in the U.S. and in other locations,

business strategies, the Company’s capacity to meet future market

demands and support preparedness for future public health

emergencies, and results of operations. The forward-looking

statements in this press release are based on numerous assumptions

regarding the Company’s present and future business strategies and

the environment in which the Company will operate in the future.

Forward-looking statements involve inherent known and unknown

risks, uncertainties and contingencies because they relate to

events and depend on circumstances that may or may not occur in the

future and may cause the actual results, performance or

achievements of the Company to be materially different from those

expressed or implied by such forward looking statements. Many of

these risks and uncertainties relate to factors that are beyond the

Company's ability to control or estimate precisely, such as future

market conditions, currency fluctuations, the behavior of other

market participants, the actions of regulators and other factors

such as the Company's ability to continue to obtain financing to

meet its liquidity needs, changes in the political, social and

regulatory framework in which the Company operates or in economic

or technological trends or conditions. For a description of the

risks that could cause the Company’s future results to differ from

those expressed in any such forward looking statements, refer to

the risk factors discussed in our most recent annual report on Form

20-F filed and our most recent filings with the U.S. Securities and

Exchange Commission. Readers should therefore not place undue

reliance on these statements, particularly not in connection with

any contract or investment decision. Except as required by law, the

company assumes no obligation to update any such forward-looking

statements.

Non-GAAP Financial Information

This press release contains non-GAAP financial measures. Please

refer to the tables included in this press release for a

reconciliation of non-GAAP financial measures.

Management monitors and evaluates our operating and financial

performance using several non-GAAP financial measures, including

Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA

Margin, Adjusted Operating Profit, Adjusted Operating Profit

Margin, Adjusted Income Taxes, Adjusted Net Profit, Adjusted

Diluted EPS, Capital Employed, Net Cash/Net Debt, Free Cash Flow,

and CAPEX. We believe that these non-GAAP financial measures

provide useful and relevant information regarding our performance

and improve our ability to assess our financial condition. While

similar measures are widely used in the industry in which we

operate, the financial measures we use may not be comparable to

other similarly titled measures used by other companies, nor are

they intended to be substitutes for measures of financial

performance or financial position as prepared in accordance with

IFRS.

About Stevanato Group

Founded in 1949, Stevanato Group is a leading global provider of

drug containment, drug delivery and diagnostic solutions to the

pharmaceutical, biotechnology and life sciences industries. The

Group delivers an integrated, end-to-end portfolio of products,

processes, and services that address customer needs across the

entire drug life cycle at each of the development, clinical and

commercial stages. Stevanato Group’s core capabilities in

scientific research and development, its commitment to technical

innovation, and its engineering excellence are central to its

ability to offer value added solutions to clients. To learn more,

visit: www.stevanatogroup.com.

Consolidated Income

Statement

(Amounts in € millions, except

per share data)

For the three months

For the nine months

ended September 30,

ended September 30,

2023

%

2022

%

2023

%

2022

%

Revenue

271.4

100.0

%

245.3

100.0

%

764.7

100.0

%

691.6

100.0

%

Costs of sales

188.5

69.5

%

167.7

68.4

%

526.6

68.9

%

472.0

68.2

%

Gross Profit

82.9

30.5

%

77.5

31.6

%

238.1

31.1

%

219.6

31.8

%

Other operating Income

2.2

0.8

%

3.4

1.4

%

7.4

1.0

%

12.1

1.7

%

Selling and Marketing Expenses

5.0

1.8

%

5.9

2.4

%

17.8

2.3

%

17.8

2.6

%

Research and Development Expenses

8.7

3.2

%

7.6

3.1

%

25.6

3.3

%

23.8

3.4

%

General and Administrative Expenses

20.2

7.4

%

20.0

8.2

%

65.4

8.5

%

60.8

8.8

%

Operating Profit

51.2

18.8

%

47.5

19.4

%

136.7

17.9

%

129.3

18.7

%

Finance Income

4.8

1.8

%

6.7

2.7

%

15.9

2.1

%

17.2

2.5

%

Finance Expense

5.6

2.1

%

8.3

3.4

%

21.9

2.9

%

22.7

3.3

%

Profit Before Tax

50.4

18.6

%

46.0

18.8

%

130.7

17.1

%

123.8

17.9

%

Income Taxes

12.5

4.6

%

9.8

4.0

%

30.3

4.0

%

29.1

4.2

%

Net Profit

37.9

14.0

%

36.3

14.8

%

100.4

13.1

%

94.7

13.7

%

Earnings per share

Basic earnings per common share

0.14

0.14

0.38

0.36

Diluted earnings per common share

0.14

0.14

0.38

0.36

Average shares outstanding

264.9

264.7

264.8

264.7

Average shares assuming dilution

265.0

264.7

264.8

264.7

Reported Segment

Information

(Amounts in €

millions)

For the three months ended

September 30, 2023

Biopharmaceutical and

Diagnostic Solutions

Engineering

Adjustments, eliminations and

unallocated items

Consolidated

External Customers

218.9

52.5

—

271.4

Inter-Segment

0.6

33.9

(34.5

)

—

Revenue

219.5

86.4

(34.5

)

271.4

Gross Profit

71.8

16.0

(4.9

)

82.9

Gross Profit Margin

32.7

%

18.5

%

30.5

%

Operating Profit

46.6

9.7

(5.1

)

51.2

Operating Profit Margin

21.2

%

11.2

%

18.8

%

For the three months ended

September 30, 2022

Biopharmaceutical and

Diagnostic Solutions

Engineering

Adjustments, eliminations and

unallocated items

Consolidated

External Customers

207.1

38.2

—

245.3

Inter-Segment

0.4

32.5

(32.9

)

—

Revenue

207.5

70.7

(32.9

)

245.3

Gross Profit

67.8

15.2

(5.5

)

77.5

Gross Profit Margin

32.7

%

21.5

%

31.6

%

Operating Profit

47.3

9.9

(9.7

)

47.5

Operating Profit Margin

22.8

%

14.0

%

19.4

%

Reported Segment

Information

(Amounts in €

millions)

For the nine months ended

September 30, 2023

Biopharmaceutical and

Diagnostic Solutions

Engineering

Adjustments, eliminations and

unallocated items

Consolidated

External Customers

619.3

145.4

—

764.7

Inter-Segment

1.4

126.2

(127.6

)

—

Revenue

620.7

271.6

(127.6

)

764.7

Gross Profit

202.7

56.9

(21.5

)

238.1

Gross Profit Margin

32.7

%

20.9

%

31.1

%

Operating Profit

125.9

38.1

(27.4

)

136.7

Operating Profit Margin

20.3

%

14.0

%

17.9

%

For the nine months ended

September 30, 2022

Biopharmaceutical and

Diagnostic Solutions

Engineering

Adjustments, eliminations and

unallocated items

Consolidated

External Customers

568.1

123.4

—

691.6

Inter-Segment

1.0

83.7

(84.7

)

—

Revenue

569.1

207.1

(84.7

)

691.6

Gross Profit

188.2

45.1

(13.7

)

219.6

Gross Profit Margin

33.1

%

21.8

%

31.8

%

Operating Profit

127.6

30.0

(28.3

)

129.3

Operating Profit Margin

22.4

%

14.5

%

18.7

%

Cash Flow

(Amounts in €

millions)

For the three months ended

September 30,

For the nine months ended

September 30,

2023

2022

2023

2022

Cash flow from/ (used in) operating

activities

33.5

(3.8

)

95.0

43.6

Cash flow used in investing activities

(132.2

)

(43.2

)

(356.8

)

(174.1

)

Cash flow from/ (used in) financing

activities

101.7

(9.9

)

98.2

(25.9

)

Net change in cash and cash

equivalents

2.9

(57.0

)

(163.6

)

(156.5

)

Non GAAP Financial Information

This press release contains non-GAAP financial measures. Please

refer to "Non-GAAP Financial Information" and the tables included

in this press release for a reconciliation of non-GAAP financial

measures.

Reconciliation of Revenue to

Constant Currency Revenue

(Amounts in €

millions)

Three months ended September 30,

2023

Biopharmaceutical and

Diagnostic Solutions

Engineering

Reported Revenue (IFRS GAAP)

218.9

52.5

Effect of changes in currency translation

rates

5.1

—

Organic Revenue (Non-IFRS GAAP)

224.1

52.5

Nine months ended September 30,

2023

Biopharmaceutical and

Diagnostic Solutions

Engineering

Reported Revenue (IFRS GAAP)

619.3

145.4

Effect of changes in currency translation

rates

4.4

0.1

Organic Revenue (Non-IFRS GAAP)

623.7

145.5

Reconciliation of

EBITDA

(Amounts in €

millions)

For the three months ended

September 30,

Change

For the nine months ended

September 30,

Change

2023

2022

%

2023

2022

%

Net Profit

37.9

36.3

4.4

%

100.4

94.7

6.1

%

Income Taxes

12.5

9.8

28.2

%

30.3

29.1

4.0

%

Finance Income

(4.8

)

(6.7

)

(28.6

)%

(15.9

)

(17.2

)

(7.5

)%

Finance Expenses

5.6

8.2

(32.5

)%

21.9

22.7

(3.9

)%

Operating Profit

51.2

47.5

7.6

%

136.7

129.3

5.7

%

Depreciation and Amortization

20.5

16.7

22.8

%

58.4

47.8

22.2

%

EBITDA

71.7

64.2

11.7

%

195.1

177.1

10.2

%

Reconciliation of Reported and

Adjusted EBITDA, Operating Profit, Income Taxes,

Net Profit, and Diluted

EPS

(Amounts in € millions, except

per share data)

Three months ended September 30,

2023

EBITDA

Operating Profit

Income Taxes (3)

Net Profit

Diluted EPS

Reported

71.7

51.2

12.5

37.9

0.14

Adjusting items:

Start-up costs new plants (1)

2.8

2.8

0.7

2.1

0.01

Restructuring and related charges (2)

0.2

0.2

0.0

0.1

0.00

Adjusted

74.7

54.2

13.3

40.1

0.15

Adjusted Margin

27.5

%

20.0

%

Three months ended September 30,

2022

EBITDA

Operating Profit

Income Taxes (3)

Net Profit

Diluted EPS

Reported

64.2

47.5

9.8

36.3

0.14

Adjusting items:

Start-up costs new plants (1)

1.6

1.6

0.2

1.4

0.01

Adjusted

65.8

49.1

10.0

37.7

0.14

Adjusted Margin

26.8

%

20.0

%

Nine months ended September 30,

2023

EBITDA

Operating Profit

Income Taxes (3)

Net Profit

Diluted EPS

Reported

195.1

136.7

30.3

100.4

0.38

Adjusting items:

Start-up costs new plants (1)

9.4

9.4

2.5

6.9

0.03

Restructuring and related charges (2)

0.3

0.3

0.1

0.2

0.00

Adjusted

204.8

146.4

32.9

107.5

0.41

Adjusted Margin

26.8

%

19.1

%

Nine months ended September 30,

2022

EBITDA

Operating Profit

Income Taxes (3)

Net Profit

Diluted EPS

Reported

177.1

129.3

29.1

94.7

0.36

Adjusting items:

Start-up costs new plants (1)

4.6

4.6

1.1

3.5

0.01

Adjusted

181.7

133.9

30.2

98.2

0.36

Adjusted Margin

26.3

%

19.4

%

- During the three and the nine months ended September 30, 2023,

the Group recorded €2.8 million and €9.4 million, respectively, of

start-up costs for the new plants in Fishers, Indiana, United

States, and in Latina, Italy. These costs are primarily related to

labor costs incurred prior to the start-up of commercial operation

that are associated with the training and travel of personnel who

are employed in the production of our high value EZ fill products

which require specific knowledge. During the three months and nine

months ended September 30, 2022, the Group recorded €1.6 million

and €4.6 million, respectively, of start-up costs for the new

plants in Fishers, Indiana, United States, in Zhangjiagang, China,

and in Latina, Italy.

- During the three and the nine months ended September 30, 2023,

the Group recorded €0.2 million and €0.3 million, respectively, of

restructuring and related charges among general and administrative

expenses.

- The income tax adjustment is calculated by multiplying the

applicable nominal tax rate to the adjusting items.

Capital Employed

(Amounts in €

millions)

As of September 30, 2023

As of December 31, 2022

- Goodwill and intangible assets

75.8

79.4

- Right of Use assets

16.7

19.3

- Property, plant and equipment

968.0

641.4

- Financial assets - investments FVTPL

0.6

0.8

- Other non-current financial assets

3.1

1.0

- Deferred tax assets

71.6

69.2

Non-current assets

1,135.8

811.1

- Inventories

277.1

213.3

- Contract Assets

158.6

103.4

- Trade receivables

229.5

212.7

- Trade payables

(240.6

)

(239.2

)

- Advances from customers

(53.0

)

(26.6

)

- Contract Liabilities

(9.8

)

(14.8

)

Trade working capital

361.8

248.8

- Tax receivables and Other

receivables

56.1

54.0

- Tax payables and Other liabilities

(155.6

)

(111.1

)

Net working capital

262.3

191.7

- Deferred tax liabilities

(9.4

)

(21.0

)

- Employees benefits

(6.5

)

(8.3

)

- Provisions

(6.0

)

(5.5

)

- Other non-current liabilities

(52.1

)

(18.1

)

Total non-current liabilities and

provisions

(73.9

)

(52.9

)

Capital employed

1,324.2

949.9

Net (debt) /cash

(227.5

)

46.0

Total Equity

(1,096.7

)

(995.9

)

Total equity and net (debt)/

cash

(1,324.2

)

(949.9

)

Free Cash Flow

(Amounts in €

millions)

For the three months ended

September 30,

For the nine months ended

September 30,

2023

2022

2023

2022

Net Cash Flow from/(used in) Operating

Activities

33.5

(3.8

)

95.0

43.6

Interest paid

1.0

0.7

2.4

2.5

Interest received

(0.1

)

(0.1

)

(0.7

)

(0.5

)

Purchase of property, plant and

equipment

(131.3

)

(40.4

)

(351.2

)

(167.1

)

Proceeds from sale of property, plant and

equipment

0.1

—

0.1

0.5

Purchase of intangible assets

(1.0

)

(2.7

)

(3.6

)

(7.8

)

Free Cash Flow

(97.8

)

(46.3

)

(257.9

)

(128.8

)

Net Cash / (Net Debt)

(Amounts in €

millions)

As of September 30,

As of December 31,

2023

2022

Non-current financial liabilities

(196.3

)

(148.4

)

Current financial liabilities

(100.9

)

(70.7

)

Other non-current financial assets - Fair

value of derivatives financial instruments

2.4

2.8

Other current financial assets

2.4

33.6

Cash and cash equivalents

64.8

228.7

Net (Debt)/ Cash

(227.5

)

46.0

CAPEX

(Amounts in €

millions)

For the three months ended

September 30,

Change

For the nine months ended

September 30,

Change

2023

2022

€

2023

2022

€

Addition to Property, plants and

equipment

106.2

68.4

37.8

355.0

194.6

160.4

Addition to Intangible Assets

1.0

2.7

(1.7

)

3.6

7.8

(4.2

)

CAPEX

107.2

71.1

36.1

358.5

202.4

156.1

Reconciliation of 2023

Guidance (Updated)

Reported and Adjusted EBITDA,

Operating Profit, Net Profit, Diluted EPS

(Amounts in € millions, except

per share data)

Revenue

EBITDA

Operating Profit

Net Profit

Diluted EPS *

Reported

1,085.0 - 1,115.0

281.3 - 293.3

201.3 - 213.3

145.8 - 155.7

0.55 - 0.59

Adjusting items:

Start-up costs new plants

10.5

10.5

8.0

0.03

Adjusted

1,085.0 - 1,115.0

291.8 - 303.8

211.8 - 223.8

153.8 - 163.7

0.58 - 0.62

*May not add due to rounding

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231031118308/en/

Media Stevanato Group media@stevanatogroup.com

Investor Relations Lisa Miles

lisa.miles@stevanatogroup.com

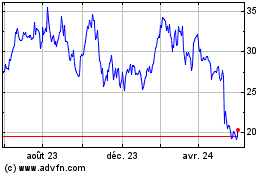

Stevanato (NYSE:STVN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

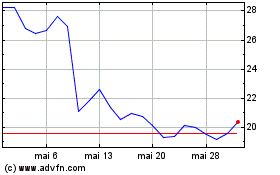

Stevanato (NYSE:STVN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024