Triangle Petroleum Lags Earnings, Beats Revs - Analyst Blog

10 Décembre 2013 - 5:03PM

Zacks

Upstream energy firm Triangle Petroleum

Corporation (TPLM) reported lower-than-expected fiscal

third-quarter 2014 (three months ended Oct 31, 2013) earnings,

owing to significant increase in operating expenses.

Earnings per share – excluding one-time items – came in at 18

cents, lagging the Zacks Consensus Estimate of 24 cents.

However, the figure improved significantly from the year-ago

adjusted loss of 5 cents. Substantial increase in production

volumes favored the results.

Revenues of $88.6 million were up by a whopping 315.7% from the

year-ago quarter’s $21.3 million. The figure also surpassed the

Zacks Consensus Estimate of $72.0 million. Higher sales from

Exploration & Production and RockPile Energy Services business

units aided the result.

Production

In the third quarter of fiscal 2014, total volume increased 389.1%

to 626,000 barrel of oil equivalent (boe) as compared to 128,000

boe reported in the year-ago period.

Segmental Performance

Exploration & Production

(E&P): Revenues from Triangle Petroleum’s

E&P segment came in at $55.5 million, representing a

year-over-year increase of 433.7%.

Operating income for the unit stood at $40.5 million, a 63.8%

increase from the previous quarter, owing to higher production.

RockPile Energy Services (RPES): Revenues

from the RPES unit was reported at $66.0 million, up 176.2% from

$23.9 million recorded in the year-ago period.

The unit reported operating profit of $13.0 million, reflecting a

13.4% sequential hike.

Caliber Midstream (CLBR): Revenues

from Triangle Petroleum’s CLBR business segment were $4.0 million,

up 8.1% sequentially.

However, the operating profit from the unit was $0.6 million down

14.3% sequentially.

Operating Cost

The company reported operating expenses of $71.4 million,

significantly up by 225.6% from the year-ago period.

Guidance

Triangle Petroleum increased the projected production volumes exit

rate for the fourth quarter of fiscal 2014 to 7,500.0-8,500.0

barrels of oil equivalent per day (Boepd) from 7,000 – 8,000

Boepd.

Zacks Rating

Colorado-based Triangle Petroleum currently retains a Zacks Rank #3

(Hold), implying that it is expected to perform in line with the

broader U.S. equity market over the next one to three months.

Meanwhile, one can look at better-ranked players in the energy

sector like Harvest Natural Resources Inc. (HNR),

VOC Energy Trust (VOC) and Matador

Resources Co. (MTDR). All the stocks sport a Zacks Rank #1

(Strong Buy).

HARVEST NATURAL (HNR): Free Stock Analysis Report

MATADOR RESOURC (MTDR): Free Stock Analysis Report

TRIANGLE PETROL (TPLM): Free Stock Analysis Report

VOC ENERGY TRST (VOC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

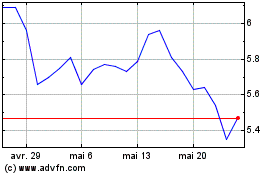

Voc Energy (NYSE:VOC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Voc Energy (NYSE:VOC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025