Engine Capital Calls on Dye & Durham’s Board Not to Issue Shares Ahead of the Special Meeting

06 Mai 2024 - 2:00PM

Business Wire

Concerned that the Recently Filed Prospectus Is

a Prelude to a Share Issuance as a Defensive Tactic to Entrench the

Board

Believes Dye & Durham's Intrinsic Value Is

at Least $25 Per Share and that Issuing Shares at the Current Price

Would Be a Serious Capital Allocation Mistake

Recommends the Board Establish a Committee of

Independent Directors to Solicit Shareholders' Feedback

Engine Capital LP, which owns approximately 6.6% of Dye &

Durham Limited’s (TSX: DND) outstanding shares, today issued the

following open letter to Dye & Durham’s Board of Directors.

***

May 6, 2024

Dye & Durham Limited 1100-25 York Street Toronto, Canada M5J

2V5 Attention: Board of Directors

Dear Members of the Board of Directors (the “Board”):

Engine Capital LP (together with its affiliates, “Engine” or

“we”) is a meaningful shareholder of Dye & Durham Limited (TSX:

DND) (“Dye & Durham” or the “Company”), holding approximately

6.6% of the Company’s outstanding shares. On April 30, 2024, Dye

& Durham filed a non-routine base shelf prospectus, which would

facilitate the issuance of (among others) common shares of the

Company. We believe the timing of this prospectus is highly

suspicious given that it comes just weeks after the Company

scheduled the Special Meeting of Shareholders (the “Special

Meeting”) requisitioned by Engine1 and more than a year after the

prior base shelf prospectus expired.2 We

are concerned that the Company may employ a dilutive share issuance

as a defensive tactic to entrench the Board by placing newly issued

shares in friendly hands to weaken the voting power of Engine and

the other current shareholders ahead of the Special

Meeting.

Issuing shares at the current price would be a serious capital

allocation mistake given the Company’s undervaluation. Ironically,

one of the primary reasons for this undervaluation is the Board’s

poor record of capital allocation, illustrated by the recent equity

issuance at $12.10 per share. We believe Dye & Durham’s

intrinsic value is at least $25 per share.3 This valuation also

aligns with sell side analysts’ target price of around $24.50 per

share.4 Issuing shares at such a discount to the Company’s

intrinsic value, whether as part of an acquisition or as part of a

financing, would destroy meaningful shareholder value. Beyond this

value destruction, issuing shares so close to the Special Meeting

would be a governance stain on the Board and would disenfranchise

the Company’s shareholders. To assuage shareholders’ concerns that

any share issuance is not done for defensive reasons, we urge the

Board to subject any such issuance to shareholders’ approval5 or,

alternatively, issue any such shares only after the record date for

the Special Meeting has passed.

The Board should be aware that Engine’s counsel has brought

these matters to the attention of the Toronto Stock Exchange and

that it is our intention to take all legal and other actions

necessary to oppose any share issuance between now and the Special

Meeting.

Separately, we believe it would be timely for the Board to form

a special committee of independent

directors whose purpose would be to communicate directly with

shareholders. We are concerned that the Board is getting filtered

information and is not properly assessing shareholders’ frustration

with the current situation. It would be natural for incoming Chair

Ms. Colleen Moorehead and a subset of independent directors to communicate directly with

shareholders, ask for their feedback and consider their views. We

believe this exercise would be conducive to a constructive

resolution with the Board as it may help the Board realize the

futility of engaging in scorched-earth tactics such as the issuance

of deeply undervalued shares.

Sincerely,

Arnaud Ajdler Managing Partner

***

No Solicitation

This press release does not constitute a solicitation of a proxy

within the meaning of applicable laws, and accordingly, DND

shareholders are not being asked to give, withhold or revoke a

proxy.

About Engine Capital

Engine Capital LP is a value-oriented special situations fund

that invests both actively and passively in companies undergoing

change.

1 The Company announced on March 29, 2024 that the Special

Meeting is scheduled for August 20, 2024. 2 The prior base shelf

prospectus expired 16 months ago in December 2022. 3 Conservatively

assumes 10x LTM EBITDA multiple, 2025 EBITDA of $280 million and

$125 million of free cash flows generated in H2 2024 and 2025. 4

Only two sell side analysts have updated their numbers since the

recent refinancing: Canaccord Genuity and Scotiabank have target

prices of $25 and $24 per share, respectively. 5 Along the

principles set out in the case of Re Eco Oro Minerals Corp., 2017

ONSEC 23, which established that actions taken by boards and

management that affect materially the control of the listed issuer

in the context of a proxy contest should be shareholder-approved

prior to taking effect.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240506795041/en/

For Investors: Engine Capital LP 212-321-0048

info@enginecap.com

For Media: Longacre Square Partners Charlotte Kiaie /

Bela Kirpalani, 646-386-0091 ckiaie@longacresquare.com /

bkirpalani@longacresquare.com

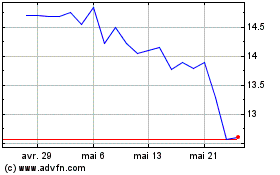

Dye and Durham (TSX:DND)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Dye and Durham (TSX:DND)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024