4Q21 profitability mainly impacted by one-time

early retirement charges together with losses at IUDÚ reflecting

inflation and higher LLPs. Total AR$ NIM up 140 bps QoQ

Grupo Supervielle S.A. (NYSE: SUPV; BYMA: SUPV),

(“Supervielle” or the “Company”) a universal financial services

group headquartered in Argentina with a nationwide presence, today

reported results for the three- and twelve-month periods ended

December 31, 2021.

Starting 1Q20, the Company began reporting results applying

Hyperinflation Accounting, in accordance with IFRS rule IAS 29

(“IAS 29”) as established by the Central Bank. According to Central

Bank regulation until December 31, 2020, the Other Comprehensive

Income also reflected the result from the changes in the purchasing

power of the currency results on securities classified as available

for sale. Through communication "A" 7211, effective January 1,

2021, the Central Bank established that the monetary result of

items measured at fair value with changes in Other Comprehensive

Income should be recognized in profit or loss under the line item

"Result from exposure to changes in the purchasing power”. As this

change in the accounting policy was applied retrospectively to all

comparative figures, figures for all quarters of 2020 have been

restated applying this new rule. This report also includes

Managerial figures which exclude the IAS29 adjustment for 4Q21,

3Q21, 2Q21, 1Q21 and 4Q20

Management Commentary

Commenting on fourth quarter 2021 results, Patricio

Supervielle, Grupo Supervielle's Chairman & CEO, noted:

“During 2021 we made significant strides across the Company

toward achieving our strategic goals. With the aim of improving ROE

and driving value creation, our strategic initiatives are centered

on six key pillars: enhance the customer experience, attract new

customers, advance on digital transformation, drive efficiency

gains, improve funding and maintain healthy asset quality.”

“Our digital transformation and innovation investments started

to bear fruit during the year expanding the bank´s customer base by

over 53,000 clients to 1.5 million in 2021. Over 80% of these new

clients are digital, with digitized customers increasing 32% during

the year.

“With regard to lending, we increased market share year-on-year.

We also regained our leading market position in leasing. Our new

strategic alliance with Kavak will enable us to further develop our

Mobility Vertical, consolidate our leadership position in

Argentina´s pre-owned car financing market, and create more

customer acquisition and cross-selling opportunities.

“We have also made progress against our strategy to lower cost

of funding. Our initiatives to capture greater share of wallet and

become the principal bank of more customers are gaining traction.

During the quarter we continued to increase our share in sight

deposits, both from retail and corporate customers which together

with liability management, contributed to marginally lower funding

costs.

“Maintaining our focus on asset quality, total NPLs improved

sequentially by 100 basis points to 4.3% in 4Q21, while our

coverage ratio stood at 110%. More importantly, bank NPLs declined

to 2.6% from 3.7% in the prior quarter, converging to lower

pre-pandemic levels, while NPLs at IUDÚ showed a slight decrease

and are expected to continue gradually decline in the coming

quarters.”

“Our network transformation and branch right-sizing, along with

more self-service areas and virtual hubs that enable anywhere

banking and that efficiently expand our reach, have allowed us to

lower operating expenses, excluding one-time early retirement

personnel expenses. In addition, while NIM improved sequentially,

mainly driven by a marginal improvement in the funding mix, our

bottom line was negatively impacted by a challenging regulatory

framework and higher taxes. Also impacting net profit were charges

related to the acceleration of our strategy to capture operating

efficiencies together with losses at IUDÚ resulting from the impact

of inflation and higher loan loss provisions.

“We are also making significant progress transforming our IUDÚ

subsidiary from a business that was previously offering personal

loans and credit cards with an on-site model to a 100% digital

banking platform that is taking retail deposits to lower cost of

funds and offering a growing range of financial services to a

broader lower-risk customer base, leveraging its position as a

regulated financial entity.”

“Looking ahead, the financial services industry in Argentina

continues to face significant macroeconomic and regulatory

challenges, including high fiscal deficit, tax levels and

inflation, along with a weakening currency, that go beyond this

year. In this difficult context, we reaffirm our focus on long-term

value creation, with leading indicators of our transformation

confirming that we are on track to accelerate digital customer

acquisition and continue to capture efficiencies. Moreover, the

bank´s capital remains hedged against inflation through real estate

investments, mortgages, and sovereign bonds.”

“Finally, underscoring our commitment to ESG, we will begin

disclosing, in accordance with the Sustainability Accounting

Standards Board (SASB), additional metrics in our 2021

Sustainability Report. The enhanced disclosure will expand on our

current reporting under the Global Reporting Initiative to more

broadly integrate ESG criteria in the Company´s strategic

planning.”

Attributable Net loss of AR$664.0 million in 4Q21,

compared to a net gain of AR$1.3 billion in 4Q20 and a net loss of

AR$66.3 million in 3Q21.

In 4Q21 and FY21, net income excluding non-recurring severance

charges in both periods, would have been profits of AR$1.9 million

and AR$1.0 billion respectively, with ROAE in real terms at

approximately 0% and 1.9%, respectively.

For FY21 the Company reported an Attributable Net loss of

AR$860.4 million, compared to a net gain of AR$5.1 billion in FY20.

Net Income for the year was impacted by several factors, including:

i) low credit demand from the private sector, which is at historic

lows, ii) increasing Central Bank regulations on volumes and prices

of banking assets and liabilities impacting financial margin, iii)

higher turnover tax, mainly from the City of Buenos Aires but also

from other Provinces, iv) higher expenses incurred in accelerating

our strategy to capture operating efficiencies, and v) an increase

in loan loss provisions at IUDÚ due to the impact of the pandemic

on its customers base and following the Central Bank deferral

programs regulations that rescheduled loan installment maturities

along 12 months.

ROAE was negative 4.9% in 4Q21 compared with positive

9.4% in 4Q20 and negative 0.5% in 3Q21.

ROAE, excluding the consumer finance lending business was

negative 0.4% in 4Q21, a 450-bps gap with the reported ROAE. This

compares to gaps of 450 bps and 380 bps in 3Q21 and 4Q20

respectively.

ROAA was negative 0.7% in 4Q21 compared to positive 1.3%

in 4Q20 and negative 0.1% in 3Q21.

Net Financial Income of AR$13.4 billion in 4Q21 down 8.3%

YoY and up 3.8% QoQ. While the Bank´s Net Financial Income

increased on a stand-alone basis 5.8% QoQ to AR$12.1 billion,

IUDÚ´s Net Financial Income declined 29.4% QoQ to AR$831.2. FY21

Net Financial Income was down 14.5% or AR$ 9.0 billion when

compared to FY20.

Net Interest Margin (NIM) of 17.9% was down 230 bps YoY,

and increased 130 bps QoQ. The AR$ NIM was 18.1%, down 180 bps YoY

and up 147 bps QoQ.

The total NPL ratio was 4.3% in 4Q21 and 5.3% in 3Q21.

The NPL ratio as of 4Q20 was 3.7%. As of December 31, 2021, the

Bank NPL was 2.6%, while IUDÚ NPL was 19.3%.

Loan loss provisions (LLP) totaled AR$1.6 billion in

4Q21, up 6.6% YoY and 2.9% QoQ. Loan loss provisions, net, which

includes reversed provisions, amounted to AR$1.3 billion in 4Q21

compared to AR$1.3 billion in 3Q21, flat QoQ.

The Coverage ratio was 109.9% as of December 31, 2021,

125.1% as of September 30, 2021, and 191.5% as of December 30,

2020. As of December 31, 2021, 78% of the commercial non-performing

loans portfolio was collateralized, compared to 76% as of September

30, 2021 and 80% as of December 31, 2020.

Efficiency ratio was 76.6% in 4Q21, compared to 71.5% in

4Q20 and 74.9% in 3Q21. The QoQ performance was mainly driven by a

2.5% increase in expenses reflecting one-time severance and early

retirement charges, while revenues were flat. Excluding

non-recurring severance payments and early retirement charges, the

4Q21 and 3Q21 efficiency ratios would have been 69.4% and 71.4%

respectively, improving sequentially. The Efficiency ratio was

74.6% in FY21 compared to 64.3% in FY20. This reflects a 16.5%

decrease in revenues, that more than offset the 3.1% decline in

non-interest expenses.

Total Deposits of AR$288.5 billion decreasing 6.4% QoQ

and increasing 7.0% up YoY. AR$ deposits declined 5.0% QoQ and rose

12.1% YoY. Average AR$ deposits decreased 1.5% QoQ. Foreign

currency deposits (measured in US$) decreased 6.5% YoY and 12.8%

QoQ. As of December 31, 2021, FX deposits represented 10.0% of

total deposits.

Loans declined 3.2% YoY and 1.9% QoQ to AR$161.2 billion,

while average volume of loans declined 3.0% YoY and increased 1.7%

QoQ. The AR$ Loan portfolio increased 1.5% YoY and 0.8% QoQ, while

the average AR$ loans increased 2.1% YoY and 5.6% QoQ.

Total Assets increased 4.0% YoY and declined 3.5% QoQ, to

AR$392.2 billion as of December 31, 2021.

Common Equity Tier 1 Ratio as of December 31, 2021, was

12.7% decreasing 140 bps when compared to 3Q21 and 110 bps when

compared to December 31, 2020. 4Q21 Tier 1 Capital Ratio was

impacted by: i) higher deductions from Tier 1 capital on higher IT

investments, ii) accelerated headcount efficiencies in the quarter

impacting net results, iii) write offs that reduced the expected

loss regulatory easing on capital, and iv) a 10% increase in risk

weighted assets which was more than offset by inflation adjustment

of capital.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220302006100/en/

Ana Bartesaghi ana.bartesaghi@supervielle.com.ar

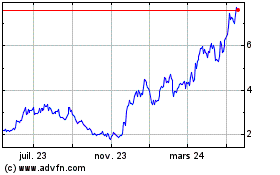

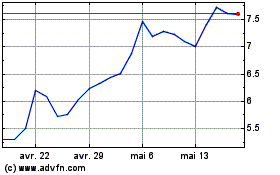

Grupo Supervielle (NYSE:SUPV)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Grupo Supervielle (NYSE:SUPV)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024