Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

23 Mai 2024 - 5:54PM

Edgar (US Regulatory)

Not

FDIC

Insured

May

Lose

Value

No

Bank

Guarantee

Schedule

of

Investments

(unaudited)

Templeton

Emerging

Markets

Income

Fund

2

Notes

to

Schedule

of

Investments

9

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited),

March

31,

2024

Quarterly

Schedule

of

Investments

See

Notes

to

Schedule

of

Investments.

a

a

Industry

Shares

a

Value

a

Common

Stocks

1.2%

South

Africa

1.2%

a,b,c

K2016470219

South

Africa

Ltd.,

A

....

Broadline

Retail

93,760,463

$

—

a,b,c

K2016470219

South

Africa

Ltd.,

B

....

Broadline

Retail

161,018,517

—

b

Platinum

Group

Metals

Ltd.,

(CAD

Traded)

......................

Metals

&

Mining

2,359,882

2,735,439

b

Platinum

Group

Metals

Ltd.,

(USD

Traded)

......................

Metals

&

Mining

469,750

549,607

b,d

Platinum

Group

Metals

Ltd.,

(USD

Traded),

144A

.................

Metals

&

Mining

48,837

56,609

3,341,655

Total

Common

Stocks

(Cost

$5,513,828)

.......................................

3,341,655

Principal

Amount

*

a

a

a

a

a

Corporate

Bonds

3.8%

Bermuda

0.0%

†

Digicel

Group

Holdings

Ltd.

,

Zero

Cpn.,

11/17/33

.............

Wireless

Telecommunication

Services

590,197

31,094

Zero

Cpn.,

11/17/33

.............

Wireless

Telecommunication

Services

257,612

75,093

106,187

Costa

Rica

3.8%

a,c

Reventazon

Finance

Trust

,

Senior

Secured

Bond

,

144A,

8

%

,

11/15/33

.

Financial

Services

10,815,840

10,934,054

South

Africa

0.0%

a,d,e,f

K2016470219

South

Africa

Ltd.

,

Senior

Secured

Note,

144A,

PIK,

3%,

12/31/22

.....................

Broadline

Retail

8,125,247

—

Senior

Secured

Note,

144A,

PIK,

8%,

12/31/22

.....................

Broadline

Retail

2,886,099

EUR

—

a,d,e,f

K2016470260

South

Africa

Ltd.

,

Senior

Secured

Note

,

144A,

PIK,

25

%

,

12/31/22

.....................

Broadline

Retail

61,769,102

—

—

Total

Corporate

Bonds

(Cost

$45,463,727)

......................................

11,040,241

a

a

Industry

Principal

Amount

*

a

Value

Foreign

Government

and

Agency

Securities

83.5%

Argentina

2.6%

Argentina

Government

Bond

,

Senior

Bond,

3.625%,

7/09/35

.....

16,852,222

7,028,838

Senior

Note,

0.75%,

7/09/30

......

967,775

509,340

7,538,178

Benin

2.8%

d

Benin

Government

Bond

,

Senior

Bond,

144A,

4.875%,

1/19/32

5,340,000

EUR

4,867,178

Senior

Bond,

144A,

4.95%,

1/22/35

.

1,410,000

EUR

1,239,551

Senior

Bond,

144A,

6.875%,

1/19/52

2,070,000

EUR

1,838,211

7,944,940

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

See

Notes

to

Schedule

of

Investments.

Quarterly

Schedule

of

Investments

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

(continued)

Brazil

5.3%

Brazil

Notas

do

Tesouro

Nacional

,

10%,

1/01/31

..................

62,380,000

BRL

$

11,988,646

F,

10%,

1/01/29

................

16,530,000

BRL

3,234,723

15,223,369

Colombia

1.1%

Colombia

Titulos

de

Tesoreria

,

B,

7.25%,

10/18/34

.............

4,572,000,000

COP

965,750

B,

6.25%,

7/09/36

..............

1,386,000,000

COP

257,299

B,

9.25%,

5/28/42

..............

8,661,000,000

COP

1,984,094

3,207,143

Dominican

Republic

4.8%

d

Dominican

Republic

Government

Bond,

Senior

Bond,

Reg

S,

6.85%,

1/27/45

14,000,000

13,905,937

Ecuador

9.0%

d

Ecuador

Government

Bond

,

Senior

Bond,

144A,

3.5%,

7/31/35

..

30,733,500

16,256,335

Senior

Note,

144A,

6%,

7/31/30

....

14,039,700

9,555,948

25,812,283

Egypt

1.9%

d

Egypt

Government

Bond

,

Senior

Bond,

144A,

8.75%,

9/30/51

.

5,850,000

4,749,469

Senior

Bond,

144A,

7.5%,

2/16/61

..

1,130,000

814,453

5,563,922

El

Salvador

0.7%

d

El

Salvador

Government

Bond,

Senior

Bond,

144A,

7.65%,

6/15/35

.......

2,650,000

2,022,426

Ethiopia

0.6%

d,f

Ethiopia

Government

Bond,

Senior

Bond,

144A,

6.625%,

12/11/24

.....

2,400,000

1,763,424

Gabon

2.1%

d

Gabon

Government

Bond

,

Senior

Bond,

144A,

6.625%,

2/06/31

3,650,000

3,123,152

Senior

Bond,

144A,

7%,

11/24/31

...

3,480,000

2,977,199

6,100,351

Ghana

1.9%

e

Ghana

Government

Bond

,

PIK,

8.35%,

2/16/27

.............

16,469,012

GHS

816,707

PIK,

8.5%,

2/15/28

..............

16,493,318

GHS

729,435

PIK,

8.65%,

2/13/29

.............

16,031,176

GHS

643,272

PIK,

5%,

2/12/30

...............

16,054,800

GHS

595,340

PIK,

8.95%,

2/11/31

.............

15,050,905

GHS

521,824

PIK,

9.1%,

2/10/32

..............

15,073,052

GHS

497,224

PIK,

9.25%,

2/08/33

.............

15,095,216

GHS

478,650

PIK,

9.4%,

2/07/34

..............

8,256,612

GHS

254,300

PIK,

9.55%,

2/06/35

.............

8,268,735

GHS

249,528

PIK,

9.7%,

2/05/36

..............

8,280,866

GHS

246,603

PIK,

9.85%,

2/03/37

.............

8,293,007

GHS

245,119

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

Quarterly

Schedule

of

Investments

See

Notes

to

Schedule

of

Investments.

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

(continued)

Ghana

(continued)

e

Ghana

Government

Bond,

(continued)

PIK,

10%,

2/02/38

..............

8,305,156

GHS

$

244,779

5,522,781

India

4.9%

India

Government

Bond

,

7.26%,

1/14/29

................

778,000,000

INR

9,417,435

Senior

Bond,

7.18%,

8/14/33

......

399,000,000

INR

4,826,900

14,244,335

Indonesia

3.3%

Indonesia

Government

Bond

,

FR59,

7%,

5/15/27

..............

1,445,000,000

IDR

92,560

FR73,

8.75%,

5/15/31

...........

3,985,000,000

IDR

280,694

FR82,

7%,

9/15/30

..............

4,047,000,000

IDR

260,550

FR87,

6.5%,

2/15/31

............

6,848,000,000

IDR

428,640

FR91,

6.375%,

4/15/32

..........

19,224,000,000

IDR

1,190,967

FR96,

7%,

2/15/33

..............

113,576,000,000

IDR

7,321,515

9,574,926

Ivory

Coast

3.9%

d

Ivory

Coast

Government

Bond

,

Senior

Bond,

144A,

5.25%,

3/22/30

.

2,500,000

EUR

2,517,072

Senior

Bond,

144A,

5.875%,

10/17/31

4,000,000

EUR

3,996,091

Senior

Bond,

144A,

4.875%,

1/30/32

5,000,000

EUR

4,662,843

11,176,006

Kazakhstan

3.9%

Kazakhstan

MEOKAM

,

10.67%,

1/21/26

................

123,900,000

KZT

273,190

15.35%,

11/18/27

...............

21,000,000

KZT

52,186

Kazakhstan

MEUKAM

,

9%,

7/03/27

...................

283,500,000

KZT

596,653

10.4%,

4/12/28

................

738,400,000

KZT

1,600,946

15.3%,

3/03/29

................

1,819,600,000

KZT

4,613,233

10.55%,

7/28/29

................

227,600,000

KZT

485,308

11%,

2/04/30

..................

418,900,000

KZT

909,704

14%,

5/12/31

..................

582,100,000

KZT

1,433,974

Senior

Bond,

5.5%,

9/20/28

.......

301,700,000

KZT

540,326

Senior

Bond,

7.68%,

8/13/29

......

438,100,000

KZT

832,074

11,337,594

Kenya

1.5%

d

Kenya

Government

Bond,

Senior

Note,

144A,

9.75%,

2/16/31

............

4,130,000

4,240,994

Mexico

7.9%

Mexican

Bonos

,

M,

10%,

11/20/36

...............

17,130,000

MXN

1,085,327

M,

Senior

Bond,

7.75%,

11/23/34

...

53,170,000

MXN

2,862,209

Mexican

Bonos

Desarr

Fixed

Rate

,

M,

7.5%,

5/26/33

...............

85,760,000

MXN

4,596,606

M,

Senior

Bond,

8.5%,

5/31/29

.....

8,900,000

MXN

518,404

M,

Senior

Bond,

8.5%,

11/18/38

....

31,390,000

MXN

1,755,964

M,

Senior

Bond,

7.75%,

11/13/42

...

67,590,000

MXN

3,454,645

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

See

Notes

to

Schedule

of

Investments.

Quarterly

Schedule

of

Investments

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

(continued)

Mexico

(continued)

Mexican

Bonos

Desarr

Fixed

Rate,

(continued)

Petroleos

Mexicanos,

Senior

Note,

6.84%,

1/23/30

................

9,790,000

$

8,640,298

22,913,453

Mongolia

2.1%

d

Mongolia

Government

Bond

,

Senior

Bond,

144A,

4.45%,

7/07/31

.

5,570,000

4,731,716

Senior

Note,

144A,

5.125%,

4/07/26

.

200,000

193,593

Senior

Note,

144A,

3.5%,

7/07/27

..

1,380,000

1,245,097

6,170,406

Oman

5.5%

d

Oman

Government

Bond,

Senior

Bond,

144A,

4.75%,

6/15/26

............

15,970,000

15,715,141

Panama

2.3%

Panama

Government

Bond

,

Senior

Bond,

6.4%,

2/14/35

.......

920,000

871,083

Senior

Bond,

6.7%,

1/26/36

.......

4,030,000

3,921,828

Senior

Bond,

6.875%,

1/31/36

.....

1,770,000

1,730,033

6,522,944

Romania

2.6%

d

Romania

Government

Bond

,

144A,

1.75%,

7/13/30

............

950,000

EUR

843,716

144A,

2.75%,

4/14/41

............

1,420,000

EUR

1,050,498

144A,

2.875%,

4/13/42

...........

7,350,000

EUR

5,446,672

7,340,886

Seychelles

0.9%

d

Seychelles

International

Bond,

Senior

Bond,

Reg

S,

8%,

1/01/26

........

2,620,680

2,610,590

Sri

Lanka

0.6%

d,f

Sri

Lanka

Government

Bond

,

Senior

Bond,

144A,

6.2%,

5/11/27

..

2,420,000

1,433,752

Senior

Bond,

144A,

6.75%,

4/18/28

.

200,000

118,482

Senior

Bond,

144A,

7.85%,

3/14/29

.

291,000

172,406

1,724,640

Supranational

3.9%

g

Asian

Development

Bank,

Senior

Note,

11.75%,

7/24/24

................

43,233,000,000

COP

11,201,296

Uganda

2.4%

Uganda

Government

Bond

,

14.25%,

8/23/29

................

229,000,000

UGX

57,640

16%,

11/14/30

.................

2,987,000,000

UGX

794,326

17%,

4/03/31

..................

248,000,000

UGX

68,699

14.375%,

2/03/33

...............

8,797,000,000

UGX

2,147,015

16%,

5/14/37

..................

14,839,000,000

UGX

3,804,887

6,872,567

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

Quarterly

Schedule

of

Investments

See

Notes

to

Schedule

of

Investments.

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

(continued)

Uzbekistan

2.9%

d

Uzbekistan

Government

Bond,

Senior

Note,

144A,

14%,

7/19/24

........

107,400,000,000

UZS

$

8,490,688

Zambia

2.1%

Zambia

Government

Bond,

14%,

11/23/27

.....................

182,000,000

ZMW

6,174,290

Total

Foreign

Government

and

Agency

Securities

(Cost

$251,494,569)

............

240,915,510

Shares

Escrows

and

Litigation

Trusts

0.0%

a,b

K2016470219

South

Africa

Ltd.,

Escrow

Account

......................

1,140,749

—

Total

Escrows

and

Litigation

Trusts

(Cost

$–)

...................................

—

Total

Long

Term

Investments

(Cost

$302,472,124)

...............................

255,297,406

Short

Term

Investments

26.2%

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

8.9%

Egypt

8.9%

h

Egypt

Treasury

Bills

,

3/04/25

......................

647,200,000

EGP

10,897,002

3/18/25

......................

884,475,000

EGP

14,744,534

25,641,536

Total

Foreign

Government

and

Agency

Securities

(Cost

$24,919,994)

..............

25,641,536

U.S.

Government

and

Agency

Securities

15.2%

United

States

15.2%

h

U.S.

Treasury

Bills,

4/02/24

.........

44,000,000

43,993,626

Total

U.S.

Government

and

Agency

Securities

(Cost

$43,993,721)

.................

43,993,626

Shares

Money

Market

Funds

2.1%

United

States

2.1%

i,j

Institutional

Fiduciary

Trust

-

Money

Market

Portfolio,

4.997%

.........

6,028,587

6,028,587

Total

Money

Market

Funds

(Cost

$6,028,587)

...................................

6,028,587

a

a

a

a

a

Total

Short

Term

Investments

(Cost

$74,942,302

)

................................

75,663,749

a

a

a

Total

Investments

(Cost

$377,414,426)

114.7%

..................................

$330,961,155

Credit

Facility

(17.3)%

........................................................

(50,000,000)

Other

Assets,

less

Liabilities

2.6%

.............................................

7,626,822

Net

Assets

100.0%

...........................................................

$288,587,977

a

a

a

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

See

Notes

to

Schedule

of

Investments.

Quarterly

Schedule

of

Investments

At

March

31,

2024,

the

Fund

had

the

following

forward

exchange

contracts

outstanding.

*

The

principal

amount

is

stated

in

U.S.

dollars

unless

otherwise

indicated.

†

Rounds

to

less

than

0.1%

of

net

assets.

a

Fair

valued

using

significant

unobservable

inputs.

See

Note

5

regarding

fair

value

measurements.

b

Non-income

producing.

c

See

Note

3

regarding

restricted

securities.

d

Security

was

purchased

pursuant

to

Rule

144A

or

Regulation

S

under

the

Securities

Act

of

1933.

144A

securities

may

be

sold

in

transactions

exempt

from

registration

only

to

qualified

institutional

buyers

or

in

a

public

offering

registered

under

the

Securities

Act

of

1933.

Regulation

S

securities

cannot

be

sold

in

the

United

States

without

either

an

effective

registration

statement

filed

pursuant

to

the

Securities

Act

of

1933,

or

pursuant

to

an

exemption

from

registration.

At

March

31,

2024,

the

aggregate

value

of

these

securities

was

$120,639,243,

representing

41.8%

of

net

assets.

e

Income

may

be

received

in

additional

securities

and/or

cash.

f

Defaulted

security

or

security

for

which

income

has

been

deemed

uncollectible.

g

A

supranational

organization

is

an

entity

formed

by

two

or

more

central

governments

through

international

treaties.

h

The

security

was

issued

on

a

discount

basis

with

no

stated

coupon

rate.

i

See

Note

4

regarding

investments

in

affiliated

management

investment

companies.

j

The

rate

shown

is

the

annualized

seven-day

effective

yield

at

period

end.

Forward

Exchange

Contracts

Currency

Counter-

party

a

Type

Quantity

Contract

Amount

*

Settlement

Date

Unrealized

Appreciation

Unrealized

Depreciation

a

a

a

a

a

a

a

a

OTC

Forward

Exchange

Contracts

Indian

Rupee

......

HSBK

Buy

1,382,976,200

16,534,174

4/05/24

$

50,851

$

—

Chilean

Peso

......

HSBK

Buy

1,845,200,000

1,904,723

4/12/24

—

(22,063)

Thai

Baht

.........

DBAB

Buy

465,792,000

13,195,241

4/17/24

—

(413,895)

Chilean

Peso

......

HSBK

Buy

1,499,500,000

1,547,280

4/25/24

—

(18,015)

Chilean

Peso

......

JPHQ

Buy

1,695,700,000

1,748,992

4/25/24

—

(19,632)

Chilean

Peso

......

JPHQ

Buy

2,227,600,000

2,270,675

4/26/24

1,065

—

Uruguayan

Peso

....

HSBK

Buy

565,240,000

14,394,051

4/30/24

32,932

—

Brazilian

Real

......

JPHQ

Buy

15,260,000

3,065,334

5/03/24

—

(31,954)

Brazilian

Real

......

MSCO

Buy

44,800,000

8,999,960

5/03/24

—

(94,622)

Indian

Rupee

......

HSBK

Buy

356,808,577

4,281,515

5/08/24

—

(6,873)

Hungarian

Forint

....

BNDP

Buy

6,043,670,000

16,464,311

5/14/24

48,089

—

Columbian

Peso

....

GSCO

Buy

31,120,000,000

7,795,103

6/04/24

167,416

—

Columbian

Peso

....

JPHQ

Buy

20,699,500,000

5,183,622

6/04/24

112,655

—

Columbian

Peso

....

MSCO

Buy

45,760,000,000

11,454,891

6/04/24

253,491

—

Malaysian

Ringgit

...

GSCO

Buy

51,620,000

11,067,753

6/12/24

—

(216,940)

Indian

Rupee

......

CITI

Buy

837,760,460

10,086,208

6/18/24

—

(63,469)

Malaysian

Ringgit

...

GSCO

Buy

43,100,000

9,258,861

6/18/24

—

(

196,142)

South

Korean

Won

..

DBAB

Buy

17,292,000,000

13,201,310

6/20/24

—

(335,906)

Thai

Baht

.........

HSBK

Buy

11,500,000

325,006

9/18/24

—

(6,063)

South

Korean

Won

..

HSBK

Buy

526,000,000

403,805

9/19/24

—

(10,513)

Total

Forward

Exchange

Contracts

...................................................

$666,499

$(1,436,087)

Net

unrealized

appreciation

(depreciation)

............................................

$(769,588)

*

In

U.S.

dollars

unless

otherwise

indicated.

a

May

be

comprised

of

multiple

contracts

with

the

same

counterparty,

currency

and

settlement

date.

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

Quarterly

Schedule

of

Investments

See

Notes

to

Schedule

of

Investments.

At

March

31,

2024,

the

Fund

had

the

following interest

rate swap

contracts

outstanding.

See

Abbreviations

on

page

13.

Interest

Rate

Swap

Contracts

Description

Payment

Frequency

Counter-

party

Maturity

Date

Notional

Amount

*

Value

Upfront

Payments

(Receipts)

Unrealized

Appreciation

(Depreciation)

aa

aa

aa

aa

Centrally

Cleared

Swap

Contracts

Receive

Fixed

7.565%

.

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/25

8,093,521

BRL

$

(219,937)

$

—

$

(219,937)

Receive

Fixed

7.62%

..

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/25

7,983,000

BRL

(212,572)

—

(212,572)

Receive

Fixed

7.625%

.

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/25

9,180,972

BRL

(245,277)

—

(245,277)

Receive

Fixed

8.19%

..

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/04/27

900,000

BRL

(28,169)

—

(28,169)

Receive

Fixed

8.675%

.

Quarterly

Pay

Floating

1-day

IBR

Quarterly

9/25/28

130,500,000,000

COP

1,404,995

—

1,404,995

Receive

Fixed

8.37%

..

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/29

1,443,981

BRL

(60,071)

—

(60,071)

Receive

Fixed

8.405%

.

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/29

2,006,000

BRL

(

82,167)

—

(82,167)

Receive

Fixed

8.45%

..

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/29

1,795,371

BRL

(72,340)

—

(72,340)

Receive

Fixed

8.485%

.

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/29

955,784

BRL

(

38,036)

—

(38,036)

Total

Interest

Rate

Swap

Contracts

....................................

$446,426

$

—

$446,426

*

In

U.S.

dollars

unless

otherwise

indicated.

Templeton

Emerging

Markets

Income

Fund

Quarterly

Schedule

of

Investments

Notes

to

Schedule

of

Investments

(unaudited)

1.

Organization

Templeton

Emerging

Markets

Income

Fund (Fund)

is

registered under

the

Investment

Company

Act

of

1940

(1940

Act)

as

a

closed-end

management

investment

company.

The

Fund

follows

the

accounting

and

reporting

guidance

in

Financial

Accounting

Standards

Board

(FASB)

Accounting

Standards

Codification

Topic

946,

Financial

Services

–

Investment

Companies

(ASC

946)

and

applies

the

specialized

accounting

and

reporting

guidance

in

U.S.

Generally

Accepted

Accounting

Principles

(U.S.

GAAP),

including,

but

not

limited

to,

ASC

946.

2. Financial

Instrument

Valuation

The

Fund's investments

in

financial

instruments

are

carried

at

fair

value

daily.

Fair

value

is

the

price

that

would

be

received

to

sell

an

asset

or

paid

to

transfer

a

liability

in

an

orderly

transaction

between

market

participants

on

the

measurement

date.

The

Fund

calculates the

net

asset

value

(NAV)

per

share

each

business

day

as

of

4

p.m.

Eastern

time

or

the

regularly

scheduled

close

of

the

New

York

Stock

Exchange

(NYSE),

whichever

is

earlier.

Under

compliance

policies

and

procedures

approved

by

the Fund's

Board

of

Trustees

(the

Board),

the

Board

has

designated

the

Fund's

investment

manager

as

the

valuation

designee

and

has

responsibility

for

oversight

of

valuation.

The

investment

manager

is

assisted

by

the

Fund's administrator

in

performing

this responsibility,

including

leading

the

cross-functional

Valuation

Committee

(VC).

The

Fund

may

utilize

independent

pricing

services,

quotations

from

securities

and

financial

instrument

dealers,

and

other

market

sources

to

determine

fair

value.

Equity

securities

and

derivative

financial instruments listed

on

an

exchange

or

on

the

NASDAQ

National

Market

System

are

valued

at

the

last

quoted

sale

price

or

the

official

closing

price of

the

day,

respectively.

Foreign

equity

securities

are

valued

as

of

the

close

of

trading

on

the

foreign

stock

exchange

on

which

the

security

is

primarily

traded,

or

as

of

4

p.m.

Eastern

time.

The

value

is

then

converted

into

its

U.S.

dollar

equivalent

at

the

foreign

exchange

rate

in

effect

at

4

p.m.

Eastern

time

on

the

day

that

the

value

of

the

security

is

determined.

Over-the-counter

(OTC)

securities

are

valued

within

the

range

of

the

most

recent

quoted

bid

and

ask

prices.

Securities

that

trade

in

multiple

markets

or

on

multiple

exchanges

are

valued

according

to

the

broadest

and

most

representative

market.

Certain

equity

securities

are

valued

based

upon

fundamental

characteristics

or

relationships

to

similar

securities.

Debt

securities

generally

trade

in

the

OTC

market

rather

than

on

a

securities

exchange.

The Fund's

pricing

services

use

multiple

valuation

techniques

to

determine

fair

value.

In

instances

where

sufficient

market

activity

exists,

the

pricing

services

may

utilize

a

market-based

approach

through

which

quotes

from

market

makers

are

used

to

determine

fair

value.

In

instances

where

sufficient

market

activity

may

not

exist

or

is

limited,

the

pricing

services

also

utilize

proprietary

valuation

models

which

may

consider

market

characteristics

such

as

benchmark

yield

curves,

credit

spreads,

estimated

default

rates,

anticipated

market

interest

rate

volatility,

coupon

rates,

anticipated

timing

of

principal

repayments,

underlying

collateral,

and

other

unique

security

features

in

order

to

estimate

the

relevant

cash

flows,

which

are

then

discounted

to

calculate

the

fair

value.

Securities

denominated

in

a

foreign

currency

are

converted

into

their

U.S.

dollar

equivalent

at

the

foreign

exchange

rate

in

effect

at

4

p.m.

Eastern

time

on

the

date

that

the

values

of

the

foreign

debt

securities

are

determined.

Investments

in

open-end

mutual

funds

are

valued

at

the

closing

NAV.

Certain

derivative

financial

instruments

are

centrally

cleared

or

trade

in

the

OTC

market.

The Fund’s

pricing

services

use

various

techniques

including

industry

standard

option

pricing

models

and

proprietary

discounted

cash

flow

models

to

determine

the

fair

value

of

those

instruments.

The Fund’s

net

benefit

or

obligation

under

the

derivative

contract,

as

measured

by

the

fair

value

of

the

contract,

is

included

in

net

assets.

The

Fund

has procedures

to

determine

the

fair

value

of

financial

instruments

for

which

market

prices

are

not

reliable

or

readily

available.

Under

these

procedures,

the

Fund

primarily employs

a

market-based

approach

which

may

use

related

or

comparable

assets

or

liabilities,

recent

transactions,

market

multiples,

and

other

relevant

information

for

the

investment

to

determine

the

fair

value

of

the

investment.

An

income-based

valuation

approach

may

also

be

used

in

which

the

anticipated

Templeton

Emerging

Markets

Income

Fund

Notes

to

Schedule

of

Investments

(unaudited)

Quarterly

Schedule

of

Investments

future

cash

flows

of

the

investment

are

discounted

to

calculate

fair

value.

Discounts

may

also

be

applied

due

to

the

nature

or

duration

of

any

restrictions

on

the

disposition

of

the

investments.

Due

to

the

inherent

uncertainty

of

valuations

of

such

investments,

the

fair

values

may

differ

significantly

from

the

values

that

would

have

been

used

had

an

active

market

existed.

Trading

in

securities

on

foreign

securities

stock

exchanges

and

OTC

markets

may

be

completed

before

4

p.m.

Eastern

time.

In

addition,

trading

in

certain

foreign

markets

may

not

take

place

on

every

Fund’s

business

day.

Events

can

occur

between

the

time

at

which

trading

in

a

foreign

security

is

completed

and

4

p.m.

Eastern

time

that

might

call

into

question

the

reliability

of

the

value

of

a

portfolio

security

held

by

the Fund.

As

a

result,

differences

may

arise

between

the

value

of

the Fund’s

portfolio

securities

as

determined

at

the

foreign

market

close

and

the

latest

indications

of

value

at

4

p.m.

Eastern

time.

In

order

to

minimize

the

potential

for

these

differences, an

independent

pricing

service

may

be

used

to

adjust

the

value

of

the Fund's

portfolio

securities

to

the

latest

indications

of

fair

value

at

4

p.m.

Eastern

time.

At March

31,

2024,

certain

securities

may

have

been

fair

valued

using

these

procedures,

in

which

case

the

securities

were

categorized

as

Level

2

within

the

fair

value

hierarchy

(referred

to

as

"market

level

fair

value").

See

the

Fair

Value

Measurements

note

for

more

information.

When

the

last

day

of

the

reporting

period

is

a

non-business

day,

certain

foreign

markets

may

be

open

on

those

days

that

the

Fund’s NAV

is

not

calculated,

which

could

result

in

differences

between

the

value

of

the

Fund’s

portfolio

securities

on

the

last

business

day

and

the

last

calendar

day

of

the

reporting

period.

Any security

valuation

changes

due

to

an

open

foreign

market

are

adjusted

and

reflected

by

the

Fund

for

financial

reporting

purposes.

3.

Restricted

Securities

At

March

31,

2024

,

investments

in

restricted

securities,

excluding

securities

exempt

from

registration

under

the

Securities

Act

of

1933,

were

as

follows:

4.

Investments

in

Affiliated

Management

Investment

Companies

The

Fund

invests

in

one

or

more

affiliated

management

investment

companies.

As

defined

in

the

1940

Act,

an

investment

is

deemed

to

be

a

"Controlled

Affiliate"

of

a

fund

when

a

fund

owns,

either

directly

or

indirectly,

25%

or

more

of

the

affiliated

fund's

outstanding

shares

or

has

the

power

to

exercise

control

over

management

or

policies

of

such

fund.

The

Fund

does

not

invest

for

purposes

of

exercising

a

controlling

influence

over

the

management

or

policies.

During

the

period

ended

March

31,

2024,

the

Fund

held

investments

in

affiliated

management

investment

companies

as

follows:

Principal

Amount

*

/

Shares

Issuer

Acquisition

Date

Cost

Value

Templeton

Emerging

Markets

Income

Fund

93,760,463

a

K2016470219

South

Africa

Ltd.,

A

...............

5/10/11

-

2/01/17

$

538,947

$

—

161,018,517

a

K2016470219

South

Africa

Ltd.,

B

...............

5/10/11

-

2/01/17

119,550

—

10,815,840

Reventazon

Finance

Trust,

Senior

Secured

Bond,

144A,

8%,

11/15/33

..............................

12/18/13

10,815,840

10,934,054

Total

Restricted

Securities

(Value

is

3.8%

of

Net

Assets)

..............

$11,474,337

$10,934,054

*

In

U.S.

dollars

unless

otherwise

indicated.

a

The

Fund

also

invests

in

unrestricted

securities

of

the

issuer,

valued

at

$—

as

of

March

31,

2024.

2. Financial

Instrument

Valuation

(continued)

Templeton

Emerging

Markets

Income

Fund

Notes

to

Schedule

of

Investments

(unaudited)

Quarterly

Schedule

of

Investments

5. Fair

Value

Measurements

The Fund

follows a

fair

value

hierarchy

that

distinguishes

between

market

data

obtained

from

independent

sources

(observable

inputs)

and

the Fund's

own

market

assumptions

(unobservable

inputs).

These

inputs

are

used

in

determining

the

value

of

the

Fund's

financial

instruments

and

are

summarized

in

the

following

fair

value

hierarchy:

• Level

1

–

quoted

prices

in

active

markets

for

identical

financial

instruments

• Level

2

–

other

significant

observable

inputs

(including

quoted

prices

for

similar

financial

instruments,

interest

rates,

prepayment

speed,

credit

risk,

etc.)

• Level

3

–

significant

unobservable

inputs

(including

the

Fund's

own

assumptions

in

determining

the

fair

value

of

financial

instruments)

The

input

levels

are

not

necessarily

an

indication

of

the

risk

or

liquidity

associated

with

financial

instruments

at

that

level.

A

summary

of

inputs

used

as

of

March

31,

2024,

in

valuing

the Fund's

assets

and

liabilities carried

at

fair

value,

is

as

follows:

aa

Value

at

Beginning

of

Period

Purchases

Sales

Realized

Gain

(Loss)

Net

Change

in

Unrealized

Appreciation

(Depreciation)

Value

at

End

of

Period

Number

of

Shares

Held

at

End

of

Period

Investment

Income

a

a

a

a

a

a

a

a

Templeton

Emerging

Markets

Income

Fund

Non-Controlled

Affiliates

Dividends

Institutional

Fiduciary

Trust

-

Money

Market

Portfolio,

4.997%

$6,793,498

$80,428,083

$(81,192,994)

$—

$—

$6,028,587

6,028,587

$173,859

Total

Affiliated

Securities

...

$6,793,498

$80,428,083

$(81,192,994)

$—

$—

$6,028,587

$173,859

Level

1

Level

2

Level

3

Total

Templeton

Emerging

Markets

Income

Fund

Assets:

Investments

in

Securities:

Common

Stocks

:

South

Africa

...........................

$

3,341,655

$

—

$

—

a

$

3,341,655

Corporate

Bonds

:

Bermuda

.............................

—

106,187

—

106,187

Costa

Rica

............................

—

—

10,934,054

10,934,054

South

Africa

...........................

—

—

—

a

—

Foreign

Government

and

Agency

Securities

....

—

240,915,510

—

240,915,510

Escrows

and

Litigation

Trusts

...............

—

—

—

a

—

Short

Term

Investments

...................

6,028,587

69,635,162

—

75,663,749

Total

Investments

in

Securities

...........

$9,370,242

$310,656,859

$10,934,054

$330,961,155

Other

Financial

Instruments:

Forward

exchange

contracts

...............

$—

$666,499

$—

$666,499

Swap

contracts

.........................

—

1,404,995

—

1,404,995

Total

Other

Financial

Instruments

.........

$—

$2,071,494

$—

$2,071,494

Liabilities:

Other

Financial

Instruments:

Forward

exchange

contracts

................

$

—

$

1,436,087

$

—

$

1,436,087

Swap

contracts

..........................

—

958,569

—

958,569

Total

Other

Financial

Instruments

.........

$—

$2,394,656

$—

$2,394,656

4.

Investments

in

Affiliated

Management

Investment

Companies

(continued)

Templeton

Emerging

Markets

Income

Fund

Notes

to

Schedule

of

Investments

(unaudited)

Quarterly

Schedule

of

Investments

A

reconciliation

in

which

Level

3

inputs

are

used

in

determining

fair

value

is

presented

when

there

are

significant

Level

3

assets

and/or

liabilities

at

the

beginning

and/or

end

of

the

period.

At March

31,

2024,

the

reconciliation

is

as

follows:

Significant

unobservable

valuation

inputs

for

material

Level

3

assets

and/or

liabilities

and

impact

to

fair

value

as

a

result

of

changes

in

unobservable

valuation

inputs

as

of

March

31,

2024,

are

as

follows:

a

Includes

financial

instruments

determined

to

have

no

value.

Balance

at

Beginning

of

Period

Purchases

Sales

Transfer

Into

Level

3

Transfer

Out

of

Level

3

Net

Accretion

(

Amortiza

-

tion

)

Net

Realized

Gain

(Loss)

Net

Unr

ealized

Appreciation

(Depreciation)

Balance

at

End

of

Period

Net

Change

in

Unrealized

Appreciation

(Depreciation)

on

Assets

Held

at

Period

End

a

a

a

a

a

a

a

a

a

a

a

Templeton

Emerging

Markets

Income

Fund

Assets:

Investments

in

Securities:

Common

Stocks

:

South

Africa

..

$

—

a

$

—

$

—

$

—

$

—

$

—

$

—

$

—

$

—

a

$

—

Corporate

Bonds

:

Costa

Rica

...

10,802,979

—

—

—

—

—

—

131,075

10,934,054

131,075

South

Africa

..

—

a

—

—

—

—

—

—

—

—

a

—

Escrows

and

Litigation

Trusts

—

a

—

—

—

—

—

—

—

—

a

—

Total

Investments

in

Securities

.......

$10,802,979

$—

$—

$—

$—

$—

$—

$131,075

$10,934,054

$131,075

a

Includes

financial

instruments

determined

to

have

no

value.

Description

Fair

Value

at

End

of

Period

Valuation

Technique

Unobservable

Inputs

Amount

Impact

to

Fair

Value

if

Input

Increases

a

Templeton

Emerging

Markets

Income

Fund

Assets:

Investments

in

Securities:

Corporate

Bonds:

Costa

Rica

.....

$10,934,054

Discounted

cash

flow

Discount

rate

b

7.8%

Decrease

All

Other

...........

—

c

Total

..................

$10,934,054

a

Represents

the

directional

change

in

the

fair

value

of

the

Level

3

financial

instruments

that

would

result

from

a

significant

and

reasonable

increase

in

the

corresponding

input.

A

significant

and

reasonable

decrease

in

the

input

would

have

the

opposite

effect.

Significant

increases

and

decreases

in

these

inputs

in

isolation

could

result

in

significantly

higher

or

lower

fair

value

measurements.

b

The

discount

rate

is

comprised

of

the

risk-free

rate,

the

10-year

Costa

Rican

CDS

spread,

and

an

incremental

issuer

credit

spread

combined

to

arrive

at

an

8%

yield

on

issue

date

for

an

8%

coupon

bond

issued

at

par.

The

incremental

issuer

spread

is

further

adjusted

to

reflect

the

current

market

spread

for

similar

credits

above

the

Costa

Rican

credit

spread.

c

Includes

financial

instruments

determined

to

have

no

value.

5. Fair

Value

Measurements

(continued)

Templeton

Emerging

Markets

Income

Fund

Notes

to

Schedule

of

Investments

(unaudited)

Quarterly

Schedule

of

Investments

Abbreviations

Counterparty

BNDP

BNP

Paribas

SA

CITI

Citibank

NA

DBAB

Deutsche

Bank

AG

GSCO

Goldman

Sachs

Group,

Inc.

HSBK

HSBC

Bank

plc

JPHQ

JPMorgan

Chase

Bank

NA

MSCO

Morgan

Stanley

Currency

BRL

Brazilian

Real

CAD

Canadian

Dollar

COP

Colombian

Peso

EGP

Egyptian

Pound

EUR

Euro

GHS

Ghanaian

Cedi

IDR

Indonesian

Rupiah

INR

Indian

Rupee

KZT

Kazakhstani

Tenge

MXN

Mexican

Peso

UGX

Ugandan

Shilling

USD

United

States

Dollar

UZS

Uzbekistani

Som

ZMW

Zambian

Kwacha

Selected

Portfolio

CDI

certificado

de

deposito

interbancário

PIK

Payment-In-Kind

The

following

reference

rates,

and

their

values

as

of

period

end,

are

used

for

security

descriptions:

Reference

Index

Reference

Rate

1-day

BRL

CDI

......................

10.65%

1-day

IBR

..........................

11.39%

For

additional

information

on

the

Fund's

significant

accounting

policies,

please

refer

to

the Fund's

most

recent

semiannual

or

annual

shareholder

report.

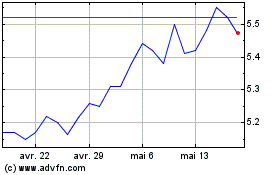

Templeton Emerging Marke... (NYSE:TEI)

Graphique Historique de l'Action

De Déc 2024 à Déc 2024

Templeton Emerging Marke... (NYSE:TEI)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024