TortoiseEcofin Acquisition Corp. III Announces Letter of Intent for a Business Combination with an Industrial Renewable Power Solutions Company

20 Juillet 2023 - 10:30PM

Business Wire

TortoiseEcofin Acquisition Corp. III (the “Company”) (NYSE:

TRTL), a publicly traded special purpose acquisition company

focused on the broad energy transition or sustainability arena

targeting industries that require innovative solutions to

decarbonize, today announced that it has executed a new non-binding

letter of intent (“LOI”) for a proposed business combination (the

“Business Combination”) with an industrial renewable power

solutions company (the “Target”) that would result in a public

listing of the Target upon completion of the proposed Business

Combination. The Company previously signed an initial LOI with the

Target on April 26, 2023 and anticipates announcing additional

details regarding the execution of a definitive agreement for the

Business Combination, which is expected in the third quarter of

2023.

“Our commitment to the energy transition is unwavering and is

supported by our deep sector expertise and long track record of

value creation over decades of investing in the energy and power

infrastructure sector,” commented Vince Cubbage, Chief Executive

Officer of TortoiseEcofin Acquisition Corp. III. “In assessing

potential business combination targets, we have focused on

companies that are developing specific solutions to current,

real-world problems. We are excited by the potential transaction

identified with this pioneering industrial renewable power

solutions company. We expect that this company will play a critical

role in facilitating the energy transition for the industrial

market.”

As a result of the signed letter of intent, pursuant to the

provisions of the Company’s Amended and Restated Memorandum and

Articles of Association, the Company has until October 22, 2023 to

consummate its business combination.

The completion of the Business Combination with the Target is

subject to, among other matters, the completion of due diligence,

the negotiation of a definitive agreement providing for the

transaction, satisfaction of the conditions negotiated therein and

approval of the transaction by the board and shareholders of both

the Company and the Target. There can be no assurance that a

definitive agreement will be entered into or that the proposed

transaction will be consummated on the terms or timeframe currently

contemplated, or at all.

Cohen & Company Capital Markets, a division of J.V.B.

Financial Group, LLC, will be serving as the exclusive financial

advisor and the lead capital markets advisor for the

transaction.

About TortoiseEcofin Acquisition Corp. III

TortoiseEcofin Acquisition Corp. III was formed for the purpose

of effecting a merger, amalgamation, share exchange, asset

acquisition, share purchase, reorganization or similar business

combination. The Company intends to focus its search for a target

business in the broad energy transition or sustainability arena

targeting industries that provide or require innovative solutions

to decarbonize in order to meet critical emission reduction

objectives.

Forward Looking Statements

This press release includes, and oral statements made from time

to time by representatives of TortoiseEcofin may include,

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Statements regarding

the Business Combinations and related matters, as well as all other

statements other than statements of historical fact included in

this press release are forward-looking statements. When used in

this press release, words such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and similar expressions, as they relate to

TortoiseEcofin or TortoiseEcofin’s management team, identify

forward-looking statements. Such forward-looking statements are

based on the beliefs of TortoiseEcofin’s management, as well as

assumptions made by, and information currently available to,

TortoiseEcofin’s management. Actual results could differ materially

from those contemplated by the forward-looking statements as a

result of certain factors detailed in TortoiseEcofin’s filings with

the Securities and Exchange Commission’s (the “SEC”). All

subsequent written or oral forward-looking statements attributable

to TortoiseEcofin or persons acting on TortoiseEcofin’s behalf are

qualified in their entirety by this paragraph. Forward-looking

statements are subject to numerous conditions, many of which are

beyond the control of TortoiseEcofin, including those set forth in

the “Risk Factors” section of TortoiseEcofin’s Annual Report on

Form 10-K and other documents of TortoiseEcofin filed, or to be

filed, with the SEC. Copies are available on the SEC’s website at

www.sec.gov. TortoiseEcofin undertakes no obligation to update

these statements for revisions or changes after the date of this

release, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230719064780/en/

For Media: Matt Dallas ICR, Inc. Matt.Dallas@icrinc.com

For Investors: John Ragozzino, CFA ICR, Inc.

John.Ragozzino@icrinc.com

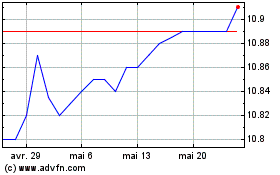

TortoiseEcofin Acquisiti... (NYSE:TRTL)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

TortoiseEcofin Acquisiti... (NYSE:TRTL)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024