false0001006837TRUE00010068372024-03-042024-03-040001006837dei:FormerAddressMember2024-03-042024-03-040001006837hchc:CommonStockParValue0001PerShareMember2024-03-042024-03-040001006837hchc:PreferredStockPurchaseRightsMember2024-03-042024-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of Earliest Event Reported): | March 4, 2024 |

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35210 | 54-1708481 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

295 Madison Ave., 12th Floor | | 10017 |

New York, NY | | |

| (Address of principal executive offices) | | (Zip Code) |

| | |

222 Lakeview Ave., Suite 1660, West Palm Beach, FL 33401 |

| Former name or former address, if changed since last report |

| | | | | | | | |

| Registrant’s telephone number, including area code: | | (212) 235-2691 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | VATE | New York Stock Exchange |

Preferred Stock Purchase Rights | N/A | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | ☐ | |

| | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02 Results of Operations and Financial Condition

On March 4, 2024, INNOVATE Corp. (the “Company”) issued a press release announcing its results for the quarter and year ended December 31, 2023 (the “Earnings Release”) and posted the INNOVATE Corp. Fourth Quarter 2023 Conference Call Investor Presentation to its Investor Relations section of the Company’s website at http://www.innovatecorp.com.

A copy of the Earnings Release and the investor presentation are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

As previously announced, the Company will conduct a conference call today, Monday, March 4, 2024 at 4:30 p.m. ET. The presentation slides to be used during the call, attached hereto as Exhibit 99.2, will be available on the “Investor Relations” section of the Company’s website (http://www.innovatecorp.com) immediately prior to the call. The conference call and the presentation slides will be simultaneously webcast on the “Investor Relations” section of the Company’s website beginning at 4:30 p.m. ET on Monday, March 4, 2024. The information contained in, or that can be accessed through the Company’s website is not a part of this filing.

The information in Item 2.02 and Item 7.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | INNOVATE Corp. |

| | |

| March 4, 2024 | By: | /s/ Michael J. Sena |

| | | |

| | | Name: Michael J. Sena |

| | | Title: Chief Financial Officer |

FOR IMMEDIATE RELEASE

INNOVATE Corp. Announces Fourth Quarter and Full Year 2023 Results

- Infrastructure: DBM Global achieved fourth quarter revenue of $353.8 million -

- Life Sciences: R2 experienced strong North America unit sales in the fourth quarter -

- Spectrum: Broadcasting entered into agreements with PBS stations for new commercial opportunities with ATSC 3.0 -

NEW YORK, NY, March 4, 2024 - INNOVATE Corp. (“INNOVATE” or the “Company”) (NYSE: VATE) announced today its consolidated results for the fourth quarter and full year.

Financial Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share amounts) | Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | Increase / (Decrease) | | 2023 | | 2022 | | Increase / (Decrease) |

| Revenue | $ | 361.0 | | | $ | 409.3 | | | (11.8) | % | | $ | 1,423.0 | | | $ | 1,637.3 | | | (13.1) | % |

| Net loss attributable to common stockholders | $ | (9.6) | | | $ | (7.0) | | | (37.1) | % | | $ | (37.6) | | | $ | (40.8) | | | 7.8 | % |

| Basic and Diluted loss per share - Net loss attributable to common stockholders | $ | (0.12) | | | $ | (0.09) | | | (33.3) | % | | $ | (0.48) | | | $ | (0.53) | | | 9.4 | % |

Total Adjusted EBITDA(1) | $ | 21.5 | | | $ | 28.1 | | | (23.5) | % | | $ | 65.0 | | | $ | 68.1 | | | (4.6) | % |

(1) Reconciliation of GAAP to Non-GAAP measures follows

Commentary

“2023 was another successful year for INNOVATE, with a number of exciting developments across the three operating segments,” said Avie Glazer, Chairman of INNOVATE. “The Infrastructure segment continues to deliver strong results and finished the year with Net Income of $28.7 million and Adjusted EBITDA of $100.6 million. At Life Sciences, MediBeacon and R2 achieved significant milestones in 2023. And at Spectrum, our refocused strategy is in the early innings and we remain excited about the future growth prospects in that business.”

“We are pleased with INNOVATE's 2023 results,” said Paul Voigt, INNOVATE's interim CEO. “Despite a challenging market backdrop, DBM delivered strong results while expanding margin throughout the year. At Pansend, MediBeacon made significant progress towards FDA approval, while R2 has experienced strong North America unit sales growth. Finally, Broadcasting launched new networks, is entering into agreements with public broadcast networks and are actively exploring broadcasting 5G opportunities in the United States.”

Fourth Quarter 2023 Highlights

Infrastructure

•DBM Global Inc. ("DBMG") reported fourth quarter 2023 revenue of $353.8 million, a decrease of 10.9%, compared to $397.3 million in the prior year quarter. Net Income was $8.9 million, compared to $5.9 million for the prior year quarter. Adjusted EBITDA decreased to $30.0 million from $32.7 million in the prior year quarter.

•DBM Global grew gross margin to 16.4% in the fourth quarter, an expansion of approximately 200 basis points year-over-year and Adjusted EBITDA margin to 8.5% in the fourth quarter, an expansion of approximately 25 basis points year-over-year.

•The tightening in the credit markets continued to impact the commercial space, however, DBM remained focused on protecting margins and delivered sequential Adjusted EBITDA margin expansion for the last three quarters in 2023.

•DBM Global’s reported backlog and adjusted backlog, which takes into consideration awarded but not yet signed contracts, was $1.1 billion and $1.2 billion as of December 31, 2023, respectively, compared to reported and adjusted backlog of $1.8 billion as of December 31, 2022.

Life Sciences

•R2 Technologies, Inc. ("R2") once again achieved record growth in North America for both system sales and number of patients treated.

•R2 sold out of all Glacial fx inventory in the fourth quarter.

•R2 received market approval in Saudi Arabia and United Arab Emirates ("UAE").

•MediBeacon remains optimistic regarding the FDA approval as it continues to answer outstanding questions from the FDA. As these final questions are resolved, MediBeacon’s goal is to achieve full FDA approval status and gain agreement on product labeling in 2024.

•On November 30, 2023, the Company sold a portion of its ownership in Triple Ring and received $5.0 million in cash proceeds and shares of Scaled Cell valued at $0.9 million.

Spectrum

•Gaining considerable traction with new network launches across the platform as evidenced by the launch of FreeTV and three large sport networks.

•Entered into agreements with PBS stations to provide ATSC 3.0 "lighthousing" along with commercial joint ventures in datacasting and other areas.

•Actively exploring 5G broadcasting opportunities in the U.S. and have filled an application with the Federal Communications Commission to convert an existing station to 5G broadcast in order to participate in Phase 2 proof of concept.

•For the fourth quarter of 2023, Broadcasting reported revenue of $5.7 million, compared to $10.7 million in the prior year quarter. The decrease was primarily driven by the elimination of advertising revenues at Azteca America network ("Azteca"), which ceased operations on December 31, 2022. This was partially offset by an increase in station revenues, which launched new markets and networks with its customers during 2023.

•For the fourth quarter of 2023, Broadcasting reported a Net Loss of $5.4 million compared to $2.8 million in the prior year quarter. Adjusted EBITDA was $1.1 million, compared to $2.5 million in the prior year quarter.

Fourth Quarter 2023 Financial Highlights

•Revenue: For the fourth quarter of 2023, INNOVATE's consolidated revenue was $361.0 million, a decrease of 11.8%, compared to $409.3 million for the prior year quarter. The decrease was primarily driven by our Infrastructure segment, and, to a lesser extent, our Spectrum segment. The decline at our Infrastructure segment was driven by timing and size of projects, mostly from DBMG's commercial structural steel fabrication and erection business, which was partially offset by increases at the industrial maintenance and repair business and at Banker Steel, while revenues at our Spectrum segment decreased primarily as a result of the termination of HC2 Network, Inc. ("Network") and its associated Azteca content on December 31, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| REVENUE by OPERATING SEGMENT |

| | | | | | | | | | | | |

| (in millions) | | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | Increase / (Decrease) | | 2023 | | 2022 | | Increase / (Decrease) |

| Infrastructure | | $ | 353.8 | | | $ | 397.3 | | | $ | (43.5) | | | $ | 1,397.2 | | | $ | 1,594.3 | | | $ | (197.1) | |

| Life Sciences | | 1.5 | | | 1.3 | | | 0.2 | | | 3.3 | | | 4.3 | | | (1.0) | |

| Spectrum | | 5.7 | | | 10.7 | | | (5.0) | | | 22.5 | | | 38.7 | | | (16.2) | |

| Consolidated INNOVATE | | $ | 361.0 | | | $ | 409.3 | | | $ | (48.3) | | | $ | 1,423.0 | | | $ | 1,637.3 | | | $ | (214.3) | |

•Net Loss: For the fourth quarter of 2023, INNOVATE reported a Net Loss attributable to common stockholders of $9.6 million, or $0.12 per fully diluted share, compared to a Net Loss of $7.0 million, or $0.09 per fully diluted share, for the prior year quarter. The increase in Net Loss was primarily due to an increase in interest expense from higher interest rates, increased amortization of debt issuance costs on the debt, and higher outstanding principal balances at all segments, as a result of new debt issued subsequent to the comparable period, an increase in net loss from our Life Sciences segment primarily as a result of higher equity method losses recognized from Pansend's investment in MediBeacon due to additional investments during 2023, which resulted in previously suspended losses being recognized as the investment's carrying amount was reduced to zero, an increase in net loss from our Spectrum segment related to a one-time benefit from the termination of Azteca in the comparable period, an increase in tax expense as a result of current state tax expense at certain tax paying entities due to increase in taxable income, an increase in net loss from our Other segment as a result of a write-off of prepaid rent, and an impairment of leasehold improvements as a result of unutilized space at our Non-Operating Corporate segment. The increase in Net Loss was partially offset by a decrease in selling, general and administrative expenses ("SG&A"), and decrease in depreciation and amortization. The overall decrease in SG&A was primarily driven by the unrepeated internal operational restructuring project in the comparable period at our Infrastructure segment, as well as decreases in SG&A at our Non-Operating Corporate segment and our Life Sciences segment driven primarily by R2 as a result of cost reduction initiatives. The overall decrease in depreciation and amortization was driven by Banker Steel, as certain intangibles were fully amortized subsequent to the comparable period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NET INCOME (LOSS) by OPERATING SEGMENT |

| | | | | | | | | | | | |

| (in millions) | | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | Increase / (Decrease) | | 2023 | | 2022 | | Increase / (Decrease) |

| Infrastructure | | $ | 8.9 | | | $ | 5.9 | | | $ | 3.0 | | | $ | 28.7 | | | $ | 29.2 | | | $ | (0.5) | |

| Life Sciences | | (6.2) | | | (4.3) | | | (1.9) | | | (15.5) | | | (19.2) | | | 3.7 | |

| Spectrum | | (5.4) | | | (2.8) | | | (2.6) | | | (22.2) | | | (13.3) | | | (8.9) | |

Non-Operating Corporate | | (5.4) | | | (4.9) | | | (0.5) | | | (33.2) | | | (35.3) | | | 2.1 | |

| Other and eliminations | | (1.2) | | | 0.4 | | | (1.6) | | | 7.0 | | | 2.7 | | | 4.3 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net loss attributable to INNOVATE Corp. | | $ | (9.3) | | | $ | (5.7) | | | (3.6) | | | $ | (35.2) | | | $ | (35.9) | | | $ | 0.7 | |

| Less: Preferred dividends | | 0.3 | | | 1.3 | | | (1.0) | | | 2.4 | | | 4.9 | | | (2.5) | |

| Net loss attributable to common stockholders | | $ | (9.6) | | | $ | (7.0) | | | $ | (2.6) | | | $ | (37.6) | | | $ | (40.8) | | | $ | 3.2 | |

•Adjusted EBITDA: For the fourth quarter of 2023, total Adjusted EBITDA, was $21.5 million, compared to total Adjusted EBITDA of $28.1 million for the prior year quarter. The decrease in Adjusted EBITDA was primarily driven by an increase in recurring SG&A expenses at our Infrastructure segment and by our Life Sciences segment primarily as a result of higher equity method losses recognized from Pansend's investment in MediBeacon due to additional investments during 2023 resulting in previously suspended losses being recognized as the investment's carrying amount was reduced to zero. Additionally contributing to the decrease in Adjusted EBITDA was our Spectrum segment as a result of a one-time benefit from the termination of Azteca in the comparable period and by our Other segment from the elimination of equity method income from our investment in HMN, which was sold on March 6, 2023. The decrease was partially offset by our Non-Operating Corporate segment due to a decrease in SG&A expenses and our Life Sciences segment driven by R2 due to a decrease in SG&A expenses as a result of cost reduction initiatives.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADJUSTED EBITDA by OPERATING SEGMENT | | | | | | | |

| | | | | | | | | | | |

| (in millions) | Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | Increase / (Decrease) | | 2023 | | 2022 | | Increase/(Decrease) |

| Infrastructure | $ | 30.0 | | | $ | 32.7 | | | $ | (2.7) | | | $ | 100.6 | | | $ | 101.7 | | | $ | (1.1) | |

| Life Sciences | (7.1) | | | (4.5) | | | (2.6) | | | (23.1) | | | (25.4) | | | 2.3 | |

| Spectrum | 1.1 | | | 2.5 | | | (1.4) | | | 2.0 | | | 4.5 | | | (2.5) | |

Non-Operating Corporate | (2.5) | | | (3.7) | | | 1.2 | | | (13.5) | | | (16.7) | | | 3.2 | |

| Other and eliminations | — | | | 1.1 | | | (1.1) | | | (1.0) | | | 4.0 | | | (5.0) | |

| Total Adjusted EBITDA | $ | 21.5 | | | $ | 28.1 | | | $ | (6.6) | | | $ | 65.0 | | | $ | 68.1 | | | $ | (3.1) | |

•Balance Sheet: As of December 31, 2023, INNOVATE had cash and cash equivalents, excluding restricted cash, of $80.8 million compared to $80.4 million as of December 31, 2022. On a stand-alone basis, as of December 31, 2023, our Non-Operating Corporate segment had cash and cash equivalents of $2.5 million compared to $9.1 million at December 31, 2022.

New York Stock Exchange Continued Listing Standards Notice

On February 26, 2024, the Company received written notice (the “Notice”) from the New York Stock Exchange (“NYSE”) that it does not presently meet NYSE’s continued listing standard requiring a minimum average closing price of $1.00 per share

over 30 consecutive trading days. The Notice does not result in the immediate delisting of the Company’s stock from the NYSE.

The Company plans to notify the NYSE that it intends to regain compliance and is considering all available options that are in the best interests of the Company and its shareholders. The Company has six months ("the Cure Period") following receipt of the notice to regain compliance with the minimum share price requirement. The Company can regain compliance at any time during the Cure Period if on the last trading day of any calendar month during the Cure Period the Company has a closing share price of at least $1.00 per share and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month.

Under NYSE rules, the Company’s common stock will continue to be listed on the NYSE during the Cure Period, subject to the Company’s compliance with other NYSE continued listing requirements.

The Notice does not affect the Company’s business operations, or its Securities and Exchange Commission reporting requirements, and does not conflict with or trigger any violation under the Company’s material debt or other agreements.

Conference Call

INNOVATE will host a live conference call to discuss its fourth quarter and full year 2023 financial results and operations today at 4:30 p.m. ET. The Company will post an earnings supplemental presentation in the Investor Relations section of the INNOVATE website at innovate-ir.com to accompany the conference call. Dial-in instructions for the conference call and the replay follows.

•Live Webcast and Call. A live webcast of the conference call can be accessed by interested parties through the Investor Relations section of the INNOVATE website at innovate-ir.com.

–Dial-in: 1-888-886-7786 (Domestic Toll Free) / 1-416-764-8658 (Toll/International)

–Participant Entry Number: 25925635

•Conference Replay*

–Dial-in: 1-844-512-2921 (Domestic Toll Free) / 1-412-317-6671 (Toll/International)

–Conference Number: 25925635

*Available approximately two hours after the end of the conference call through March 18, 2024.

About INNOVATE Corp.

INNOVATE Corp., is a portfolio of best-in-class assets in three key areas of the new economy – Infrastructure, Life Sciences and Spectrum. Dedicated to stakeholder capitalism, INNOVATE employs approximately 4,000 people across its subsidiaries. For more information, please visit: www.INNOVATECorp.com.

Contacts

Investor Contact:

Anthony Rozmus

ir@innovatecorp.com

(212) 235-2691

Non-GAAP Financial Measures

In this press release, INNOVATE refers to certain financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including Total Adjusted EBITDA (excluding discontinued operations, if applicable) and Adjusted EBITDA for its operating segments. In addition, other companies may define Adjusted EBITDA differently than we do, which could limit its usefulness.

Adjusted EBITDA

Management believes that Adjusted EBITDA provides investors with meaningful information for gaining an understanding of our results as it is frequently used by the financial community to provide insight into an organization’s operating trends and facilitates comparisons between peer companies, since interest, taxes, depreciation, amortization and the other items listed in the definition of Adjusted EBITDA below can differ greatly between organizations as a result of differing capital structures and tax strategies. Adjusted EBITDA can also be a useful measure of a company’s ability to service debt. While management believes that non-U.S. GAAP measurements are useful supplemental information, such adjusted results are not intended to replace our U.S. GAAP financial results. Using Adjusted EBITDA as a performance measure has inherent limitations as an analytical tool as compared to net income (loss) or other U.S. GAAP financial measures, as this non-GAAP measure excludes certain items, including items that are recurring in nature, which may be meaningful to investors. As a result of the exclusions, Adjusted EBITDA should not be considered in isolation and does not purport to be an alternative to net income (loss) or other U.S. GAAP financial measures as a measure of our operating performance.

The calculation of Adjusted EBITDA, as defined by us, consists of Net income (loss) attributable to INNOVATE Corp., excluding discontinued operations, if applicable; depreciation and amortization; other operating (income) loss, which is inclusive of (gain) loss on sale or disposal of assets, lease termination costs, asset impairment expense and FCC reimbursements; interest expense; other (income) expense, net; income tax expense (benefit); non-controlling interest; share-based compensation expense; legacy accounts receivable expense; restructuring and exit costs; and acquisition and disposition costs.

Cautionary Statement Regarding Forward-Looking Statements

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This press release contains, and certain oral statements made by our representatives from time to time may contain, "forward-looking statements." Generally, forward-looking statements include information describing actions, events, results, strategies and expectations and are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. Such forward-looking statements are based on current expectations and inherently involve certain risks, assumptions and uncertainties. The forward-looking statements in this press release include, without limitation, any statements regarding INNOVATE’s plans and expectations for future growth and ability to capitalize on potential opportunities, the achievement of INNOVATE’s strategic objectives, expectations for performance of new projects and realization of revenue from the backlog at DBM Global, anticipated success from the continued sale of new products in the Life Sciences segment, anticipated developments regarding the FDA approval process at MediBeacon, anticipated performance of new channels and LPTV frequencies, expanded uses for LPTV channels in the Spectrum segment and the deployment of datacasting, anticipated agreements in the Spectrum segment with public broadcast networks, anticipated 5G broadcasting opportunities in the Spectrum segment, anticipated developments regarding Federal Communications Commission approval to convert existing station to 5G broadcast, our intentions to regain compliance with the NYSE's continued listing standards, and changes in macroeconomic and market conditions and market volatility (including developments and volatility arising from the COVID-19 pandemic), including interest rates, the value of securities and other financial assets, and the impact of such changes and volatility on INNOVATE’s financial position. Such statements are based on the beliefs and assumptions of INNOVATE’s management and the management of INNOVATE’s subsidiaries and portfolio companies.

The Company believes these judgments are reasonable, but you should understand that these statements are not guarantees of performance, results or the creation of stockholder value and the Company’s actual results could differ materially from those expressed or implied in the forward-looking statements due to a variety of important factors, both positive and negative, including those that may be identified in subsequent statements and reports filed with the Securities and Exchange Commission (“SEC”), including in our reports on Forms 10-K, 10-Q, and 8-K. Such important factors include, without limitation: our dependence on distributions from our subsidiaries to fund our operations and payments on our obligations; the impact on our business and financial condition of our substantial indebtedness and the significant additional indebtedness and other financing obligations we may incur; our dependence on key personnel; volatility in the trading price of our common stock; the impact of recent supply chain disruptions, labor shortages and increases in overall price levels, including in transportation costs; interest rate environment; developments relating to the ongoing hostilities in Ukraine and Israel; increased competition in the markets in which our operating segments conduct their businesses; our ability to successfully identify any strategic acquisitions or business opportunities; uncertain global economic conditions in the markets in which our operating segments conduct their businesses; changes in regulations and tax laws; covenant noncompliance risk; tax consequences associated with our acquisition, holding and disposition of target companies and assets; the ability of our operating segments to attract and retain customers; our expectations regarding the timing, extent and effectiveness of our cost reduction initiatives and management’s ability to moderate or control discretionary spending; our expectations and timing with respect to any strategic dispositions and sales of our operating subsidiaries, or businesses; the possibility of indemnification claims arising out of divestitures of businesses; and our possible inability to raise additional capital when needed or refinance our existing debt, on attractive terms, or at all.

Although INNOVATE believes its expectations and assumptions regarding its future operating performance are reasonable, there can be no assurance that the expectations reflected herein will be achieved. These risks and other important factors discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the SEC, and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release.

You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to INNOVATE or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and unless legally required, INNOVATE undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

INNOVATE CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (Unaudited) | | (Unaudited) | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 361.0 | | | $ | 409.3 | | | $ | 1,423.0 | | | $ | 1,637.3 | |

| Cost of revenue | | 299.9 | | | 346.4 | | | 1,207.0 | | | 1,415.9 | |

| Gross profit | | 61.1 | | | 62.9 | | | 216.0 | | | 221.4 | |

| Operating expenses: | | | | | | | | |

| Selling, general and administrative | | 41.4 | | | 49.8 | | | 168.0 | | | 180.1 | |

| Depreciation and amortization | | 4.3 | | | 6.6 | | | 20.2 | | | 27.2 | |

| | | | | | | | |

| Other operating loss | | 1.4 | | | — | | | 1.3 | | | 0.7 | |

| Income from operations | | 14.0 | | | 6.5 | | | 26.5 | | | 13.4 | |

| Other (expense) income: | | | | | | | | |

| Interest expense | | (19.2) | | | (13.6) | | | (68.2) | | | (52.0) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(Loss) income from equity investees | | (3.6) | | | 0.8 | | | (9.4) | | | (1.3) | |

| | | | | | | | |

Other (expense) income, net | | (0.5) | | | (1.7) | | | 16.7 | | | (1.2) | |

| Loss from operations before income taxes | | (9.3) | | | (8.0) | | | (34.4) | | | (41.1) | |

Income tax (expense) benefit | | (1.3) | | | 0.7 | | | (4.5) | | | (0.9) | |

| | | | | | | | |

| | | | | | | | |

| Net loss | | (10.6) | | | (7.3) | | | (38.9) | | | (42.0) | |

| Net loss attributable to non-controlling interests and redeemable non-controlling interests | | 1.3 | | | 1.6 | | | 3.7 | | | 6.1 | |

| Net loss attributable to INNOVATE Corp. | | (9.3) | | | (5.7) | | | (35.2) | | | (35.9) | |

| Less: Preferred dividends | | 0.3 | | | 1.3 | | | 2.4 | | | 4.9 | |

| Net loss attributable to common stockholders | | $ | (9.6) | | | $ | (7.0) | | | $ | (37.6) | | | $ | (40.8) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Loss per share - basic and diluted | | $ | (0.12) | | | $ | (0.09) | | | $ | (0.48) | | | $ | (0.53) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Weighted average common shares outstanding - basic and diluted | | 78.5 | | | 77.6 | | | 78.1 | | | 77.5 | |

| | | | | | | | |

| | | | | | | | |

INNOVATE CORP.

CONSOLIDATED BALANCE SHEETS

(in millions, except share amounts)

| | | | | | | | | | | | | | |

| | (Unaudited) | | |

| | December 31,

2023 | | December 31,

2022 |

| | |

| Assets | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 80.8 | | | $ | 80.4 | |

| Accounts receivable, net | | 278.4 | | | 254.9 | |

| Contract assets | | 118.6 | | | 165.1 | |

| Inventory | | 22.4 | | | 18.9 | |

| | | | |

| Assets held for sale | | 3.1 | | | — | |

| Other current assets | | 14.6 | | | 17.1 | |

| Total current assets | | 517.9 | | | 536.4 | |

| Investments | | 1.8 | | | 59.5 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Deferred tax asset | | 2.0 | | | 1.7 | |

| Property, plant and equipment, net | | 154.6 | | | 165.0 | |

| Goodwill | | 127.1 | | | 127.1 | |

| Intangibles, net | | 178.9 | | | 190.1 | |

| Other assets | | 61.3 | | | 71.9 | |

| Total assets | | $ | 1,043.6 | | | $ | 1,151.7 | |

| | | | |

| Liabilities, temporary equity and stockholders’ deficit | | | | |

| Current liabilities | | | | |

| Accounts payable | | $ | 142.9 | | | $ | 202.5 | |

| Accrued liabilities | | 70.8 | | | 65.4 | |

| Current portion of debt obligations | | 30.5 | | | 30.6 | |

| Contract liabilities | | 153.5 | | | 98.6 | |

| | | | |

| | | | |

| Other current liabilities | | 16.1 | | | 20.1 | |

| Total current liabilities | | 413.8 | | | 417.2 | |

| | | | |

| | | | |

| | | | |

| Deferred tax liability | | 4.1 | | | 9.1 | |

| Debt obligations | | 679.3 | | | 683.8 | |

| Other liabilities | | 82.7 | | | 71.2 | |

| Total liabilities | | 1,179.9 | | | 1,181.3 | |

| Commitments and contingencies | | | | |

| Temporary equity | | | | |

| Preferred stock Series A-3 and Series A-4, $0.001 par value | | 16.4 | | | 17.6 | |

| Shares authorized: 20,000,000 as of both December 31, 2023 and 2022 | | | | |

| Shares issued and outstanding: 6,125 of Series A-3 and 10,000 of Series A-4 as of both December 31, 2023 and 2022 | | | | |

| Redeemable non-controlling interest | | (1.0) | | | 43.4 | |

| Total temporary equity | | 15.4 | | | 61.0 | |

| Stockholders’ deficit | | | | |

| Common stock, $0.001 par value | | 0.1 | | | 0.1 | |

| Shares authorized: 160,000,000 as of both December 31, 2023 and 2022 | | | | |

| Shares issued: 80,722,983 and 80,216,028 as of December 31, 2023 and 2022, respectively | | | | |

| Shares outstanding: 79,234,991 and 78,787,768 as of December 31, 2023 and 2022, respectively | | | | |

| Additional paid-in capital | | 328.2 | | | 330.1 | |

| Treasury stock, at cost: 1,487,992 and 1,428,260 shares as of December 31, 2023 and 2022, respectively | | (5.4) | | | (5.3) | |

| Accumulated deficit | | (487.3) | | | (452.1) | |

| Accumulated other comprehensive (loss) income | | (1.1) | | | 5.9 | |

| Total INNOVATE Corp. stockholders’ deficit | | (165.5) | | | (121.3) | |

| Non-controlling interest | | 13.8 | | | 30.7 | |

| Total stockholders’ deficit | | (151.7) | | | (90.6) | |

| Total liabilities, temporary equity and stockholders’ deficit | | $ | 1,043.6 | | | $ | 1,151.7 | |

INNOVATE CORP.

RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | Three Months Ended December 31, 2023 |

| | Infrastructure | | Life Sciences | | Spectrum | | Non-Operating Corporate | | Other and Eliminations | | INNOVATE |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net income (loss) attributable to INNOVATE Corp. | | $ | 8.9 | | | $ | (6.2) | | | $ | (5.4) | | | $ | (5.4) | | | $ | (1.2) | | | $ | (9.3) | |

| Adjustments to reconcile net income (loss) to Adjusted EBITDA: | | | | | | | | | | | | |

| Depreciation and amortization | | 2.8 | | | 0.2 | | | 1.3 | | | — | | | — | | | 4.3 | |

| Depreciation and amortization (included in cost of revenue) | | 4.0 | | | — | | | — | | | — | | | — | | | 4.0 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Other operating (income) loss | | — | | | — | | | (0.2) | | | 0.5 | | | 1.1 | | | 1.4 | |

| Interest expense | | 3.5 | | | 0.8 | | | 3.4 | | | 11.5 | | | — | | | 19.2 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Other (income) expense, net | | — | | | — | | | 2.2 | | | (1.8) | | | 0.1 | | | 0.5 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Income tax expense (benefit) | | 9.2 | | | — | | | 0.3 | | | (8.2) | | | — | | | 1.3 | |

| Non-controlling interest | | 0.9 | | | (1.7) | | | (0.5) | | | — | | | — | | | (1.3) | |

| | | | | | | | | | | | |

| Share-based compensation expense | | — | | | (0.3) | | | — | | | 0.5 | | | — | | | 0.2 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Acquisition and disposition costs | | 0.7 | | | 0.1 | | | — | | | 0.4 | | | — | | | 1.2 | |

| Adjusted EBITDA | | $ | 30.0 | | | $ | (7.1) | | | $ | 1.1 | | | $ | (2.5) | | | $ | — | | | $ | 21.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | Three Months Ended December 31, 2022 |

| | Infrastructure | | Life Sciences | | Spectrum | | Non-Operating Corporate | | Other and Eliminations | | INNOVATE |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net income (loss) attributable to INNOVATE Corp. | | $ | 5.9 | | | $ | (4.3) | | | $ | (2.8) | | | $ | (4.9) | | | $ | 0.4 | | | $ | (5.7) | |

| Adjustments to reconcile net income (loss) to Adjusted EBITDA: | | | | | | | | | | | | |

| Depreciation and amortization | | 5.1 | | | 0.1 | | | 1.4 | | | — | | | — | | | 6.6 | |

| Depreciation and amortization (included in cost of revenue) | | 3.8 | | | — | | | — | | | — | | | — | | | 3.8 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Interest expense | | 3.1 | | | 0.6 | | | 1.3 | | | 8.6 | | | — | | | 13.6 | |

| | | | | | | | | | | | |

| Other expense (income), net | | 0.9 | | | 0.8 | | | 2.1 | | | (1.9) | | | (0.2) | | | 1.7 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Income tax expense (benefit) | | 5.1 | | | — | | | (0.1) | | | (6.4) | | | 0.7 | | | (0.7) | |

| Non-controlling interest | | 0.5 | | | (1.9) | | | (0.4) | | | — | | | 0.2 | | | (1.6) | |

| | | | | | | | | | | | |

| Share-based compensation expense | | — | | | 0.2 | | | — | | | 0.5 | | | — | | | 0.7 | |

| Restructuring and exit costs | | 6.4 | | | — | | | 0.7 | | | — | | | — | | | 7.1 | |

| | | | | | | | | | | | |

| Acquisition and disposition costs | | 1.9 | | | — | | | 0.3 | | | 0.4 | | | — | | | 2.6 | |

| Adjusted EBITDA | | $ | 32.7 | | | $ | (4.5) | | | $ | 2.5 | | | $ | (3.7) | | | $ | 1.1 | | | $ | 28.1 | |

INNOVATE CORP.

RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | Year Ended December 31, 2023 |

| | Infrastructure | | Life Sciences | | Spectrum | | Non-Operating Corporate | | Other and Eliminations | | INNOVATE |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net income (loss) attributable to INNOVATE Corp. | | $ | 28.7 | | | $ | (15.5) | | | $ | (22.2) | | | $ | (33.2) | | | $ | 7.0 | | | $ | (35.2) | |

| Adjustments to reconcile net income (loss) to Adjusted EBITDA: | | | | | | | | | | | | |

| Depreciation and amortization | | 14.4 | | | 0.5 | | | 5.2 | | | 0.1 | | | — | | | 20.2 | |

| Depreciation and amortization (included in cost of revenue) | | 15.7 | | | 0.1 | | | — | | | — | | | — | | | 15.8 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Other operating (income) loss | | (0.2) | | | — | | | (0.1) | | | 0.5 | | | 1.1 | | | 1.3 | |

| Interest expense | | 13.8 | | | 2.9 | | | 13.4 | | | 38.1 | | | — | | | 68.2 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Other (income) expense, net | | (1.2) | | | (4.1) | | | 7.7 | | | (6.7) | | | (12.4) | | | (16.7) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Income tax expense (benefit) | | 20.2 | | | — | | | 0.3 | | | (14.8) | | | (1.2) | | | 4.5 | |

| Non-controlling interest | | 2.8 | | | (7.3) | | | (2.5) | | | — | | | 3.3 | | | (3.7) | |

| | | | | | | | | | | | |

| Share-based compensation expense | | — | | | 0.2 | | | — | | | 2.0 | | | — | | | 2.2 | |

| Legacy accounts receivable expense | | 2.2 | | | — | | | — | | | — | | | — | | | 2.2 | |

| Restructuring and exit costs | | 2.1 | | | — | | | 0.1 | | | — | | | — | | | 2.2 | |

| | | | | | | | | | | | |

| Acquisition and disposition costs | | 2.1 | | | 0.1 | | | 0.1 | | | 0.5 | | | 1.2 | | | 4.0 | |

| Adjusted EBITDA | | $ | 100.6 | | | $ | (23.1) | | | $ | 2.0 | | | $ | (13.5) | | | $ | (1.0) | | | $ | 65.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | Year Ended December 31, 2022 |

| | Infrastructure | | Life Sciences | | Spectrum | | Non-Operating Corporate | | Other and Eliminations | | INNOVATE |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net income (loss) attributable to INNOVATE Corp. | | $ | 29.2 | | | $ | (19.2) | | | $ | (13.3) | | | $ | (35.3) | | | $ | 2.7 | | | $ | (35.9) | |

| Adjustments to reconcile net income (loss) to Adjusted EBITDA: | | | | | | | | | | | | |

| Depreciation and amortization | | 21.0 | | | 0.3 | | | 5.8 | | | 0.1 | | | — | | | 27.2 | |

| Depreciation and amortization (included in cost of revenue) | | 15.0 | | | — | | | — | | | — | | | — | | | 15.0 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Other operating (income) loss | | (0.6) | | | — | | | 1.3 | | | — | | | — | | | 0.7 | |

| Interest expense | | 10.1 | | | 0.8 | | | 7.4 | | | 33.7 | | | — | | | 52.0 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Other (income) expense, net | | (1.0) | | | 0.4 | | | 3.9 | | | (1.9) | | | (0.2) | | | 1.2 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Income tax expense (benefit) | | 16.5 | | | — | | | (0.1) | | | (16.2) | | | 0.7 | | | 0.9 | |

| Non-controlling interest | | 2.8 | | | (8.2) | | | (1.9) | | | — | | | 1.2 | | | (6.1) | |

| | | | | | | | | | | | |

| Share-based compensation expense | | — | | | 0.5 | | | — | | | 1.9 | | | — | | | 2.4 | |

| Restructuring and exit costs | | 6.5 | | | — | | | 0.7 | | | — | | | — | | | 7.2 | |

| | | | | | | | | | | | |

| Acquisition and disposition costs | | 2.2 | | | — | | | 0.7 | | | 1.0 | | | (0.4) | | | 3.5 | |

| Adjusted EBITDA | | $ | 101.7 | | | $ | (25.4) | | | $ | 4.5 | | | $ | (16.7) | | | $ | 4.0 | | | $ | 68.1 | |

INNOVATE Corp. ™ 2024 INNOVATE Corp. Q4 2023 Earnings Release Supplement March 4, 2024

INNOVATE Corp. ™ 2024 Safe Harbor Disclaimers 2 Cautionary Statement Regarding Forward-Looking Statements Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This presentation contains, and certain oral statements made by our representatives from time to time may contain, "forward-looking statements." Generally, forward-looking statements include information describing actions, events, results, strategies and expectations and are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. Such forward-looking statements are based on current expectations and inherently involve certain risks, assumptions and uncertainties. The forward-looking statements in this presentation include, without limitation, any statements regarding INNOVATE’s plans and expectations for future growth and ability to capitalize on potential opportunities, the achievement of INNOVATE’s strategic objectives, expectations for performance of new projects and realization of revenue from the backlog at DBM Global, anticipated success from the continued sale of new products in the Life Sciences segment, anticipated developments regarding the FDA approval process at MediBeacon, anticipated performance of new channels and LPTV frequencies, expanded uses for LPTV channels in the Spectrum segment and the deployment of datacasting, anticipated agreements in the Spectrum segment with public broadcast networks, anticipated 5G broadcasting opportunities in the Spectrum segment, anticipated developments regarding Federal Communications Commission approval to convert existing station to 5G broadcast, our intentions to regain compliance with the NYSE's continued listing standards, and changes in macroeconomic and market conditions and market volatility (including developments and volatility arising from the COVID-19 pandemic), including interest rates, the value of securities and other financial assets, and the impact of such changes and volatility on INNOVATE’s financial position. Such statements are based on the beliefs and assumptions of INNOVATE’s management and the management of INNOVATE’s subsidiaries and portfolio companies. The Company believes these judgments are reasonable, but you should understand that these statements are not guarantees of performance, results or the creation of stockholder value and the Company’s actual results could differ materially from those expressed or implied in the forward-looking statements due to a variety of important factors, both positive and negative, including those that may be identified in subsequent statements and reports filed with the Securities and Exchange Commission (“SEC”), including in our reports on Forms 10-K, 10-Q, and 8-K. Such important factors include, without limitation: our dependence on distributions from our subsidiaries to fund our operations and payments on our obligations; the impact on our business and financial condition of our substantial indebtedness and the significant additional indebtedness and other financing obligations we may incur; our dependence on key personnel; volatility in the trading price of our common stock; the impact of recent supply chain disruptions, labor shortages and increases in overall price levels, including in transportation costs; interest rate environment; developments relating to the ongoing hostilities in Ukraine and Israel; increased competition in the markets in which our operating segments conduct their businesses; our ability to successfully identify any strategic acquisitions or business opportunities; uncertain global economic conditions in the markets in which our operating segments conduct their businesses; changes in regulations and tax laws; covenant noncompliance risk; tax consequences associated with our acquisition, holding and disposition of target companies and assets; the ability of our operating segments to attract and retain customers; our expectations regarding the timing, extent and effectiveness of our cost reduction initiatives and management’s ability to moderate or control discretionary spending; our expectations and timing with respect to any strategic dispositions and sales of our operating subsidiaries, or businesses; the possibility of indemnification claims arising out of divestitures of businesses; and our possible inability to raise additional capital when needed or refinance our existing debt, on attractive terms, or at all. Although INNOVATE believes its expectations and assumptions regarding its future operating performance are reasonable, there can be no assurance that the expectations reflected herein will be achieved. These risks and other important factors discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the SEC, and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to INNOVATE or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and unless legally required, INNOVATE undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

INNOVATE Corp. ™ 2024 Safe Harbor Disclaimers 3 Non-GAAP Financial Measures In this earnings release supplement, INNOVATE refers to certain financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including Total Adjusted EBITDA (excluding discontinued operations, if applicable) and Adjusted EBITDA for its operating segments. In addition, other companies may define Adjusted EBITDA differently than we do, which could limit its usefulness. Adjusted EBITDA Management believes that Adjusted EBITDA provides investors with meaningful information for gaining an understanding of our results as it is frequently used by the financial community to provide insight into an organization’s operating trends and facilitates comparisons between peer companies, since interest, taxes, depreciation, amortization and the other items listed in the definition of Adjusted EBITDA below can differ greatly between organizations as a result of differing capital structures and tax strategies. Adjusted EBITDA can also be a useful measure of a company’s ability to service debt. While management believes that non-U.S. GAAP measurements are useful supplemental information, such adjusted results are not intended to replace our U.S. GAAP financial results. Using Adjusted EBITDA as a performance measure has inherent limitations as an analytical tool as compared to net income (loss) or other U.S. GAAP financial measures, as this non-GAAP measure excludes certain items, including items that are recurring in nature, which may be meaningful to investors. As a result of the exclusions, Adjusted EBITDA should not be considered in isolation and does not purport to be an alternative to net income (loss) or other U.S. GAAP financial measures as a measure of our operating performance. The calculation of Adjusted EBITDA, as defined by us, consists of Net income (loss) attributable to INNOVATE Corp., excluding discontinued operations, if applicable; depreciation and amortization; other operating (income) loss, which is inclusive of (gain) loss on sale or disposal of assets, lease termination costs, asset impairment expense and FCC reimbursements; interest expense; other (income) expense, net; income tax expense (benefit); non-controlling interest; share-based compensation expense; legacy accounts receivable expense; restructuring and exit costs; and acquisition and disposition costs. Third Party Sources Third party information presented in this earnings release supplement is based on sources we believe to be reliable; however, there can be no assurance information so presented will prove accurate in whole or in part.

INNOVATE Corp. ™ 2024 Strong Finish to 2023; Business Segments are Well-Positioned for Execution of Strategic Initiatives in 2024 ■ DBM Global delivered fourth quarter revenue of $353.8 million and significantly expanded gross margin by approximately 200 basis points. ■ R2 Technologies achieved record growth in North America for both system sales and number of patients treated. ■ MediBeacon continues to work through their substantive review for the kidney monitoring program with the FDA. ■ Broadcasting announced new network launches and, separately, agreements with PBS stations for new commercial opportunities with ATSC 3.0. Fourth Quarter and Full Year 2023 Highlights 4

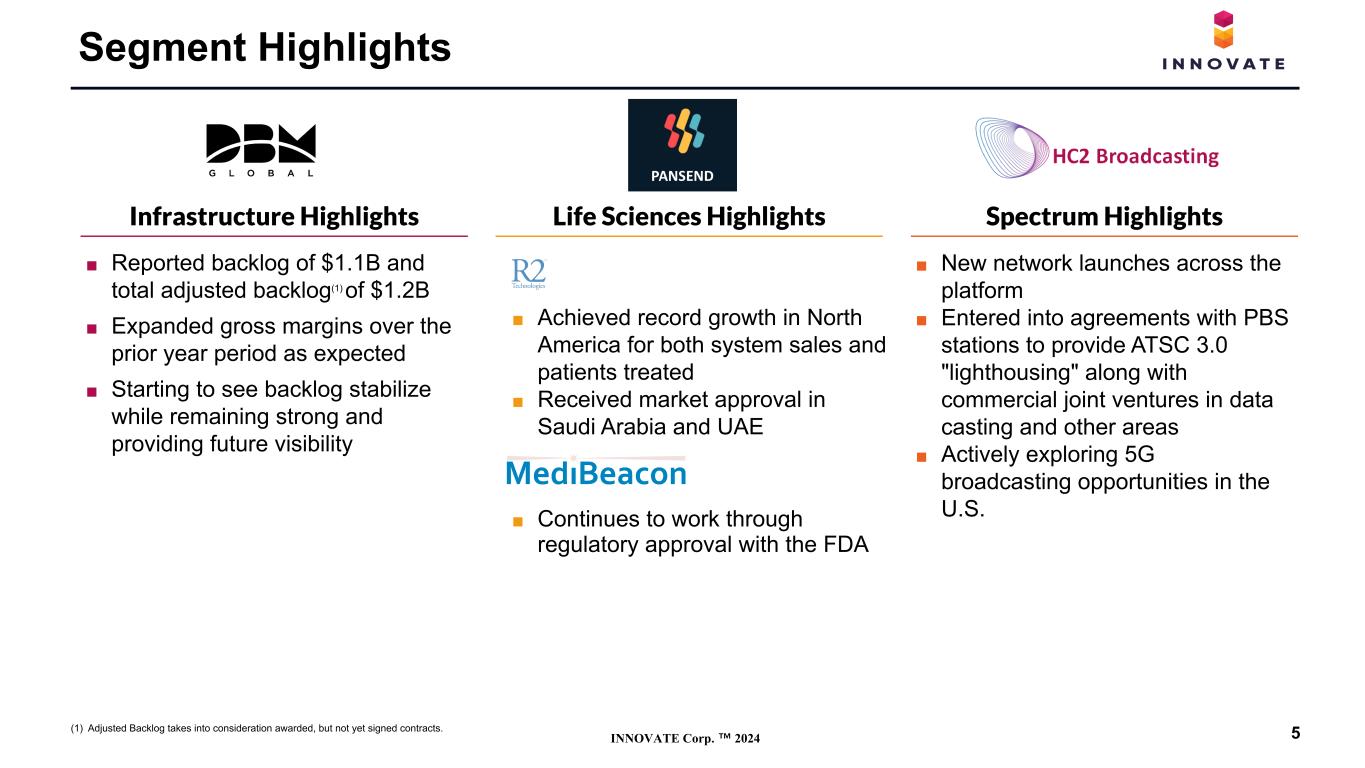

INNOVATE Corp. ™ 2024 ■ New network launches across the platform ■ Entered into agreements with PBS stations to provide ATSC 3.0 "lighthousing" along with commercial joint ventures in data casting and other areas ■ Actively exploring 5G broadcasting opportunities in the U.S. ■ Achieved record growth in North America for both system sales and patients treated ■ Received market approval in Saudi Arabia and UAE ■ Continues to work through regulatory approval with the FDA ■ Reported backlog of $1.1B and total adjusted backlog(1) of $1.2B ■ Expanded gross margins over the prior year period as expected ■ Starting to see backlog stabilize while remaining strong and providing future visibility Segment Highlights Infrastructure Highlights Life Sciences Highlights Spectrum Highlights 5(1) Adjusted Backlog takes into consideration awarded, but not yet signed contracts.

INNOVATE Corp. ™ 2024 Consolidated Q4 Results ■ Revenue decreased $48.3M or 11.8% driven by our Infrastructure segment, and, to a lesser extent, our Spectrum segment. The decline at our Infrastructure segment was driven by timing and size of projects, mostly from DBMG's commercial structural steel fabrication and erection business, which was partially offset by increases at the industrial maintenance and repair business and Banker Steel, while revenues at our Spectrum segment decreased primarily as a result of the termination of HC2 Network, Inc. ("Network") and its associated Azteca America network ("Azteca") content on December 31, 2022. ■ Net Loss attributable to INNOVATE Corp. of $9.3M ■ Adjusted EBITDA(2) decreased by $6.6M to $21.5M driven by our Infrastructure, Life Sciences, Spectrum and Other segments, which was partially offset by our Non-Operating corporate segment. Infrastructure ■ Net Income of $8.9M(1) ■ Adjusted EBITDA(2) down $2.7M year-over-year driven by an increase in recurring SG&A expenses. ■ Reported and adjusted(3) backlog of $1.1B and $1.2B, respectively, compared to reported and adjusted(3) backlog of $1.8B at December 31, 2022. Life Sciences ■ Revenue of $1.5M driven by R2, which is up $0.2M or 15.4%, primarily as a result of the launch of the Glacial fx system in the U.S. and an increase in Glacial Rx units sold in the U.S., which was partially offset by a change in product mix sold outside the U.S, as more Glacial Spa systems, which have a lower retail price per unit, were sold compared to Glacial Rx systems, which have a higher retail price per unit, as well as decrease in consumables sold outside the U.S. ■ Adjusted EBITDA losses(2) up $2.6M year-over-year primarily due to higher equity method losses recognized from our investment in MediBeacon in the current period due to additional investments in MediBeacon resulting in previously suspended losses to be recognized as the investment's carrying amount was reduced to zero, which was partially offset by a decrease in SG&A expenses at R2, driven by a decrease in marketing costs and compensation expenses as a result of cost reduction initiatives. Spectrum ■ Net Loss of $5.4M(1) ■ Adjusted EBITDA(2) down $1.4M year-over-year primarily due to a one-time benefit related to the termination of Azteca in the prior period, which was partially offset by a decrease in unrepeated SG&A expenses in the prior period. Non-Operating Corporate ■ Adjusted EBITDA losses(2) down $1.2M primarily driven by a decrease in compensation and legal expenses. Other & Eliminations ■ Adjusted EBITDA(2) down $1.1M driven by the elimination of equity method income from our investment in HMN, which was sold on March 6, 2023. Q4 2023 QTD Financial Highlights Revenue ($ millions) 4Q23 4Q22 Infrastructure $ 353.8 $ 397.3 Life Sciences 1.5 1.3 Spectrum 5.7 10.7 Consolidated INNOVATE $ 361.0 $ 409.3 Net income (loss) Attrib. to INNOVATE Corp. & Adjusted EBITDA 4Q23 4Q22 ($ millions) NI(1) Adjusted EBITDA(2) NI(1) Adjusted EBITDA(2) Infrastructure $ 8.9 $ 30.0 $ 5.9 $ 32.7 Life Sciences (6.2) (7.1) (4.3) (4.5) Spectrum (5.4) 1.1 (2.8) 2.5 Non-Operating Corporate (5.4) (2.5) (4.9) (3.7) Other & Eliminations (1.2) — 0.4 1.1 Consolidated INNOVATE $ (9.3) $ 21.5 $ (5.7) $ 28.1 (1) Net income (loss) attributable to INNOVATE Corp. (2) See Appendix for reconciliation of Non-GAAP to U.S. GAAP. (3) Adjusted Backlog takes into consideration awarded, but not yet signed contracts. 6 Fourth Quarter Consolidated Revenue and Adjusted EBITDA(2) of $361.0 million and $21.5 million, respectively

INNOVATE Corp. ™ 2024 ■ Convert backlog to revenue and pursue market opportunities in 2024. ■ Continues to see sizable projects and opportunity in the market and its pipeline for 2025. ■ 10.9% revenue decrease driven primarily by the timing and size of projects at DBMG's commercial structural steel fabrication and erection business which was partially offset by an increase at the industrial maintenance and repair business, Banker Steel and the construction modeling and detailing business due to timing and size of projects. ■ Adjusted EBITDA(2) decrease was primarily driven by an increase in recurring SG&A expenses, and lower contributions at Banker steel due to timing and size of projects, which was partially offset by increased margins at the industrial maintenance and repair business. ■ Reported backlog was $1.1B and adjusted backlog, which takes into consideration awarded but not yet signed contracts, was $1.2B. Financials ($ millions) 4Q23 4Q22 Revenue $ 353.8 $ 397.3 Net Income(1) $ 8.9 $ 5.9 Adjusted EBITDA (2) $ 30.0 $ 32.7 (1) Net income attributable to INNOVATE Corp. (2) See Appendix for reconciliation of Non-GAAP to U.S. GAAP. All data as of December 31, 2023 unless otherwise noted. Segment Highlights - Infrastructure DBM Global ("DBM") 7 $1,782.3 $1,595.6 $1,462.2 $1,265.5 $1,057.2 Backlog Adjusted Backlog 4Q22 1Q23 2Q23 3Q23 4Q23 $500 $1,000 $1,500 $2,000 ~$1,169.3 Trending Backlog Overview Near-Term Focus ($ millions)

INNOVATE Corp. ™ 2024 MediBeacon ■ R2 experienced 76% sequential growth and 111% full year-over- year growth in North America system sales. ■ 173% increase in monthly patients. ■ 106% increase in average monthly utilization per Glacial provider. ■ Expanded global reach with market approval received in both Saudi Arabia and United Arab Emirates (UAE). R2 Technologies (1) Investment-to-date totals and equity ownership percentages are as of December 31, 2023. (2) MediBeacon agents and devices are not approved for human use by any regulatory agency. (3) Triple Ring was partially sold on 11/30/23 in exchange for cash and shares of Scaled Cell Solutions, Inc. INNOVATE retained shares of Triple Ring (4) https://clinicaltrials.gov/study/NCT05425719 Company Investment to Date Equity % Fully Diluted % R2 Technologies $52.3M 56.6% 51.5% MediBeacon $34.2M 46.2% 40.1% Genovel $4.0M 80.0% 75.2% Triple Ring(3) $0.9M 7.2% 1.9% Scaled Cell Solutions(3) $0.9M 20.1% 20.1% 8 Segment Highlights - Life Sciences Pansend Life Sciences ("Pansend") ■ Continues to work through regulatory approval with the FDA. Met with the FDA in the first quarter 2024 and working to resolve outstanding questions in order to move to approval status. ■ Disclosed positive findings in its Pivotal Study completed in 2023 for which it met the prenegotiated primary and secondary endpoints for efficacy and safety, respectively(4). Summary of Investments

INNOVATE Corp. ™ 2024 ■ Gaining considerable traction with sizeable network launches which include FreeTV and three large sports networks. ■ Entering into agreements with PBS stations to provide ATSC 3.0 “lighthousing” along with commercial joint ventures in datacasting and other areas. ■ Filed an application with the FCC to convert an existing station to 5G broadcast in order to participate in Phase 2 proof of concept. Financials ($ millions) 4Q23 4Q22 Station Group $ 5.7 $ 5.4 Network ("Azteca") — 5.3 Revenue $ 5.7 $ 10.7 Net (Loss) Income(1) $ (5.4) $ (2.8) Adjusted EBITDA (2) $ 1.1 $ 2.5 9 Segment Highlights - Spectrum HC2 Broadcasting ("Broadcasting") 245 45 251 Central Cast Integrated Operating Stations 4Q17 4Q18 4Q19 4Q20 4Q21 4Q22 1Q23 2Q23 3Q23 4Q23 0 50 100 150 200 250 Overview Near-Term Focus ■ Continue business development and sign up large content providers; strong pipeline of pending lease agreements or revenue shares across multiple markets. ■ Seeing new revenue opportunities with across a variety of networks. ■ Continue to actively explore opportunities related to 5G broadcast TV. Station Growth (1) Net (loss) attributable to INNOVATE Corp. (2) See Appendix for reconciliation of Non-GAAP to U.S. GAAP.

INNOVATE Corp. ™ 2024 (1) Debt Maturity Profile excludes Preferred Stock and operating leases (2) Debt Amortization and Maturity Profile chart presents debt annual amortization and maturity payments (3) Excludes restricted cash Debt Summary(1) ($ millions) Maturity Dec-23 Dec-22 8.50% Senior Secured Notes 2026 $ 330.0 $ 330.0 7.50% Convertible Senior Notes 2026 51.8 51.8 Line of Credit 2025 20.0 20.0 CGIC Unsecured Note 2026 35.1 — Infrastructure Debt Various 198.8 243.0 Spectrum Debt 2025 69.7 69.7 Life Science Debt 2024 17.4 10.8 Total Principal Outstanding $ 722.8 $ 725.3 Unamortized OID and DFC (13.0) (10.9) Total Debt $ 709.8 $ 714.4 Cash & Cash Equivalents(3) 80.8 80.4 Net Debt $ 629.0 $ 634.0 Current Credit Picture 10 Debt Amortization and Maturity Profile $30.5 $197.1 $494.9 $0.2 $0.1 Holdco Infrastructure Spectrum Life Science 2024 2025 2026 2027 2028 $— $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 ($ millions) (2)

INNOVATE Corp. ™ 2024 Appendix Select GAAP Financials & Non-GAAP Reconciliations

INNOVATE Corp. ™ 2024 INNOVATE Selected GAAP Financials Income Statement (Unaudited) (Unaudited) (in millions) Three Months Ended December 31, Year Ended December 31, 2023 2022 2023 2022 Revenue $ 361.0 $ 409.3 $ 1,423.0 $ 1,637.3 Cost of revenue 299.9 346.4 1,207.0 1,415.9 Gross profit 61.1 62.9 216.0 221.4 Operating expenses: Selling, general and administrative 41.4 49.8 168.0 180.1 Depreciation and amortization 4.3 6.6 20.2 27.2 Other operating loss 1.4 — 1.3 0.7 Income from operations 14.0 6.5 26.5 13.4 Other (expense) income: Interest expense (19.2) (13.6) (68.2) (52.0) (Loss) income from equity investees (3.6) 0.8 (9.4) (1.3) Other (expense) income, net (0.5) (1.7) 16.7 (1.2) Loss from operations before income taxes (9.3) (8.0) (34.4) (41.1) Income tax (expense) benefit (1.3) 0.7 (4.5) (0.9) Net loss (10.6) (7.3) (38.9) (42.0) Net loss attributable to non-controlling interests and redeemable non- controlling interests 1.3 1.6 3.7 6.1 Net loss attributable to INNOVATE Corp. (9.3) (5.7) (35.2) (35.9) Less: Preferred dividends 0.3 1.3 2.4 4.9 Net loss attributable to common stockholders $ (9.6) $ (7.0) $ (37.6) $ (40.8) 12

INNOVATE Corp. ™ 2024 Reconciliation of U.S. GAAP Income (Loss) to Adjusted EBITDA 13 (in millions) Three Months Ended December 31, 2023 Infrastructure Life Sciences Spectrum Non-Operating Corporate Other and Eliminations INNOVATE Net income (loss) attributable to INNOVATE Corp. $ 8.9 $ (6.2) $ (5.4) $ (5.4) $ (1.2) $ (9.3) Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 2.8 0.2 1.3 — — 4.3 Depreciation and amortization (included in cost of revenue) 4.0 — — — — 4.0 Other operating (income) loss — — (0.2) 0.5 1.1 1.4 Interest expense 3.5 0.8 3.4 11.5 — 19.2 Other (income) expense, net — — 2.2 (1.8) 0.1 0.5 Income tax expense (benefit) 9.2 — 0.3 (8.2) — 1.3 Non-controlling interest 0.9 (1.7) (0.5) — — (1.3) Share-based compensation expense — (0.3) — 0.5 — 0.2 Acquisition and disposition costs 0.7 0.1 — 0.4 — 1.2 Adjusted EBITDA $ 30.0 $ (7.1) $ 1.1 $ (2.5) $ — $ 21.5

INNOVATE Corp. ™ 2024 Reconciliation of U.S. GAAP Income (Loss) to Adjusted EBITDA 14 (in millions) Year Ended December 31, 2023 Infrastructure Life Sciences Spectrum Non-Operating Corporate Other and Eliminations INNOVATE Net income (loss) attributable to INNOVATE Corp. $ 28.7 $ (15.5) $ (22.2) $ (33.2) $ 7.0 $ (35.2) Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 14.4 0.5 5.2 0.1 — 20.2 Depreciation and amortization (included in cost of revenue) 15.7 0.1 — — — 15.8 Other operating (income) loss (0.2) — (0.1) 0.5 1.1 1.3 Interest expense 13.8 2.9 13.4 38.1 — 68.2 Other (income) expense, net (1.2) (4.1) 7.7 (6.7) (12.4) (16.7) Income tax expense (benefit) 20.2 — 0.3 (14.8) (1.2) 4.5 Non-controlling interest 2.8 (7.3) (2.5) — 3.3 (3.7) Share-based compensation expense — 0.2 — 2.0 — 2.2 Legacy accounts receivable expense 2.2 — — — — 2.2 Restructuring and exit costs 2.1 — 0.1 — — 2.2 Acquisition and disposition costs 2.1 0.1 0.1 0.5 1.2 4.0 Adjusted EBITDA $ 100.6 $ (23.1) $ 2.0 $ (13.5) $ (1.0) $ 65.0

INNOVATE Corp. ™ 2024 Reconciliation of U.S. GAAP Income (Loss) to Adjusted EBITDA 15 (in millions) Three Months Ended December 31, 2022 Infrastructure Life Sciences Spectrum Non-Operating Corporate Other and Eliminations INNOVATE Net income (loss) attributable to INNOVATE Corp. $ 5.9 $ (4.3) $ (2.8) $ (4.9) $ 0.4 $ (5.7) Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 5.1 0.1 1.4 — — 6.6 Depreciation and amortization (included in cost of revenue) 3.8 — — — — 3.8 Interest expense 3.1 0.6 1.3 8.6 — 13.6 Other expense (income), net 0.9 0.8 2.1 (1.9) (0.2) 1.7 Income tax expense (benefit) 5.1 — (0.1) (6.4) 0.7 (0.7) Non-controlling interest 0.5 (1.9) (0.4) — 0.2 (1.6) Share-based compensation expense — 0.2 — 0.5 — 0.7 Restructuring and exit costs 6.4 — 0.7 — — 7.1 Acquisition and disposition costs 1.9 — 0.3 0.4 — 2.6 Adjusted EBITDA $ 32.7 $ (4.5) $ 2.5 $ (3.7) $ 1.1 $ 28.1

INNOVATE Corp. ™ 2024 Reconciliation of U.S. GAAP Income (Loss) to Adjusted EBITDA 16 (in millions) Year Ended December 31, 2022 Infrastructure Life Sciences Spectrum Non-Operating Corporate Other and Eliminations INNOVATE Net income (loss) attributable to INNOVATE Corp. $ 29.2 $ (19.2) $ (13.3) $ (35.3) $ 2.7 $ (35.9) Adjustments to reconcile net income (loss) to Adjusted EBITDA: Depreciation and amortization 21.0 0.3 5.8 0.1 — 27.2 Depreciation and amortization (included in cost of revenue) 15.0 — — — — 15.0 Other operating (income) loss (0.6) — 1.3 — — 0.7 Interest expense 10.1 0.8 7.4 33.7 — 52.0 Other (income) expense, net (1.0) 0.4 3.9 (1.9) (0.2) 1.2 Income tax expense (benefit) 16.5 — (0.1) (16.2) 0.7 0.9 Non-controlling interest 2.8 (8.2) (1.9) — 1.2 (6.1) Share-based compensation expense — 0.5 — 1.9 — 2.4 Restructuring and exit costs 6.5 — 0.7 — — 7.2 Acquisition and disposition costs 2.2 — 0.7 1.0 (0.4) 3.5 Adjusted EBITDA $ 101.7 $ (25.4) $ 4.5 $ (16.7) $ 4.0 $ 68.1

v3.24.0.1

Cover

|

Mar. 04, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 04, 2024

|

| Entity Registrant Name |

INNOVATE CORP.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35210

|

| Entity Tax Identification Number |

54-1708481

|

| Entity Address, Address Line One |

295 Madison Ave.

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

212

|

| Local Phone Number |

235-2691

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001006837

|

| Former Address |

|

| Document Information [Line Items] |

|

| Entity Address, Address Line One |

222 Lakeview Ave.

|

| Entity Address, Address Line Two |

Suite 1660

|

| Entity Address, City or Town |

West Palm Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33401

|

| Common Stock, par value $0.001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

VATE

|

| Security Exchange Name |

NYSE

|

| Preferred Stock Purchase Rights |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock Purchase Rights

|

| Security Exchange Name |

NYSE

|

| No Trading Symbol Flag |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act