INNOVATE Corp. Announces Rights Offering for Common Stock

26 Février 2024 - 2:00PM

INNOVATE Corp. (“INNOVATE” or the “Company”) (NYSE: VATE), a

diversified holding company, announced today that its Board of

Directors (the “Board”) has approved a plan to proceed with and

fixed a record date for an $19.0 million rights offering for its

common stock.

All INNOVATE stockholders will have the

opportunity to participate in the offering and subscribe for their

basic subscription amount of newly issued shares of common stock in

proportion to their respective existing ownership amounts. INNOVATE

stockholders who exercise their respective full basic subscription

rights will have over-subscription privileges giving such INNOVATE

stockholders the option to subscribe for any shares of common stock

that remain unsubscribed at the expiration of the rights offering.

If the aggregate subscriptions (basic subscriptions plus

over-subscriptions) exceed the amount offered in the rights

offering, then the aggregate over-subscription amount will be

pro-rated among the stockholders exercising their respective

over-subscription privileges based on the basic subscription

amounts of such stockholders.

The Company will distribute to each holder of

the Company’s common stock as of March 6, 2024 (the “rights

offering record date”), one transferable subscription right to

purchase shares of the Company’s common stock at a price to be

determined prior to commencement of the rights offering. Holders of

the Company’s existing preferred stock and convertible notes that

are entitled to participate in dividend distributions to holders of

the Company’s common stock will also be entitled to participate in

the rights offering. The offering will expire at 5:00 PM Eastern

Time on March 25, 2024, unless extended by the Company. The Company

expects to mail subscription rights certificates evidencing the

rights and a copy of the prospectus supplement for the offering to

record date stockholders beginning on March 8, 2024.

The rights offering will be backstopped by

Lancer Capital LLC (“Lancer Capital”), an investment fund led by

Avram A. Glazer, the Chairman of the Board and the Company’s

largest stockholder. Lancer Capital will not be permitted to

exercise or transfer any subscription rights received by it, or to

acquire other rights, in the rights offering, which rights are

required to be held by Lancer Capital until the expiration thereof.

Due to limitations of common stock that can be acquired by Lancer

Capital, in lieu of exercising its subscription rights, Lancer

Capital will purchase up to $19.0 million of the Company’s newly

issued Series C Non-Voting Participating Convertible Preferred

Stock (the “Preferred Stock”), for an issue price of $1,000 per

share. In connection with the backstop commitment, and as a result

of limitations in the amount common equity that can be raised under

the Company’s effective shelf registration statement on Form S-3,

Lancer Capital will also agree to purchase an additional $16.0

million of Preferred Stock in a private placement transaction to

close concurrently with the settlement of the rights offering. The

Preferred Stock terms will include a liquidation preference junior

to the Company’s existing preferred stock and equal to the

Company’s common stock (other than a preference of $0.001 per share

of Preferred Stock that will be paid to the holders of the

Preferred Stock before any payment or distribution is made to the

holders of the common stock).

If for any reason the settlement of the rights

offering does not occur by March 29, 2024, then on that date Lancer

Capital will purchase $25.0 million of Preferred Stock and, upon

the settlement of the Rights Offering, to the extent that Lancer

Capital would have, based on the number of shares of common stock

actually sold upon exercise of the rights, purchased less than

$25.0 million of Convertible Preferred Stock under the backstop

commitment and the concurrent private placement, the Company will

redeem such excess Preferred Stock from Lancer Capital at the

redemption price of $1,000 per share.

The Preferred Stock can be convertible into

common stock at the price equivalent to the subscription price

under the rights offering contingent on shareholder approval, which

will be voted on at the next annual meeting. If the Preferred Stock

is not converted to common stock, it may be redeemed at the

Company’s option or on the sixth anniversary of issuance plus

accrued interest of 8% which is only due upon redemption and not

conversion.

Lancer Capital’s backstop commitment and the

concurrent private placement will be effected in the manner set

forth in an investment agreement to be entered into with the

Company in connection with the commencement of the rights offering,

a copy of which will be filed by the Company with the SEC.

The Company has waived its Tax Benefit

Preservation Plan to permit persons exercising rights to acquire

4.9% or more of the outstanding common stock upon the exercise

thereof without becoming an Acquiring Person (as defined in the Tax

Benefit Preservation Plan).

INNOVATE expects to use the proceeds from the rights offering

for general corporate purposes.

The rights offering will be made

pursuant to INNOVATE’s effective shelf registration statement on

Form S-3, filed with the SEC on September 29, 2023 and declared

effective on October 6, 2023, and a prospectus supplement

containing the detailed terms of the rights offering to be filed

with the SEC. The information in this

press release is not complete and is subject to change. This press

release shall not constitute an offer to sell or a solicitation of

an offer to buy any securities (including without limitation the

Preferred Stock to be issued and sold in the concurrent private

placement), nor shall there be any offer, solicitation or sale of

the securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful under the securities laws of

such state or jurisdiction. The rights offering will be made only

by means of a prospectus and a related prospectus

supplement. Copies of the prospectus and

related prospectus supplement, when they become available, will be

distributed to all eligible stockholders as of the rights offering

record date and may also be obtained free of charge at the website

maintained by the SEC

at www.sec.gov or by

contacting the information agent for the rights

offering.

The Preferred Stock to be issued to

Lancer Capital pursuant to the backstop commitment and the

concurrent private placement will not be registered under the Act

and may not be offered or sold in the United States absent

registration or an applicable exemption from registration

requirements.

About INNOVATE

INNOVATE Corp. is a portfolio of

best-in-class assets in three key areas of the new economy –

Infrastructure, Life Sciences and Spectrum. Dedicated to

stakeholder capitalism, INNOVATE employs approximately 4,000 people

across its subsidiaries. For more information, please

visit: www.INNOVATECorp.com.

Cautionary Statement Regarding

Forward-Looking Statements

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995: This press release

contains, and certain oral statements made by our representatives

from time to time may contain, forward-looking statements regarding

the proposed rights offering and concurrent private placement,

including, among others, statements related to the expected timing,

eligible offerees, backstop purchasers and expectations

regarding participation in the rights offering, the use of

proceeds from the rights offering, the size of the rights offering

and other terms of the rights offering, all of which involve risks,

assumptions and uncertainties, many of which are outside of the

Company's control, and are subject to change. The commencement and

consummation of the rights offering are also subject to customary

conditions, including declaration by the Board of the dividend

constituting the rights to be issued in the rights offering and

market conditions. Accordingly, no assurance can be given that the

rights offering or concurrent private placement will be consummated

on the terms described above or at all. All forward-looking

statements speak only as of the date made, and unless legally

required, INNOVATE undertakes no obligation to update or revise

publicly any forward-looking statements, whether as a result of new

information, future events or otherwise.

Contact:

Solebury Strategic CommunicationsAnthony

Rozmusir@innovatecorp.com(212) 235-2691

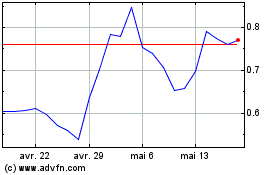

INNOVATE (NYSE:VATE)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

INNOVATE (NYSE:VATE)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024