As filed with the Securities and Exchange Commission on May 6, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________

URBAN EDGE PROPERTIES

(Exact Name of Registrant as Specified in Its Charter)

| | | | | |

Maryland (State or Other Jurisdiction of Incorporation or Organization) | 47-6311266 (I.R.S. Employer Identification Number) |

888 Seventh Avenue New York, New York (Address of Principal Executive Offices) | 10019 (Zip Code) |

URBAN EDGE PROPERTIES 2024 OMNIBUS SHARE PLAN

(Full Title of Plan)

__________________________

Robert C. Milton III, Esq.

Urban Edge Properties

888 Seventh Avenue, New York, New York 10019

(Name and address of agent for service)

(212) 956-2556

(Telephone number, including area code, of agent for service)

with a copy to:

Yoel Kranz, Esq.

Goodwin Procter LLP

620 Eighth Avenue

New York, New York 10018

Tel: (212) 813-8800

__________________________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer ☒ | Accelerated filer ☐ |

Non-accelerated filer ☐ | Smaller reporting company ☐ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Registration Statement on Form S-8 is being filed by Urban Edge Properties (the “Company”, “we” or “us”) to register the offer and sale of up to 7,400,000 newly authorized common shares of beneficial interest, par value $0.01 per share (“Common Shares”), pursuant to the Urban Edge Properties 2024 Omnibus Share Plan (the “Plan”).

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.*

Item 2. Registrant Information and Employee Plan Annual Information.*

*The documents containing the information specified in this Part I will be sent or given to participants in the Plan in accordance with Rule 428(b)(1) promulgated under the Securities Act of 1933, as amended (the “Securities Act”). In accordance with Rule 428 promulgated under the Securities Act and the requirements of Part I of Form S-8, such documents need not be filed with the Securities and Exchange Commission (the “SEC”) either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 promulgated under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Company with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated by reference (other than, in each case, those documents, or the portions of those documents or exhibits thereto, deemed to be furnished and not filed in accordance with SEC rules):

•The Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 14, 2024; •The Company’s Definitive Proxy Statement on Schedule 14A, filed with the SEC on March 22, 2024 (solely to the extent specifically incorporated by reference into the Company’s Annual Report on Form 10-K for the year ended December 31, 2023); •The Company’s Current Report on Form 8-K filed with the SEC on May 6, 2024; and •The description of the Company’s Common Shares contained in the Company’s Registration Statement on Form 10-12B (File No. 001-36523), filed with the SEC on June 26, 2014, as updated by Exhibit 4.1 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with SEC on February 14, 2023, including any amendment or report filed for the purpose of updating such description. In addition, all documents filed by the Company with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such documents (other than, in each case, those documents, or the portions of those documents or exhibits thereto, deemed to be furnished and not filed in accordance with SEC rules).

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is incorporated or deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Trustees and Officers.

Maryland law permits a Maryland real estate investment trust to include in its declaration of trust a provision limiting or eliminating the liability of its trustees and officers to the real estate investment trust and its shareholders for money damages except for liability resulting from (i) actual receipt of an improper benefit or profit in money, property or services, for the amount of the benefit or profit in money, property or services actually received or (ii) active and deliberate dishonesty that is established by a final judgment and which is material to the cause of action. The Company’s declaration of trust includes such a provision eliminating such liability to the maximum extent permitted by Maryland law.

The Company’s declaration of trust and bylaws obligate it, to the fullest extent permitted by Maryland law in effect from time to time, to indemnify and to pay or reimburse reasonable expenses in advance of final disposition of a proceeding, without requiring a preliminary determination of the trustee’s or officer’s ultimate entitlement to indemnification, to (i) any present or former trustee or officer who is made or threatened to be made a party to the proceeding by reason of his or her service in that capacity, or (ii) any individual who, while serving as the Company’s trustee or officer and at the request of the Company, serves or has served as a director, trustee, officer, partner, member or manager of another corporation, real estate investment trust, partnership, limited liability company, joint venture, trust, employee benefit plan or other enterprise and who is made or threatened to be made a party to the proceeding by reason of his or her service in that capacity. The Company’s declaration of trust and bylaws also permit it, with the approval of the board of trustees, to indemnify and advance expenses to any person who served a predecessor of the Company in any of the capacities described above and to any employee or agent of the Company or its predecessor.

Maryland law requires a Maryland real estate investment trust (unless its declaration of trust provides otherwise, which the Company’s does not) to indemnify a trustee or officer who has been successful, on the merits or otherwise, in the defense of any proceeding to which he or she is made a party by reason of his or her service in that capacity. Maryland law permits a real estate investment trust to indemnify its present and former trustees and officers, among others, against judgments, penalties, fines, settlements and reasonable expenses actually incurred by them in connection with any proceeding to which they may be made or threatened to be made a party by reason of their service in those or other capacities unless it is established that (a) the act or omission of the trustee or officer was material to the matter giving rise to the proceeding and (i) was committed in bad faith or (ii) was the result of active and deliberate dishonesty, (b) the trustee or officer actually received an improper personal benefit in money, property or services or (c) in the case of any criminal proceeding, the trustee or officer had reasonable cause to believe that the act or omission was unlawful. However, under Maryland law, a Maryland real estate investment trust may not indemnify for an adverse judgment in a suit by or in the right of the real estate investment trust or for a judgment of liability on the basis that personal benefit was improperly received, unless in either case a court orders indemnification and then only for expenses. In addition, Maryland law permits a real estate investment trust to advance reasonable expenses to a trustee or officer upon the real estate investment trust’s receipt of (a) a written affirmation by the trustee or officer of his or her good faith belief that he or she has met the standard of conduct necessary for indemnification by the real estate investment trust and (b) a written undertaking by him or her or on his or her behalf to repay the amount paid or reimbursed by the real estate investment trust if it shall ultimately be determined that the standard of conduct was not met.

The Company has entered into agreements with each of its trustees, and has entered or expects to enter into indemnification agreements with each of its executive officers, in each case that will provide for indemnification to the maximum extent permitted by Maryland law.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to officers, trustees or controlling persons of the Company pursuant to the foregoing provisions or otherwise, the Company has been advised that, in the opinion of the SEC, such indemnification is against public policy and, therefore, unenforceable. In addition, indemnification may be limited by state securities laws. The Company has purchased liability insurance for the purpose of providing a source of funds to pay the indemnification described above.

Item 7. Exemption From Registration Claimed.

Not applicable.

Item 8. Exhibits.

EXHIBIT INDEX

| | | | | |

| Exhibit Number | Description |

| |

| |

| |

| |

| |

| |

| |

| |

* Filed herewith

Item 9. Undertakings.

The undersigned registrant hereby undertakes:

(a) (1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of a prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(h) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to trustees, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a trustee, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such trustee, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, Urban Edge Properties certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York and State of New York, on May 6, 2024.

URBAN EDGE PROPERTIES

a Maryland real estate investment trust

By: /s/ Robert C. Milton III

Name: Robert C. Milton III

Title: Executive Vice President, General Counsel

and Secretary

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Jeffrey S. Olson, Mark J. Langer and Robert C. Milton, III, and each of them, his true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) and supplements to this registration statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the SEC or any other regulatory authority, granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this registration statement has been signed below by the following persons in the capacities and on the date indicated.

| | | | | | | | |

| Signature | Title | Date |

| | |

| /s/ Jeffrey S. Olson | Chairman of the Board of Trustees and Chief Executive Officer (Principal Executive Officer) | May 6, 2024 |

| Jeffrey S. Olson | | |

| | |

| /s/ Mark J. Langer | Chief Financial Officer (Principal Financial Officer) | May 6, 2024 |

| Mark J. Langer | | |

| | |

| /s/ Andrea R. Drazin | Chief Accounting Officer (Principal Accounting Officer) | May 6, 2024 |

| Andrea R. Drazin | | |

| | |

| /s/ Mary L. Baglivo | Trustee | May 6, 2024 |

| Mary L. Baglivo | | |

| | |

| /s/ Steven H. Grapstein | Trustee | May 6, 2024 |

| Steven H. Grapstein | | |

| | |

| /s/ Norman K. Jenkins | Trustee | May 6, 2024 |

| Norman K. Jenkins | | |

| | |

| /s/ Kevin P. O’Shea | Trustee | May 6, 2024 |

| Kevin P. O’Shea | | |

| | |

| /s/ Catherine D. Rice | Trustee | May 6, 2024 |

| Catherine D. Rice | | |

| | |

| /s/ Katherine M. Sandstrom | Trustee | May 6, 2024 |

| Katherine M. Sandstrom | | |

| | |

| /s/ Douglas W. Sesler | Trustee | May 6, 2024 |

| Douglas W. Sesler | | |

Exhibit 5.1

| | |

750 E. PRATT STREET SUITE 900 BALTIMORE, MD 21202 T 410.244.7400 F 410.244.7742 www.Venable.com |

May 6, 2024

Urban Edge Properties

888 Seventh Avenue

New York, New York 10019

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We have served as Maryland counsel to Urban Edge Properties, a Maryland real estate investment trust (the “Company”), in connection with certain matters of Maryland law arising out of the registration of 7,400,000 common shares (the “Shares”) of beneficial interest, par value $0.01 per share, of the Company (the “Common Shares”), that the Company may issue pursuant to the Urban Edge Properties 2024 Omnibus Share Plan (the “Plan”), covered by the above-referenced Registration Statement and all amendments thereto (the “Registration Statement”), filed by the Company with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “1933 Act”), on or about the date hereof.

In connection with our representation of the Company, and as a basis for the opinion hereinafter set forth, we have examined originals, or copies certified or otherwise identified to our satisfaction, of the following documents (hereinafter collectively referred to as the “Documents”):

1.The Registration Statement;

2.The Plan;

3. The Declaration of Trust of the Company (the “Declaration of Trust”), certified by the State Department of Assessments and Taxation of Maryland (the “SDAT”);

4. The Amended and Restated Bylaws of the Company, certified as of the date hereof by an officer of the Company;

5. Resolutions (the “Resolutions”) adopted by the Board of Trustees of the Company and a duly authorized committee thereof relating to the authorization the Plan and the issuance of the Shares, certified as of the date hereof by an officer of the Company;

6. The Company’s Current Report on Form 8-K, filed with the Commission on May 6, 2024, reporting the result of the matters voted on by the Company’s shareholders at the Company’s 2024 Annual Meeting of Shareholders;

Urban Edge Properties

May 6, 2024

Page 2

7. A certificate of the SDAT as to the good standing of the Company, dated as of a recent date;

8. A certificate executed by an officer of the Company, dated as of the date hereof; and

9. Such other documents and matters as we have deemed necessary or appropriate to express the opinion set forth below, subject to the assumptions, limitations and qualifications stated herein.

In expressing the opinion set forth below, we have assumed the following:

1. Each individual executing any of the Documents, whether on behalf of such individual or any other person, is legally competent to do so.

2. Each individual executing any of the Documents on behalf of a party (other than the Company) is duly authorized to do so.

3. Each of the parties (other than the Company) executing any of the Documents has duly and validly executed and delivered each of the Documents to which such party is a signatory, and such party's obligations set forth therein are legal, valid and binding and are enforceable in accordance with all stated terms.

4. All Documents submitted to us as originals are authentic. The form and content of all Documents submitted to us as unexecuted drafts do not differ in any respect relevant to this opinion from the form and content of such Documents as executed and delivered. All Documents submitted to us as certified or photostatic copies conform to the original documents. All signatures on all Documents are genuine. All public records reviewed or relied upon by us or on our behalf are true and complete. All representations, warranties, statements and information contained in the Documents are true and complete. There has been no oral or written modification of or amendment to any of the Documents, and there has been no waiver of any provision of any of the Documents, by action or omission of the parties or otherwise.

5. The Shares will not be issued or transferred in violation of Article VII of the Declaration of Trust or any restrictions contained in the Plan.

6. Upon the issuance of any of the Shares, the total number of Common Shares issued and outstanding will not exceed the total number of Common Shares that the Company is then authorized to issue under the Declaration of Trust. We note that, as of the date hereof, there are more than 7,400,000 Common Shares available for issuance under the Declaration of Trust.

Urban Edge Properties

May 6, 2024

Page 3

7. Each award that provides for the potential issuance of a Share pursuant to the Plan (each, an “Award”) will be duly authorized and validly granted in accordance with the Plan and exercised or exchanged in accordance with the terms of the Plan, including any Award agreement.

Based upon the foregoing, and subject to the assumptions, limitations and qualifications stated herein, it is our opinion that:

1. The Company is a real estate investment trust duly formed and existing under and by virtue of the laws of the State of Maryland and is in good standing with the SDAT.

2. The issuance of the Shares has been duly authorized and, when and to the extent issued in accordance with the Registration Statement, the Resolutions, the Plan and any stock option agreement, restricted stock agreement or other form of award agreement utilized under the Plan, the Shares will be validly issued, fully paid and nonassessable.

The foregoing opinion is limited to the laws of the State of Maryland and we do not express any opinion herein concerning federal law or the laws of any other state. We express no opinion as to the applicability or effect of any federal or state securities laws, including the securities laws of the State of Maryland, federal or state laws regarding fraudulent transfers or the laws, codes or regulations of any municipality or other local jurisdiction. To the extent that any matter as to which our opinion is expressed herein would be governed by the laws of any jurisdiction other than the State of Maryland, we do not express any opinion on such matter. The opinion expressed herein is subject to the effect of any judicial decision which may permit the introduction of parol evidence to modify the terms or the interpretation of agreements.

The opinion expressed herein is limited to the matters specifically set forth herein and no other opinion shall be inferred beyond the matters expressly stated. We assume no obligation to supplement this opinion if any applicable law changes after the date hereof or if we become aware of any fact that might change the opinion expressed herein after the date hereof.

This opinion is being furnished to you for submission to the Commission as an exhibit to the Registration Statement. We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving this consent, we do not admit that we are within the category of persons whose consent is required by Section 7 of the 1933 Act.

Very truly yours,

/s/ Venable LLP

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our reports dated February 14, 2024, relating to the financial statements of Urban Edge Properties, and the effectiveness of Urban Edge Properties’ internal control over financial reporting, appearing in the Annual Report on Form 10-K of Urban Edge Properties for the year ended December 31, 2023.

/s/ DELOITTE & TOUCHE LLP

New York, New York

May 6, 2024

Urban Edge Properties

2024 Omnibus Share Plan

Table of Contents

| | | | | | | | |

| 1. | Purpose | 2 |

| | |

| 2. | Shares Available for Awards | 2 |

| | |

| 3. | Administration | 3 |

| | |

| 4. | Eligibility | 3 |

| | |

| 5. | Awards | 3 |

| | |

| 6. | Stock Options | 4 |

| | |

| 7. | Stock Appreciation Rights | 4 |

| | |

| 8. | Performance Shares | 5 |

| | |

| 9. | Restricted Stock | 5 |

| | |

| 10. | Other Stock-Based Awards | 5 |

| | |

| 11. | Operating Partnership Units | 6 |

| | |

| 12. | Award Agreements | 7 |

| | |

| 13. | Withholding | 7 |

| | |

| 14. | Nontransferability | 7 |

| | |

| 15. | No Right to Employment | 7 |

| | |

| 16. | Adjustment of and Changes in Shares | 7 |

| | |

| 17. | Amendment | 8 |

| | |

| 18. | Section 409 A | 8 |

| | |

| 19. | Effective Date | 8 |

1. Purpose

The purpose of the 2024 Omnibus Share Plan of Urban Edge Properties, as amended from time to time (the “Plan”), is to promote the financial interests of Urban Edge Properties (the “Trust”), including its growth and performance, by encouraging employees of the Trust and its subsidiaries, including officers (together, the “Employees”), its non-employee trustees of the Trust and non-employee directors of its subsidiaries (together, the “Non-Employee Trustees”), and certain non-employee advisors and consultants that provide bona fide services to the Trust or its subsidiaries (together, the “Consultants”) to acquire an ownership position in the Trust, enhancing the ability of the Trust and its subsidiaries to attract and retain Employees, Non-Employee Trustees and Consultants of outstanding ability, and providing Employees, Non-Employee Trustees and Consultants with a way to acquire or increase their proprietary interest in the Trust’s success and to further align the interests of the Employees, Non-Employee Trustees and Consultants with shareholders of the Trust.

2. Shares Available for Awards

Subject to the provisions of this Section 2 or any adjustment as provided in Section 16, awards may be granted under the Plan with respect to 3,700,000 Share Equivalents (as defined below), which, in accordance with the share counting provisions of this Section 2, would result in the issuance of up to a maximum of 3,700,000 common shares, par value $.01, of beneficial interest in the Trust (the “Shares”) if all awards granted under the Plan were Full Value Awards (as defined below) and 7,400,000 Shares if all awards granted under the Plan were not Full Value Awards. The Shares issued under the Plan may be authorized and unissued Shares or treasury Shares, as the Trust may from time to time determine. Any Shares that are subject to awards that are not Full Value Awards shall be counted against the number of Share Equivalents available for the grant of awards under the Plan, as set forth in the first sentence of this Section 2, as one-half Share Equivalent for every Share granted pursuant to an award; any Shares that are subject to awards that are Full Value Awards shall be counted as one Share Equivalent for every Share granted pursuant to an award. “Full Value Award” means an award under the Plan other than a stock option, stock appreciation right or other award that does not deliver to a Participant on the grant date of such award the full value of the underlying Shares. “Share Equivalent” shall be the measuring unit for purposes of the Plan to determine the number of Shares that may be subject to awards hereunder, which number of Shares shall not in any event exceed 7,400,000, subject to the provisions of this Section 2 or any adjustment as provided in Section 16.

The Committee (as defined in Section 3) may, without affecting the number of Share Equivalents available pursuant to this Section 2, authorize the issuance or assumption of benefits under the Plan in connection with any merger, consolidation, acquisition of property or stock, reorganization or similar transaction upon such terms and conditions as it may deem appropriate, subject to compliance with Section 409A (as defined in Section 16) and any other applicable provisions of the Code.

Shares subject to an award granted under the Plan or the Trust’s 2015 Omnibus Share Plan that expires, is forfeited, terminated or cancelled, in whole or in part, other than by exercise, or is paid in cash in lieu of Shares, shall thereafter again be available for grant under the Plan; provided, however, that the number of Share Equivalents that shall again be available for the grant under the Plan shall be increased by one Share Equivalent for each Share that is subject to a Full Value Award at the time such Full Value Award expires or is forfeited, terminated or cancelled and by one-half Share Equivalent for each Share that is subject to an award that is not a Full Value Award at the time such award expires or is forfeited, terminated or cancelled. Awards that use Shares as a reference but that are paid or settled in whole or in part in cash shall not affect the number of Share Equivalents available under the Plan pursuant to this Section 2 to the extent paid or settled in cash. The number of Share Equivalents available for the purpose of awards under the Plan shall be reduced by (i) one-half of the gross number of Shares for which stock options or stock appreciation rights are exercised, regardless of whether any of the Shares underlying such awards are not actually issued to the Participant as the result of a net settlement and (ii) one-half of any Shares withheld to satisfy any tax withholding obligation with respect to any award that is not a Full Value Award and one Share for each Share withheld to satisfy any tax withholding obligation with respect to any Full Value Award, as described further in Section 13. Notwithstanding the foregoing, the following Shares shall not be added to the Shares authorized for grant under the Plan: (i) shares tendered or held back upon exercise of a stock option or settlement of an award to cover the exercise price or tax withholding and (ii) Shares subject to a stock appreciation right that are not issued in connection with the stock settlement of the stock appreciation right upon exercise thereof.

The maximum aggregate number of Shares that may be issued under the Plan pursuant to the exercise of incentive stock options within the meaning of Section 422 of the Internal Revenue Code of 1986 (the “Code”) shall not exceed 3,700,000 Shares (as adjusted pursuant to the provisions of Section 16).

3. Administration

The Plan shall be administered by the Compensation Committee (the “Committee”) of the Board of Trustees of the Trust. A majority of the Committee shall constitute a quorum, and the acts of a majority shall be the acts of the Committee. Notwithstanding anything to the contrary contained herein, the Board of Trustees may, in its sole discretion, at any time and from time to time, grant awards or administer the Plan. In any such case, the Board of Trustees will have all of the authority and responsibility granted to the Committee herein.

Subject to the provisions of the Plan, the Committee shall select the Employees, Non-Employee Trustees and Consultants who will be participants in the Plan (together, the “Participants”). The Committee shall (i) determine the type of awards to be made to Participants, determine the Shares or share units subject to awards, and (ii) have the authority to interpret the Plan, to establish, amend, and rescind any rules and regulations relating to the Plan, to determine the terms and provisions of any agreements entered into hereunder, and to make all other determinations necessary or advisable for the administration of the Plan, based on, among other things, information made available to the Committee by the management of the Trust. The Committee may correct any defect, supply any omission or reconcile any inconsistency in the Plan or in any award in the manner and to the extent it shall deem desirable to carry it into effect. The determinations of the Committee in its administration of the Plan, as described herein, shall be final and conclusive.

4. Eligibility

All Employees who have demonstrated significant management potential or who have the capacity for contributing in a substantial measure to the successful performance of the Trust, as determined by the Committee, and Non-Employee Trustees and Consultants, as determined by the Committee, are eligible to be Participants in the Plan.

5. Awards

Awards under the Plan may consist of the following: stock options (either incentive stock options within the meaning of Section 422 of the Code or non-qualified stock options), stock appreciation rights, performance shares, grants of restricted stock and other-stock based awards, including OP Units (as defined in Section 11). Awards of performance shares, restricted stock or share units and other-stock based awards may provide the Participant with dividends or dividend equivalents and voting rights prior to vesting (whether based on a period of time or based on attainment of specified performance conditions). Unless the Committee otherwise specifies in the award agreement, if dividends or dividend equivalent rights are granted, dividends and dividend equivalents shall be paid to the Participant at the same time as the Trust pays dividends to common shareholders (even if the Shares subject to the underlying award are held by the Trust) but not less than annually and not later than the fifteenth day of the third month following the end of the calendar year in which the dividends or dividend equivalents are credited (or, if later, the fifteenth day of the third month following the end of the calendar year in which the dividends or dividend equivalents are no longer subject to a “substantial risk of forfeiture” within the meaning of Section 409A (as defined in Section 16)); provided, however, that dividend and dividend equivalent payments in the case of an award that is subject to performance vesting conditions shall be treated as unvested so long as such award remains unvested, and any such dividend and dividend equivalent payments that would otherwise have been paid during the vesting period shall instead be accumulated (and, if paid in cash, reinvested in additional Shares based on the Surrender Value (as defined in Section 6) of the Shares on the date of reinvestment) and paid within 30 days following the date on which such award is determined by the Committee to have satisfied such performance vesting conditions. Any dividends or dividend equivalents that are accumulated and paid after the date specified in the preceding sentence may be treated separately from the right to other amounts under the award.

Notwithstanding any other provision of the Plan to the contrary, Full Value Awards (a) that vest on the basis of the Participant’s continued employment or service shall be subject to a minimum vesting schedule of at least three years (with no more than one-third of the Shares subject thereto vesting earlier than a date 60 days prior to the first anniversary of the date on which such award is granted and on each of the next two anniversaries of such initial

vesting date) and (b) that vest on the basis of the attainment of performance goals shall provide for a performance period that ends no earlier than 60 days prior to the first anniversary of the commencement of the period over which performance is evaluated; provided, however, that the foregoing limitations shall not preclude the acceleration of vesting of any such award upon the death, disability or retirement of the Participant or upon an actual change in control (and not, for example, the commencement of a tender offer for the Trust’s shares or shareholder approval of a transaction that, if consummated, would result in an actual change in control). Notwithstanding the foregoing, Full Value Awards with respect to 5% of the maximum aggregate number of Share Equivalents available for the purpose of awards under the Plan pursuant to Section 2 may be granted under the Plan to any one or more Participants without respect to such minimum vesting provisions.

6. Stock Options

The Committee shall establish the option price at the time each stock option is granted, which price shall not be less than 100% of the Fair Market Value (as defined below) of the Shares on that date. Stock options shall be exercisable for such period as specified by the Committee but in no event may options be exercisable more than ten years after their date of grant. No stock option shall be exercisable earlier than a date 60 days prior to the first anniversary of the date on which such award is granted, except in the event of the Participant’s retirement, death or disability or an actual change in control. The option price of each Share as to which a stock option is exercised shall be paid in full at the time of such exercise. Such payment shall be made (i) in cash, (ii) by tender of Shares owned by the Participant valued at Surrender Value as of the date of exercise, (iii) to the extent approved by the Committee in its sole discretion, by surrender of all or part of the Shares issuable upon exercise of the option by the largest whole number of Shares with a Surrender Value that does not exceed the aggregate exercise price; provided, however, that the Trust shall accept a cash or other payment from the Participant to the extent of any remaining balance of the aggregate exercise price not satisfied by such reduction in the number of whole Shares to be issued, (iv) in such other consideration as the Committee deems appropriate, or (v) by a combination of cash, Shares and such other consideration.

For purposes of the Plan, (i) “Fair Market Value” means, with respect to a Share, the average of the high and the low prices reported for the Shares on the applicable date as reported on the New York Stock Exchange or, if not so reported, as determined in accordance with a valuation methodology approved by the Committee in a manner consistent with Section 409A, unless determined as otherwise specified herein and (ii) “Surrender Value” means, with respect to a Share, the closing price reported for the Shares on the applicable date as reported on the New York Stock Exchange or, if not so reported, as determined in accordance with a valuation methodology approved by the Committee in a manner consistent with Section 409A, unless determined as otherwise specified herein. For purposes of the grant of any award, the applicable date will be the trading day on which the award is granted or, if the date the award is granted is not a trading day, the trading day immediately prior to the date the award is granted. For purposes of the exercise of any award, the applicable date is the date a notice of exercise is received by the Trust or, if such date is not a trading day, the trading day immediately following the date a notice of exercise is received by the Trust.

7. Stock Appreciation Rights

Stock appreciation rights may be granted in tandem with a stock option, in addition to a stock option, or may be freestanding and unrelated to a stock option. Stock appreciation rights granted in tandem with or in addition to a stock option may be granted either at the same time as the stock option or at a later time. The Committee shall establish the grant price of each stock appreciation right granted at the time each such stock appreciation right is granted, which price shall not be less than 100% of the Fair Market Value of the Shares subject to such award on that date. No stock appreciation right shall be exercisable earlier than a date 60 days prior to the first anniversary of the date on which such award is granted, except in the event of the Participant’s retirement, death or disability or an actual change in control, or later than 10 years from the grant date of such award. A stock appreciation right shall entitle the Participant to receive from the Trust an amount equal to the increase of the Fair Market Value of the Shares on the exercise of the stock appreciation right over the grant price. The Committee, in its sole discretion, shall determine whether the stock appreciation right shall be settled in cash, Shares or a combination of cash and Shares.

8. Performance Shares

Performance shares may be granted in the form of actual Shares or share units having a value equal to an identical number of Shares. In the event that a certificate is issued in respect of Shares subject to a grant of performance shares, such certificate shall be registered in the name of the Participant but shall be held by the Trust until the time the Shares subject to the grant of performance shares are earned. The performance conditions and the length of the performance period shall be determined by the Committee. The Committee, in its sole discretion, shall determine whether performance shares granted in the form of share units shall be paid in cash, Shares, or a combination of cash and Shares.

9. Restricted Stock

Restricted stock may be granted in the form of actual Shares or share units having a value equal to an identical number of Shares. In the event that a certificate is issued in respect of Shares subject to a grant of restricted stock, such certificate shall be registered in the name of the Participant but shall be held by the Trust until the end of the restricted period. The employment conditions and the length of the period for vesting of restricted stock shall be established by the Committee at time of grant. The Committee, in its sole discretion, shall determine whether restricted stock granted in the form of share units shall be paid in cash, Shares, or a combination of cash and Shares.

10. Other Cash-Based and Stock-Based Awards

Other types of cash-based, equity-based or equity-related awards (including the grant or offer for sale of unrestricted Shares and performance stock and performance units settled in shares or cash) may be granted under such terms and conditions as may be determined by the Committee in its sole discretion. Such awards may, at the discretion, be subject to performance-based conditions. Any such performance-based conditions shall be based on one or more of the following business criteria (either separately or in combination) with regard to the Trust (or a subsidiary, division, other operational unit or administrative department of the Trust): (i) pre-tax income, (ii) after-tax income, (iii) net income (meaning net income as reflected in the Trust’s financial reports for the applicable period, on an aggregate, diluted and/or per share basis), (iv) operating income, (v) cash flow, (vi) earnings per share, (vii) return on equity, (viii) return on invested capital or assets, (ix) cash and/or funds available for distribution, (x) appreciation in the Fair Market Value of Shares, (xi) return on investment, (xii) total return to shareholders, (xiii) net earnings growth, (xiv) stock appreciation (meaning an increase in the price or value of the Shares after the date of grant of an award and during the applicable period), (xv) related return ratios, (xvi) increase in revenues, (xvii) net earnings, (xviii) changes (or the absence of changes) in the per share or aggregate market price of the Shares, (xix) number of securities sold, (xx) earnings before any one or more of the following items: interest, taxes, depreciation or amortization for the applicable period, as reflected in the Trust’s financial reports for the applicable period, (xxi) total revenue growth (meaning the increase in total revenues after the date of grant of an award and during the applicable period, as reflected in the Trust’s financial reports for the applicable period), (xxii) total shareholder return, (xxiii) funds from operations, as determined and reported by the Trust in its financial reports, (xxiv) increase in net asset value per Share, (xxv) economic value-added, (xxvi) volume of acquisitions, dispositions or other strategic transactions, (xxvii) productivity, (xxviii) development-related activities, (xxix) leasing, (xxx) rent growth, occupancy or percentage leased, and (xxxi) balance sheet measures. The performance goals may differ from Participant to Participant.

Performance criteria may be absolute amounts or percentages of amounts or may be relative to the performance of a peer group of real estate investment trusts or other corporations or indices. Except as otherwise expressly provided, all financial terms are used as defined under Generally Accepted Accounting Principles (“GAAP”) and all determinations shall be made in accordance with GAAP, as applied by the Trust in the preparation of its periodic reports to shareholders. In addition, the performance goals may be based upon the attainment of specified levels of Trust (or subsidiary, division, other operational unit or administrative department of the Trust) performance under one or more of the measures described above relative to the performance of other real estate investment trusts or the historic performance of the Trust. Unless the Committee provides otherwise at the time of establishing the performance goals, for each fiscal year of the Trust, the Committee may provide for objectively determinable adjustments, modifications or amendments, as determined in accordance with GAAP, to any of the performance criteria described above for one or more of the items of gain, loss, profit or expense: (A) determined to be extraordinary or unusual in nature or infrequent in occurrence, (B) related to the disposal of a segment of a business, (C) related to a change in accounting principle under GAAP, (D) related to discontinued

operations that do not qualify as a segment of business under GAAP, and (E) attributable to the business operations of any entity acquired by the Trust during the fiscal year.

Following the completion of each performance period, the Committee shall have the sole discretion to determine, based on information made available to the Committee by the management of the Trust, whether the applicable performance goals have been met with respect to a given Participant and, if they have, shall so certify and ascertain the amount of the applicable performance-based award. No Performance-Based Awards will be paid for such performance period until such certification is made by the Committee. The amount of the Performance-Based Award actually paid to a given Participant may be less (but not more) than the amount determined by the applicable performance goal formula, at the discretion of the Committee. The amount of the Performance-Based Award determined by the Committee for a performance period shall be paid to the Participant at such time as determined by the Committee in its sole discretion, after the end of such performance period and after the Committee’s certification described above.

11. Operating Partnership Units

Awards may be granted under the Plan in the form of undivided fractional limited partnership interests in Urban Edge Properties LP (together with any successor entity, the “Operating Partnership”), a Delaware limited partnership, the entity through which the Trust conducts its business and an entity that has elected to be treated as a partnership for federal income tax purposes, of one or more classes (“OP Units”) established pursuant to the Operating Partnership’s agreement of limited partnership, as amended from time to time. Awards of OP Units shall be valued by reference to, or otherwise determined by reference to or based on, Shares. OP Units awarded under the Plan may be (1) convertible, exchangeable or redeemable for other limited partnership interests in the Operating Partnership (including OP Units of a different class or series) or Shares, or (2) valued by reference to the book value, fair value or performance of the Operating Partnership. Awards of OP Units are intended to qualify as “profits interests” within the meaning of IRS Revenue Procedure 93-27, as clarified by IRS Revenue Procedure 2001-43, with respect to a Participant in the Plan who is rendering services to or for the benefit of the Operating Partnership, including its subsidiaries.

For purposes of calculating the number of Shares underlying an award of OP Units relative to the total number of Share Equivalents available for issuance under the Plan, the Committee shall establish in good faith the maximum number of Shares to which a Participant receiving such award of OP Units may be entitled upon fulfillment of all applicable conditions set forth in the relevant award documentation, including vesting conditions, partnership capital account allocations, value accretion factors, conversion ratios, exchange ratios and other similar criteria. If and when any such conditions are no longer capable of being met, in whole or in part, the number of Shares underlying such awards of OP Units shall be reduced accordingly by the Committee, and the number of Share Equivalents shall be increased by one Share Equivalent for each Share so reduced. Awards of OP Units may be granted either alone or in addition to other awards granted under the Plan. The Committee shall determine the eligible Participants to whom, and the time or times at which, awards of OP Units shall be made; the number of OP Units to be awarded; the price, if any, to be paid by the Participant for the acquisition of such OP Units; and the restrictions and conditions applicable to such award of OP Units. Conditions may be based on continuing employment (or other service relationship), computation of financial metrics and/or achievement of pre-established performance goals and objectives, with related length of the service period for vesting, minimum or maximum performance thresholds, measurement procedures and length of the performance period to be established by the Committee at the time of grant, in its sole discretion. The Committee may allow awards of OP Units to be held through a limited partnership, or similar “look-through” entity, and the Committee may require such limited partnership or similar entity to impose restrictions on its partners or other beneficial owners that are not inconsistent with the provisions of this Section 11. The provisions of the grant of OP Units need not be the same with respect to each Participant.

Notwithstanding Section 5 of the Plan, the award agreement or other award documentation in respect of an award of OP Units may provide that the recipient of an award under this Section 11 shall be entitled to receive, currently or on a deferred or contingent basis, dividends or dividend equivalents with respect to the number of Shares underlying the award or other distributions from the Operating Partnership prior to vesting (whether based on a period of time or based on attainment of specified performance conditions), as determined at the time of grant by the Committee, in its sole discretion, and the Committee may provide that such amounts (if any) shall be deemed to have been reinvested in additional Shares or OP Units.

OP Units awarded under this Section 11 may be issued for no cash consideration.

12. Award Agreements

Each award under the Plan shall be evidenced by an agreement setting forth the terms and conditions, as determined by the Committee, which shall apply to such award, in addition to the terms and conditions specified in the Plan.

13. Withholding

The Trust shall have the right to deduct from any payment to be made pursuant to the Plan, or to require prior to the issuance or delivery of any Shares or the payment of cash under the Plan, any taxes required by law to be withheld therefrom. The Committee, in its sole discretion, may permit a Participant who is an employee of the Trust or its subsidiaries to elect to satisfy such withholding obligation by having the Trust retain the number of Shares whose Fair Market Value equals the minimum statutory amount of taxes required by applicable law to be withheld. Any fraction of a Share required to satisfy such obligation shall be disregarded, and the amount due shall instead be paid in cash to or by the Participant, as the case may be.

14. Nontransferability

No award under the Plan shall be assignable or transferable except by will or the laws of descent and distribution, and no right or interest of any Participant shall be subject to any lien, obligation or liability of the Participant. Notwithstanding the foregoing, the Committee may determine, at the time of grant or thereafter, that an award (other than stock options intended to be incentive stock options within the meaning of Section 422 of the Code) is transferable by the Participant to such Participant’s immediate family members (or trusts, partnerships, or limited liability companies established for such immediate family members). For this purpose, immediate family member means, except as otherwise defined by the Committee, the Participant’s children, stepchildren, grandchildren, parents, stepparents, grandparents, spouse, siblings (including half brothers and sisters), in-laws and persons related by reason of legal adoption. Such transferees may transfer an award only by will or the laws of descent or distribution. An award transferred pursuant to this Section 14 shall remain subject to the provisions of the Plan, and shall be subject to such other rules as the Committee shall determine. Upon transfer of a stock option, any related stock appreciation right shall be canceled. Except in the case of a holder’s incapacity, an award shall be exercisable only by the holder thereof.

15. No Right to Employment

No person shall have any claim or right to be granted an award, and the grant of an award shall not be construed as giving a Participant any right to continue his or her service to the Trust or its subsidiaries as an Employee, Non-Employee Trustee or Consultant. Further, the Trust and its subsidiaries expressly reserve the right at any time to dismiss a Participant free from any liability, or any claim under the Plan, except as provided herein or in any agreement entered into hereunder.

16. Adjustment of and Changes in Shares

In the event of any change in the outstanding Shares by reason of any share dividend or split, reverse split, recapitalization, merger, consolidation, spinoff, combination or exchange of Shares or other corporate change, or any distributions to common shareholders other than regular cash dividends, the Committee shall make such substitution or adjustment, if any, as it deems to be equitable, as to (i) the number of Share Equivalents for which awards may be granted under the Plan, (ii) the number or kind of Shares or other securities issued or reserved for issuance pursuant to outstanding awards, (iii) the individual Participant limitation set forth in Section 2, and (iv) the number of Shares set forth in Section 2 that can be issued through incentive stock options within the meaning of Section 422 of the Code; provided, however, that no such substitution or adjustment shall be required if the Committee determines that such action could cause an award to fail to satisfy the conditions of an applicable exception from the requirements of Section 409A of the Code (“Section 409A”) or otherwise could subject a Participant to the additional tax imposed under Section 409A in respect of an outstanding award; and further provided that no Participant shall have the right to require the Committee to make any adjustment or substitution under this Section 16 or have any claim or right whatsoever against the Trust or any of its subsidiaries or affiliates or

any of their respective trustees, directors, officer or employees in respect of any action taken or not taken under this Section 16.

17. Amendment

The Committee may amend or terminate the Plan or any portion thereof from time to time, provided that no amendment shall be made without shareholder approval if such amendment (i) would increase the maximum aggregate number of Shares that may be issued under the Plan (other than pursuant to Section 16), (ii) would materially modify the requirements for participation in the Plan, (iii) would result in a material increase in the benefits accrued to Participants under the Plan, (iv) would reduce the exercise price of outstanding stock options or stock appreciation rights or cancel outstanding stock options or stock appreciation rights in exchange for cash, other awards or stock options or stock appreciation rights with an exercise price that is less than the exercise price of the original stock options or stock appreciation rights (other than pursuant to Section 16) or (v) requires shareholder approval to comply with any applicable laws, regulations or rules, including the rules of a securities exchange or self-regulatory agency.

18. Section 409A

It is the Trust’s intent that awards under the Plan be exempt from, or comply with, the requirements of Section 409A, and that the Plan be administered and interpreted accordingly. If and to the extent that any award made under the Plan is determined by the Trust to constitute “non-qualified deferred compensation” subject to Section 409A and is payable to a Participant by reason of the Participant’s termination of employment, then (a) such payment or benefit shall be made or provided to the Participant only upon a “separation from service” as defined for purposes of Section 409A under applicable regulations and (b) if the Participant is a “specified employee” (within the meaning of Section 409A and as determined by the Trust), such payment or benefit shall not be made or provided before the date that is six months after the date of the Participant’s separation from service (or the Participant’s earlier death).

19. Effective Date

The Plan was adopted on February 9, 2024 by the Compensation Committee of the Board of Trustees of the Trust and on February 22, 2024 by the Board of Trustees of the Trust, in each case, subject to the approval of the shareholders of the Trust, and shall be effective as of the date of such shareholder approval (the “Effective Date”). Subject to earlier termination pursuant to Section 17, the Plan shall have a term of ten years from the Effective Date; provided, however, that all awards made under the Plan before its termination, and the Committee’s authority to administer the terms of such awards, will remain in effect until such awards have been satisfied or terminated in accordance with the terms and provisions of the Plan and the applicable award agreements.

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Urban Edge Properties

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Security

Type | | Security Class Title | | Fee

Calculation

Rule | | Amount

Registered(1)(2) | | Proposed

Maximum

Offering

Price Per

Unit(3) | | Maximum

Aggregate

Offering

Price | | Fee Rate | | Amount of

Registration

Fee |

| Equity | | Common Shares, par value $0.01 per share | | Other | | 7,400,000 | | $16.69 | | $123,506,000 | | 0.0001476 | | $18,229.49 |

| | | | | | | | | | | | | | | | |

| Total Offering Amounts | | | | | | | | | | $18,229.49 |

| Total Fee Offsets | | | | | | | | | | $— |

| Net Fee Due | | | | | | | | | | $18,229.49 |

| | | | | |

| (1) | Pursuant to Rule 416(a) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover an indeterminate number of additional common shares, par value $0.01 per share (“Common Shares”), of Urban Edge Properties (the “Company”) as may be required pursuant to the Urban Edge Properties 2024 Omnibus Share Plan (the “2024 Plan”) in the event of a stock split, stock dividend, recapitalization or similar transaction. |

| (2) | Consists of 7,400,000 Common Shares issuable pursuant to the 2024 Plan. |

| (3) | Calculated solely for the purpose of computing the registration fee in accordance with Rules 457(c) and 457(h) under the Securities Act based on the average of the high and the low sales prices of shares of the Company’s Common Shares as reported on the New York Stock Exchange on April 29, 2024. |

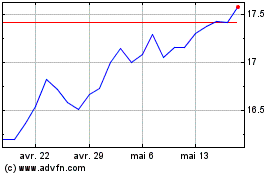

Urban Edge Properties (NYSE:UE)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Urban Edge Properties (NYSE:UE)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024