CORRECTION FROM SOURCE-Canadian General Investments: Investment Update-Unaudited

04 Octobre 2012 - 3:47PM

Marketwired Canada

The following corrects and replaces the press release issued at 11:12 ET on

October 3, 2012 which reported incorrect year-to-date and 12-month net asset

value returns for Canadian General Investments, Limited.

Canadian General Investments, Limited (CGI)

(TSX:CGI)(TSX:CGI.PR.B)(TSX:CGI.PR.C)(LSE:CGI) reports on an unaudited basis

that its net asset value per share (NAV) at September 30, 2012 was $22.07,

resulting in year-to-date and 12-month NAV returns, with dividends reinvested,

of 8.9% and 18.2%, respectively. These compare with the 5.4% and 9.2% returns of

the benchmark S&P/TSX Composite Index on a total return basis for the same

periods.

The closing price for CGI's common shares at September 30, 2012 was $15.47,

resulting in year-to-date and 12-month market returns, with dividends

reinvested, of -2.2% and 5.8%, respectively.

The sector weightings of CGI's investment portfolio at market as of September

30, 2012 were as follows:

Energy 22.0%

Materials 21.3%

Financials 20.1%

Consumer Discretionary 9.6%

Industrials 8.4%

Information Technology 6.0%

Health Care 4.7%

Telecommunication Services 3.5%

Utilities 2.9%

Cash & Cash Equivalents 0.9%

Consumer Staples 0.6%

The top ten investments which comprised 34.7% of the investment portfolio at

market as of September 30, 2012 were as follows:

Catamaran Corporation 4.7%

Franco-Nevada Corporation 4.3%

Labrador Iron Ore Royalty

Corporation 3.8%

Apple Inc. 3.8%

Dollarama Inc. 3.8%

Brookfield Canada Office Properties 3.6%

Enbridge Inc. 3.4%

Bank of Montreal 2.6%

BMTC Group Inc. 2.4%

Rogers Communications Inc. 2.3%

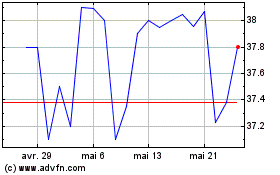

Canadian General Investm... (TSX:CGI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Canadian General Investm... (TSX:CGI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025