Ascot Resources Ltd. (

TSX: AOT; OTCQX:

AOTVF) (“

Ascot” or the

“

Company”) announces the Company's audited

consolidated financial results for the year ended December 31,

2022. For details of the audited consolidated financial statements,

Management's Discussion and Analysis, and Annual Information Form

for the year ended December 31, 2022, please see the Company's

filings on SEDAR www.sedar.com.

Derek White, President and CEO, commented, "2022

was a pivotal year for Ascot as the Company commenced construction

at the Premier Gold Project, progressed underground development

into the Big Missouri deposit, and advanced exploration drilling on

high-grade gold mineralization targets such as the Sebakwe Zone and

the Day Zone. Amid challenging market conditions in 2022, the

Company successfully concluded a re-financing process by securing

approximately two hundred million dollars from like-minded partners

to advance the Project into production. As we look ahead, we are

eager to complete Project construction in 2023 and advance to

initial gold production in early 2024 and thereby become Canada’s

next gold producer.”

All amounts herein are reported in $000s of

Canadian dollars (“C$”) unless otherwise specified.

2022 AND RECENT HIGHLIGHTS

-

On January 19, 2023, the Company closed a previously announced

financing package for completion of construction of the Project.

The financing package consists of US$110 million as a deposit in

respect of gold and silver streaming agreements and a strategic

equity investment (the “Strategic Investment”) of C$45 million, a

portion of which is structured as Canadian Development Expenditures

flow through shares, such that the total gross proceeds to the

Company is C$50 million. Concurrent with the closing of the

financing package, the outstanding principal and accrued interest

of the senior debt with Sprott Private Resource Lending II (CO) Inc

(“Sprott Lending”) was repaid and the Production Payment Agreement

(“PPA”) in connection with the senior debt was also terminated and

the existing gold stream from the Red Mountain property with Sprott

Private Resource Streaming and Royalty (B) Corp. (“Sprott

Streaming”) was terminated and replaced by the new gold and silver

stream.

-

After completion of the portal preparation work in April 2022,

underground mine development work and installation of surface

infrastructure at the Big Missouri commenced in May 2022. At the

end of October 2022, a total of approximately 921 metres have been

developed in all headings, including muck bays, sumps, ore access

drift, and the main ramp. Ground conditions have been excellent and

heading advancement and productivity have been going well.

Development accessed initial ore in the A Zone of the Big Missouri

deposit in August 2022 and sampling protocol has been developed for

grade reconciliation to the block model.

-

The surface infrastructure at the Big Missouri, S1 pit portal area

was prepared for winter snow conditions, which commenced at the end

of October 2022. The restart of mining development is planned for

mid-2023.

-

The Premier site was preserved and winterized in late 2022, as the

company was pursuing refinancing for the Project. Shortly after the

closing of the financing package in mid-January 2023, the Company

recommenced its construction activities. Various construction

contractors have been re-mobilized to site to complete the

remaining scope on mill construction and piping. Earthworks on

tailings and the construction of the new water treatment plant will

commence in Q2 2023 once the snow has melted.

-

On March 8, 2022, the Company closed a previously announced bought

deal financing for total gross proceeds of C$64 million. The net

proceeds from the financing were used for capital costs at the

Premier Gold Project (“PGP)”) for PGP’s exploration program and for

general corporate purposes.

-

The Company’s 2022 exploration drilling program ran from May to

October. Exploration drill holes intercepted several zones of

mineralization at the Sebakwe zone, where gold mineralization has

now been traced over a strike length of over 300 metres with a

vertical extent of about 80 metres. Exploration drilling at the Day

zone intercepted additional mineralization, which remains open to

the north and the south. In-fill drilling targeted areas of early

planned stopes at the Big Missouri deposit, where drill intercepts

largely confirmed the geological interpretations in the area. Drill

results were announced between July 2022 and January 2023 (see full

news releases at www.ascotgold.com).

-

On October 17, 2022, the Company announced initial positive grade

reconciliation between muck samples and the block model grade from

underground development at the Big Missouri deposit at PGP.

Combined results from ore drives 1 and 2 yielded overall 9%

positive grade reconciliation from muck samples compared to the

resource block model. As expected, the Company encountered high

variability in development round grades often associated with

high-grade epithermal gold deposits. Initial results suggested good

potential to increase mined grades by continuously improving

external mining dilution.

-

On February 17, 2023, the Company reorganized its Board of

Directors (“Board”) by adding two new members: José Néstor Marún

and Stephen Altmann, both of whom were appointed pursuant to the

recently Strategic Investment with Ccori Apu S.A.C. The Company

also reported the voluntary resignation of Ken Carter and James

Stypula from Ascot’s Board. As a result, Ascot’s Board maintains

its size of seven directors, and its gender diversity with 29%

women.

FINANCIAL RESULTS FOR THE THREE MONTHS

AND YEAR ENDED DECEMBER 31, 2022

The Company reported a net loss of $5,988 for Q4

2022 compared to $170 for Q4 2021. The increase in the net loss is

mainly attributable to financing costs of $4,848 largely related to

the senior debt expensed during the period, a $3,083 increase in

stock-based compensation expense due to accelerated vesting of

Restricted Share Units (RSU) in Q4 2022, partially offset by a

$1,655 increase in other income primarily due to a higher gain on

change in estimate of PPA liability as well as a higher

flow-through premium recognition.

The Company reported a net loss of $10,808 in

2022 compared to $2,948 in 2021. The increase in the net loss is

mainly attributable to financing costs of $5,969 during the year,

which include deferred costs of $5,075 attributable to the

cancellation of the undrawn portion of the senior credit facility,

a $3,694 increase in stock-based compensation expense due to

accelerated vesting of RSUs in 2022 as well as stock options and

units granted in 2022, a $2,609 increase in foreign exchange loss,

partially offset by a $4,633 increase in other income primarily due

to a higher flow-through premium recognition, and a higher gain on

change in estimate of PPA liability.

LIQUIDITY AND CAPITAL

RESOURCES

As at December 31, 2022, the Company had a cash

& cash equivalents balance of $7,474 and working capital of

$1,658 excluding the current portion of the credit facilities. On

January 19, 2023, the Company closed a previously announced

financing package of approximately $200,000 for completion of

construction of the Project. Concurrent with the closing of the

financing package, the Company used US$26 million of the gross

proceeds to repay in full to Sprott Lending the outstanding

principal and accrued interest of the senior debt, including a 2%

prepayment fee and the termination fee for termination of the

PPA

During 2022, the Company issued 59,510,018

common shares, 13,710,500 warrants, 13,049,779 stock options,

1,447,298 Deferred Share Units, 3,415,670 Restricted Share Units

and 162,162 Performance Share Units. Also, 7,881,125 stock options

expired and 62,000 Deferred Share Units, 122,964 Restricted Share

Units and 54,054 Performance Share Units were exercised during

2022.

MANAGEMENT’S OUTLOOK FOR

2023

With the financing package closed on January 19,

2023, the Company believes that it has sufficient funding to

complete construction of the Project and achieve first gold

production in early 2024. The key activities for 2023 include:

- Construction of

the process plant and associated surface infrastructure such that

the plant is expected to be in pre-commissioning by the end of

2023

- Completion of

the tailings dam improvements and start up of the new water

treatment plant by Q4 2023

- Advancement of

the Premier North Lights portal and underground development and

additional underground development of the Big Missouri mine

- Maintaining a

Health and Safety record of zero lost time incident and achieving

the 2023 goals outlined in the Company’s 2022 Sustainability

Report

- Advancing the

recruitment of site personnel in line with the site personnel plan

by the end of 2023

- Maintaining

permitting and environmental compliance so that there are no delays

in the project construction schedule

- More exploration

and infill drilling north and west of existing resources

Qualified Person

John Kiernan, P.Eng., Chief Operating Officer of

the Company is the Company’s Qualified Person (QP) as defined by

National Instrument 43-101 and has reviewed and approved the

technical contents of this news release.

On behalf of the Board of Directors of

Ascot Resources Ltd.“Derek C. White”President &

CEO

For further information

contact:

David Stewart, P.Eng.VP, Corporate Development & Shareholder

Communicationsdstewart@ascotgold.com778-725-1060 ext. 1024

About Ascot Resources Ltd.

Ascot is a Canadian junior exploration and

development company focused on re-starting the past producing

Premier gold mine, located on Nisga’a Nation Treaty Lands, in

British Columbia’s prolific Golden Triangle. Ascot shares trade on

the TSX under the ticker AOT. Concurrent with progressing the

development of Premier, the Company continues to successfully

explore its properties for additional high-grade underground

resources. Ascot is committed to the safe and responsible

development of Premier in collaboration with Nisga’a Nation as

outlined in the Benefits Agreement.

For more information about the Company, please

refer to the Company’s profile on SEDAR at www.sedar.com or visit

the Company’s web site at www.ascotgold.com, or for a virtual tour

visit www.vrify.com under Ascot Resources.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws ("forward-looking statements"). Forward-looking statements are

often, but not always, identified by the use of words such as

"seek", "anticipate", "believe", "plan", "estimate", "expect",

"targeted", "outlook", "on track" and "intend" and statements that

an event or result "may", "will", "should", "could" or "might"

occur or be achieved and other similar expressions. All statements,

other than statements of historical fact, included herein are

forward-looking statements, including statements in respect of the

advancement and development of the PGP and the timing related

thereto, the exploration of the Company’s properties and

management’s outlook for the remainder of 2023 and beyond. These

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements, including risks associated with the business of Ascot;

risks related to exploration and potential development of Ascot's

projects; business and economic conditions in the mining industry

generally; fluctuations in commodity prices and currency exchange

rates; uncertainties relating to interpretation of drill results

and the geology, continuity and grade of mineral deposits; the need

for cooperation of government agencies and indigenous groups in the

exploration and development of properties and the issuance of

required permits; the need to obtain additional financing to

develop properties and uncertainty as to the availability and terms

of future financing; the possibility of delay in exploration or

development programs and uncertainty of meeting anticipated program

milestones; uncertainty as to timely availability of permits and

other governmental approvals; risks associated with COVID-19

including adverse impacts on the world economy, construction timing

and the availability of personnel; and other risk factors as

detailed from time to time in Ascot's filings with Canadian

securities regulators, available on Ascot's profile on SEDAR at

www.sedar.com including the Annual Information Form of the Company

dated March 23, 2023 in the section entitled "Risk Factors".

Forward-looking statements are based on assumptions made with

regard to: the estimated costs associated with construction of the

Project; the timing of the anticipated start of production at the

Project; the ability to maintain throughput and production levels

at the Premier Mill; the tax rate applicable to the Company; future

commodity prices; the grade of Resources and Reserves; the ability

of the Company to convert inferred resources to other categories;

the ability of the Company to reduce mining dilution; the ability

to reduce capital costs; and exploration plans. Forward-looking

statements are based on estimates and opinions of management at the

date the statements are made. Although Ascot believes that the

expectations reflected in such forward-looking statements and/or

information are reasonable, undue reliance should not be placed on

forward-looking statements since Ascot can give no assurance that

such expectations will prove to be correct. Ascot does not

undertake any obligation to update forward-looking statements. The

forward-looking information contained in this news release is

expressly qualified by this cautionary statement.

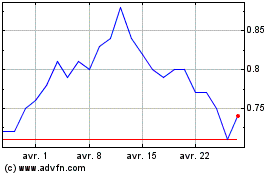

Ascot Resources (TSX:AOT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ascot Resources (TSX:AOT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025