SAP Shares Slump After Cloud Business Growth Disappoints

21 Juillet 2023 - 10:03AM

Dow Jones News

By Mauro Orru

Shares of German business-software company SAP plunged in Friday

morning trading after the group posted cloud revenue growth below

analysts' expectations for the second quarter, prompting SAP to cut

its cloud revenue projection for the year.

At 0725 GMT, SAP shares traded 5.2% lower at EUR119.88.

Reporting on a non-IFRS basis, the Walldorf, Germany-based

company said Thursday that total revenue had climbed to 7.55

billion euros ($8.40 billion) from EUR7.21 billion in last year's

second quarter, with cloud revenue up 19% to EUR3.32 billion and

software-licenses revenue down 26% to EUR316 million.

SAP is moving away from software-licenses sales, once its

biggest revenue streams, to subscription-based cloud services,

banking on a more profitable and predictable model based on

recurring revenue.

The group said its cloud business had delivered a strong

performance across all regions in the quarter, citing "outstanding"

growth in Germany, Brazil and India.

Operating profit increased to EUR2.06 billion from EUR1.68

billion, with SAP's closely watched operating margin up to 27.2%

from 23.3%.

Analysts had forecast total revenue of EUR7.60 billion and cloud

revenue of EUR3.40 billion on operating profit of EUR1.93 billion

and a 25.6% operating margin, according to a company-provided

consensus on a non-IFRS basis.

SAP, like other European software companies, presents its

figures as two sets of numbers. One set is based on the

International Financial Reporting Standards--an international

accounting method that seeks to provide a global reporting

standard--though analysts and investors tend to follow SAP's

non-IFRS numbers. Those figures exclude share-based compensation,

restructuring expenses and acquisition-related charges.

For 2023, SAP now expects non-IFRS operating profit at constant

currencies between EUR8.65 billion and EUR8.95 billion, up from

EUR8.6 billion to EUR8.9 billion as previously expected. However,

cloud revenue at constant currencies should range between EUR14

billion and EUR14.2 billion, and no longer to EUR14.4 billion as

previously expected.

The downgrade to cloud revenue guidance comes just two months

after SAP updated its 2025 targets, a development that will likely

leave investors scratching their heads, Jefferies analysts wrote in

a note to clients. "Given management optimism through the quarter,

we doubt investors will be sympathetic," they said.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

July 21, 2023 03:48 ET (07:48 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

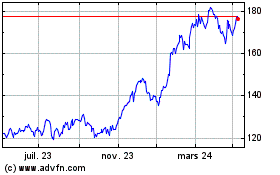

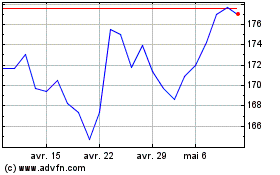

Sap (TG:SAP)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Sap (TG:SAP)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024