Wabtec Announces Pricing of Senior Notes Offering

26 Février 2024 - 11:33PM

Business Wire

Wabtec Corporation (NYSE: WAB) (“Wabtec”) today announced that

it has priced a public offering of $500 million aggregate principal

amount of 5.611% Senior Notes due 2034 (the “Notes”). The Notes

will be guaranteed by each of Wabtec’s current and future

subsidiaries that guarantee its indebtedness under its credit

agreements or any other debt of Wabtec or any other guarantor.

The Notes will pay interest semi-annually in arrears. The Notes

will mature on March 11, 2034, unless earlier redeemed or

repurchased. Wabtec intends to use the net proceeds from the

offering, together with cash on hand and/or borrowings under a new

credit agreement expected to be entered into by Wabtec concurrently

with the closing of the sale of the Notes (the “2024 Credit

Agreement”), to repay all of its outstanding 4.15% Senior Notes due

2024 at maturity (the “2024 Notes”), which is scheduled to occur on

March 15, 2024.

The sale of the Notes is expected, subject to customary closing

conditions, to close on March 11, 2024. The sale of the Notes is

not conditioned upon the entry into or funding of the 2024 Credit

Agreement.

Citigroup Global Markets Inc., J.P. Morgan Securities LLC, PNC

Capital Markets LLC and TD Securities (USA) LLC are acting as joint

book-running managers for the offering.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any of the Notes, nor shall there

be any sale of the Notes in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction.

The offering is being made under an automatic shelf registration

statement on Form S-3 (333-275386) filed with the Securities and

Exchange Commission (“SEC”) on November 8, 2023. The offering may

be made only by means of a prospectus and related prospectus

supplement. Before you invest, you should read the registration

statement, including the prospectus, and prospectus supplement, and

other documents Wabtec has filed with the SEC for more complete

information about Wabtec and this offering. You may get these

documents for free by visiting EDGAR on the SEC's website at

http://www.sec.gov. Alternatively, to obtain a copy of the

prospectus and the prospectus supplement for this offering, please

contact Citigroup Global Markets Inc. toll-free at 800-831-9146,

J.P. Morgan Securities LLC collect at 212-834-4533, PNC Capital

Markets LLC toll-free at 855-881-0697 or TD Securities (USA) LLC

toll-free at 855-495-9846.

About Wabtec

Wabtec Corporation (NYSE: WAB) is revolutionizing the way the

world moves for future generations. The company is a leading global

provider of equipment, systems, digital solutions and value-added

services for the freight and transit rail industries, as well as

the mining, marine and industrial markets. Wabtec has been a leader

in the rail industry for over 150 years and has a vision to achieve

a zero-emission rail system in the U.S. and worldwide.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking” statements as that

term is defined in Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended by the Private Securities Litigation Reform Act of 1995.

All statements, other than historical facts, including statements

regarding Wabtec’s offering of the Notes, the use of proceeds

therefrom, Wabtec’s planned repayment of the 2024 Notes, Wabtec’s

planned entry into the 2024 Credit Agreement, and any assumptions

underlying any of the foregoing, are forward-looking statements.

Forward-looking statements concern future circumstances and results

and other statements that are not historical facts and are

sometimes identified by the words “may,” “will,” “should,”

“potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,”

“estimate,” “overestimate,” “underestimate,” “believe,” “could,”

“project,” “predict,” “continue,” “target” or other similar words

or expressions. Forward-looking statements are based upon current

plans, estimates and expectations that are subject to risks,

uncertainties and assumptions. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those indicated

or anticipated by such forward-looking statements. The inclusion of

such statements should not be regarded as a representation that

such plans, estimates or expectations will be achieved. Further

information on the risk factors that may affect Wabtec’s business

and financial performance is as detailed from time to time in

Wabtec’s reports filed with the SEC, including Wabtec’s annual

report on Form 10-K, periodic quarterly reports on Form 10-Q,

current reports on Form 8-K and other documents filed with the SEC.

The foregoing list of important factors is not exclusive. Wabtec

may not close the sale of the Notes and, if the sale of the Notes

closes, cannot provide any assurances regarding its final terms,

may not enter into the 2024 Credit Agreement and / or may not repay

all of any of the 2024 Notes. Any forward-looking statements in

this press release speak only as of the date of this press release.

Wabtec does not undertake any obligation to update any

forward-looking statements, whether as a result of new information

or development, future events or otherwise, except as required by

law. Readers are cautioned not to place undue reliance on any of

these forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240226093192/en/

Wabtec Investor Contact Kristine Kubacki, CFA

412-450-2033 Kristine.Kubacki@wabtec.com

Wabtec Media Contact Tim Bader 682-319-7925

Tim.Bader@wabtec.com

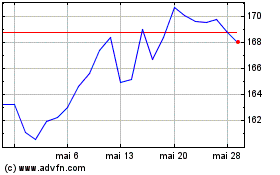

Wabtec (NYSE:WAB)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Wabtec (NYSE:WAB)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025