UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

þ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

Titan International, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1)Title of each class of securities to which transaction applies:

______________________________________________________________________________________

2)Aggregate number of securities to which transaction applies:

______________________________________________________________________________________

3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

______________________________________________________________________________________

4)Proposed maximum aggregate value of transaction.

______________________________________________________________________________________

5)Total fee paid:

______________________________________________________________________________________

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration number, or the Form or Schedule and the date of its filing.

1)Amount Previously Paid:

______________________________________________________________________________________

2)Form, Schedule or Registration Statement No.:

______________________________________________________________________________________

3)Filing Party:

______________________________________________________________________________________

4)Date Filed:

______________________________________________________________________________________

May 30, 2023

To: Titan International, Inc. Shareholders

From: Maurice Taylor, Chairman

RE: Glass-Lewis/ ISS Recommendations

Dear shareholders,

Enclosed is a letter I sent to Glass-Lewis and ISS today. Titan has just had its two best years as a company and our One Titan Team, led by CEO Paul Reitz, have done a fantastic job driving this performance, in some of the most challenging times in history. Most of you know that I call a spade a spade. The note I sent Glass-Lewis/ISS might sound poor to you, but nice smooth words mean nothing to woke fools. So, I told them what I think. They have never called me or visited our factories, but they think they know how to run a business. The reasons they say to not support the Board’s recommendations on compensation and the Board election are simply not founded given our performance. There is alignment with compensation and the Boards actions over the last number of years to drive the improvements at the Company and its direction. I simply ask you to pay attention to the details and make decisions for yourselves. As always, I appreciate your support and loyalty over the many years.

Best,

Morry

This letter contains forward-looking statements. These forward-looking statements are covered by the safe harbor for "forward-looking statements" provided by the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “plan,” “would,” “could,” “potential,” “may,” “will,” and other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, these assumptions are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond Titan International, Inc.'s control. As a result, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors including, but not limited to, the effect of the COVID-19 pandemic on our operations and financial performance; the effect of a recession on the Company and its customers and suppliers; changes in the Company’s end-user markets into which the Company sells its products as a result of domestic and world economic or regulatory influences or otherwise; changes in the marketplace, including new products and pricing changes by the Company’s competitors; the Company's ability to maintain satisfactory labor relations; unfavorable outcomes of legal proceedings; the Company's ability to comply with current or future regulations applicable to the Company's business and the industry in which it competes or any actions taken or orders issued by regulatory authorities; availability and price of raw materials; levels of operating efficiencies; the effects of the Company's indebtedness and its compliance with the terms thereof; changes in the interest rate environment and their effects on the Company's outstanding indebtedness; unfavorable product liability and warranty claims; actions of domestic and foreign governments, including the imposition of additional tariffs; geopolitical and economic uncertainties relating to the countries in which the Company operates or does business; risks associated with acquisitions, including difficulty in integrating operations and personnel, disruption of ongoing business, and increased expenses; results of investments; the effects of potential processes to explore various strategic transactions, including potential dispositions; fluctuations in currency translations; risks associated with environmental laws and regulations; risks relating to our manufacturing facilities, including that any of our material facilities may become inoperable; risks relating to financial reporting, internal controls, tax accounting, and information systems; and the other risks and factors detailed in the Company’s periodic reports filed with the Securities and Exchange Commission, including the disclosures under "Risk Factors" in those reports. These forward-looking statements are made only as of the date hereof. The Company cautions that any forward-looking statements included in this letter are subject to a number of risks and uncertainties, and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, changed circumstances or future events, or for any other reason, except as required by law.

May 30, 2023

Glass Lewis

Joah Clements

Douglas Ryan

ISS

Jaira Eehna Cacho

Daniel Boon

RE: Glass Lewis / ISS Recommendation for Proxy Vote

Dear Messrs Clements, Ryan, Boon and Ms. Cacho:

For a number of years now you both have been telling TWI Shareholders not to vote for certain or even all of our Board members. I have come to the conclusion that both of your companies are out of touch with reality and you don’t have any real idea how to run a business! Before I go on about your lack of knowledge, I would like to remind you that the past two years have been the very best years for TWI’s performance in our long history. The decisions by our Board over the last number of years and the hard work by our management team has led to this performance and that is not easy work. We are a small $2 Billion dollar company which manufactures steel wheels, undercarriages and rubber tires, and yes, we started with nothing and now we are the largest offroad steel wheel business in the world today. We also have the largest farm tire business with Goodyear and Titan brands in the North and South America’s. The Board’s compensation decisions for our management team are reflective of the performance of the Company, as well as for strategic initiatives, and that is clearly disclosed in our proxy. A few years back, the Board hired a compensation consultant to come up with a compensation plan that was given to Shareholders to approve in 2019. We have followed those principles, and it is clear that it is aligned with shareholders based on the metrics you publish, most notably total compensation to TWI’s Total Shareholder Return. I guess it is simple, you should tell all Shareholders that your companies have consultant groups that companies can hire to please you - what a brilliant idea.

I think you guys should go ask Goldman Sachs regarding this little $2 Billion dollar company. You see in 2008, Wall Street was being hit by everyone, no one and I mean NO ONE, wanted to be seen with the big New York firms, including Goldman Sachs. Titan did a promotional film

Maurice M. Taylor, Jr. 1525 Kautz Road, Suite 600

Chairman West Chicago, IL 60185

(217) 228-6011

for them, and 85% of the focus group loved seeing wheels being made, then the tires that would go on the wheels. It was impressive to see once you saw the trucks that carried the iron ore from the mines with our products. This is a story everyone sees and understands, and it is how Titan got financing to grow and prosper through the years. These are simple messages and ones that people understand what makes a company like ours tick. The point is, you have to pay attention to the details and you have missed it with your recommendations for compensation and withholding support for our Board. Results matter.

I think your firm’s recommendations are hurting TWI Shareholders by pretending that you know something about business. You have now even told TWI Shareholders to withhold votes for Laura Thompson, who has contributed in a big way and provides diversity to our Board. You should keep your opinion to the bigger boys – $12 Billion or larger, I believe.

Sorry if I hurt your feelings or don’t get your perspectives, but you have never even visited our operations, so your opinions don’t count in my world. I continue to invite you and you are welcome any time. I believe it would really help.

Best,

Morry

Maurice M. Taylor, Jr. 1525 Kautz Road, Suite 600

Chairman West Chicago,IL 60185

(217) 228-6011

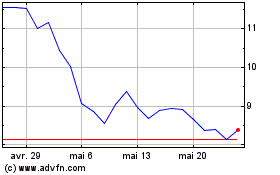

Titan (NYSE:TWI)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Titan (NYSE:TWI)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024