Universal's Insurance Subsidiaries Complete 2024-2025 Reinsurance Program

30 Mai 2024 - 10:10PM

Business Wire

- Successfully secured a combined UPCIC and APPCIC catastrophe

reinsurance program with no material changes to historical

reinsurance partners or terms and conditions.

- Replaced $217M of cost-free Reinsurance to Assist Policyholders

(RAP) coverage and $150M of expiring catastrophe bond coverage in

the traditional reinsurance market.

- Total cost of the 2024-2025 reinsurance program for UPCIC and

APPCIC projected to be approximately 33.0% of estimated direct

earned premium for the 12-month treaty period, compared to 31.8% at

this time last year, reflecting a modest 1.2-point year over year

increase despite our demand for private market capacity increasing

significantly.

- The largest private reinsurance participants all maintain a

rating from AM Best of ‘A’ or higher (Nephila Capital, Markel,

RenaissanceRe, Munich Re, Chubb Tempest Re, Ariel Re, Everest Re

and Lloyd’s of London syndicates).

Universal Insurance Holdings, Inc. (NYSE: UVE) (“Universal” or

the “Company”) today announced the completion by Universal Property

& Casualty Insurance Company (“UPCIC”) and American Platinum

Property and Casualty Insurance Company (“APPCIC”), the Company’s

wholly-owned insurance company subsidiaries, of their combined

2024-2025 reinsurance program, effective June 1, 2024.

“We are pleased to announce the completion of the 2024-2025

reinsurance program for both of our insurance companies,” said

Matthew J. Palmieri, Chief Risk Officer. “Reinsurance serves as the

fulcrum of our insurance entities’ ability to absorb multiple

catastrophic events in a given year, protecting policyholders and

allowing operations to continue smoothly. For this renewal, we

approached the market with considerably more private market

catastrophe capacity demand and the Company executed efficiently

with our long-standing reinsurance partners ahead of the upcoming

2024 Atlantic Hurricane Season. We also added new multi-year

coverage extending through the 2025-2026 reinsurance period in the

process.”

UPCIC’s in force wind-covered policy count in Florida declined

by 25,266 from March 31, 2023 to March 31, 2024, resulting in a

year over year reduction to the top end of the combined first event

reinsurance tower for our insurance subsidiaries. UPCIC and APPCIC

set the top of their combined reinsurance tower for a single All

States (including Florida) event to $2.404 billion. $1.023 billion

of this coverage has limits that automatically reinstate to

guarantee a certain level of protection in multi-event scenarios,

an increase of $177 million in aggregate limit available for

subsequent events over the 2023-2024 period.

To further insulate future years, UPCIC and APPCIC secured $240

million of catastrophe capacity with contractually agreed limits

that extend coverage to include the 2025-2026 treaty year, of which

$165 million of the capacity sits below the Florida Hurricane

Catastrophe Fund and $75 million sits above the Florida Hurricane

Catastrophe Fund.

The insurance entities’ combined $45 million All States

(including Florida) first event retention loss is unchanged from

the prior year.

About Universal

Universal Insurance Holdings, Inc. (NYSE: UVE) is a holding

company providing property and casualty insurance and value-added

insurance services. We develop, market, and write insurance

products for consumers predominantly in the personal residential

homeowners lines of business and perform substantially all other

insurance-related services for our primary insurance entities,

including risk management, claims management and distribution. We

provide insurance products in the United States through both our

appointed independent agents and our direct online distribution

channels, primarily in Florida. Learn more at

universalinsuranceholdings.com or get an insurance quote at

clovered.com.

Forward-Looking Statements

This press release may contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. The words “believe,” “expect,” “anticipate,” “will,”

“plan,” and similar expressions identify forward-looking

statements, which speak only as of the date the statement was made.

Such statements may include commentary on plans, products and lines

of business, marketing arrangements, reinsurance programs and other

business developments and assumptions relating to the foregoing.

Forward-looking statements are inherently subject to risks and

uncertainties, some of which cannot be predicted or quantified,

including those risks and uncertainties described under the heading

“Risk Factors” and “Liquidity and Capital Resources” in our 2023

Annual Report on Form 10-K, and supplemented in our subsequent

Quarterly Reports on Form 10-Q. Future results could differ

materially from those described, and the Company disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events,

or otherwise. For further information regarding risk factors that

could affect the Company’s operations and future results, refer to

the Company’s reports filed with the Securities and Exchange

Commission, including the Company’s Annual Report on Form 10-K and

the most recent quarterly reports on Form 10-Q.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240530371611/en/

Investors/Media: Arash Soleimani, CFA, CPA, CPCU, ARe

Chief Strategy Officer asoleimani@universalproperty.com

954-804-8874

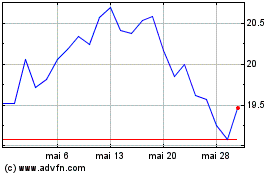

Universal Insurance (NYSE:UVE)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Universal Insurance (NYSE:UVE)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024