MCI Onehealth Technologies Inc. (“MCI” or the “Company”) (TSX:

DRDR), a clinician-led healthcare technology company focused on

increasing access to and quality of healthcare, announced today

that it has entered into definitive agreements with WELL Health

Technologies Corp. (“WELL”), that will result in MCI selling a

significant portion of its clinical assets to WELL Health Clinic

Network Inc., obtaining new financing and positioning MCI to emerge

as a key national platform with a strong focus on AI-powered

healthcare technology and clinical research (the “Transaction”).

The Transaction is the outcome of a review of

strategic alternatives which has been underway for over a year,

under the supervision of a special committee of the Company

consisting of two of its independent directors. Implementation of

the Transaction is conditional on the receipt of all required

approvals from the Toronto Stock Exchange (“TSX”), regulatory

bodies and the shareholders of the Company, as well as the

satisfaction of other conditions precedent.

“Through this strategic transaction with WELL

and its partners, MCI is taking a dramatic step forward in its plan

to become a leader at the cutting-edge of data science, artificial

intelligence and healthcare,” said Dr. Alexander

Dobranowski, CEO of the Company. “Revitalized and

recapitalized, and building off the established track-record of

sector innovator Khure Health’s AI-driven rare and complex disease

detection technology, we will be in an excellent position to become

a market leader in the healthcare-AI space. Supported by our

partnership and strategic alliance with WELL, we will have the

tools we need to compete and innovate in the fast-paced area of

healthcare-AI, both domestically and internationally, with the aim

of improving care pathways and facilitating early disease

detection.”

Hamed Shahbazi, Founder and CEO of WELL

commented: “We are pleased to welcome MCI’s clinics, doctors and

patients to the WELL family and look forward to being an engaged

and helpful investor and strategic partner of MCI as it accelerates

towards becoming an AI- and data-science-focused pureplay company

and leader.”

About the Transaction

Pursuant to the definitive agreements executed

by the parties on July 19, 2023, the Transaction will be comprised

of the following key elements:

Bridge Financing

WELL is advancing $3 million to the Company

under a secured promissory note, to provide the Company with

working capital to stabilize its business, continue to operate in

the ordinary course and to accelerate the pursuit of its strategic

plan during the interim period between signing and closing. The

note bears interest at a rate of prime plus 9%, which will accrue

and be payable, along with all outstanding principal, on the

earlier of four months or the date the Transaction closes. The

promissory note is secured against all of the present and after

acquired personal property of the Company and its subsidiary, MCI

Medical Clinics Inc.

Convertible Debenture Financing

The Company will complete a convertible

debenture financing to raise between $7.5 million and $10 million,

to fund working capital and support future M&A activity while

it focuses on growing its data-driven, AI-enabled healthcare

technology offerings. WELL will participate in the financing as

lead investor, for a minimum of $2.5 million of the total

financing.

The debentures will be unsecured obligations of

the Company, mature 5 years from the date the financing closes, and

bear interest at a rate of 10% per annum, which will be payable at

maturity. The principal and interest outstanding under the

debentures will be convertible into Class A Subordinate Voting

Shares of the Company (“Class A Shares”) at any time, at the option

of the holder, at a conversion price of $0.20/share. Participants

in the convertible debenture financing will also receive, for every

$1 of debentures, 5 warrants for Class A Shares exercisable at a

price of $0.20/share.

The financing is conditional on, among other

things, the Company obtaining approval from the TSX and its

shareholders for the proposed conversion and exercise price of the

debentures and warrants, as well as the size of the raise and

corresponding dilution.

Sale of Ontario Clinics

The Company will sell to WELL, under an asset

purchase agreement between their respective subsidiaries, eleven of

its fourteen medical clinics in Ontario, along with other related

assets, for a purchase price of $1.5 million.

The acquired clinics will join WELL’s extensive

and efficiently run network of clinics, the largest owned and

operated network in Canada, ensuring stability and continued

quality of care for patients and healthcare professionals. The

Company’s flagship Polyclinic group of clinics will be retained by

the Company, and will continue to contribute to the Company’s

technology-enabled healthcare research offerings.

The sale of the Ontario clinics is subject to

standard closing conditions typical for transactions of a similar

nature and kind, and is expected to close concurrently with the

convertible debenture financing noted above.

Secured Debt Resolution

In connection with the Transaction, it is

anticipated that the Company will fully satisfy and discharge its

outstanding secured credit facility with TD Bank. The Transaction

also contemplates a solution for the Company’s existing secured

credit facilities with The First Canadian Wellness Co. Inc. (the

“Lender”), a related party to the Company, under which the Company

presently owes an aggregate of approximately $9.0 million in

principal and accrued fees and interest. Under the definitive

agreements for the Transaction:

- The Company will

deliver, as soon as reasonably practicable and subject to TSX,

shareholder and third-party approvals, certain non-core assets to

the Lender in full satisfaction of the $1.5 million facility that

was made available to the Company by the Lender on May 18, 2023

(the “New Facility”).

- The Company will

pay $600,000 to the Lender to partially satisfy the balance of the

Company’s outstanding obligations to Lender.

- WELL will

purchase the remainder of the secured credit facility from the

Lender and, at closing of the Transaction, will settle, compromise,

release or otherwise discharge the obligations of the Company and

certain of its subsidiaries under that facility.

As a result of the foregoing, it is anticipated

that the obligations of the Company and certain of its subsidiaries

under the secured credit facility from the Lender will be satisfied

and discharged through the Transaction, with the balance of the

Company’s subsidiaries to be discharged post-closing following the

satisfaction of certain conditions. This element of the Transaction

is not conditional on the completion of other aspects of the

Transaction.

Dr. George Christodoulou and Dr. Sven Grail,

directors, co-Chairs and control persons of the Company, control

the Lender, and Mr. Kingsley Ward and Mr. Anthony Lacavera,

directors of the Company, each have a 1/6th financial interest in

the New Facility. As such, the transfer of the Non-Core Assets to

the Lender constitutes a related party transaction under

Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions (“MI 61-101”).

The transfer of the non-core assets to the

Lender in satisfaction of the New Facility has been unanimously

approved by those directors of the Company who do not have an

interest in the transaction, with interested directors abstaining

from voting and deliberations on the approval. The Company is

exempt from the formal valuation requirement under MI 61-101 as the

fair market value of the non-core assets does not exceed more than

25% of the market capitalization of the Company on the date the

transfer was agreed to. The Company is also exempt from the

minority approval requirement under MI 61-101 on the foregoing

basis. The Company did not file a material change report 21 days in

advance of implementing the transfer as arrangements for the

transfer of the non-core assets to the Lender in satisfaction of

the New Facility were only recently settled.

Call Option

WELL will be granted a call option from certain

shareholders of the Company, which gives WELL the right to acquire

up to 30.8 million Class A Shares and 30.8 million Class B Multiple

Voting Shares of the Company (“Class B Shares”) representing an

aggregate of approximately 81.5% of the votes attributable to all

issued and outstanding shares of the Company.

The exercise of the option is conditional on the

achievement by the Company of a number of performance milestones

designed to demonstrate improvements in the Company’s financial and

capital markets performance, as well as obtaining any required TSX

or regulatory approvals. The option can only be exercised in pairs,

such that WELL must concurrently acquire a Class A Share and a

Class B Share, and is exercisable for 36 months post-closing. The

exercise of the call option is expected to proceed under the

private agreement exemption in National Instrument 62-104 –

Take-over Bids and Issuer Bids (NI 62-104), such that the price of

the call option would not be permitted to exceed 115% of the market

price of the Class A Shares at the time of exercise. If at the time

of exercise, the exercise price would exceed 115% of the market

price of the Class A Shares, the exercise would be subject to the

standard rules and procedures applicable to take-over bids under NI

62-104.

This aspect of the Transaction requires an

amendment to the Company’s articles to add WELL as an authorized

holder of the Class B Multiple Voting Shares, which will be subject

to obtaining disinterested shareholder approval at a shareholder

meeting of the Company.

Other Key Terms

Other material aspects of the Transaction will

include:

- Entering into an

investor rights agreement providing WELL with, among other things

(a) the right to nominate up to (i) 2 directors or non-voting board

observers of the Company, or (ii) a majority of the directors or

non-voting board observers of the Company in the event that WELL

becomes a control person of the Company having more than 20% of the

voting rights attached to all outstanding voting securities of the

Company; (b) pre-emptive rights in respect of future issuances of

securities of the Company, and (c) qualification and registration

rights, in each case subject to standard terms and conditions.

- WELL and the

Company will enter into a strategic alliance agreement at closing

of the Transaction, which will provide the Company with an enhanced

platform from which to execute on its data-driven, AI-enabled

healthcare technology offerings.

- The holders of

the 6 million Class B Shares not subject to the call option have

agreed to surrender their Class B Shares to the Company for

cancellation without consideration upon closing of the

Transaction.

Additional Information on the Transaction

Copies of the definitive agreements for the

Transaction will be made available for review on the Company’s

SEDAR page at www.sedar.com and the Company will disclose any

additional material information about the Transaction in due

course.

Completion of the Transaction is subject to a

number of conditions precedent, including but not limited to (a)

TSX approvals, (b) shareholder approvals, and (c) other conditions

precedent typical for transactions of this nature and kind. If the

conditions precedent cannot be satisfied or (if applicable) waived,

the Transaction (or individual components of the Transaction) will

not close. Moreover, there can be no assurance at this time that

the Transaction, or any individual component of the Transaction,

will be completed as proposed or at all.

Investors are cautioned that, except as

disclosed in the management information circular to be prepared in

connection with the Transaction, any information released or

received with respect to the Transaction may not be accurate or

complete and should not be relied upon. Trading in the Company’s

securities in anticipation of the completion of the Transaction, or

any individual component of the Transaction, should be considered

highly speculative.

The TSX has not considered or made any

determination on the merits of the proposed Transaction and have

neither approved nor disapproved of this press release.

Annual General and Special Meeting of

Shareholders

The Company expects to call an annual general

and special meeting of its shareholders to consider and approve the

Transaction in the near-term. Additional details concerning the

meeting, and accompanying management information circular, will be

disseminated in due course.

About MCIMCI is a healthcare

technology company focused on empowering patients and doctors with

advanced technologies and data-driven clinical insights to increase

access, improve quality, and reduce healthcare costs. Led by a

proven management team of doctors and experienced executives, MCI

remains focused on executing a strategy centered around acquiring

technology and health services that complement the company’s

current roadmap. For more information, visit mcionehealth.com.

About WELL

WELL’s mission is to tech-enable healthcare

providers. WELL does this by developing the best technologies,

services, and support available, which ensures healthcare providers

are empowered to positively impact patient outcomes. WELL’s

comprehensive healthcare and digital platform includes extensive

front and back-office management software applications that help

physicians run and secure their practices. WELL’s solutions enable

more than 28,000 healthcare providers between the US and Canada and

power the largest owned and operated healthcare ecosystem in Canada

with more than 130 clinics supporting primary care, specialized

care and diagnostic services. In the United States WELL’s solutions

are focused on specialized markets such as the gastrointestinal

market, women’s health, primary care, and mental health. WELL is

publicly traded on the Toronto Stock Exchange under the symbol

“WELL” and on the OTC Exchange under the symbol “WHTCF”. To learn

more about the Company, please visit: www.well.company

For media enquiries please contact:Nolan Reeds

| nolan@mcionehealth.com

Forward Looking Statements

Certain statements in this press release,

constitute “forward-looking information” and "forward looking

statements" (collectively, "forward looking statements") within the

meaning of applicable Canadian securities laws and are based on

assumptions, expectations, estimates and projections as of the date

of this press release. Forward-looking statements include

statements with respect to the anticipated completion of the

strategic transaction and its various elements, the terms on which

the strategic transaction will be completed, the go-forward

business of the Company following completion of the strategic

transaction, and the calling of a shareholder meeting for the

Company. The words “obtain”, “implement”, “taking”, “to become”,

“aim”, “improve”, “facilitating”, “accelerating”, “growing”,

“ensuring”, “continue”, “contribute”, “anticipate”, “expects”,

“contemplates”, “complete”, “engaged”, “potential”, “future”,

“remains”, “consider”, “result in”, “increase”, “deliver”,

“emerge”, “is conditional”, “plan”, “look forward to”, “subject to”

or variations of such words and phrases or statements that certain

future conditions, actions, events or results “will”, “may”,

“could”, “would”, “should”, “might” or “can”, or negative versions

thereof, “occur”, “continue” or “be achieved”, and other similar

expressions, identify forward-looking statements. Forward-looking

statements are necessarily based upon management’s perceptions of

historical trends, current conditions and expected future

developments, as well as a number of specific factors and

assumptions that, while considered reasonable by MCI as of the date

of such statements, are outside of MCI's control and are inherently

subject to significant business, economic and competitive

uncertainties and contingencies which could result in the

forward-looking statements ultimately being entirely or partially

incorrect or untrue. Forward looking statements contained in this

press release are based on various assumptions, including, but not

limited to, the following: MCI’s ability to satisfy any conditions

precedent and complete the Transaction; MCI’s ability to obtain the

necessary TSX, regulatory and shareholder approvals required for

the completion of the Transaction; MCI’s ability to complete the

Transaction or to complete it on the terms described above; MCI’s

ability to maintain its relationships and to successfully integrate

its business with WELL; MCI’s ability to hold its annual general

and special meeting of shareholders within the prescribed time

periods; MCI’s ability to satisfy and discharge its outstanding

debt facilities and other indebtedness; MCI’s plans for future cost

reduction; the availability of working capital and sources of

liquidity; MCI’s ability to continue to operate as a going concern;

the anticipated terms of the strategic alliance agreement with

WELL; MCI’s ability to achieve its growth and revenue strategies;

the demand for MCI's products and fluctuations in future revenues;

the availability of future business ventures, commercial

arrangements and acquisition targets or opportunities and MCI’s

ability to consummate them and to effectively integrate future

acquisition targets into its platform; the effects of competition

in the industry; the requirement for increasingly innovative

product solutions and service offerings; trends in customer growth;

the stability of general economic and market conditions; currency

exchange rates and interest rates; MCI's ability to comply with

applicable laws and regulations; MCI's continued compliance with

third party intellectual property rights; and that the risk factors

noted below, collectively, do not have a material impact on MCI's

business, operations, revenues and/or results. By their nature,

forward-looking statements are subject to inherent risks and

uncertainties that may be general or specific and which give rise

to the possibility that expectations, forecasts, predictions,

projections or conclusions will not prove to be accurate, that

assumptions may not be correct, and that objectives, strategic

goals and priorities will not be achieved.

Known and unknown risk factors, many of which

are beyond the control of MCI, could cause the actual results of

MCI to differ materially from the results, performance,

achievements or developments expressed or implied by such

forward-looking statements. Such risk factors include but are not

limited to those factors which are discussed under the section

entitled “Risk Factors” in MCI's annual information form dated

March 31, 2023, which is available under MCI's SEDAR profile at

www.sedar.com. The risk factors are not intended to represent a

complete list of the factors that could affect MCI and the reader

is cautioned to consider these and other factors, uncertainties and

potential events carefully and not to put undue reliance on

forward-looking statements. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Forward-looking statements are

provided for the purpose of providing information about

management’s expectations and plans relating to the future. MCI

disclaims any intention or obligation to update or revise any

forward-looking statements whether as a result of new information,

future events or otherwise, or to explain any material difference

between subsequent actual events and such forward-looking

statements, except to the extent required by applicable law. All of

the forward-looking statements contained in this press release are

qualified by these cautionary statements.

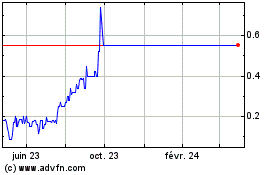

MCI Onehealth Technologies (TSX:DRDR)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

MCI Onehealth Technologies (TSX:DRDR)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025