—Second Quarter Sales Growth Led by Premium

Products—

—Gross Margin Expansion Driven by Higher

Utilization and Production Efficiencies—

—Guiding to Third Quarter Revenues of $220

million to $230 million—

—Full Year Sales Guidance Adjusted to

Reflect Softness in Entry-Level Consumer Demand and Uncertain

Economic Outlook; Maintains Full Year EBITDA Margin Guidance of 30%

to 30.5%—

Trex Company, Inc. (NYSE:TREX), the world’s largest manufacturer

of high-performance, low-maintenance composite decking and railing,

and a leading brand of outdoor living products, today announced

financial results for the second quarter of 2024.

Second Quarter

Financial 2024 Highlights

- Net sales of $376 million

- Gross margin of 44.7%

- Net income of $87 million and diluted earnings per share of

$0.80

- EBITDA of $130 million and EBITDA margin of 34.6%

CEO

Comments

“Second quarter sales increased at a mid-single-digit rate led

by our premium products, including Trex Transcend® Lineage and Trex

Signature® decking, where sell-through continued to track at a

double-digit rate and contractor lead-times averaged six to eight

weeks,” said Bryan Fairbanks, President and CEO. "Sales of our

lower-priced product lines, however, were below our expectations,

consistent with recent data indicating lower than anticipated

purchasing by consumers in this segment. We expect additional

softness in this market in the second half of this year.

Conversely, our premium product sales continue to outperform

entry-level products, and pro channel inventories are aligning with

projected demand.

“Trex continued to post industry-leading margins in the second

quarter, benefiting from higher utilization, cost-out programs, and

other efficiency initiatives that drove an 80-basis point expansion

in gross margin. Additionally, we succeeded in expanding EBITDA

margin by 180 basis points and leveraging our SG&A spend, while

increasing our investments in branding and product development. We

expect to continue to benefit from our cost-out programs in the

second half of this year, enabling us to maintain our EBITDA margin

guidance for the full year, despite reduced sales expectations.

“In the second quarter we continued to move forward with new

product launches. Introducing new products that expand the appeal

and price range of our decking and railing product lines, while

gaining share in attractive adjacent categories remains a strategic

priority for Trex. In developing new products, we are committed to

providing customers with superior options that are differentiated

by customized engineering and long-lasting quality. We recently

announced new additions to our railing portfolio, and we are

preparing to expand the color options for our Trex Enhance® decking

lines. Also, we are pleased with the pace of orders for our

recently introduced Trex® branded deck fasteners, which are

engineered for ease of installation and designed to provide a

cohesive esthetic to the consumer,” Mr. Fairbanks noted.

Second Quarter 2024

Results

Second quarter 2024 net sales were $376 million, an increase of

6% compared to $357 million reported in the prior-year quarter and

driven by volume predominantly in the premium product category.

Based on the Company’s definition of sell-through, which only

considers point of sale transactions at both home centers and

within the pro channel, total sell-through increased at a

low-single-digit rate in the second quarter.

Gross profit was $168 million and gross margin was 44.7%, up 8%

and 80 basis points, respectively, compared to the $156 million and

43.9% reported in the same quarter last year. The increase was

primarily the result of higher absorption due to increased

production levels and the Company’s ongoing continuous improvement

activities.

Selling, general and administrative expenses were $51 million,

or 13.6% of net sales, compared to $52 million, or 14.5% of net

sales, in the 2023 second quarter. The reduction is primarily

related to lower personnel-related expenses, partially offset by

increases in branding and other expenses.

Net income for the 2024 second quarter was $87 million, or $0.80

per diluted share, an increase of 13% from the $77 million, or

$0.71 per diluted share, reported in the 2023 second quarter.

EBITDA increased 11% to $130 million from $117 million, and EBITDA

margin expanded 180 basis points to 34.6% from 32.8% in the prior

year period.

Year-to-Date

Results

Year-to-date net sales increased 26% to $750 million from $595

million in the year-ago period. Gross profit was $338 million and

gross margin was 45.0%, up 35% and 290 basis points, respectively,

from the $251 million and 42.1% during the same period in 2023.

Selling, general and administrative expenses were $102 million,

or 13.6% of net sales, compared to $89 million, or 15.0% of net

sales, in the year-ago period.

Net income year-to-date was $176 million, or $1.62 per share,

representing 49% growth from the $118 million, or $1.09 per share,

reported in the 2023 first half. EBITDA was $264 million, up 42%

from the $186 million of the prior year. EBITDA margin expanded by

390 basis points to 35.1% from 31.2% in 2023.

Recent Developments

& Recognitions

- Trex expanded its popular Trex Signature® Railing line with the

introduction of X-Series™ Cable Rail and X-Series™ Frameless Glass

Rail. Now available through Trex channel partners, these two new

offerings blend modern profiles with simplified installation to

deliver a winning combination for contractors and clients.

- Green Builder Media named Trex as their Sustainable Brand

Leader in the decking category for the 14th year in a row. Trex is

the only brand in the building industry to win top honors in its

category every year since the program’s inception in 2010.

- Trex published its 2023 Sustainability Report, “Seeing More

Value in Sustainability.” The report charts progress across the

broad spectrum of Company activities and expands on several key

points, including the Company’s commitment to circularity, its

safety record, training and educational opportunities,

manufacturing efficiency, and community engagement.

Summary and

Outlook

“Our second quarter and first half results demonstrate the

underlying earning capabilities of Trex Company, our ability to

drive financial improvements within existing production capacity

and leverage our SG&A expenses. The broad appeal of our decking

and railing product lines, our innovative and new product

introductions, and our leadership position in the attractive

outdoor living category underpin our long-term growth

opportunities,” continued Mr. Fairbanks.

“Looking ahead to the second half of 2024, we see encouraging

data related to our mid-market and premium product sales and expect

that channel inventory levels at the end of the year will be

slightly lower than 2023 year-end levels. Given the uncertain

economic outlook and the softness in the entry-level segment, we

are taking a measured approach to adjusting our sales guidance for

the full year. We now expect 2024 revenue to range from $1.13

billion to $1.15 billion and expect third quarter revenue to range

from $220 million to $230 million. We are pleased to be able to

maintain our full year EBITDA margin guidance range at 30.0% to

30.5%. SG&A as a percentage of net sales, is projected to be

flat with the prior year at approximately 16%, depreciation and

amortization is estimated between $53 million and $55 million, and

our tax rate is expected to be in the 25% to 26% range.

“As the market leader, Trex is the primary beneficiary of

long-term secular trends, including the large number of decks in

the U.S. that are at or beyond replacement age, the record growth

in U.S. homes that are candidates for remodel projects, and the

ongoing conversion from wood to composites. Further, we continue to

make considerable progress on our railing strategy and are moving

forward to penetrate adjacent product lines. The modular build-out

of our Arkansas capacity will strengthen our ability to efficiently

manage the long-term incremental demand that we foresee in the

coming years,” Mr. Fairbanks concluded.

Second Quarter 2024

Conference Call and Webcast Information

Trex will hold a conference call to discuss its second quarter

2024 results on Tuesday, August 6, 2024, at 5:00 p.m. ET. To

participate on the day of the call, dial 1-844-792-3734, or

internationally 1-412-317-5126, approximately ten minutes before

the call, and tell the operator you wish to join the Trex Company

Conference Call.

A live webcast of the conference call will be available in the

Investor Relations section of the Trex Company website at 2Q24

Earnings Webcast. For those who cannot listen to the live

broadcast, an audio replay of the conference call will be available

within 24 hours of the call on the Trex website. The audio replay

will be available for 30 days.

Use of Non-GAAP

Measures

The Company reports its financial results in accordance with

accounting principles generally accepted in the United States

(GAAP). To supplement our consolidated financial statements

reported on a GAAP basis, we provide the following non-GAAP

financial measures of earnings before interest, income taxes,

depreciation and amortization (EBITDA) and EBITDA as a percentage

of net sales, EBITDA margin. Management believes these non-GAAP

financial measures provide investors with additional meaningful

financial information that should be considered when assessing our

underlying business performance and trends. Further, management

believes these non-GAAP financial measures also enhance investors’

ability to compare period-to-period financial results. Non-GAAP

financial measures should be viewed in addition to, and not as an

alternative for, the Company’s reported results prepared in

accordance with GAAP and are not meant to be considered superior to

or a substitute for our GAAP results. Our non-GAAP financial

measures do not represent a comprehensive basis of accounting.

Therefore, our non-GAAP financial measures may not be comparable to

similarly titled measures reported by other companies.

Reconciliations of these non-GAAP financial measures to GAAP

information are included below. Management uses these non-GAAP

financial measures in making financial, operating, compensation and

planning decisions and in evaluating the Company’s performance.

Disclosing these non-GAAP financial measures allows investors and

management to view our operating results excluding the impact of

items that are not reflective of the underlying operating

performance.

Reconciliation of net income (GAAP) to EBITDA (non-GAAP) is as

follows:

Three Months Ended Six Months Ended June 30,

June 30,

2024

2023

2024

2023

($ in thousands)

Net Income

$

86,998

$

77,036

$

176,068

$

118,167

Interest expense (income), net

-

1,305

(6

)

3,289

Income tax expense

29,906

26,426

59,853

40,258

Depreciation and amortization

13,451

12,283

27,606

24,198

EBITDA

$

130,355

$

117,050

$

263,521

$

185,912

Net income as a percentage of net sales

23.1

%

21.6

%

23.5

%

19.9

%

EBITDA as a percentage of net sales (EBITDA margin)

34.6

%

32.8

%

35.1

%

31.2

%

About Trex

Company

For more than 30 years, Trex Company [NYSE: TREX] has invented,

reinvented and defined the composite decking category. Today, the

Company is the world’s #1 brand of sustainably made,

wood-alternative decking and deck railing, and a leader in high

performance, low-maintenance outdoor living products. The

undisputed global leader, Trex boasts the industry’s strongest

distribution network with products sold through more than 6,700

retail outlets across six continents. Through strategic licensing

agreements, the Company offers a comprehensive outdoor living

portfolio that includes deck drainage, flashing tapes, LED

lighting, outdoor kitchen components, pergolas, spiral stairs,

fencing, lattice, cornhole and outdoor furniture – all marketed

under the Trex® brand. Based in Winchester, Va., Trex is proud to

have been named America’s Most Trusted® Outdoor Decking* four years

in a row (2021-2024). The Company was also recently included on

Barron’s list of the 100 Most Sustainable U.S. Companies 2024,

named one of America’s Most Responsible Companies 2024 by Newsweek

and ranked as one of the 100 Best ESG Companies for 2023 by

Investor’s Business Daily. For more information, visit Trex.com.

You may also follow Trex on Facebook (trexcompany), Instagram

(trexcompany), X (Trex_Company), LinkedIn (trex-company), TikTok

(trexcompany), Pinterest (trexcompany) and Houzz

(trex-company-inc), or view product and demonstration videos on the

brand’s YouTube channel (TheTrexCo).

*Trex received the highest numerical score in the proprietary

Lifestory Research 2021-2024 America’s Most Trusted® Outdoor

Decking studies. Study results are based on experiences and

perceptions of people surveyed. Your experiences may vary. Visit

www.lifestoryresearch.com.

Forward-Looking

Statements

The statements in this press release regarding the Company’s

expected future performance and condition constitute

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. These statements are subject to risks and

uncertainties that could cause the Company’s actual operating

results to differ materially. Such risks and uncertainties include,

but are not limited to: the extent of market acceptance of the

Company’s current and newly developed products; the costs

associated with the development and launch of new products and the

market acceptance of such new products; the sensitivity of the

Company’s business to general economic conditions; the impact of

seasonal and weather-related demand fluctuations on inventory

levels in the distribution channel and sales of the Company’s

products; the availability and cost of third-party transportation

services for the Company’s products and raw materials; the

Company’s ability to obtain raw materials, including scrap

polyethylene, wood fiber, and other materials used in making our

products, at acceptable prices; increasing inflation in the

macro-economic environment; the Company’s ability to maintain

product quality and product performance at an acceptable cost; the

Company’s ability to increase throughput and capacity to adequately

match supply with demand; the level of expenses associated with

warranty claims, product replacement and consumer relations

expenses related to product quality; the highly competitive markets

in which the Company operates; cyber-attacks, security breaches or

other security vulnerabilities; the impact of current and upcoming

data privacy laws and the EU General Data Protection Regulation and

the related actual or potential costs and consequences; material

adverse impacts from global public health pandemics and

geopolitical conflicts; and material adverse impacts related to

labor shortages or increases in labor costs. Documents filed with

the U.S. Securities and Exchange Commission by the Company,

including in particular its latest annual report on Form 10-K and

quarterly reports on Form 10-Q, discuss some of the important

factors that could cause the Company’s actual results to differ

materially from those expressed or implied in these forward-looking

statements. The Company expressly disclaims any obligation to

update or revise publicly any forward-looking statements, whether

as a result of new information, future events or otherwise.

TREX COMPANY, INC.

Condensed Consolidated

Statements of Comprehensive Income

(In thousands, except share and

per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(Unaudited) (Unaudited) Net sales

$

376,470

$

356,538

$

750,105

$

595,256

Cost of sales

208,360

200,090

412,384

344,380

Gross profit

168,110

156,448

337,721

250,876

Selling, general and administrative expenses

51,206

51,681

101,806

89,162

Income from operations

116,904

104,767

235,915

161,714

Interest expense (income), net

-

1,305

(6

)

3,289

Income before income taxes

116,904

103,462

235,921

158,425

Provision for income taxes

29,906

26,426

59,853

40,258

Net income

$

86,998

$

77,036

$

176,068

$

118,167

Basic earnings per common share

$

0.80

$

0.71

$

1.62

$

1.09

Basic weighted average common shares outstanding

108,693,887

108,770,204

108,667,028

108,771,077

Diluted earnings per common share

$

0.80

$

0.71

$

1.62

$

1.09

Diluted weighted average common shares outstanding

108,810,296

108,871,440

108,803,081

108,893,848

Comprehensive income

$

86,998

$

77,036

$

176,068

$

118,167

TREX COMPANY, INC.

Condensed Consolidated Balance Sheets (In thousands, except

share data) (unaudited)

June 30,

2024

December 31,

2023

ASSETS Current assets: Cash and cash equivalents

$

1,172

$

1,959

Accounts receivable, net

270,037

41,136

Inventories

148,858

107,089

Prepaid expenses and other assets

13,747

22,070

Total current assets

433,814

172,254

Property, plant and equipment, net

774,009

709,402

Operating lease assets

38,006

26,233

Goodwill and other intangible assets, net

17,953

18,163

Other assets

6,152

6,833

Total assets

$

1,269,934

$

932,885

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities: Accounts payable

$

59,267

$

23,963

Accrued expenses and other liabilities

116,953

56,734

Accrued warranty

5,181

4,865

Line of credit

63,000

5,500

Total current liabilities

244,401

91,062

Deferred income taxes

67,226

72,439

Operating lease liabilities

28,322

18,840

Non-current accrued warranty

18,526

17,313

Other long-term liabilities

16,559

16,560

Total liabilities

375,034

216,214

Preferred stock, $0.01 par value, 3,000,000 shares

authorized; none issued and outstanding

—

—

Common stock, $0.01 par value, 360,000,000 shares authorized;

141,069,074 and 140,974,843 shares issued and 108,705,768 and

108,611,537 shares outstanding at June 30, 2024 and December 31,

2023, respectively

1,411

1,410

Additional paid-in capital

142,317

140,157

Retained earnings

1,512,126

1,336,058

Treasury stock, at cost, 32,363,306 and 32,363,306 shares at June

30, 2024 and December 31, 2023, respectively

(760,954

)

(760,954

)

Total stockholders’ equity

894,900

716,671

Total liabilities and stockholders’ equity

$

1,269,934

$

932,885

TREX COMPANY, INC.

Condensed Consolidated Statements of Cash Flows (In

thousands)

Six Months Ended June

30,

2024

2023

(unaudited)

Operating Activities Net income

$

176,068

$

118,167

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

27,606

24,198

Deferred Income Taxes

(5,212

)

-

Stock-based compensation

6,992

4,562

Loss on disposal of property, plant and equipment

2,262

1,081

Other non-cash adjustments

243

(388

)

Changes in operating assets and liabilities: Accounts receivable

(228,901

)

(168,751

)

Inventories

(41,769

)

67,348

Prepaid expenses and other assets

(850

)

2,046

Accounts payable

35,768

13,816

Accrued expenses and other liabilities

28,688

20,686

Income taxes receivable/payable

18,746

25,016

Net cash provided by operating activities

19,641

107,781

Investing Activities Expenditures for property, plant

and equipment

(73,202

)

(82,357

)

Proceeds from sales of property, plant and equipment

106

-

Net cash used in investing activities

(73,096

)

(82,357

)

Financing Activities Borrowings under line of credit

438,300

330,000

Principal payments under line of credit

(380,800

)

(346,000

)

Repurchases of common stock

(5,570

)

(18,192

)

Proceeds from employee stock purchase and option plans

738

639

Financing costs

-

30

Net cash provided by (used in) financing activities

52,668

(33,523

)

Net decrease in cash and cash equivalents

(787

)

(8,099

)

Cash and cash equivalents at beginning of period

1,959

12,325

Cash and cash equivalents at end of period

$

1,172

$

4,226

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806493008/en/

Brenda K. Lovcik Senior Vice President and CFO 540-542-6300 Lynn

Morgen Casey Kotary ADVISIRY Partners 212-750-5800

lynn.morgen@advisiry.com casey.kotary@advisiry.com

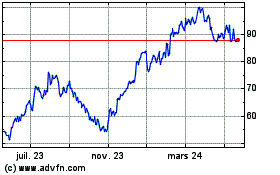

Trex (NYSE:TREX)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

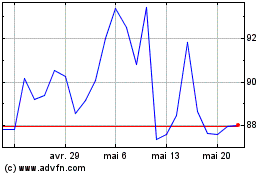

Trex (NYSE:TREX)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025