- Company Overview: Established in 2009, One Power is a

vertically integrated industrial power solutions provider. It

specializes in developing, constructing, owning, and operating

state-of-the-art, behind-the-meter power solutions, including wind

energy, for industrial clients.

- Innovative Approach: One Power, believes it is building

Utility 2.0, a decentralized, customer-centric power grid that

empowers industrial clients to produce their own on-site, renewable

energy.

- Binding 20-Year Contracts: The company has long-term

binding contracts with well-known industrial clients including

Whirlpool, Marathon Petroleum Corporation, Holcim, Ball

Corporation, and Martin Marietta.

- Deal Structured to Prioritize Shareholders: Transaction

includes various mechanisms, including non-dilutive Contingent

Share Rights (CSRs) from One Power CEO, elimination of specific

Sponsor warrants, and extended equity lock-up agreements and up to

5 million earnout shares issuable to pre-closing One Power holders

upon achievement of trading price-based targets during five-year

post-closing period.

- Transaction Details: Gross proceeds of

approximately $345 million were deposited into TRTL’s trust

account, before the impact of potential redemptions, at the time of

its initial public offering. Proceeds from the Transaction are

expected to be used to execute on the company’s business plan.

- Valuation: Implied pre-money enterprise value of One

Power of $300 million.

- Transaction Announcement Presentation. In lieu of a

traditional transaction announcement conference call, One Power and

TRTL have released a transaction announcement video which can be

accessed via One Power’s investor relations webpage page at

https://oneenergy.com/investors/.

One Energy Enterprises Inc. and TortoiseEcofin Acquisition Corp.

III today announced that they have entered into a definitive

Business Combination Agreement (the “Business Combination

Agreement”) for a business combination (the “Transaction” or the

“Business Combination”). One Energy Enterprises Inc. (“One Power”)

is a vertically integrated industrial power solutions company, and

is the largest installer of on-site, behind-the-meter,

megawatt-scale, wind energy in the United States. TortoiseEcofin

Acquisition Corp. III (“TRTL”) (NYSE: TRTL) is an energy transition

focused special purpose acquisition company. The Transaction is

structured as a merger, following which the business of One Power

will be the combined business of the public company, which will be

renamed One Power Company the (“Combined Company”). Securities of

the Combined Company are expected to be listed on the New York

Stock Exchange under the ticker symbol “ONEP”.

One Power builds, owns, and operates major electrical

infrastructure for industrial energy users “behind-the-meter”,

enabling on-site power generation that enables better utility

monitoring, long-term, competitive rate visibility and enhanced

reliability of utility services. One Power is best known for its

Wind For Industry® projects.

One Power believes that the power grid is undergoing a

fundamental change and that large industrial companies want to take

back control of the power grid they helped build more than 100

years ago. One Power calls the power grid of the future “Utility

2.0” and One Power is already building it today.

One Power’s strategy of constructing and operating industrial

power systems and microgrids targets a significant addressable

market estimated to include more than 53,000 large industrial

facilities in the U.S., which in aggregate account for

approximately 26% of domestic electricity consumption despite

accounting for only 0.6% of energy users. The decarbonization of

America’s industrial facilities, on their terms, is expected to

contribute meaningfully to enduring decarbonization of our

economy.

The Company offers four main industrial power solutions:

- Wind for Industry® – On-site, behind-the-meter, wind

energy with megawatt-scale wind turbines under 20-year take or pay

contracts at fixed power rates.

- Managed High Voltage – On-site, behind-the-meter,

outside-the-plant, digital, high-voltage power infrastructure,

enabling customers to interconnect at higher voltages, distribute

power more efficiently, and further electrify their

facilities.

- Megawatt Hubs - Transmission-voltage-interconnected

30MW-150MW sites that are ready for the energy-intensive industries

of the future like mobile data centers and commercial electric

vehicle fleets.

- Net Zero Projects - Integrated projects that bring wind,

solar, and power infrastructure together to help industrials get as

close to net-zero grid energy use as possible on an annualized

basis with on-site renewable generation.

One Power delivers most of its services under long-term, 20-year

contracts with blue-chip customers. The Company’s current customer

portfolio includes Whirlpool, Marathon Petroleum Corporation,

Holcim, Ball Corporation, and Martin Marietta.

Deal Structure Intended to Prioritize Shareholder

Interests

One Power and TRTL entered into the Business Combination

Agreement to pursue a transaction intended to align interests among

multiple stakeholders. One Power’s founder and Chief Executive

Officer, Jereme Kent, who is expected to be the CEO of the Combined

Company after the Transaction, has agreed to contribute half of his

pro forma One Power shares to a non-dilutive Contingent Share

Rights (CSR) structure. Under certain conditions, CSR participants,

which are expected to consist of non-redeeming TRTL public

shareholders as well, potentially, as PIPE investors, if any, are

entitled to receive all or a portion of these approximately 5.5

million shares; if post-closing trading prices exceed the

applicable threshold, the CSR shares will be distributed to One

Power’s CEO. Additionally, certain specific Sponsor warrants would

be terminated in connection with the Transaction and multi-year

lock-up agreements will apply to certain One Power equity holders

and to TRTL Sponsor securities. TRTL Sponsor has also agreed to

subject 2.25 million founder shares to an earnout structure, for

release to TRTL Sponsor only if certain trading price based

earn-out conditions apply after closing. The threshold for both the

CSR and the TRTL sponsor earn-out mechanisms is set at a volume

weighted average trading price (VWAP) that equals or exceeds $12.00

for 20 out of any 30 consecutive trading days and must be met in

the first 24 months after closing. The proposed Transaction also

features an earnout for the potential benefit of existing One Power

equity holders with two trading-price based “thresholds” to be

measured over a five-year post-closing period.

Under the terms of the proposed transaction, current One Power

stockholders are rolling 100% of their equity into the Combined

Company; One Power’s CEO, who is also expected to be the CEO of the

Combined Company, has also agreed to a three-year lock up on his

One Power securities (subject to customary permitted transfers)

with no early release provisions. TRTL Sponsor’s founder shares

will be subject to a two-year post-closing lock-up period subject

to early release occurring during same period if the post-closing

VWAP of One Power shares exceeds $15.00 for 20 out of any 30

consecutive trading days over a two-year period post-closing or

there is a qualifying subsequent change of control transaction.

Future members of the board of directors of the Combined Company

will also be required to agree to two-year lock-up agreements.

Management Commentary

Jereme Kent, CEO and Founder of One Power, commented, “Entering

into a definitive agreement to merge with TRTL is a monumental step

towards our vision of reshaping the utility industry. With the

added financial strength we anticipate from going public, we hope

to accelerate our growth plans to continue helping industrial

clients take back control of their power and transition to a more

sustainable, reliable, and cost-effective power solution that is

custom engineered to their individual needs.”

Vince Cubbage, Chairman and CEO of TRTL, stated, “As the

electrification and decarbonization of our economy continues to

accelerate, we believe One Power is poised to scale its delivery of

megawatt-scale, mission-critical, high-voltage power systems to

blue-chip industrial customers. One Power’s cost-advantaged

renewable power solutions bypass long interconnect queues and grid

transmission congestion, reducing costs as well as disruption time

for customers. With the necessary capital, we think One Power can

successfully extend its market pioneering position.”

Transaction Overview

Pursuant to the Business Combination Agreement, a newly formed

wholly-owned subsidiary of TRTL will merge with and into One Power,

with One Power continuing as the surviving company in the merger.

The aggregate transaction consideration deliverable to the One

Energy stockholders shall be a number of newly issued shares of

common stock of the Combined Company equal to $300 million minus

the amount of indebtedness of One Power at the Closing, with each

share of common stock valued at $10 per share.

In addition, after the closing, One Energy stockholders will

have a contingent right to receive up to an additional five million

shares, upon the Combined company meeting certain share price

targets set forth in the Business Combination Agreement.

At the time of its initial public offering, TRTL’s trust account

contained approximately $345 million (prior to any redemptions by

public shareholders). Any proceeds to One Power from the proposed

Transaction (after satisfaction of payments to redeeming TRTL

shareholders and satisfaction of relevant fees, expenses and other

liabilities) will be used to by the Combined Company to execute its

business plan and for general working capital purposes. The

pre-money enterprise value of One Power implied by the transaction

terms is $300 million.

The Transaction has been unanimously approved by the Boards of

Directors of TRTL and One Energy Enterprises Inc. Completion of the

proposed Transaction is subject to customary closing

conditions.

Additional information about the proposed Transaction will be

provided in a Current Report on Form 8-K to be filed by TRTL with

the U.S. Securities and Exchange Commission (the “SEC”) and

available at www.sec.gov.

Advisors

Cohen & Company Capital Markets, a division of J.V.B.

Financial Group, LLC (“CCM”), served as exclusive financial

advisor, lead capital markets advisor and sole placement agent to

One Power. Nelson Mullins Riley & Scarborough LLP served as

legal counsel to One Power. Ellenoff, Grossman & Schole LLP

served as legal counsel to TRTL.

Investor Presentation and Video Information

In lieu of a conference call, an announcement video describing

One Power and the Proposed Transaction has been prepared by

management and released concurrent with the transaction

announcement. The video can be accessed via One Power’s investor

relations website at https://oneenergy.com/investors/. A copy of

the investor presentation and transcript of the video recording

will be furnished as exhibits to TRTL’s current report on Form 8-K,

available, free of charge, on the SEC’s website at www.sec.gov.

About One Power

One Power is an industrial power company and the largest

installer of on-site, behind-the-meter, wind energy in the United

States. Recognizing that large energy consumers are fed up with the

failings of legacy utilities, One Power developed modern energy

services to control cost and risk, such as Wind for Industry® and

Managed High Voltage®. One Power is building the customer-centric

grid of the future. Founded in 2009, One Power is headquartered in

Findlay, Ohio and currently has approximately 65 employees. Learn

more about the customer-centric power grid of the future at One

Power’s website (www.onepower.com).

About TortoiseEcofin Acquisition Corp. III

TortoiseEcofin Acquisition Corp. III was formed for the purpose

of effecting a merger, amalgamation, share exchange, asset

acquisition, share purchase, reorganization or similar business

combination.

Additional Information and Where to Find It

In connection with the proposed transaction (the “Proposed

Transaction”) between TortoiseEcofin Acquisition Corp. III (“TRTL”)

and One Energy Enterprises Inc. (“One Energy,” the business of

which (referred to herein as “One Power”), after consummation, if

any (the “Closing”) of the Proposed Transaction, will be the

business of the “Combined Company,” which is expected to be renamed

“One Power Company”), which is the subject of the Agreement and

Plan of Merger between TRTL, One Energy and certain other parties

thereto (the “Merger Agreement”), TRTL intends to file a

registration statement on Form S-4 (as may be amended or

supplemented from time to time, the “Form S-4” or the “Registration

Statement”) with the U.S. Securities and Exchange Commission (the

“SEC”), which will include a preliminary proxy statement and a

prospectus in connection with the Proposed Transaction.

SHAREHOLDERS OF TRTL ARE ADVISED TO READ, WHEN AVAILABLE, THE

PRELIMINARY PROXY STATEMENT, ANY AMENDMENTS THERETO, THE DEFINITIVE

PROXY STATEMENT, THE PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS

FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE

PROPOSED TRANSACTION AS THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. HOWEVER, THIS DOCUMENT WILL NOT

CONTAIN ALL THE INFORMATION THAT SHOULD BE CONSIDERED CONCERNING

THE PROPOSED TRANSACTION. IT IS ALSO NOT INTENDED TO FORM THE BASIS

OF ANY INVESTMENT DECISION OR ANY OTHER DECISION IN RESPECT OF THE

PROPOSED TRANSACTION. When available, the definitive proxy

statement and other relevant documents will be mailed to the

shareholders of TRTL as of a record date to be established for

voting on the Proposed Transaction. Shareholders and other

interested persons will also be able to obtain copies of the

preliminary proxy statement, the definitive proxy statement, the

Registration Statement and other documents filed by TRTL with the

SEC that will be incorporated by reference therein, without charge,

once available, at the SEC’s website at www.sec.gov.

TRTL’s shareholders will also be able to obtain a copy of such

documents, without charge, by directing a request to:

TortoiseEcofin Acquisition Corp. III, 195 US HWY 50, Suite 208,

Zephyr Cove, NV 89448; e-mail: IR@trtlspac.com. These documents,

once available, can also be obtained, without charge, at the SEC’s

website at www.sec.gov.

Participants in the Solicitation

TRTL, One Energy and their respective directors and executive

officers may be deemed participants in the solicitation of proxies

of TRTL’s shareholders in connection with the Proposed Transaction.

TRTL’s shareholders and other interested persons may obtain more

detailed information regarding the names, affiliations and

interests of certain of TRTL executive officers and directors in

the solicitation by reading TRTL’s final prospectus filed with the

SEC on July 21, 2021, in connection with TRTL’s initial public

offering, TRTL’s Annual Report on Form 10-K for the year ended

December 31, 2021, as filed with the SEC on March 24, 2022, TRTL’s

Annual Report on Form 10-K for the year ended December 31, 2022, as

filed with the SEC on March 22, 2023, and TRTL’s other filings with

the SEC. A list of the names of such directors and executive

officers and information regarding their interests in the Proposed

Transaction, which may, in some cases, be different from those of

shareholders generally, will be set forth in the Registration

Statement relating to the Proposed Transaction when it becomes

available. These documents can be obtained free of charge from the

source indicated above.

No Offer or Solicitation

This communication shall not constitute a solicitation of a

proxy, consent or authorization with respect to any securities or

in respect of the Proposed Transaction. This communication shall

not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any states or jurisdictions in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of such state or jurisdiction. No offering of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act or an

exemption therefrom.

Forward-Looking Statements

This communication may contain forward-looking statements for

purposes of the “safe harbor” provisions under the United States

Private Securities Litigation Reform Act of 1995. Any statements

other than statements of historical fact contained herein are

forward-looking statements. Such forward-looking statements

include, but are not limited to, expectations, hopes, beliefs,

intentions, plans, prospects, financial results or strategies

regarding One Power, the Combined Company and the Proposed

Transaction and the future held by the respective management teams

of TRTL or One Power, the anticipated benefits and the anticipated

timing of the Proposed Transaction, future financial condition and

performance of One Power or the Combined Company)and expected

financial impacts of the Proposed Transaction (including future

revenue, profits, proceeds, pro forma enterprise value and cash

balance), the satisfaction of closing conditions to the Proposed

Transaction, financing transactions, if any, related to the

Proposed Transaction, the level of redemptions by TRTL’s public

shareholders and the expected future performance and market

opportunities of One Power or the Combined Company. These

forward-looking statements generally are identified by the words

“anticipate,” “believe,” “could,” “expect,” “estimate,” “future,”

“intend,” “may,” “might,” “strategy,” “opportunity,” “plan,”

“project,” “possible,” “potential,” “project,” “predict,” “scales,”

“representative of,” “valuation,” “should,” “will,” “would,” “will

be,” “will continue,” “will likely result,” and similar

expressions, but the absence of these words does not mean that a

statement is not forward-looking. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this communication, including,

without limitation: (i) the risk that the Proposed Transaction may

not be completed in a timely manner or at all, which may adversely

affect the price of TRTL’s securities, (ii) the risk that the

Proposed Transaction may not be completed by TRTL’s business

combination deadline and the potential failure to obtain an

extension of the business combination deadline if sought by TRTL,

(iii) the failure to satisfy the conditions to the consummation of

the Proposed Transaction, including the requirements that the

Merger Agreement and the transactions contemplated thereby be

approved by the shareholders of TRTL and by the stockholders of One

Energy, respectively, (iv) the failure to obtain regulatory

approvals and any other third party consents, as applicable, as may

be required to consummate the Proposed Transaction, (v) the

occurrence of any event, change or other circumstance that could

give rise to the termination of the Merger Agreement, or that

redemptions by TRTL public shareholders may exceed expectations,

(vi) the effect of the announcement or pendency of the Proposed

Transaction on One Power's business relationships, operating

results, and business generally, (vii) risks that the Proposed

Transaction disrupts current plans and operations of One Power,

(viii) the outcome of any legal proceedings that may be instituted

against One Energy or against TRTL related to the Merger Agreement

or the Proposed Transaction, (ix) the ability to maintain the

listing of TRTL’s securities on NYSE, (x) changes in the

competitive market in which One Power operates, variations in

performance across competitors, changes in laws and regulations

affecting One Power’s business and changes in the capital structure

of the Combined Company after the Closing, (xi) the ability to

implement business plans, growth, marketplace, customer pipeline

and other expectations after the completion of the Proposed

Transaction, and identify and realize additional opportunities,

(xiii) the potential inability of One Power to achieve its business

and growth plans, (xiv) the ability of One Power to enforce its

current material contracts or to secure long-term or other

committed contracts with new or existing customers on terms

favorable to One Power, (xv) the risk that One Power will need to

raise additional capital to execute its business plans, which may

not be available on acceptable terms or at all; (xvi) the risk that

One Power experiences difficulties in managing its growth and

expanding operations; (xvii) the risk of our cyber security

measures being unable to prevent hacking or disruption to our

customers; and (xviii) the risk of economic downturn, increased

competition, a changing of energy regulatory landscape and related

impacts that could occur in the highly competitive energy market,

including, among other things, that One Power will not meet

milestones for funding its ongoing and future project pipeline. The

foregoing list of factors is not exhaustive. Recipients should

carefully consider such factors and the other risks and

uncertainties described and to be described in the “Risk Factors”

section of TRTL’s initial public offering prospectus filed with the

SEC on July 21, 2021, TRTL’s Annual Report on Form 10-K for the

year ended December 31, 2021, as filed with the SEC on March 24,

2022, TRTL’s Annual Report on Form 10-K for the year ended December

31, 2022, as filed with the SEC on March 22, 2023, and subsequent

periodic reports filed by TRTL with the SEC, the Registration

Statement to be filed by TRTL in connection with the Proposed

Transaction and other documents filed or to be filed by TRTL from

time to time with the SEC. These filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Recipients are cautioned not to put

undue reliance on forward-looking statements, and neither One

Energy nor TRTL assume any obligation to, nor intend to, update or

revise these forward-looking statements, whether as a result of new

information, future events, or otherwise, except as required by

law. Neither One Energy nor TRTL gives any assurance that either

One Energy or TRTL, or the Combined Company, will achieve its

expectations.

Information Sources; No Representations

The communication furnished herewith has been prepared for use

by TRTL and One Power in connection with the Proposed Transaction.

The information therein does not purport to be all-inclusive. The

information therein is derived from various internal and external

sources, with all information relating to the business, past

performance, results of operations and financial condition of TRTL

derived entirely from TRTL and all information relating to the

business, past performance, results of operations and financial

condition of One Power, or the Combined Company after the Closing,

are derived entirely from One Energy (referred to herein as “One

Power”). No representation is made as to the reasonableness of the

assumptions made with respect to the information therein, or to the

accuracy or completeness of any projections or modeling or any

other information contained therein. Any data on past performance

or modeling contained therein is not an indication as to future

performance.

No representations or warranties, express or implied, are given

in respect of the communication. To the fullest extent permitted by

law in no circumstances will TRTL or One Energy, or any of their

respective subsidiaries, affiliates, shareholders, representatives,

partners, directors, officers, employees, advisors or agents, be

responsible or liable for any direct, indirect or consequential

loss or loss of profit arising from the use of the this

communication (including without limitation any projections or

models), any omissions, reliance on information contained within

it, or on opinions communicated in relation thereto or otherwise

arising in connection therewith, which information relating in any

way to the operations of One Energy or the prospective operations

of One Power has been derived, directly or indirectly, exclusively

from One Energy and has not been independently verified by TRTL or

any other party. Neither the independent auditors of TRTL nor the

independent auditors of or One Energy audited, reviewed, compiled

or performed any procedures with respect to any projections or

models for the purpose of their inclusion in the communication and,

accordingly, neither of them expressed any opinion or provided any

other form of assurances with respect thereto for the purposes of

the communication.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230815535700/en/

For Investors: John Ragozzino, CFA

ICR, Inc. OneEnergyIR@icrinc.com

For Media: Matt Dallas ICR, Inc.

OneEnergyPR@icrinc.com

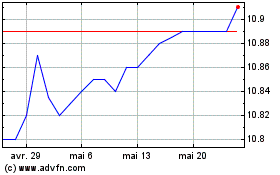

TortoiseEcofin Acquisiti... (NYSE:TRTL)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

TortoiseEcofin Acquisiti... (NYSE:TRTL)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024