Birchcliff Energy Ltd. Announces Terms of $50 Million Preferred Share Offering

31 Mai 2013 - 2:01PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Birchcliff Energy Ltd. ("Birchcliff" or the "Corporation") (TSX:BIR) is pleased

to announce that in connection with its previously announced marketed offering

of cumulative redeemable preferred shares, Series C ("Preferred Shares, Series

C"), it has entered into an underwriting agreement with a syndicate of

underwriters and has filed an amended and restated preliminary short form

prospectus (the "Amended Preliminary Prospectus"), which amends and restates the

Corporation's preliminary short form prospectus dated May 28, 2013 (the

"Preliminary Prospectus").

The underwriting agreement provides for the sale of 2,000,000 Preferred Shares,

Series C, with a 7% yield, at a price of $25.00 per Preferred Share, Series C,

for gross proceeds of $50,000,000 (the "Offering"). Holders of the Preferred

Shares, Series C will be entitled to receive, as and when declared by the Board

of Directors, cumulative annual dividends of $1.75 per Preferred Share, Series

C, payable quarterly. The Preferred Shares, Series C will not be redeemable by

the Corporation prior to June 30, 2018 and will not be redeemable by the holders

of the Preferred Shares, Series C prior to June 30, 2020, in accordance with

their terms.

The Amended Preliminary Prospectus reflects the updated terms of the Offering

and was filed by the Corporation on May 30, 2013 in all provinces of Canada,

except Quebec. The Amended Preliminary Prospectus will be available on

Birchcliff's website at www.birchcliffenergy.com and on SEDAR at www.sedar.com.

The Offering is being conducted through a syndicate of underwriters co-led by

National Bank Financial Inc., Cormark Securities Inc. and GMP Securities L.P.,

on their own behalf and on behalf of CIBC World Markets Inc., RBC Dominion

Securities Inc., Scotia Capital Inc., HSBC Securities (Canada) Inc., Macquarie

Capital Markets Canada Ltd., Peters & Co. Limited, Stifel Nicolaus Canada Inc.

and Integral Wealth Securities Limited (collectively, the "Underwriters").

Net proceeds of the Offering will be used to initially reduce indebtedness under

the Corporation's revolving credit facilities, which will be subsequently

redrawn and applied as needed to fund the Corporation's ongoing exploration and

development programs and for general working capital purposes.

The Offering is scheduled to close on or about June 14, 2013 and is subject to

certain conditions including, but not limited to, completion of a satisfactory

due diligence investigation by the Underwriters and the receipt of all necessary

third party and regulatory approvals, including the approval of the Toronto

Stock Exchange.

Advisories

This press release does not constitute an offer to sell or a solicitation of an

offer to buy the Preferred Shares, Series C in any jurisdiction. The Preferred

Shares, Series C offered have not been registered under the United States

Securities Act of 1933, as amended, and may not be offered or sold within the

United States unless registered under the U.S. Securities Act and applicable

state securities laws or an exemption from such registration is available.

A Preliminary Prospectus and an Amended Preliminary Prospectus containing

important information relating to these securities has been filed with

securities commissions or similar authorities in certain jurisdictions of

Canada. The Preliminary Prospectus and Amended Preliminary Prospectus are still

subject to completion or amendment. Copies of the Preliminary Prospectus and the

Amended Preliminary Prospectus, may be obtained from National Bank Financial

Inc., Cormark Securities Inc., GMP Securities L.P., CIBC World Markets Inc., RBC

Dominion Securities Inc., Scotia Capital Inc., HSBC Securities (Canada) Inc.,

Macquarie Capital Markets Canada Ltd., Peters & Co. Limited, Stifel Nicolaus

Canada Inc. and Integral Wealth Securities Limited. There will not be any sale

or acceptance of an offer to buy the securities until a receipt for the final

short form prospectus has been issued. Forward Looking Information: This press

release contains forward-looking information within the meaning of applicable

Canadian securities laws. Forward-looking information relates to future events

or future performance and is based upon the Corporation's current internal

expectations, estimates, projections, assumptions and beliefs. All information

other than historical fact is forward-looking information. In particular, this

Press Release contains forward-looking information relating to the anticipated

use of proceeds of the Offering and the anticipated closing date of the

Offering. The anticipated closing date of the Offering assumes that prior to

that date, the Corporation will obtain all necessary third party and regulatory

approvals and all applicable pre-conditions will be satisfied. The anticipated

use of proceeds assumes that the Offering closes as contemplated and the board

of directors of the Corporation do not allocate the proceeds of the Offering for

alternative purposes.

Undue reliance should not be placed on forward-looking information, as there can

be no assurance that the plans, intentions or expectations upon which they are

based will occur. Although the Corporation believes that the expectations

reflected in the forward-looking statements are reasonable, there can be no

assurance that such expectations will prove to be correct. As a consequence,

actual results may differ materially from those anticipated. Forward-looking

information necessarily involves both known and unknown risks. The risk factors

that could render assumptions relating to the Offering invalid are primarily

events beyond the Corporation's control that preclude the Corporation from

satisfying all applicable pre-conditions.

Additional information on these and other risk factors that could affect

operations or financial results are included in the Preliminary Prospectus dated

May 28, 2013, the Amended Preliminary Prospectus dated May 30, 2013 and the

Corporation's most recent Annual Information Form and in other reports filed

with Canadian securities regulatory authorities which are available at

www.sedar.com. Forward-looking information is based on estimates and opinions of

management at the time the information is presented. The Corporation is not

under any duty to update the forward-looking information after the date of this

Press Release to conform such information to actual results or to changes in the

Corporation's plans or expectations, except as otherwise required by applicable

securities laws.

Birchcliff is a Calgary, Alberta based intermediate oil and gas company with

operations concentrated within its one core area, the Peace River Arch of

Alberta. Birchcliff's Common Shares, Cumulative Redeemable Preferred Shares,

Series A and Warrants are listed for trading on the Toronto Stock Exchange under

the symbols "BIR", "BIR.PR.A" and "BIR.WT", respectively.

FOR FURTHER INFORMATION PLEASE CONTACT:

Birchcliff Energy Ltd.

Jeff Tonken

President and Chief Executive Officer

(403) 261-6401

Birchcliff Energy Ltd.

Bruno Geremia

Vice-President and Chief Financial Officer

(403) 261-6401

Birchcliff Energy Ltd.

Jim Surbey

Vice-President, Corporate Development

(403) 261-6401

(403) 261-6424 (FAX)

www.birchcliffenergy.com

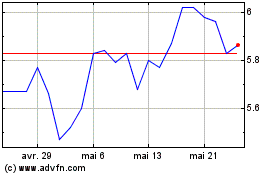

Birchcliff Energy (TSX:BIR)

Graphique Historique de l'Action

De Déc 2024 à Déc 2024

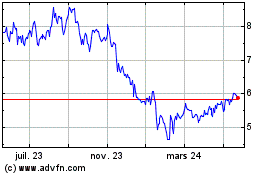

Birchcliff Energy (TSX:BIR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024