Dividend 15 Split Corp. II: Announces Overnight Offering

26 Mars 2014 - 8:25PM

Marketwired Canada

Dividend 15 Split Corp. II (the "Company") is pleased to announce that it has

filed a preliminary short form prospectus in each of the provinces of Canada

with respect to an offering of Preferred Shares and Class A Shares of the

Company. The offering will be co-led by National Bank Financial Inc., CIBC, RBC

Capital Markets and will also include BMO Capital Markets, TD Securities Inc.,

GMP Securities L.P. and Canaccord Genuity Corp.

The Preferred Shares will be offered at a price of $10.00 per Preferred Share to

yield 5.25% on the issue price and the Class A Shares will be offered at a price

of $8.50 per Class A Share to yield 14.12% on the issue price. The closing price

on the TSX of each of the Preferred Shares and the Class A Shares on March 25,

2014 was $10.14 and $9.08, respectively.

The net proceeds of the secondary offering will be used by the Company to invest

in an actively managed portfolio of dividend-yielding common shares which

includes each of the 15 Canadian companies listed below:

Bank of Montreal Enbridge Inc. TELUS Corporation

The Bank of Nova Scotia Manulife Financial Corp. Thomson-Reuters

Corporation

BCE Inc. National Bank of Canada The Toronto-Dominion Bank

Canadian Imperial Bank of Royal Bank of Canada TransAlta Corporation

Commerce

CI Financial Corp. Sun Life Financial Inc. TransCanada Corporation

The Company's investment objectives are:

Preferred Shares:

i. to provide holders of the Preferred Shares with fixed, cumulative

preferential monthly cash dividends in the amount of $0.04375 per

Preferred Share to yield 5.25% per annum on the original issue price;

and

ii. on or about December 1, 2019, to pay the holders of the Preferred Shares

the original issue price of those shares.

Class A Shares:

i. to provide holders of the Class A Shares with regular monthly cash

dividends initially targeted to be $0.10 per Class A; and

ii. on or about December 1, 2019, to pay the holders of Class A Shares at

least the original issue price of those shares.

The sales period of this overnight offering will end at 9:00 a.m. (Toronto time)

on March 27, 2014.

A preliminary short form prospectus containing important information relating to

the Preferred Shares and the Class A Shares has been filed with securities

commissions or similar authorities in all provinces of Canada. The preliminary

short form prospectus is still subject to completion or amendment. Copies of the

preliminary short form prospectus may be obtained from your registered financial

advisor using the contact information for such advisor, or from representatives

of the underwriters listed above. There will not be any sale or any acceptance

of an offer to buy the Preferred Shares or the Class A Shares until a receipt

for the final short form prospectus has been issued.

FOR FURTHER INFORMATION PLEASE CONTACT:

Dividend 15 Split Corp. II

Investor Relations

416-304-4443 otoll free at 1-877-4-Quadra (1-877-478-2372)

www.dividend15.com

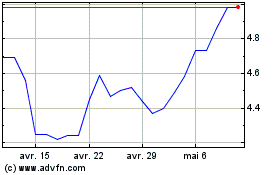

Dividend 15 Split Corp II (TSX:DF)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Dividend 15 Split Corp II (TSX:DF)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024