Broadcom Inc. (NASDAQ: AVGO) and VMware, Inc. (NYSE: VMW) today

announced that the deadline for VMware stockholders of record to

elect the form of merger consideration they wish to receive in

connection with Broadcom’s acquisition of VMware (the

“Transaction”) is 5:00 p.m. Eastern Time on October 23, 2023 (such

deadline, as it may be extended, the “Election Deadline”). VMware

stockholders who hold shares through a bank, broker or other

nominee may be subject to an earlier election deadline and should

carefully review any materials they received from their bank,

broker or other nominee. As previously disclosed, the parties

expect to close the Transaction on October 30, 2023, subject to the

receipt of regulatory approvals and other customary closing

conditions.

The election materials necessary for VMware stockholders of

record to make an election as to the form of merger consideration

they wish to receive were sent beginning on August 11, 2023 to

holders of record of VMware common stock as of August 4, 2023.

VMware stockholders of record wishing to make an election must

deliver properly completed election materials to Computershare

Trust Company, N.A. by the Election Deadline. VMware stockholders

who hold shares through a bank, broker or other nominee may be

subject to an earlier election deadline and must carefully review

and properly complete any election materials they received from

their bank, broker or other nominee regarding how to make an

election.

As further described in the election materials and in the

parties’ proxy statement/prospectus dated October 3, 2022, each

VMware stockholder will be entitled to receive, for each share of

VMware common stock held immediately prior to the closing of the

Transaction, (i) $142.50 in cash, without interest (the cash

consideration), or (ii) 0.2520 of a share of Broadcom common stock

(the stock consideration). The merger consideration is subject to

proration so that 50% of the aggregate shares of VMware common

stock outstanding immediately prior to the closing of the

Transaction will be converted into the cash consideration and the

remaining 50% of the aggregate shares of VMware common stock will

be converted into the stock consideration.

Each VMware stockholder will receive cash in lieu of any

fractional shares of Broadcom common stock that the stockholder

otherwise would be entitled to receive. If no election is made by a

VMware stockholder, the merger consideration that the stockholder

will receive will be determined in accordance with the proration

methodology in the merger agreement for the Transaction.

VMware stockholders with questions regarding the election

materials or the election process should contact Georgeson LLC, the

information agent for the election, at (866) 821-2570 or their

bank, broker or other nominee, as applicable, as soon as

possible.

A more detailed description of the merger consideration and the

allocation and proration procedures applicable to elections is

contained in the proxy statement/prospectus. VMware stockholders

are urged to read the proxy statement/prospectus carefully and in

its entirety. Copies of the proxy statement/prospectus may be

obtained free of charge by following the instructions below under

“Additional Information about the Transaction and Where to Find

It.”

About Broadcom

Broadcom Inc. (NASDAQ: AVGO), a Delaware corporation

headquartered in San Jose, CA, is a global technology leader that

designs, develops and supplies a broad range of semiconductor and

infrastructure software solutions. Broadcom’s category-leading

product portfolio serves critical markets including data center,

networking, enterprise software, broadband, wireless, storage and

industrial. Our solutions include data center networking and

storage, enterprise, mainframe and cybersecurity software focused

on automation, monitoring and security, smartphone components,

telecoms and factory automation.

About VMware

VMware is a leading provider of multi-cloud services for all

apps, enabling digital innovation with enterprise control. As a

trusted foundation to accelerate innovation, VMware software gives

businesses the flexibility and choice they need to build the

future. Headquartered in Palo Alto, California, VMware is committed

to building a better future through the company’s 2030 Agenda. For

more information, please visit www.VMware.com/company.

Cautionary Statement Regarding Forward-Looking

Statements

This communication relates to a proposed business combination

transaction between Broadcom and VMware. This communication

includes forward-looking statements within the meaning of Section

21E of the U.S. Securities Exchange Act of 1934, as amended, and

Section 27A of the U.S. Securities Act of 1933, as amended. These

forward-looking statements include but are not limited to

statements that relate to the expected future business and

financial performance, the anticipated benefits of the proposed

transaction, the anticipated impact of the proposed transaction on

the combined business, the expected amount and timing of the

synergies from the proposed transaction, and the anticipated

closing date of the proposed transaction. These forward-looking

statements are identified by words such as “will,” “expect,”

“believe,” “anticipate,” “estimate,” “should,” “intend,” “plan,”

“potential,” “predict,” “project,” “aim,” and similar words or

phrases. These forward-looking statements are based on current

expectations and beliefs of Broadcom and VMware management and

current market trends and conditions.

These forward-looking statements involve risks and uncertainties

that are outside Broadcom’s and VMware’s control and may cause

actual results to differ materially from those contained in

forward-looking statements, including but not limited to: the

effect of the proposed transaction on our ability to maintain

relationships with customers, suppliers and other business partners

or operating results and business; the ability to implement plans,

achieve forecasts and meet other expectations with respect to the

business after the completion of the proposed transaction and

realize expected synergies; business disruption following the

announcement and closing of the proposed transaction; difficulties

in retaining and hiring key personnel and employees due to the

proposed transaction and business combination; the diversion of

management time on transaction-related issues; the satisfaction of

the conditions precedent to completion of the proposed transaction,

including the ability to secure regulatory approvals on the terms

expected, at all or in a timely manner; significant indebtedness,

including indebtedness incurred in connection with the proposed

transaction, and the need to generate sufficient cash flows to

service and repay such debt; the disruption of current plans and

operations; the outcome of legal proceedings related to the

Transaction; the ability to complete the proposed transaction on a

timely basis or at all; the ability to successfully integrate

VMware’s operations; cyber-attacks, information security and data

privacy; global political and economic conditions, including

cyclicality in the semiconductor industry and in Broadcom’s other

target markets, rising interest rates, the impact of inflation and

challenges in manufacturing and the global supply chain; the impact

of public health crises, such as pandemics (including COVID-19) and

epidemics and any related company or government policies and

actions to protect the health and safety of individuals or

government policies or actions to maintain the functioning of

national or global economies and markets; and events and trends on

a national, regional and global scale, including those of a

political, economic, business, competitive and regulatory

nature.

These risks, as well as other risks related to the proposed

transaction, are included in the registration statement on Form S-4

and proxy statement/prospectus that has been filed with the

Securities and Exchange Commission (“SEC”) in connection with the

proposed transaction. While the list of factors presented here is,

and the list of factors presented in the registration statement on

Form S-4 are, considered representative, no such list should be

considered to be a complete statement of all potential risks and

uncertainties. For additional information about other factors that

could cause actual results to differ materially from those

described in the forward-looking statements, please refer to

Broadcom’s and VMware’s respective periodic reports and other

filings with the SEC, including the risk factors identified in

Broadcom’s and VMware’s most recent Quarterly Reports on Form 10-Q

and Annual Reports on Form 10-K. The forward-looking statements

included in this communication are made only as of the date hereof.

Neither Broadcom nor VMware undertakes any obligation to update any

forward-looking statements to reflect subsequent events or

circumstances, except as required by law.

No Offer or Solicitation

This communication is not intended to and shall not constitute

an offer to buy or sell or the solicitation of an offer to buy or

sell any securities, or a solicitation of any vote or approval, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made, except by

means of a prospectus meeting the requirements of Section 10 of the

U.S. Securities Act of 1933, as amended.

Additional Information about the Transaction and Where to

Find It

In connection with the proposed transaction, Broadcom has filed

with the SEC a registration statement on Form S-4 that includes a

proxy statement of VMware and that also constitutes a prospectus of

Broadcom. Each of Broadcom and VMware may also file other relevant

documents with the SEC regarding the proposed transaction. The

registration statement was declared effective by the SEC on October

3, 2022 and the definitive proxy statement/prospectus has been

mailed to VMware shareholders. This document is not a substitute

for the proxy statement/prospectus or registration statement or any

other document that Broadcom or VMware may file with the SEC.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION

STATEMENT, PROXY STATEMENT/ PROSPECTUS AND ANY OTHER RELEVANT

DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY

IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders may obtain free copies of the

registration statement and proxy statement/prospectus and other

documents containing important information about Broadcom, VMware

and the proposed transaction once such documents are filed with the

SEC through the website maintained by the SEC at

http://www.sec.gov. Copies of the documents filed with the SEC by

Broadcom may be obtained free of charge on Broadcom’s website at

https://investors.broadcom.com. Copies of the documents filed with

the SEC by VMware may be obtained free of charge on VMware’s

website at ir.vmware.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231017464159/en/

Broadcom Inc.

Ji Yoo Broadcom Investor Relations 408-433-8000

investor.relations@broadcom.com

Joele Frank / Tim Ragones / Arielle Rothstein Joele Frank,

Wilkinson Brimmer Katcher 212-355-4449

VMware, Inc.

Jagroop Bal VMware Investor Relations ir@vmware.com

Doreen Ruyak VMware Global PR druyak@vmware.com

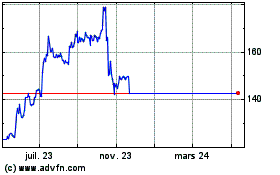

Vmware (NYSE:VMW)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Vmware (NYSE:VMW)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025