- Basic EPS of $0.63 or record adjusted EPS1

of $0.87

- EBITDA per share of $1.21 or record

adjusted EBITDA1 per share of $1.41

- Record total assets of $384.1 billion, a

year-over-year increase of 65.9%

- Record asset gathering of $6.6 billion in

net flows across wealth and asset management in 2021

- Completed eight RIA acquisitions with

combined assets of $43.3 billion

- Made strategic investments in two

alternative asset managers, Columbia Pacific Advisors and GLAS

Funds

- U.S. wealth management surpassed $100 billion in assets to

become CI’s largest business with $151.3 billion in assets, up from

zero two years ago

- Paid quarterly dividend of $0.18 a share,

totalling $35.6 million

- Following quarter-end, CI agreed to acquire

$2.2-billion Northwood Family Office, Canada’s leading multi-family

office, and Corient Capital Partners, a fast-growing California RIA

with $6.4 billion in assets

All financial

amounts in Canadian dollars as at December 31, 2021, unless stated

otherwise. Financial amounts for the quarters and year ended 2021

are unaudited.

CI Financial Corp. (“CI”) (TSX: CIX, NYSE: CIXX) today released

record financial results for the quarter ended December 31,

2021.

“2021 was the most successful year in the history of CI in terms

of financial performance and asset gathering,” said Kurt MacAlpine,

CI Chief Executive Officer. “These outstanding results stem from

the tremendous progress we have made in executing on our strategy

and the successful transformation of the company. During the year,

we added $6.6 billion of new client assets, excluding market moves

and M&A. This was the result of robust growth in wealth

management and our best asset management flows in six years.

“In the U.S., we significantly expanded our wealth management

business by completing the acquisitions of eight registered

investment advisors and taking minority stakes in two alternative

asset managers in the fourth quarter alone,” Mr. MacAlpine said.

“At $151 billion in assets, U.S. wealth management is now our

largest business line.

“In Canada, our wealth management platform posted year-over-year

asset growth of 20%, reaching $80.6 billion, while AUM in our asset

management segment grew by more than 11% due to strong investment

performance and positive net sales. The significant turnaround in

net sales stems from actions taken to modernize our asset

management business, including integrating our boutique investment

teams into a single global platform and introducing a broad range

of innovative investment solutions.”

Operating and financial data highlights

(in billions)

For the Three Months

Ended

For the Year Ended

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Dec. 31, 2021

Dec. 31, 2020

Core assets under management*

144.2

139.4

138.2

132.6

129.6

144.2

129.6

U.S. assets under management

7.9

7.2

6.6

5.9

5.5

7.9

5.5

Total assets under management

152.1

146.6

144.8

138.5

135.1

152.1

135.1

Core average assets under management*

143.0

141.1

135.9

131.6

126.2

137.9

124.1

Total average assets under management

150.5

148.0

141.9

137.1

131.2

144.4

126.9

Canadian wealth management

80.6

76.9

75.5

71.1

67.3

80.6

67.3

U.S. wealth management

151.3

97.0

83.8

31.0

29.2

151.3

29.2

Total wealth management assets

232.0

173.8

159.3

102.1

96.5

232.0

96.5

Total assets

384.1

320.4

304.0

240.6

231.5

384.1

231.5

Total asset management net flows

--

0.8

0.4

(0.9)

(2.1)

0.3

(8.8)

* Core assets represent Canada and Australia

(in millions, except per share

amounts)

For the Three Months

Ended

For the Year Ended

(2021 amounts unaudited)

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Dec. 31, 2021

Dec. 31, 2020

(unaudited)

(unaudited)

Net income

123.7

43.8

117.6

124.2

105.0

409.3

476.0

Basic earnings per share

0.63

0.22

0.58

0.60

0.50

2.03

2.22

Diluted earnings per share

0.62

0.22

0.57

0.59

0.50

2.02

2.21

EBITDA

237.3

141.3

212.6

203.5

174.2

794.7

752.4

EBITDA per share

1.21

0.71

1.05

0.98

0.83

3.94

3.51

Cash flow from operating activities

163.7

182.5

130.1

189.7

77.3

665.9

542.0

Adjusted net income1

171.0

159.2

153.0

151.6

148.7

634.8

528.7

Adjusted basic earnings per share1

0.87

0.80

0.75

0.73

0.71

3.15

2.47

Adjusted EBITDA1

277.2

258.1

242.3

236.3

226.0

1,013.9

807.0

Adjusted EBITDA per share1

1.41

1.30

1.19

1.14

1.08

5.03

$3.77

Free cash flow1

187.1

180.9

164.1

155.6

145.6

687.7

563.8

Share repurchases

20.4

99.1

132.0

112.7

29.8

364.3

257.9

Dividends paid per share

0.18

0.18

0.18

0.18

0.18

0.72

0.72

Average basic shares outstanding

196.8

199.3

203.0

207.5

209.3

201.6

214.1

Average diluted shares outstanding

198.4

202.3

205.5

209.3

211.1

202.5

215.6

Long term debt (including current

portion)

3,776

3,408

3,350

2,201

2,456

3,776

2,456

Net debt1

3,453

2,655

2,461

1,856

1,872

3,453

1,872

Net debt to adjusted EBITDA1

3.14

2.59

2.53

1.94

2.08

3.14

2.08

1. Free cash flow, net debt, adjusted net income, adjusted

earnings per share and adjusted EBITDA are not standardized

earnings measures prescribed by IFRS. For further information, see

“Non-IFRS Measures” note below.

Financial highlights

Total fourth quarter revenues grew by 15.3% as compared to the

third quarter. Excluding foreign currency exchange gains and losses

and a gain on an investment during the fourth quarter, total

revenue grew 6.8%, primarily driven by seasonal performance fees

and distributions related to seed capital investments in certain

funds, higher average core assets under management, as well as by

recent acquisitions and higher client asset balances.

Total expenses in the fourth quarter decreased slightly from the

third quarter. Excluding adjustments related to changes in fair

value for contingent consideration and amortization of intangible

assets related to our acquisitions, legal and restructuring

charges, and contingent consideration recorded as compensation,

total expenses increased 3.5% primarily due to year-end incentive

compensation adjustments and higher marketing and branding

costs.

Net income grew to $123.7 million in the fourth quarter from

$43.8 million in the third quarter. Excluding the adjustments noted

above, fourth quarter net income was $171.0 million, which

increased 7.4% from $159.2 million in the third quarter.

For the full year, revenues grew 33% to $2.7 billion, reflecting

the impact of acquisitions, favorable market conditions and

positive organic growth across the franchise. For the full year,

expenses grew 52% to $2.1 billion, reflecting the impact of

acquisitions as well as higher variable costs associated with

higher asset levels. Net income was $412.4 million in 2021 as

compared to $475.5 million in 2020. Adjusted net income (see

non-IFRS measures) increased to $634.8 million from $528.7 million,

primarily due to the impact of acquisitions and favorable market

conditions.

Capital allocation

In the fourth quarter of 2021, CI repurchased 0.8 million shares

at a cost of $20.9 million, for an average cost of $26.21 per

share, and paid $35.6 million in dividends at a rate of $0.18 per

share.

The Board of Directors declared a quarterly dividend of $0.18

per share, payable on July 15, 2022 to shareholders of record on

June 30, 2022. The annual dividend rate of $0.72 per share

represented a yield of 3.3% on CI’s closing share price of $21.80

on February 18, 2022.

Fourth quarter business highlights

- CI completed the acquisitions of eight registered investment

advisors with combined assets of approximately $43.3 billion. They

are all high-quality firms focused on high-net-worth and

ultra-high-net-worth clients and include:

- Budros, Ruhlin & Roe, Inc., a Columbus, Ohio-based RIA

managing $4.4 billion in assets.

- CPWM, LLC (doing business as Columbia Pacific Wealth

Management), which manages $8.6 billion from its headquarters in

Seattle and an office in San Francisco.

- Gofen and Glossberg, LLC, a Chicago-based RIA with $9.7 billion

in assets and a history dating back to 1932.

- Matrix Capital Advisors, LLC, of Chicago, which oversees $0.9

billion in assets.

- McCutchen Group LLC, a Seattle-based multi-family office

managing $4.7 billion.

- Odyssey Wealth Management, LLC, an RIA with $0.3 billion in

assets acquired by CI affiliate RGT Wealth Advisors, LLC of

Dallas.

- RegentAtlantic Capital, LLC, a $9.1-billion RIA based in

Morristown, N.J. with an office in New York City.

- R.H. Bluestein& Co., which manages $5.6 billion from

offices in Birmingham, Michigan and New YorkCity.

- CI acquired minority stakes in two alternative investment

firms:

- Columbia Pacific Advisors, LLC of Seattle, which manages

approximately $4.8 billion in assets across a broad selection of

institutional-caliber alternative strategies.

- GLAS Funds, LLC of Cleveland, a leading tech-enabled platform

providing investors with secure and streamlined digital access to

alternative investments. It has $1.6 billion in combined assets

under management and assets under contract.

- CI Global Asset Management (“CI GAM”) investment funds received

extensive industry recognition for investment excellence. CI GAM

received 13 Refinitiv Canada Lipper Fund Awards and 38 FundGrade

A+® Awards. The FundGrade A+ winners included 16 mutual funds and

exchange-traded funds and 22 segregated funds managed by the firm.

The Lipper and FundGrade A+ awards were announced in November and

January, respectively.

Following quarter-end:

- Effective January 1, CI established CI Private Wealth US, LLC

(“CIPW”) to hold CI’s interests in its U.S. RIAs. CIPW is

structured as a partnership in which CI is majority owner and

certain employees of CIPW and its affiliates hold shares in the

firm. This unique model aligns the interests of all partners and

incentivizes them to collaborate, realize synergies, and drive the

profitable growth of the firm as a whole.

- CI agreed to acquire Corient Capital Partners, LLC, a Newport

Beach, California-based RIA overseeing approximately $6.3 billion

on behalf of ultra-high-net-worth individuals and families across

the United States.

- CI agreed to acquire Toronto-based Northwood Family Office

Ltd., Canada’s leading multi-family office. It manages and

co-ordinates the integrated financial, investment and personal

affairs of wealthy Canadian and global families and oversees

approximately $2.2 billion of investment assets.

- CI continued to build on its leadership position in digital

assets in Canada with the acquisition of a minority stake in Newton

Crypto Ltd., a crypto asset trading platform, and the launch of the

CI Galaxy Multi-Crypto ETF (TSX: CMCX).

Analysts’ conference call

CI will hold a conference call with analysts today at 10:00 a.m.

EST, led by Mr. MacAlpine and Chief Financial Officer Amit Muni. A

live webcast of the call and slide presentation can be accessed

here, or through the Investor Relations section of CI’s website.

Alternatively, investors may listen to the discussion through the

following numbers (access code: 652352):

- Canada toll-free: 1-833-950-0062

- United States: 1-844-200-6205

- United States (New York local): 1-646-904-5544.

About CI Financial

CI Financial Corp. is an integrated global wealth and asset

management company. CI’s primary asset management businesses are CI

Global Asset Management (CI Investments Inc.) and GSFM Pty Ltd.,

and it operates in Canadian wealth management through CI Assante

Wealth Management (Assante Wealth Management (Canada) Ltd.), CI

Private Counsel LP, Aligned Capital Partners Inc., CI Direct

Investing (WealthBar Financial Services Inc.), and CI Investment

Services Inc.

CI’s U.S. wealth management businesses consist of Barrett Asset

Management, LLC, Balasa Dinverno Foltz LLC, BRR OpCo, LLC, Bowling

Portfolio Management LLC, Brightworth, LLC, The Cabana Group, LLC,

CPWM, LLC, Congress Wealth Management LLC, Dowling & Yahnke,

LLC, Doyle Wealth Management, LLC, Gofen & Glossberg, LLC,

Matrix Capital Advisors, LLC, McCutchen Group LLC, OCM Capital

Partners, LLC, Portola Partners Group LLC, Radnor Financial

Advisors, LLC, RegentAtlantic Capital, LLC, The Roosevelt

Investment Group, LLC, RGT Wealth Advisors, LLC, R.H. Bluestein

& Co., Segall Bryant & Hamill, LLC, Stavis & Cohen

Private Wealth, LLC, and Surevest LLC.

CI is listed on the Toronto Stock Exchange under CIX and on the

New York Stock Exchange under CIXX. Further information is

available at www.cifinancial.com.

Commissions, trailing commissions, management fees and expenses

all may be associated with an investment in mutual funds and

exchange-traded funds (ETFs). Please read the prospectus before

investing. Important information about mutual funds and ETFs is

contained in their respective prospectus. Mutual funds and ETFs are

not guaranteed; their values change frequently, and past

performance may not be repeated. You will usually pay brokerage

fees to your dealer if you purchase or sell units of an ETF on

recognized Canadian exchanges. If the units are purchased or sold

on these Canadian exchanges, investors may pay more than the

current net asset value when buying units of the ETF and may

receive less than the current net asset value when selling

them.

This press release contains forward-looking statements

concerning anticipated future events, results, circumstances,

performance or expectations with respect to CI Financial Corp.

(“CI”) and its products and services, including its business

operations, strategy and financial performance and condition.

Forward-looking statements are typically identified by words such

as “believe”, “expect”, “foresee”, “forecast”, “anticipate”,

“intend”, “estimate”, “goal”, “plan” and “project” and similar

references to future periods, or conditional verbs such as “will”,

“may”, “should”, “could” or “would”. These statements are not

historical facts but instead represent management beliefs regarding

future events, many of which by their nature are inherently

uncertain and beyond management’s control. Although management

believes that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, such statements

involve risks and uncertainties. The material factors and

assumptions applied in reaching the conclusions contained in these

forward-looking statements include that announced acquisitions will

be completed, that the investment fund industry will remain stable

and that interest rates will remain relatively stable. Factors that

could cause actual results to differ materially from expectations

include, among other things, general economic and market

conditions, including interest and foreign exchange rates, global

financial markets, changes in government regulations or in tax

laws, industry competition, technological developments and other

factors described or discussed in CI’s disclosure materials filed

with applicable securities regulatory authorities from time to

time. The foregoing list is not exhaustive and the reader is

cautioned to consider these and other factors carefully and not to

place undue reliance on forward- looking statements. Other than as

specifically required by applicable law, CI undertakes no

obligation to update or alter any forward-looking statement after

the date on which it is made, whether to reflect new information,

future events or otherwise.

This communication is provided as a general source of

information and should not be considered personal, legal,

accounting, tax or investment advice, or construed as an

endorsement or recommendation of any entity or security discussed.

Individuals should seek the advice of professionals, as

appropriate, regarding any particular investment. Investors should

consult their professional advisors prior to implementing any

changes to their investment strategies.

CI Global Asset Management is a registered business name of CI

Investments Inc.

The Refinitiv Lipper Fund Awards, granted annually, highlight

funds and fund companies that have excelled in delivering

consistently strong risk-adjusted performance relative to their

peers. The Refinitiv Lipper Fund Awards are based on the Lipper

Leader for Consistent Return rating, which is a risk-adjusted

performance measure calculated over 36, 60 and 120 months. The fund

with the highest Lipper Leader for Consistent Return (Effective

Return) value in each eligible classification wins the Refinitiv

Lipper Fund Award. For more information, see lipperfundawards.com.

Although Refinitiv Lipper makes reasonable efforts to ensure the

accuracy and reliability of the data contained herein, the accuracy

is not guaranteed by Refinitiv Lipper.

FundGrade A+® is used with permission from Fundata Canada Inc.,

all rights reserved. The annual FundGrade A+® Awards are presented

by Fundata Canada Inc. to recognize the “best of the best” among

Canadian investment funds. The FundGrade A+® calculation is

supplemental to the monthly FundGrade ratings and is calculated at

the end of each calendar year. The FundGrade rating system

evaluates funds based on their risk-adjusted performance, measured

by Sharpe Ratio, Sortino Ratio, and Information Ratio. For more

information, see www.FundGradeAwards.com. Although Fundata makes

every effort to ensure the accuracy and reliability of the data

contained herein, the accuracy is not guaranteed by Fundata.

CI Financial Corp.

Consolidated Statement of

Operations

(in millions, except per share

amounts)

(unaudited)

For the Three Months

Ended

For the Year Ended

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Dec. 31, 2021

Dec. 31, 2020

(unaudited)

(unaudited)

Management Fees

464.9

460.9

441.1

425.1

415.9

1,792.1

1,635.8

Administration Fees

258.5

243.0

193.7

167.5

125.6

862.6

364.4

Other Revenues

39.5

(42.6)

27.6

47.8

26.8

72.3

52.6

Total Revenues

762.9

661.3

662.4

640.4

568.3

2,727.0

2,052.8

SG&A

203.9

192.5

165.6

140.2

116.7

702.3

449.4

Trailer Fees

142.5

142.0

136.4

130.8

129.4

551.7

509.4

Advisor & Dealer Fees

112.8

110.9

99.3

101.5

87.0

424.5

253.4

Deferred Sales Commissions

1.1

1.4

1.3

1.9

1.4

5.7

7.5

Interest and Lease Finance

32.5

31.6

24.2

21.3

17.8

109.7

65.4

Amortization and Depreciation

29.1

26.8

21.4

19.6

13.9

96.8

43.5

Other Expenses

65.9

73.7

47.6

62.9

59.9

250.2

81.3

Total Expenses

587.8

578.9

495.9

478.3

426.1

2,140.9

1,410.0

Income Before Income Taxes

175.1

82.4

166.6

162.1

142.2

586.2

642.7

Income Taxes

51.3

37.0

48.2

37.4

36.6

173.8

167.2

Non-Controlling Interest

-

1.6

0.8

0.6

0.6

3.1

(0.4)

Net Income Attributable to

Shareholders

123.7

43.8

117.6

124.2

105.0

409.3

476.0

Earnings Per Share – Basic

$0.63

$0.22

$0.58

$0.60

$0.50

$2.03

$2.22

Earnings Per Share – Diluted

$0.62

$0.22

$0.57

$0.59

$0.50

$2.02

$2.21

Average Common Shares Outstanding -

Basic

196.8

199.3

203.0

207.5

209.3

201.6

214.1

Average Common Shares Outstanding -

Diluted

198.4

202.3

205.5

209.3

211.1

202.5

215.6

CI Financial Corp.

Consolidated Balance

Sheet

(in millions)

(unaudited)

December 31,

2021

2020

(unaudited)

Assets

Cash and short-term investments

230.8

483.6

Client and trust funds on deposit

1,199.9

973.1

Investments

131.8

133.4

Accounts receivable and prepaid

expenses

273.0

240.9

Income taxes recoverable

3.6

7.7

Total current assets

1,839.0

1,838.7

Capital assets, net

52.6

47.0

Right-of-use asset

142.6

50.6

Intangibles

6,185.2

4,291.0

Deferred income taxes

56.9

7.8

Other assets

383.2

124.7

Total assets

8,659.6

6,359.8

Liabilities and Shareholders'

equity

Accounts payable and accrued

liabilities

369.1

315.9

Current portion of provisions and other

financial liabilities

572.4

275.7

Dividends payable

71.1

75.3

Client and trust funds payable

1,202.1

961.1

Income taxes payable

19.0

3.2

Current portion of long-term debt

297.5

203.8

Current portion of lease liabilities

20.2

14.9

Total current liabilities

2,551.4

1,849.9

Long-term debt

3,478.5

2,252.3

Deferred income taxes

480.8

470.7

Provisions and other financial

liabilities

379.6

107.8

Lease liabilities

153.5

61.3

Total liabilities

7,043.9

4,742.1

Equity

Share capital

1,810.2

1,868.0

Contributed surplus

28.4

22.8

Deficit

(226.7)

(287.6)

Accumulated other comprehensive income

(23.3)

(20.7)

Total equity attributable to the

shareholders of the company

1,588.6

1,582.4

Non-controlling interest

27.1

35.3

Total Equity

1,615.6

1,617.7

Total liabilities and equity

8,659.6

6,359.8

CI Financial Corp.

Consolidated Statement of Cash

Flows

(in millions)

(unaudited)

Year ended December

31,

2021

2020

(unaudited)

Operating Activities

Net income for the period

412.4

475.5

Add (deduct) items not involving cash:

Realized and unrealized (gain) loss

(20.6)

(6.9)

Fair value change - acquisition

liabilities

149.9

-

Contingent consideration recorded as

compensation

7.2

-

Equity-based compensation

22.0

10.7

Amortization and depreciation

96.8

43.5

Deferred income taxes

(42.4)

(1.7)

Loss on repurchase of long-term debt

24.9

2.3

Operating cash flow from continuing

operations

650.2

523.4

Net change in operating assets and

liabilities

15.7

18.6

Cash and cash equivalents provided by

(used in) continuing operating activities

665.9

541.9

Investing Activities

Purchase of investments

(5.1)

(17.6)

Proceeds on sale of investments

15.4

23.6

Additions to capital assets

(7.8)

(12.0)

Increase in other assets

(167.4)

(47.6)

Additions to intangibles

(12.4)

(17.1)

Cash paid to settle acquisition

liabilities

(290.0)

-

Acquisitions, net of cash acquired

(934.5)

(527.3)

Cash used in investing activities

(1,401.8)

(598.1)

Financing Activities

Repurchase of long-term debt

(50.7)

(56.0)

Repurchase of share capital

(364.3)

(257.9)

Payment of lease liabilities

(16.7)

(12.2)

Net distributions from non-controlling

interest

(3.1)

0.8

Repayment of long-term debt

(640.4)

(569.0)

Issuance of long-term debt

1,704.8

1,471.0

Dividends paid

(146.5)

(155.3)

Cash and cash equivalents provided by

(used in) financing activities

483.1

421.4

Net increase (decrease) in cash and cash

equivalents during the period

(252.8)

365.2

Cash and cash equivalents, beginning of

period

483.6

118.4

Cash and cash equivalents, end of

period

230.8

483.6

CI Financial Corp.

Segment Results

(in millions)

(unaudited)

Asset Management Segment

For the Three Months

Ended

For the Year Ended

(in millions)

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Dec. 31, 2021

Dec. 31, 2020

(unaudited)

(unaudited)

Management Fees

469.6

465.6

445.5

429.2

419.6

1810.0

1,650.1

Other Revenues

20.5

(26.4

)

8.2

24.7

0.8

26.9

(2.2

)

Total Revenues

490.1

439.2

453.7

453.9

420.5

1,836.9

1,647.8

SG&A

95.9

98.2

93.5

89.0

82.5

376.7

325.2

Trailer Fees

151.4

150.9

144.9

139.0

137.2

586.2

538.4

Deferred Sales Commissions

1.2

1.5

1.4

2.0

1.5

6.1

8.0

Amortization and Depreciation

6.1

6.1

6.1

7.2

6.7

25.4

24.7

Other Expenses

26.9

5.9

27.5

30.4

52.7

90.6

69.2

Total Expenses

281.4

262.5

273.3

267.7

280.5

1,085.0

965.5

Income before income taxes and

non-segmented items

208.7

176.7

180.4

186.2

140.0

751.9

682.3

Adjustments:

Non-controlling interest

(0.2

)

(0.5

)

(0.2

)

-

(0.4

)

(1.0

)

(0.9

)

Amortization of acquisition related

intangibles

0.6

0.6

0.6

0.5

0.5

2.3

2.0

FX (gains) and losses

1.4

19.0

(1.2

)

(8.2

)

13.0

11.0

8.4

Change in fair value of contingent

consideration

14.2

1.9

10.0

-

-

26.2

-

Write-down/(write-up) on investments

(16.8

)

-

-

-

1.8

(16.8

)

1.8

Legal and restructuring charges

10.4

0.4

14.6

0.1

47.5

25.6

54.6

Bond redemption costs

-

-

0.2

24.7

1.9

24.9

1.9

Gain on equity investment

-

-

(1.4

)

-

-

(1.4

)

-

Adjusted income before income taxes and

non- segmented items

218.3

198.1

203.1

203.3

204.2

822.8

750.1

Wealth Management Segment

For the Three Months

Ended

For the Year Ended

(in millions)

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Dec. 31, 2021

Dec. 31, 2020

(unaudited)

(unaudited)

Administration Fees

308.0

292.2

240.3

212.3

167.9

1,052.8

530.1

Other Revenues

19.0

(16.2

)

19.4

23.1

26.0

45.3

54.8

Total Revenues

327.0

276.0

259.7

235.4

194.0

1,098.2

584.9

SG&A

112.8

99.1

76.7

55.4

38.0

344.0

138.8

Advisor and dealer fees

153.1

151.0

137.3

137.8

121.4

579.2

389.3

Amortization and Depreciation

23.0

20.7

15.3

12.4

7.2

71.4

18.8

Other Expenses

39.0

67.9

20.1

32.5

7.3

159.5

12.2

Total Expenses

328.1

338.6

249.4

238.2

173.9

1,154.2

559.0

Income (loss) before income taxes and non-

segmented items

(1.1

)

(62.6

)

10.3

(2.8

)

20.1

(56.0

)

25.9

Adjustments:

Non-controlling interest

(0.9

)

(1.5

)

(0.5

)

(0.7

)

(0.4

)

(3.6

)

(0.1

)

Amortization of acquisition related

intangibles

18.1

16.2

11.4

9.4

4.6

55.1

9.9

FX (gains) and losses

(4.5

)

31.2

(7.0

)

(12.0

)

(15.2

)

7.8

(15.8

)

Change in fair value of contingent

consideration

29.7

59.5

12.4

22.2

-

123.7

-

Write-down/(write-up) on investments

-

-

-

7.1

-

7.1

-

Legal and restructuring charges

3.2

3.5

2.9

0.7

4.6

10.3

6.0

Bond redemption costs

-

-

-

-

-

-

-

Contingent consideration recorded as

compensation

2.1

4.2

0.9

-

-

7.2

-

Adjusted income before income taxes and

non- segmented items

46.6

50.4

30.6

24.0

13.7

151.6

25.9

Assets Under Management

For the Three Months

Ended

For the Year Ended

(in billions)

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Dec. 31, 2021

Dec. 31, 2020

Assets under management, beginning

146.6

144.8

138.5

135.1

128.3

135.1

131.7

Gross sales

5.8

5.7

6.8

6.2

4.9

24.5

18.3

Redemptions

5.9

4.9

6.4

7.0

7.0

24.2

27.1

Net sales

--

0.8

0.4

(0.9)

(2.1)

0.3

(8.8)

Acquisitions (divestitures)

0.2

0.2

5.0

Fund performance

5.5

1.0

5.7

4.3

8.9

16.5

7.1

Assets under management, ending

152.1

146.6

144.8

138.5

135.1

152.1

135.1

Average assets under management

150.5

148.0

141.9

137.1

131.2

144.4

126.9

Core assets under management,

ending

144.2

139.4

138.2

132.6

129.6

144.2

129.6

Core average assets under

management

143.0

141.1

135.9

131.6

126.2

137.9

124.1

Asset Management Sales

Quarter ended December 31,

2021

Quarter ended December 31,

2020

(In millions)

Gross

Sales

Redemptions

Net

Sales

Gross

Sales

Redemptions

Net

Sales

Canadian Business

Retail

4,562

4,420

142

3,722

4,976

(1,255)

Institutional

385

716

(331)

302

1,226

(925)

4,947

5,136

(189)

4,023

6,203

(2,180)

Australian Business

Retail

175

86

90

276

116

160

Institutional

27

35

(8)

124

320

(197)

203

121

82

400

436

(36)

U.S.

656

396

260

428

126

301

Closed Business

7

202

(195)

12

237

(226)

Total

5,813

5,855

(42)

4,863

7,003

(2,140)

Non-IFRS Measures

In an effort to provide additional information regarding our

results as determined by IFRS, we also disclose certain non-IFRS

information which we believe provides useful and meaningful

information. Our management reviews these non-IFRS financial

measurements when evaluating our financial performance and results

of operations; therefore, we believe it is useful to provide

information with respect to these non-GAAP measurements so as to

share this perspective of management. Non-IFRS measurements do not

have any standardized meaning, do not replace nor are superior to

IFRS financial measurements and may not be comparable to similar

measures presented by other companies. The non-IFRS financial

measurements contained in this press release include:

- Adjusted net income and adjusted basic earnings per share

- EBITDA, EBITDA per basic share, adjusted EBITDA, and adjusted

EBITDA per basic share

- Free cash flow

- Net debt.

Our adjusted net income, adjusted basic earnings per share,

adjusted EBITDA, adjusted EBITDA per basic share and free cash flow

excludes the following revenues and expenses which we believe

allows investors a consistent way to analyze our financial

performance:

- gains or losses related to foreign currency fluctuations on our

cash balances

- costs related to our acquisitions including:

- amortization of intangible assets

- change in fair value of contingent consideration

- related advisory fees

- contingent consideration classified as compensation per

IFRS

- restructuring charges

- gains or losses in assets and investments

- costs related to issuing or retiring debt obligations.

Further explanations of these Non-IFRS measures can be found in

the “Non-IFRS Measures” section of Management’s Discussion and

Analysis dated November 11, 2021 available on SEDAR at

www.sedar.com or at www.cifinancial.com.

Adjusted Net Income and EPS

For the Three Months

Ended

For the Year Ended

(in millions)

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Dec. 31, 2021

Dec. 31, 2020

(unaudited)

(unaudited)

Reported Net Income Before Non-controlling

Interest

123.9

45.4

118.4

124.8

105.7

412.5

475.5

Amortization of Acquisition Related

Intangibles

18.7

16.8

12.0

9.9

5.2

57.4

12.0

FX (gains) and Losses

(3.1)

50.3

(8.2)

(20.2)

(2.2)

18.8

(7.5)

Change in Fair Value of Acquisition

Liabilities

43.9

61.4

22.4

22.2

--

149.9

--

Legal and Restructuring Charges

13.6

3.9

17.5

0.8

52.1

35.9

60.6

Write-down in Assets

(16.8)

--

--

7.1

1.8

(9.7)

1.8

Bond Redemption Costs

--

--

0.2

24.7

1.9

24.9

1.9

Gain on Equity Investment

--

--

(1.4)

--

--

(1.4)

--

Contingent Consideration Recorded as

compensation

2.1

4.2

0.9

--

--

7.2

--

Total Adjustments (pre-tax)

58.2

136.6

43.6

44.5

58.8

283.0

68.8

Tax Effect (recovery)

(11.1)

(21.2)

(8.2)

(17.0)

(14.9)

(57.5)

(16.1)

Non-Controlling Interest

--

1.6

0.8

0.7

0.8

3.1

(0.4)

Adjusted Net Income

171.0

159.2

153.0

151.6

148.7

634.8

528.7

Average Common Shares Outstanding -

Basic

196.8

199.3

203.0

207.5

209.3

201.6

214.1

Adjusted Earnings Per Share –

Basic

0.87

0.80

0.75

0.73

0.71

3.15

2.47

EBITDA

For the Three Months

Ended

For the Year Ended

(in millions)

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Dec. 31, 2021

Dec. 31, 2020

(unaudited)

(unaudited)

Net Income

123.7

45.4

118.4

124.8

105.7

412.4

475.5

Add:

Interest & lease finance

32.5

31.6

24.2

21.3

17.8

109.6

65.4

Provision for income taxes

51.3

37.0

48.2

37.4

36.6

173.8

167.2

Amortization and depreciation

29.8

27.3

21.8

20.0

14.2

98.8

44.2

EBITDA

237.3

141.3

212.6

203.5

174.2

794.7

752.4

Average Common Shares Outstanding -

Basic

196.8

199.3

203.0

207.5

209.3

201.6

214.1

EBITDA per share

1.21

0.71

1.05

0.98

0.83

3.94

3.51

Adjusted EBITDA

For the Three Months

Ended

For the Year Ended

(in millions)

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Dec. 31, 2021

Dec. 31, 2020

(unaudited)

(unaudited)

EBITDA

237.5

141.3

212.6

203.5

174.2

794.8

752.4

Adjustments:

FX (gains) and losses

(3.1)

50.3

(8.2)

(20.2)

(2.2)

18.8

(7.5)

Change in fair value of acquisition

liabilities

43.9

61.4

22.4

22.2

--

149.9

--

Legal & restructuring provision

13.6

3.9

17.5

0.8

52.1

35.9

60.6

Write-downs (gains) in assets and

investments

(16.8)

--

(1.4)

7.1

1.8

(11.1)

1.8

Bond redemption costs

--

--

0.2

24.7

1.9

24.9

1.9

Contingent consideration recorded as

compensation

2.1

4.2

0.9

--

--

7.2

--

Less: Non-controlling interest

(0.2)

3.0

1.9

1.8

1.8

6.4

2.2

Adjusted EBITDA

277.2

258.1

242.3

236.3

226.0

1,013.9

807.0

Average Common Shares Outstanding -

Basic

196.8

199.3

203.0

207.5

209.3

201.6

214.1

Adjusted EBTIDA per share

1.41

1.30

1.19

1.14

1.08

5.03

3.77

Net Debt

For the Three Months

Ended

(in millions)

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

(unaudited)

Gross Debt

3,776.0

3,408.4

3,350.2

2,200.9

2,456.1

Less:

Cash and short-term investments

230.8

653.9

801.3

248.4

483.6

Marketable securities

116.9

122.5

121.1

122.0

118.1

Add:

Regulatory capital and non-controlling

interest

25.0

23.1

33.4

25.9

18.0

Net debt

3,453.4

2,655.1

2,461.2

1,856.4

1,872.4

Adjusted EBITDA

277.2

258.1

242.3

236.3

226.0

Annualized

1,099.8

1,024.1

971.9

958.3

899.1

Gross leverage (Gross debt/Annualized

EBITDA)

3.4x

3.3x

3.4x

2.3x

2.7x

Net leverage (Net debt/Annualized

EBITDA)

3.1x

2.6x

2.5x

1.9x

2.1x

Free Cash Flow

For the Three Months

Ended

For the Year Ended

(in millions)

Dec. 31, 2021

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Dec. 31, 2021

Dec. 31, 2020

(unaudited)

(unaudited)

Cash provided by operating activities

163.7

182.5

130.1

189.7

77.3

665.9

542.0

Net change in operating assets and

liabilities

15.5

(47.3)

28.0

(11.9)

31.7

(15.7)

(18.6)

Operating Cash Flow

179.2

135.3

158.1

177.8

108.9

650.2

523.4

Adjustments:

FX (gains) and losses

(3.1)

50.3

(8.2)

(20.2)

(2.2)

18.8

(7.5)

Legal & restructuring charges

13.6

3.9

17.5

0.8

52.1

35.9

60.6

Write-down (gain) in assets and

investments

--

--

--

7.1

1.8

7.1

1.8

Sub-total

10.5

54.2

9.4

(12.3)

51.7

61.8

54.9

Tax effect (recovery) of adjustments

(2.6)

(5.9)

(1.4)

(8.3)

(13.5)

(18.1)

(12.8)

Less: Non-controlling interest

--

2.6

1.9

1.7

1.6

6.2

1.7

Free Cash Flow

187.1

180.9

164.1

155.6

145.6

687.7

563.8

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220222005580/en/

Investor Relations Jason Weyeneth, CFA Vice-President,

Investor Relations & Strategy 416-681-8779 jweyeneth@ci.com

Media Canada Murray Oxby Vice-President, Communications

416-681-3254 moxby@ci.com

United States Trevor Davis, Gregory FCA for CI Financial

443-248-0359 cifinancial@gregoryfca.com

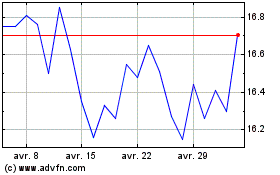

CI Financial (TSX:CIX)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

CI Financial (TSX:CIX)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024