Canacol Energy Ltd. ("Canacol" or the "Corporation") (TSX:CNE;

OTCQX:CNNEF; BVC:CNEC) provides the following gas sales and

drilling operations update, along with announcement of quarterly

dividend.

November Gas Sales of 169

MMscfpd

Realized contractual natural gas sales (which

are gas produced, delivered, and paid for) were 169 million

standard cubic feet per day for November 2023.

Gas sales during the month of November were

impacted by high reservoir levels and related hydroelectric power

generation due to heavy rainfall which reduced the demand for gas

for thermoelectric power generation. The last week of November saw

a fall in reservoir levels related to less rainfall and a related

increase in thermoelectrical power generation and gas consumption.

Reservoir levels continue to fall into December due to lower

rainfall.

The Corporation expects production capacity to

be approximately 180 MMscfpd exiting the month of December 2023

following the workover of the Clarinete 4 producer and the drilling

of the Nelson 16 development well.

Near Term Drilling Program

The Corporation completed the drilling of the

Pandereta 10 development well which encountered 122 feet of net gas

pay within the Cienaga de Oro (“CDO”) sandstone reservoir. The well

was tied into the Jobo facility and brought on production at the

end of November.

The rig is currently drilling the Nelson 16

development well which is expected to be completed and tied in by

the end of December 2023. The Corporation will then drill the

Nelson 17 development well, which it expects to be completed and

tied into production by the third week of January 2024.

First Ever Royalty Construction Project

Completed

The Ministry of Mines and Energy Resolution

40207/2021 facilitates investments in local public projects in lieu

of royalty payments to the National Government. The intent is that

communities benefit directly and promptly from resources extracted

from within their municipalities. Project proposals are developed

jointly between the Corporation and local governments and then

approved by the Department Governor.

We are pleased to announce the completion of the

first project of its kind ever signed and executed in Colombia,

which consisted of the construction of a 3.8 km paved road executed

between the Corporation and the Department of Sucre.

The signing and execution of these royalty

agreements is another example of how the energy sector consistently

contributes to social development, closing gaps, and improving the

quality of life for Colombian citizens.

Dividend Announcement

Canacol Energy Ltd. announced that it has

declared a dividend of CAD$.26 per share, payable on January 15,

2024, to shareholders of record at the close of business on

December 29, 2023. This dividend qualifies as an 'eligible

dividend' for Canadian income tax purposes. The declaration,

timing, amount and payment of future dividends remain at the

discretion of the Board of Directors.

Dividends on shares traded on the Toronto Stock

Exchange (“TSX”) will be paid in Canadian Dollars (“CAD”) on

January 15, 2024.

For shareholders trading on the Colombia Stock

Exchange (“BVC”), the Colombian peso equivalency shall be

calculated based on the exchange rate as certified by the Banco de

la Republica (“Central Bank”) on the date of monetization and will

be published accordingly on the SIMEV website

www.superfinanciera.gov.co

Shares traded on the Toronto Stock

Exchange

Form NR301 will be mailed to Registered

non-resident shareholders as at the dividend record date, by

Olympia Trust Company, Canacol’s transfer agent. In order to

receive the preferred treaty rate, you must complete and mail back

the form as soon as possible. Failure to supply a completed NR301

form will result in Olympia withholding the statutory 25%

withholding tax rate on any payments to Registered non-resident

shareholders. If you have previously completed Form NR301, you do

not need to complete a new form.

Instructions on how to correctly complete the

NR301 are on the back of the form. Shareholders who hold their

shares through a broker should contact their broker directly. They

do not need to return a form to Olympia.

Shares traded on the Colombia Stock

Exchange

Dividend payments will be subject to withholding

at the Canadian statutory rate of 25%. Shareholders who are

entitled to a reduced withholding tax rate under a tax treaty

should contact their broker or nominee to submit Form NR301

(English version). Brokers should submit Form NR301 on behalf of

their shareholders to Deposito Centralizado de Valores (“Deceval”)

as soon as possible. If you have previously completed Form NR301,

you do not need to complete a new form.

Form NR301 can be downloaded

at:https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/nr301/nr301-13e.pdf

For information purposes, a Spanish version of

Form NR301 can be downloaded

at:http://canacolenergy.co/es/investors/stocks-dividends/dividend-forms/

The content contained herein is not tax advice.

Do not use or otherwise rely upon any of the content without first

seeking independent tax advice.

About Canacol

Canacol is a natural gas exploration and

production company with operations focused in Colombia. The

Corporation's common stock trades on the Toronto Stock Exchange,

the OTCQX in the United States of America, and the Colombia Stock

Exchange under ticker symbol CNE, CNNEF, and CNEC,

respectively.

Forward-Looking Statements

This press release contains certain

forward-looking statements within the meaning of applicable

securities law. Forward-looking statements are frequently

characterized by words such as "plan", "expect", "project",

"intend", "believe", "anticipate", "estimate" and other similar

words, or statements that certain events or conditions "may" or

"will" occur, including without limitation statements relating to

estimated production rates from the Corporation's properties and

intended work programs and associated timelines. Forward-looking

statements are based on the opinions and estimates of management at

the date the statements are made and are subject to a variety of

risks and uncertainties and other factors that could cause actual

events or results to differ materially from those projected in the

forward-looking statements. The Corporation cannot assure that

actual results will be consistent with these forward-looking

statements. They are made as of the date hereof and are subject to

change and the Corporation assumes no obligation to revise or

update them to reflect new circumstances, except as required by

law. Prospective investors should not place undue reliance on

forward looking statements. These factors include the inherent

risks involved in the exploration for and development of crude oil

and natural gas properties, the uncertainties involved in

interpreting drilling results and other geological and geophysical

data, fluctuating energy prices, the possibility of cost overruns

or unanticipated costs or delays and other uncertainties associated

with the oil and gas industry. Other risk factors could include

risks associated with negotiating with foreign governments as well

as country risk associated with conducting international

activities, and other factors, many of which are beyond the control

of the Corporation.

Realized contractual gas sales is defined as gas

produced and sold plus gas revenues received from nominated take or

pay contracts.

For more information please contact:

Investor Relations

South America: +571.621.1747 IR-SA@canacolenergy.com

Global: +1.403.561.1648 IR-GLOBAL@canacolenergy.com

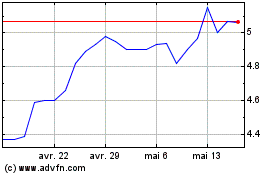

Canacol Energy (TSX:CNE)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Canacol Energy (TSX:CNE)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024