Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

23 Octobre 2023 - 6:52PM

Edgar (US Regulatory)

|

Tortoise Power and Energy Infrastructure Fund

|

|

|

|

|

|

|

|

SCHEDULE OF INVESTMENTS (Unaudited)

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

August 31, 2023

|

|

| |

|

|

|

|

|

|

| |

|

Principal

Amount/Shares

|

|

|

Fair Value

|

|

|

Corporate Bonds - 60.0% (1)

|

|

|

|

|

|

|

|

Canada Crude Oil Pipelines - 6.4% (1)

|

|

|

|

|

|

|

|

Enbridge, Inc.

|

|

|

|

|

|

|

|

5.500%, 07/15/2077

|

|

$

|

7,042,000

|

|

|

$

|

6,322,216

|

|

|

United States Natural Gas

Gathering/Processing - 20.6% (1)

|

|

|

|

|

|

|

|

|

|

Antero Midstream Partners LP

|

|

|

|

|

|

|

|

|

|

5.750%, 03/01/2027 (2)

|

|

|

3,800,000

|

|

|

|

3,682,944

|

|

|

Blue Racer Midstream LLC

|

|

|

|

|

|

|

|

|

|

6.625%, 07/15/2026 (2)

|

|

|

5,900,000

|

|

|

|

5,798,847

|

|

|

EnLink Midstream LLC

|

|

|

|

|

|

|

|

|

|

5.375%, 06/01/2029

|

|

|

4,000,000

|

|

|

|

3,814,223

|

|

|

Hess Corp.

|

|

|

|

|

|

|

|

|

|

5.625%, 02/15/2026 (2)

|

|

|

4,160,000

|

|

|

|

4,053,504

|

|

|

The Williams Companies, Inc.

|

|

|

|

|

|

|

|

|

|

4.550%, 06/24/2024

|

|

|

3,000,000

|

|

|

|

2,967,831

|

|

| |

|

|

|

|

|

|

20,317,349

|

|

|

United States Natural Gas/Natural Gas Liquids Pipelines - 22.7% (1)

|

|

|

|

|

|

|

|

|

|

Cheniere Corp.

|

|

|

|

|

|

|

|

|

|

5.875%, 03/31/2025

|

|

|

2,000,000

|

|

|

|

1,993,147

|

|

|

Cheniere Energy, Inc.

|

|

|

|

|

|

|

|

|

|

4.625%, 10/15/2028

|

|

|

3,100,000

|

|

|

|

2,915,681

|

|

|

DT Midstream, Inc.

|

|

|

|

|

|

|

|

|

|

4.375%, 06/15/2031 (2)

|

|

|

2,000,000

|

|

|

|

1,731,400

|

|

|

NGPL PipeCo LLC

|

|

|

|

|

|

|

|

|

|

3.250%, 07/15/2031 (2)

|

|

|

3,500,000

|

|

|

|

2,872,420

|

|

|

ONEOK, Inc.

|

|

|

|

|

|

|

|

|

|

6.350%, 01/15/2031

|

|

|

3,000,000

|

|

|

|

3,084,839

|

|

|

Rockies Express Pipeline LLC

|

|

|

|

|

|

|

|

|

|

4.950%, 07/15/2029 (2)

|

|

|

3,000,000

|

|

|

|

2,747,044

|

|

|

Tallgrass Energy LP

|

|

|

|

|

|

|

|

|

|

5.500%, 01/15/2028 (2)

|

|

|

3,250,000

|

|

|

|

3,012,230

|

|

|

Targa Resources Corp.

|

|

|

|

|

|

|

|

|

|

5.200%, 07/01/2027

|

|

|

4,000,000

|

|

|

|

3,959,637

|

|

| |

|

|

|

|

|

|

22,316,398

|

|

|

United States Other - 4.7% (1)

|

|

|

|

|

|

|

|

|

|

New Fortress Energy, Inc.

|

|

|

|

|

|

|

|

|

|

6.500%, 09/30/2026 (2)

|

|

|

5,000,000

|

|

|

|

4,643,303

|

|

|

United States Refined Product Pipelines - 1.6% (1)

|

|

|

|

|

|

|

|

|

|

Buckeye Partners LP

|

|

|

|

|

|

|

|

|

|

5.850%, 11/15/2043

|

|

|

2,000,000

|

|

|

|

1,531,637

|

|

|

United States Renewables and Power Infrastructure - 4.0% (1)

|

|

|

|

|

|

|

|

|

|

NextEra Energy, Inc.

|

|

|

|

|

|

|

|

|

|

4.800%, 12/01/2077

|

|

|

4,500,000

|

|

|

|

3,980,870

|

|

|

Total Corporate Bonds

|

|

|

|

|

|

|

|

|

|

(Cost $62,556,545)

|

|

|

|

|

|

|

59,111,773

|

|

| |

|

|

|

|

|

|

|

|

|

Common Stock - 36.6% (1)

|

|

|

|

|

|

|

|

|

|

Canada Crude Oil Pipelines - 1.9% (1)

|

|

|

|

|

|

|

|

|

|

Enbridge, Inc.

|

|

|

53,741

|

|

|

|

1,885,234

|

|

|

Canada Natural Gas/Natural Gas Liquids

Pipelines - 1.8% (1)

|

|

|

|

|

|

|

|

|

|

TC Energy Corp.

|

|

|

48,667

|

|

|

|

1,757,852

|

|

|

United States Crude Oil Pipelines -

6.3% (1)

|

|

|

|

|

|

|

|

|

|

Plains GP Holdings LP

|

|

|

389,094

|

|

|

|

6,241,068

|

|

|

United States Natural Gas

Gathering/Processing - 4.6% (1)

|

|

|

|

|

|

|

|

|

|

EnLink Midstream LLC

|

|

|

90,965

|

|

|

|

1,131,604

|

|

|

Equitrans Midstream Corp.

|

|

|

108,596

|

|

|

|

1,042,522

|

|

|

Hess Midstream Partners LP

|

|

|

66,901

|

|

|

|

1,933,439

|

|

|

Kinetik Holdings, Inc.

|

|

|

11,954

|

|

|

|

419,705

|

|

| |

|

|

|

|

|

|

4,527,270

|

|

|

United States Natural Gas/Natural Gas

Liquids Pipelines - 18.4% (1)

|

|

|

|

|

|

|

|

|

|

DT Midstream, Inc.

|

|

|

24,885

|

|

|

|

1,301,237

|

|

|

Excelerate Energy, Inc.

|

|

|

11,787

|

|

|

|

219,238

|

|

|

Kinder Morgan, Inc.

|

|

|

190,405

|

|

|

|

3,278,774

|

|

|

NextDecade Corp. (3)

|

|

|

98,612

|

|

|

|

598,575

|

|

|

ONEOK, Inc.

|

|

|

32,054

|

|

|

|

2,089,921

|

|

|

Targa Resources Corp.

|

|

|

69,258

|

|

|

|

5,973,502

|

|

|

The Williams Companies, Inc.

|

|

|

135,347

|

|

|

|

4,673,532

|

|

| |

|

|

|

|

|

|

18,134,779

|

|

|

United States Refining - 0.4% (1)

|

|

|

|

|

|

|

|

|

|

PBF Energy, Inc.

|

|

|

8,275

|

|

|

|

388,015

|

|

|

United States Renewables and Power

Infrastructure - 3.2% (1)

|

|

|

|

|

|

|

|

|

|

Atlantica Sustainable Infrastructure Plc

|

|

|

16,523

|

|

|

|

370,941

|

|

|

NextEra Energy Partners LP

|

|

|

8,013

|

|

|

|

399,689

|

|

|

Sempra Energy

|

|

|

33,854

|

|

|

|

2,377,228

|

|

| |

|

|

|

|

|

|

3,147,858

|

|

|

Total Common Stock

|

|

|

|

|

|

|

|

|

|

(Cost $28,586,241)

|

|

|

|

|

|

|

36,082,076

|

|

| |

|

|

|

|

|

|

|

|

|

Master Limited Partnerships - 28.8% (1)

|

|

|

|

|

|

|

|

|

|

United States Crude Oil Pipelines -

1.5% (1)

|

|

|

|

|

|

|

|

|

|

NuStar Energy LP

|

|

|

90,687

|

|

|

|

1,519,914

|

|

|

United States Natural Gas

Gathering/Processing - 3.7% (1)

|

|

|

|

|

|

|

|

|

|

Western Midstream Partners LP

|

|

|

135,715

|

|

|

|

3,622,233

|

|

|

United States Natural Gas/Natural Gas

Liquids Pipelines - 11.0% (1)

|

|

|

|

|

|

|

|

|

|

Energy Transfer LP

|

|

|

407,632

|

|

|

|

5,490,803

|

|

|

Enterprise Products Partners LP

|

|

|

202,757

|

|

|

|

5,395,364

|

|

| |

|

|

|

|

|

|

10,886,167

|

|

|

United States Refined Product

Pipelines - 12.6% (1)

|

|

|

|

|

|

|

|

|

|

Holly Energy Partners LP

|

|

|

30,993

|

|

|

|

660,151

|

|

|

Magellan Midstream Partners LP

|

|

|

73,459

|

|

|

|

4,879,147

|

|

|

MPLX LP

|

|

|

195,684

|

|

|

|

6,827,415

|

|

| |

|

|

|

|

|

|

12,366,713

|

|

|

Total Master Limited Partnerships

|

|

|

|

|

|

|

|

|

|

(Cost $16,938,658)

|

|

|

|

|

|

|

28,395,027

|

|

| |

|

|

|

|

|

|

|

|

|

Money Market Fund - 0.2% (1)

|

|

|

|

|

|

|

|

|

|

United States Investment Company - 0.2% (1)

|

|

|

|

|

|

|

|

|

|

Invesco Government & Agency Portfolio - Institutional Class, 5.251% (4)

|

|

|

|

|

|

|

|

|

|

(Cost $245,693)

|

|

|

245,693

|

|

|

|

245,693

|

|

| |

|

|

|

|

|

|

|

|

|

Total Investments - 125.6% (1)

|

|

|

|

|

|

|

|

|

|

(Cost $108,327,137)

|

|

|

|

|

|

|

123,834,569

|

|

|

Other Assets in Excess of Liabilities - 0.1% (1)

|

|

|

|

|

|

|

134,955

|

|

|

Credit Facility Borrowings - (25.7)% (1)

|

|

|

|

|

|

|

(25,400,000

|

)

|

|

Total Net Assets Applicable to Common Stockholders - 100.0% (1)

|

|

|

|

|

|

$

|

98,569,524

|

|

|

(1)

|

Calculated as a percentage of net assets.

|

|

|

|

|

(2)

|

Security purchased within the terms of a private placement memorandum, except from registration under Rule 144A of the Securities Act

0f 1933, as amended, and may be sold only to dealers in that

program or other "qualified institutional buyers." As of August 31, 2023, the value of this investment was $28,541,692 or 29.0% of

total net assets.

|

|

(3)

|

Non-income producing security.

|

|

|

|

|

(4)

|

Rate indicated is the current yield as of August 31, 2023.

|

|

|

|

|

Summary of Fair Value Exposure

|

|

|

|

|

|

| |

|

The Fund has adopted fair value accounting standards, which establish an authoritative definition of fair value and set out a

hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and

related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

|

| |

|

Level 1 - Unadjusted quoted prices in active markets for identical assets or liablities that the Fund has the ability to access.

|

| |

|

Level 2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either

directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar

data.

|

| |

|

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing

the Fund's own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

|

| |

|

|

|

|

|

|

|

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at

fair value on a recurring basis. The Fund’s investments are carried at fair value.

|

| |

|

|

|

|

|

|

|

Municipal Bonds —Municipal bonds, including listed issues, are valued at fair value on the basis of valuations furnished by an

independent pricing service which utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price

quotations (where observable), bond spreads, and fundamental data relating to the issuer. Most municipal bonds are categorized in Level 2 of the fair value hierarchy.

|

| |

|

|

|

|

|

|

|

Securities for which market quotations are not readily available, or if the closing price does not represent fair value, are valued

following procedures established by the Advisor and the appointed Valuation Designee. The Valuation Designee is subject to board oversight and certain reporting and other requirements designed to facilitate the board’s ability to

effectively oversee the Valuation Designee’s Fair Value determinations. The Advisor will regularly evaluate whether the Fund’s fair value pricing procedures continue to be appropriate in light of the specific circumstances of the Fund and

the quality of prices obtained through the application of such procedures by the Fund’s Valuation Designee.

|

| |

|

|

|

|

|

|

|

When fair value pricing is employed, security prices that the Fund uses to calculate its NAV may differ from quoted or published

prices for the same securities. Due to the subjective and variable nature of fair value pricing, it is possible that the fair value determined for a particular security may be materially different (higher or lower) than the price of the

security quoted or published by others, the value when trading resumes, and/or the value realized upon the security’s sale. Therefore, if a shareholder purchases or redeems Fund shares when the Fund holds securities priced at a fair value,

the number of shares purchased or redeemed may be higher or lower than it would be if the Fund were using market value pricing.

|

| |

|

|

|

|

|

|

|

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those

securities.

|

| |

|

|

|

|

|

|

|

The following table is a summary of the inputs used to value the Fund’s securities by level within the fair value hierarchy as of

August 31, 2023:

|

| |

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Corporate Bonds(a)

|

|

$

|

-

|

|

|

$

|

59,111,773

|

|

|

$

|

-

|

|

|

$

|

59,111,773

|

|

|

Common Stock(a)

|

|

|

36,082,076

|

|

|

|

-

|

|

|

|

-

|

|

|

|

36,082,076

|

|

|

Master Limited Partnerships(a)

|

|

|

28,395,027

|

|

|

|

-

|

|

|

|

-

|

|

|

|

28,395,027

|

|

|

Money Market Fund(b)

|

|

|

245,693

|

|

|

|

-

|

|

|

|

-

|

|

|

|

245,693

|

|

|

Total Investments

|

|

$

|

64,722,796

|

|

|

$

|

59,111,773

|

|

|

$

|

-

|

|

|

$

|

123,834,569

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) All other industry classifications are identified in the Schedule of Investments.

|

|

|

|

|

|

|

|

|

|

|

(b) Short-term investment is a sweep investment for cash balances.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

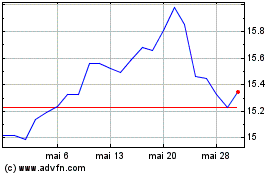

Tortoise Power and Energ... (NYSE:TPZ)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Tortoise Power and Energ... (NYSE:TPZ)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024