0001827871FALSE00018278712023-08-222023-08-220001827871us-gaap:CommonStockMember2023-08-222023-08-220001827871us-gaap:WarrantMember2023-08-222023-08-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 22, 2023

| | |

| Electriq Power Holdings, Inc. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-39948 | | 85-3310839 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

625 N. Flagler Drive, | Suite 1003 | | 33401 |

| West Palm Beach, | Florida | |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (833) 462-2883

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange

on which registered |

| Class A common stock, par value $0.0001 per share | ELIQ | New York Stock Exchange |

| Warrants, each exercisable for one share of Class A common stock at an exercise price of $6.57 per share | ELIQ.WS | NYSE American |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of |

| 1934 (§240.12b-2 of this chapter). | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Items 5.02.Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e)

On August 22, 2023, Electriq Power Holdings, Inc. (the “Company”) entered into employment agreements (the “Employment Agreements”) with each of Frank Magnotti, Chief Executive Officer of the Company; Petrina Thomson, Chief Financial Officer of the Company; James Van Hoof, Chief Operating Officer and General Counsel of the Company; and Jan Klube, Chief Technology Officer of the Company (collectively, the “Executives”). Each Employment Agreement provides for an initial three-year employment term and will automatically be extended for subsequent 12-month terms unless either party provides notice of non-renewal at least 180 days prior to the expiration of the then-current employment term.

Pursuant to the Employment Agreements, Mr. Magnotti, Ms. Thomson, and Messrs. Van Hoof and Klube are entitled to annual base salaries of $465,000, $319,000, $355,000 and $290,000, respectively, and are eligible to participate in the Company’s annual incentive plan and long-term equity incentive plan, with the applicable Executive’s annual cash incentive bonus targeted at a percentage of base salary (80% for Mr. Magnotti and 50% for Ms. Thomson and Messrs. Van Hoof and Klube) which may be increased, but not decreased, by the Compensation Committee of the Board of Directors (the “Board”) of the Company. In addition, under the Employment Agreements, each Executive is eligible to earn a retention bonus ($232,500 for Mr. Magnotti, $159,500 for Ms. Thomson, $177,500 for Mr. Van Hoof and $145,000 for Mr. Klube) in the event that such Executive remains employed by the Company on January 31, 2024 (the “Retention Bonus”), and participate in the employee benefit plans and programs generally available to other peer employees of the Company.

The Employment Agreements also provide for (i) an award of time-based restricted stock and (ii) as contemplated in the Agreement and Plan of Merger, dated November 13, 2022 (as amended by the First Amendment to Merger Agreement dated December 23, 2022, the Second Amendment to Merger Agreement dated March 22, 2023, and the Third Amendment to Merger Agreement dated June 8, 2023), among the Company, Eagle Merger Corp. and Electriq Power, Inc., a one-time Top-Up award (“Top-Up Award”) of time-based restricted stock (collectively, the “Equity Awards”) to ensure that each Executive holds approximately the same ownership in the Company on a fully diluted basis as of the Grant Date as the Executive held prior to the Grant Date. The Equity Awards were granted under the Company’s 2022 Equity Incentive Plan as contemplated by each Executive’s Employment Agreement and will vest in three equal annual installments, subject to the terms of the applicable award agreement with each Executive. The Equity Awards were granted to the Executives in the following amounts:

•Frank Magnotti received an award of 410,347 shares of time-based restricted stock and a Top-Up Award of 1,915,699 shares of time-based restricted stock;

•Petrina Thomson received an award of 159,930 shares of time-based restricted stock and a Top-Up Award of 38,093 shares of time-based restricted stock;

•James Van Hoof received an award of 177,817 shares of time-based restricted stock and a Top-Up Award of 76,366 shares of time-based restricted stock; and

•Jan Klube received an award of 71,548 shares of time-based restricted stock and a Top-Up Award of 163,454 shares of time-based restricted stock.

Pursuant to the Employment Agreements, if the applicable Executive’s employment terminates due to his or her death or “disability” (as defined in the applicable Employment Agreement), then he or she (or his or her estate or beneficiaries, as applicable) will be entitled to (i) the Executive’s accrued salary through and including the date of determination and any bonus earned, but unpaid, for the year prior to the year in which the Separation from Service (as defined in the applicable Employment Agreement) occurs (the “Accrued Salary”), (ii) a pro-rata bonus equal to the annual bonus the Executive would have earned for the fiscal year in which the Separation from Service occurs based on performance as determined by the Board (the “Prior Year Earned Bonus”), (iii) a pro-rata bonus equal to the Retention Bonus the Executive would have earned if such Separation from Service had not occurred and (iv) full vesting of any then-unvested shares of restricted common stock of the Company.

In addition, the Employment Agreements provide that if the applicable Executive’s employment is terminated by the Company without “cause” (and other than due to death or “disability”) or by the applicable Executive for “good reason” (each as defined in the applicable Employment Agreement), in either case prior to a change in control, then, subject to the Executive’s timely execution of an irrevocable general waiver and release of claims, the Executive will be entitled to receive, in addition to the Executive’s Accrued Salary and Prior Year Earned Bonus:

•an amount equal to two (2) times the Executive’s then-current base salary;

•an amount equal to two (2) times the average amount of the annual bonus paid to the Executive for each of the two (2) fiscal years immediately prior to the fiscal year in which the Separation from Service occurs;

•with respect to the Top-Up Award, any then unvested shares will immediately vest in full, but only if terminated by the Company without “cause”; and

•with respect to any outstanding equity awards or other long-term incentive awards, such awards will be treated in accordance with the terms of the applicable plans and award agreements.

If the applicable Executive’s employment is terminated by the Company without “cause” (and other than due to death or “disability”) or by the applicable Executive for “good reason” (each as defined in the applicable Employment Agreement), in either case on or following a change in control of the Company, then, in lieu of the severance payments and benefits described above and subject to the Executive’s timely execution of an irrevocable general waiver and release of claims, the Executive will be entitled to receive, in addition to the Executive’s Accrued Salary and Prior Year Earned Bonus:

•an amount equal to two (2) times the Executive’s then-current base salary;

•an amount equal to two (2) times the average amount of the annual bonus paid to the Executive for each of the two (2) fiscal years immediately prior to the fiscal year in which the Separation from Service occurs;

•with respect to any outstanding equity awards or other long-term incentive awards, such awards will be treated in accordance with the terms of the applicable plans and award agreements; and

•an additional payment equal to the Retention Bonus the Executive would have earned if such Separation from Service had not occurred.

The Employment Agreements also include confidentiality and non-disclosure covenants, non-disparagement restrictions, and non-compete and employee and customer non-solicit restrictions.

The foregoing description of the Employment Agreements is qualified in its entirety by reference to the text of the Employment Agreements, which will be filed with the Company’s periodic report on Form 10-Q for the quarter ended September 30, 2023.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | ELECTRIQ POWER HOLDINGS, INC. |

| | | | |

| | | | |

Date: August 28, 2023 | | By: | | /s/ Frank Magnotti |

| | Name: | | Frank Magnotti |

| | Title: | | Chief Executive Officer |

Cover

|

Aug. 22, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 22, 2023

|

| Entity Registrant Name |

Electriq Power Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39948

|

| Entity Tax Identification Number |

85-3310839

|

| Entity Address, Address Line One |

625 N. Flagler Drive,

|

| Entity Address, Address Line Two |

Suite 1003

|

| Entity Address, City or Town |

West Palm Beach,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33401

|

| City Area Code |

(833)

|

| Local Phone Number |

462-2883

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001827871

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

ELIQ

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of Class A common stock at an exercise price of $6.57 per share

|

| Trading Symbol |

ELIQ.WS

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

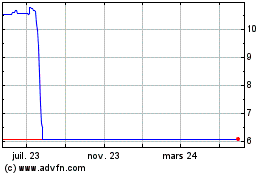

TLG Acquisition One (NYSE:TLGA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

TLG Acquisition One (NYSE:TLGA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024