Aleafia Health Inc. (TSX: AH, OTCQX: ALEAF) (“

Aleafia

Health” or the “

Company”) is pleased to

report its financial results for the three months ended June 30,

2022, its first quarter of its fiscal year ending March 31, 2023

(“

FY2023”).

Branded cannabis net revenue, quarter over quarter,

increased 25%: Aleafia Health continued its upward sales

growth trend, with branded cannabis net revenue increasing 24% to a

record $10.0 million from $8.0 million quarter over quarter. In the

key branded adult-use market, the Company’s net revenue7 increased

107% to $6.7 million from $3.2 million in the same period last

year.

“Our pivot to a branded cannabis strategy is the success story

driving the three pillars of company revenue: adult-use branded

cannabis, a ‘sticky’ recurring medical cannabis revenue stream and

growing higher margin international sales,” said Aleafia Health CEO

Tricia Symmes. “As a result of revenue increases, the Company has

achieved the 2nd highest growth rate amongst top 12 Canadian LPs in

retail sell through over the prior quarter while achieving a #12

ranking for market share in our core markets for Q2 CY2022.”8

“Due to our successful branded growth strategy, the Company

continues to target a top 10 standing9 in our key markets and

reaffirms our expectation to reach breakeven Adjusted EBITDA

profitability during the second half of FY2023,”10 said

Aleafia Health CFO Matt Sale. “Showing continued success in retail

sell through provides us the confidence to reaffirm our guidance to

deliver at least $53 million in total net revenue in fiscal year

202311, with a current run-rate of $48 million.”

Divvy Brand Leadership: “In each of the three

largest revenue categories - flower, pre-rolls and vapes - the

Company is gaining in market share and continuing to deliver

excellent growth rates,” Symmes said. “In the Ontario value

category, Divvy flower enjoys a #7 market share ranking (with 3.4%

share), pre-rolls enjoy a #5 ranking (with a 6.9% share), and our

recently launched vape products continue to grab market share

amidst a highly competitive format, and enjoy a 1.4% market

share.”12

Medical: The Company reported a 4% increase in

medical cannabis net revenue to $2.8 million in Q1 FY2023 over $2.5

million in the prior quarter. This represents a $11 million

run-rate net revenue base. Moreover, the Company has attained a

milestone 7.5% market share in the overall Canadian medical market,

according to Health Canada data.13 “In a competitive medical

cannabis segment, market share has increased and we have restarted

our growth trajectory over the last two quarters,” said Symmes. “We

continue to penetrate the Quebec market with a 71% quarter over

quarter increase in patient registrations. Growth in Quebec has

helped to offset industry wide medical channel decline which has

also affected our business. Sales to veterans also increased 4%

quarter over quarter.”

“Anchored by our Emblem brand, we continue to view medical as a

core part of our diversified sales mix, and is synergistic with our

branded adult-use channel given the ability to sell products into

both segments,” said Sale.

International Revenue Growth: “International

revenue is a competitive advantage and a differentiating factor for

Aleafia, as we leverage our high quality, diversified flower supply

and export it to the higher margin international sales markets,”

Symmes said. “Current international agreements have led to more

than $0.5 million in sales to Germany and Australia this quarter.

We have also secured a new European partner with a $4.6 million

sales commitment, representing further channel development.

International success leverages both the Company’s products and its

brands.”

“The newly signed agreement improves revenue and cash flow

visibility, locks in attractive margins, and improves our overall

cash conversion cycle and net working capital performance,” said

Sale.

Continued Cost Rationalization: “We are

striving to achieve breakeven Adjusted EBITDA profitability by the

end of FY2023,” Sale said. “Firstly, we are increasing revenue by

capturing market share. SKU optimization has furthered revenue

growth, which aligns the portfolio with the highest selling product

formats with strongest margins, coupled with moderate and strategic

price increases. Second, we are relentlessly focused on cost

rationalization. In addition to difficult headcount reductions and

other initiatives, the Company has engaged in vendor consolidation

to reduce complexity across sites while negotiating trusted vendor

price improvements due to economies of scale. With all of these

efforts combined, the Company has extracted $20 million in

annualized SG&A savings over the last four quarters, and

break-even Adjusted EBITDA profitability is within our grasp during

FY2023, a milestone for the Company.”

“On the cultivation side of the business, all processes in our

Grimsby, Ont. hybrid greenhouse have been remapped to allow it to

meet anticipated growing throughput of high potency THC flower,”

said Sale. “With strategic investments to improve flower

consistency and quality, we continue to see steady improvements in

Grimsby.”

New Nitecaps: “In Q1 FY2023, the Company

completed development on a breakthrough product that has just been

brought to the Ontario and Alberta markets this month,” said

Symmes. “Our Noon & Night Nitecaps softgels with CBD suspended

in melatonin and-MCT oil are an industry first.”

“We are highly strategic and thoughtful about our new product

roll-outs. In this case, Nitecaps can be leveraged in the adult-use

and medical channels as sleep is top-of-mind for many patients,

addressing an unmet consumer need,” said Sale.

“Aleafia Health today is a vastly different Company than it was

one year ago,” said Symmes. “With an extraordinary team of people

at all levels, we are now positioned to reach new heights,

supported by cost containment, a transforming balance sheet, and

new equity financing. We are now rooted in a new era, with a

relentless drive toward profitability and increased market share

capture.”

For Investor & Media Relations:

Matthew Sale, CFO1-833-879-2533IR@AleafiaHealth.comLEARN MORE:

www.AleafiaHealth.com

About Aleafia Health:

The Company is a federally licensed Canadian

cannabis company offering cannabis products in Canadian adult-use

and medical markets and in select international markets, including

Australia and Germany. The Company operates a virtual medical

cannabis clinic staffed by physicians and nurse practitioners which

provide health and wellness services across Canada.

The Company owns three licensed cannabis

production facilities and operates a strategically located

distribution centre all in the province of Ontario, including the

largest, outdoor cannabis cultivation facility in Canada. The

Company produces a diverse portfolio of cannabis and cannabis

derivative products including dried flower, pre-roll, milled,

vapes, oils, capsules, edibles, sublingual strips, and

topicals.

Forward Looking Information

Certain statements herein relating to the Company constitute

“forward looking information”, within the meaning of applicable

securities laws, including without limitation, statements regarding

future estimates, business plans and/or objectives, sales programs,

forecasts and projections, assumptions, expectations, and/or

beliefs of future performance, are “forward-looking information”.

Such forward-looking statements involve unknown risks and

uncertainties that could cause actual and future events to differ

materially from those anticipated in such statements. Forward

looking statements include, but are not limited to, statements with

respect to our market share, net revenue, branded cannabis net

revenue, Adjusted EBITDA, and other financial outlook projections

for fiscal year 2023, our commercial operations, including

production and / or sales of cannabis, quantities of future

cannabis production, anticipated revenue in connection with such

sales, and other Information that is based on forecasts of future

results, estimates of production not yet determinable, and other

key management assumptions. The following material factors or

assumptions were used to develop the forward looking information:

market size and growth of the Canadian adult-use and medical

cannabis markets, retail store penetration, script trends,

cultivation and processing capacity, costs of production, gross and

net revenue per gram. Actual results may differ materially from

those expressed or implied by such forward looking statements and

involve risk and uncertainties relating to: future cultivation

yield and quality, actual operating performance of facilities,

product launches, facility licenses and amendments, average selling

prices, cost of goods sold, operating expenses, Adjusted EBITDA,

regulatory changes in the Canadian and international markets, and

other uninsured risks. The forward looking information was approved

by Management as of August 10, 2022. The Company assumes no

responsibility to update or revise forward-looking information to

reflect new events or circumstances unless required by law. The

forward looking information is provided for information purposes

only and readers are cautioned that it may not be appropriate for

other purposes. This presentation is provided for general

information purposes only and does not constitute an offer to sell

or solicitation of an offer to buy any security in any

jurisdiction.

Operational and Financial Highlights

|

($,000s) |

Three months ended |

|

30-Jun-22 |

30-Jun-21 |

|

Operating Results |

|

|

|

Kilograms Sold - Dried Flower |

|

8,497 |

|

|

7,811 |

|

| Avg Net Realized Price |

|

1.42 |

|

|

1.37 |

|

|

|

|

|

| Adult-Use Market Share

%(1) |

|

2.5 |

% |

|

0.8 |

% |

| Adult-Use Market Share

Ranking |

|

12 |

|

|

19 |

|

|

|

|

|

| Medical Use Orders |

|

15,568 |

|

|

20,359 |

|

| Medical Use Avg Order

Value |

$156 |

|

$144 |

|

|

|

|

|

|

Financial Results |

|

|

| Revenue |

|

16,512 |

|

|

11,650 |

|

|

|

|

|

| Branded Cannabis Net

Revenue |

|

9,953 |

|

|

7,573 |

|

| Wholesale Revenue |

|

2,075 |

|

|

3,099 |

|

| Net revenue(1) |

|

12,028 |

|

|

10,672 |

|

|

|

|

|

| Branded Cannabis profit $ |

|

2,519 |

|

|

2,955 |

|

| Branded Cannabis profit % |

|

25 |

% |

|

39 |

% |

|

|

|

|

| Bulk Wholesale profit $ |

|

108 |

|

|

1,593 |

|

| Bulk Wholesale profit % |

|

5 |

% |

|

51 |

% |

|

|

|

|

| Adjusted gross profit before

fair value ("FV") adj's |

|

2,627 |

|

|

4,548 |

|

| Total Gross profit % |

|

22 |

% |

|

43 |

% |

|

|

|

|

| Adjusted SG&A |

|

4,709 |

|

|

9,728 |

|

| % to net revenue |

|

39 |

% |

|

91 |

% |

|

|

|

|

| Adjusted EBITDA(2)(3) |

|

(938 |

) |

|

(3,434 |

) |

| |

|

|

| Net

Cash used in Operating Activities |

|

(1,596 |

) |

|

(10,834 |

) |

| |

|

|

|

|

|

|

Cautionary Statement Regarding Non-IFRS

Measures

Adjusted EBITDA, Adult-Use Cannabis Net Revenue, Branded

Cannabis Net Revenue and Medical Cannabis Net Revenue are non-IFRS

measures that do not have a standardized meaning and therefore may

not be comparable to similar measures presented by other issuers.

Definitions and a reconciliation of Adjusted EBITDA against the

comparable IFRS measure can be found below. For additional

information including the purpose of the non-IFRS measure, see

“Cautionary Statement re Non-IFRS measures” in the Company’s

Management’s Discussion and Analysis for the period ended June 30,

2022 found on SEDAR at www.sedar.com.

Adjusted EBITDA

Adjusted EBITDA is widely used by industry participants and

analysts to measure company performance. The Company considers

Adjusted EBITDA a key metric for measuring operating performance

and cash flow, to manage working capital, debt repayments and

capital expenditures. Adjusted EBITDA is calculated as net income

(loss), excluding (i) amortization and depreciation, (ii) fair

value changes in biological assets and changes in inventory sold,

(iii) share-based payments, (iv) bad debt expense, (v) business

transaction costs, (vi) non-operating expenses (income), (vii)

taxes, (viii) interest expenses, (ix) one-time sale of assets, and

(x) unrealized gain (loss) on marketable securities. Adjusted

EBITDA is not recognized or defined under IFRS, and as a result, it

may not be comparable to the data presented by competitors.

|

|

Three months ended |

|

($,000s) |

30-Jun-22 |

30-Jun-21 |

|

Net profit (loss) |

(4,469 |

) |

5,231 |

|

| Add back: |

|

|

|

Depreciation and amortization1 |

1,950 |

|

2,897 |

|

|

Interest expense, net |

2,760 |

|

1,755 |

|

|

EBITDA |

241 |

|

9,883 |

|

| FV changes in biological

assets and changes in inventory sold |

(3,090 |

) |

(3,572 |

) |

| Share-based payments |

570 |

|

539 |

|

| Bad debt expense |

0 |

|

1,894 |

|

| Business transaction

costs |

315 |

|

1,061 |

|

| Gain on sale of assets |

(3 |

) |

(12,092 |

) |

| Fair value through profit and

loss adjustments |

977 |

|

(700 |

) |

| Non-operating expense

(income) |

52 |

|

(447 |

) |

|

Adjusted

EBITDA(3) |

(938 |

) |

(3,434 |

) |

|

|

|

|

|

|

Adult-use Cannabis Net Revenue is net cannabis

revenue for Canadian adult-use sales. Cannabis net revenue is sale

of cannabis revenue less excise taxes

Branded Cannabis Net Revenue is calculated as

Adult-use Cannabis Net Revenue, Medical Cannabis Net Revenue and

clinic revenue.

Medical Cannabis Net Revenue is net cannabis

revenue for Canadian and international medical sales.

1 This is a non-IFRS measure. See cautionary statement re

non-IFRS measures below.2 Based on HiFyre retail sales pull through

data in BC, AB, SK, and ON for the period Q2 CY2022 and excludes

beverage and cultivation3 This is a non-IFRS measure. See

cautionary statement re non-IFRS measures below.4 This is forward

looking information. See cautionary statement below.5 This is a

non-IFRS measure. See cautionary statement re non-IFRS measures

below.6 This is forward looking information. See cautionary

statement below.7 This is a non-IFRS measure. See cautionary

statement re non-IFRS measures below.8 Based on HiFyre retail sales

pull through data in BC, AB, SK, and ON for the period Q1 CY2022 to

Q2 CY2022 and excludes beverage and cultivation9 This is forward

looking information. See cautionary statement below.10 Based on

HiFyre retail sales pull through data in BC, AB, SK, and ON for the

period Q1 CY2022 to Q2 CY2022 and excludes beverage and

cultivation11 This is forward looking information. See cautionary

statement below.12 Based on OCS sales data of wholesale channel and

non-premium segment.13 Data on cannabis for medical purposes –

Health Canada, Market Share Calculated as share of active patient

registrations

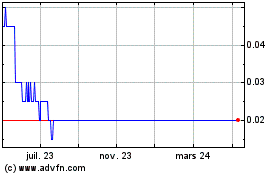

Aleafia Health (TSX:AH)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

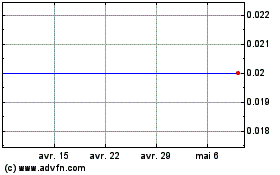

Aleafia Health (TSX:AH)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024