VANCOUVER, June 22, 2011 /CNW/ -- VANCOUVER, June 22, 2011 /CNW/ -

Burcon NutraScience Corporation (TSX - BU) ("Burcon") today

reported financial results for the fiscal year ended March 31, 2011

and provided a review of the year's operations. A summary of the

highlights of the past year includes: -- Received a no objection

letter from the U.S. Food and Drug Administration (FDA) that

Puratein(®) and Supertein(™) are GRAS (Generally Recognized As

Safe) under their intended conditions of use; -- Held discussions,

supported due diligence activities, and negotiated possible

business structures with a short list of potential strategic

alliance partners for the commercialization of CLARISOY(® )soy

protein; -- Entered into a License and Production Agreement with

ADM for the worldwide production, marketing and sale of Burcon's

CLARISOY(®) soy protein; -- Filed several patent applications over

newly developed novel processes for the production, functional and

nutritional applications of, and functional attributes of

CLARISOY(®) soy protein; -- Granted 13 U.S. patents over Burcon's

canola and flax protein patent applications; -- Raised $1,867,000

through the exercise of incentive stock options and agents'

compensation options. Since the announcement of CLARISOY(®), Burcon

has undertaken numerous activities in the pursuit of establishing a

strategic alliance for the commercialization of CLARISOY(®) soy

protein. Over the past year, Burcon held numerous discussions

and negotiations with a short-list of global companies for the

commercialization of CLARISOY(®).( )The process of

pursuing a strategic alliance partner or partners for the

development of Burcon's CLARISOY(® )soy protein was focused on

partnering for both the production of CLARISOY(®) as well as the

marketing and sale of CLARISOY(®) to food and beverage

manufacturers. In November 2010, Burcon announced that it had

signed a letter of intent with ADM to license its CLARISOY(®)

technology. In March 2011, Burcon and ADM entered into a

definitive license and production agreement for the worldwide

production, marketing and sale of Burcon's CLARISOY(®) soy

protein. The license agreement provides ADM with the

exclusive rights across all geographic regions and all potential

product applications to produce, market and sell CLARISOY(®) soy

protein. ADM will make royalty payments to Burcon on the

sales of CLARISOY(®) under the twenty-year license agreement.

The maintenance of the CLARISOY(®) soy protein patent portfolio

during the term of the license agreement will be responsibility of

Burcon. In August 2010, Burcon announced that the U.S. FDA issued a

no objection letter with respect to Puratein(®) and Supertein™

canola protein isolates. This response indicates that the FDA

has no objection to the conclusion that Puratein(®) and Supertein™

are generally recognized as safe among qualified experts for use

alone or together as an ingredient in dairy products, grain

products, fruit and vegetable juices and beverages, salad

dressings, meal replacements, and nutritional bars. Based on

the information provided, as well as other information available to

the FDA, the FDA responded that it has no questions at this time

regarding the conclusion that Puratein(®) and Supertein™ are GRAS

under their intended conditions of use. Puratein(®) and

Supertein™ are therefore considered to be GRAS-Notified. Concurrent

with the announcement of the license and production agreement with

ADM for CLARISOY(®), Burcon also announced that it had amended the

license and development agreement (the Canola Agreement) with ADM

to provide an extended development period for continued research

aimed at expanding the commercial value of Puratein(®) and

Supertein™. The development period has been extended to March

1, 2012 to facilitate continued research on the commercialization

potential, particularly with respect to their unique functional and

nutritional characteristics. As part of the amendment, Burcon

has agreed to reimburse ADM for its share of the regulatory

recognition costs for Puratein(®) and Supertein™ of US$360,000

(C$356,000). Subsequent to the year-end, the funds were

deposited into an escrow account held in trust for Burcon and ADM

until March 1, 2012. On March 1, 2012, the funds held in the

escrow account, including any accrued interest, will be released to

ADM, and upon receipt, all intellectual property, reports, studies

or other materials prepared by ADM, Burcon or by a third party in

connection with the GRAS process will be deemed to be owned solely

by Burcon and ADM will have no further rights with respect

thereto. Unless Burcon and ADM come to any other agreements,

the Canola Agreement will terminate on March 1, 2012. For the

coming year, Burcon's objectives are to further the development and

commercialization of its soy and canola products. CLARISOY(® )

Burcon intends to conduct further research and development to

improve or develop novel applications for CLARISOY(®) soy protein

into food products. Burcon also will support ADM in

connection with its development of a commercial facility for the

production, marketing and sale of CLARISOY(®) soy protein.

Puratein(®) and Supertein(™) Burcon plans to conduct further

research and development to establish the unique functional and

nutritional characteristics of Supertein(™) and Puratein(®) canola

protein isolates and also initiate scientific research projects

aimed at establishing the potential health benefits of Supertein(™)

canola protein isolate and its use as a functional food

ingredient. Burcon's ultimate objective from its canola

research activities is to develop Puratein(®) and Supertein(™)

through one or more strategic alliances to pursue the development

and construction of a first commercial facility. Burcon will

continue to refine its protein extraction and purification

technologies and to develop new technologies and related

products. In addition, Burcon will further strengthen and

expand its intellectual property portfolio. Burcon will also

explore opportunities for acquiring or licensing into Burcon, novel

technologies that will complement or enhance Burcon's intellectual

property portfolio and business initiatives. Financial Results and

Highlights Burcon reported a loss of $8,433,451 ($0.29 per share)

for the year as compared to $6,660,322 ($0.24 per share) in the

prior year. Included in the loss amount reported is

stock-based compensation (non-cash) costs of $3,718,096 (2010 -

$2,649,297). The other non-cash costs included in the loss

for the year are amortization of $178,050 (2010 - $163,969) and

loss on disposal of property and equipment of $nil (2010 - $924).

Research and development (R&D) expenses increased by

approximately $663,000 from fiscal 2010. In March 2011,

Burcon determined that it had met all the criteria of deferring

development costs with respect to CLARISOY(®) and has accordingly

capitalized $202,000 to development costs. As noted above,

Burcon has recorded in R&D expenses $356,000 that it has agreed

to reimburse ADM for its share of regulatory recognition costs for

Supertein(™) and Puratein(®). There were no other significant

changes in R&D expenditures for the year. General and

administrative expenses increased by about $745,000 over the prior

year. Included in salaries and benefits is stock-based

compensation expense of approximately $2,636,000 (2010

-$1,928,000). Options granted to directors in the third

quarter of fiscal 2010 vested immediately and a related fair value

of about $1,059,000 was recorded as stock-based compensation.

The full-year effect of the options granted at the same time to

employees contributed to an increase of stock-based compensation of

about $1,416,000. Options granted to directors this year, of

which some were vested immediately, also contributed to

approximately $645,000 of the increase, offset by about $287,000 of

stock-based compensation expense from options that completed

vesting in the first quarter. The cash portion of salaries

and benefits increased by about $174,000 over last year due to two

of the Company's officers having transferred their employment to

Burcon during the year which resulted in an increase in salaries

and benefits of about $112,000. The balance of the increase

is attributable to the hiring of a business development analyst

late last year, as well as an increase in directors' fees due to

the appointment of new independent directors and additional

committee meetings held during the year. Included in investor

relations expenses is approximately $125,000 (2010 - $104,000) of

stock-based compensation expense. The cash portion of

investor relations expense increased by approximately

$40,000. Fees and travel expenses paid to U.S. and

Canadian investor and public relations consultants contributed

about $46,000 to the increase, as well as expenses for a

newly-designed website of about $32,000, offset by a decrease in

annual report and video expenditures of about $18,000. Patent legal

fees and expenses account for a significant portion of Burcon's

professional fees. Burcon's patent strategy is to

aggressively seek protection for new technologies as well as

further protecting current technologies. During the year,

several patents entered National Phase, in particular during the

last quarter that resulted in significant filing fees in several

countries. During the previous year, Burcon filed several new

patent applications relating to CLARISOY(®)( )soy protein isolate

and also incurred higher foreign agency fees for the registration

in various European countries of patents granted in Europe and also

for a patent that entered national phase in the fourth quarter that

resulted in significant filing fees in various countries.

From inception, Burcon has expended approximately $5.8 million on

patent legal fees and disbursements to strengthen its patent

portfolio in various countries of the world and file patent

applications for new inventions. At March 31, 2011, the Company's

cash and short-term investment totaled approximately $11,932,000,

as compared to approximately $13,982,000 at March 31, 2010.

During this year, Burcon received proceeds of $1.9 million from

option and agents' warrant exercises. Management believes it

has sufficient resources to fund its expected level of operations

and working capital requirements to at least January 2013,

excluding proceeds from outstanding convertible securities. About

Burcon NutraScience Burcon is a leader in nutrition, health and

wellness in the field of functional, renewable plant proteins.

Since 1999, Burcon has developed a portfolio of composition,

application, and process patents originating from our core protein

extraction and purification technology. We are developing

Puratein(®) and Supertein(™ )canola protein isolates with unique

functional and nutritional attributes, and CLARISOY(®), a

revolutionary soy protein which is 100% soluble and completely

transparent in acidic solutions. Our team of highly specialized

scientists and engineers work from our own research facility to

develop and optimize environmentally sound technologies. To-date,

our patent portfolio consists of 164 issued patents in various

countries, including 27 issued U.S. patents, and in excess of 275

additional pending patent applications, 70 of which are U.S. patent

applications. ON BEHALF OF THE BOARD OF DIRECTORS "Johann F.

Tergesen" Johann F. Tergesen President and Chief Operating Officer

Burcon NutraScience Corporation is a publicly listed on the Toronto

Stock Exchange under the symbol "BU". For more information on

Burcon, visit www.burcon.ca. The TSX has not reviewed and does not

accept responsibility for the adequacy of the content of the

information contained herein. This press release contains

forward-looking statements that involve risks and uncertainties.

These forward-looking statements relate to, among other things,

plans and timing for the introduction or enhancement of our

products, statements about future market conditions, supply and

demand conditions, and other expectations, intentions and plans

contained in this press release that are not historical fact. Our

expectations regarding the prospect for future success depend upon

our ability to develop and sell products, which we do not produce

today and cannot be sold without further research and development.

When used in this press release, the words "goal", "intend",

"believes" and "potential" and similar expressions, generally

identify forward-looking statements. These statements reflect our

current expectations. They are subject to a number of risks and

uncertainties. In light of the many risks and uncertainties

surrounding the development of a source of protein from canola

meal, you should understand that we cannot assure you that the

forward looking statements contained in this press release will be

realized. Burcon NutraScience Corporation Consolidated Balance

Sheets As at March 31, 2011 and 2010 2011 2010 $ $ Assets Current

assets Cash and cash equivalents 9,628,020 11,661,745 Short-term

investments 2,304,465 2,320,372 Amounts receivable 41,919 25,052

Prepaid expenses 81,570 109,566 12,055,974 14,116,735 Property and

equipment 732,977 749,455 Deferred development costs, net of

accumulated amortization of $nil (2010 - $nil) 201,500 - Goodwill

1,254,930 1,254,930 14,245,381 16,121,120 Liabilities Current

liabilities Accounts payable and accrued liabilities 1,328,920

401,179 Shareholders' Equity Capital stock 47,158,758 44,236,390

Contributed surplus 3,762,983 3,762,983 Options 8,115,843 5,236,268

Warrants - 171,972 Deficit (46,121,123) (37,687,672) 12,916,461

15,719,941 14,245,381 16,121,120 Burcon NutraScience

Corporation Consolidated Statements of Operations, Comprehensive

Loss, and Deficit For the years ended March 31, 2011 and 2010 2011

2010 $ $ Expenses General and administrative 3,922,482 3,177,036

Research and development 2,764,045 2,101,159 Professional fees

1,716,424 1,296,863 Management fees and services 165,563 169,496

Amortization of property and equipment 3,667 3,379 Loss from

operations (8,572,181) (6,747,933) Interest and other income

138,730 87,611 Loss and comprehensive loss for the year (8,433,451)

(6,660,322) Deficit - Beginning of year (37,687,672) (31,027,350)

Deficit - End of year (46,121,123) (37,687,672) Basic and diluted

loss per share (0.29) (0.24) Burcon NutraScience Corporation

Consolidated Statements of Cash Flows For the years ended March 31,

2011 and 2010 2011 2010 $ $ Cash flows from operating activities

Loss for the year (8,433,451) (6,660,322) Items not affecting cash

Amortizaion of property and equipment 178,050 163,969 Loss on

disposal of property and equipment - 924 Stock-based compensation

expense 3,718,096 2,649,297 (4,537,305) (3,846,132) Changes in

non-cash working capital items Amounts receivable (16,867) 10,569

Prepaid expenses (3,634) (23,542) Accounts payable and accrued

liabilities 927,741 54,449 (3,630,065) (3,804,656) Cash flows from

investing activities Decrease (increase) in short-term investments

15,907 (2,320,372) Acquisition of property and equipment (180,608)

(288,503) Development costs deferred (105,852) - Proceeds from

disposal of property and equipment - 828 (270,553) (2,608,047) Cash

flows from financing activities Issue of capital stock - net of

issue costs 1,866,893 15,832,472 (Decrease) increase in cash and

cash equivalents (2,033,725) 9,419,769 Cash and cash equivalents -

Beginning of year 11,661,745 2,241,976 Cash and cash equivalents -

End of year 9,628,020 11,661,745 Cash and cash equivalents consist

of Cash 531,516 61,554 Cash equivalents 9,096,504 11,600,191

9,628,020 11,661,745 Supplemental disclosure of non-cash investing

activities Charged to deferred development costs: Stock-based

compensation 76,613 - Amortization of property and equipment 19,036

- To view this news release in HTML formatting,

please use the following URL:

http://www.newswire.ca/en/releases/archive/June2011/22/c8662.html p

align="center" Jade Cheng, Chief Financial Officerbr/ Burcon

NutraScience Corporationbr/ (604) 733-0896 / (888) 408-7960

toll-freebr/ a

href="mailto:jcheng@burcon.ca"jcheng@burcon.ca/a a

href="http://www.burcon.ca"www.burcon.ca/a /p

Copyright

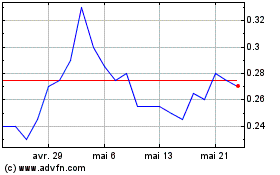

Burcon NutraScience (TSX:BU)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Burcon NutraScience (TSX:BU)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024