MCI Onehealth Technologies Inc. (“MCI” or the "Company") (TSX:

DRDR) is pleased to announce the voting results from its annual

general and special meeting (the “Meeting”) of the shareholders of

the Company held on September 21, 2023. Shareholders representing

97.72% of MCI’s outstanding shares attended the Meeting in person

or were represented by proxy.

All matters of business set out in the Company’s

management information circular dated August 21, 2023 (the

“Circular”) were passed at the Meeting, including:

- Fixing the number of directors at

five and electing management’s five nominees.

- Re-appointing BDO Canada LLP as

auditor of the Company.

- Ratifying and approving the

Company’s equity incentive plan and the rolling 10% cap on the

number of Class A Subordinate Voting Shares of the Company that may

be allocated to equity incentive grants under the plan (the “Equity

Incentive Plan Resolution”).

- Authorizing the board of directors

to amend the options for Class A Subordinate Voting Shares held by

Alexander Dobranowski and Scott Nirenberski, the CEO and CFO of the

Company, to reduce their exercise prices and increase their term

beyond their original expiry dates (the “Option Amendment

Resolution”).

- Authorizing the Company to

participate in a strategic transaction (the “Transaction”) with

WELL Health Technologies Corp. (“WELL”), as described in greater

detail in the Company’s press release dated July 20, 2023, (the

"Transaction Approval Resolution") and authorizing the creation of

WELL as a new control person of the Company upon completion of the

Transaction (the “Change of Control Resolution”).

- Authorizing a consolidation of the

Company's Class A Subordinate Voting Shares and Class B Multiple

Voting Shares (the “Share Consolidation Resolution”).

- Authorizing the Company to file

articles of amendment to amend the share terms applicable to its

Class B Multiple Voting Shares to facilitate completion of the

Transaction (the “Class B Multiple Voting Share Terms

Resolution”).

- Authorizing a change to the

Company’s name from “MCI Onehealth Technologies Inc.” to a name to

be determined by the board of directors (the “Name Change

Resolution”).

- Authorizing Dr. Sven Grail and Dr.

George Christodoulou, each a control person of the Company, and

their permitted transferees under Section 3.2 of Ontario Security

Commission Rule 56-501 to grant a call option in respect of the

Transaction and to make one or more distributions of their

respective Class A Subordinate Voting Shares pursuant to applicable

prospectus exemptions (the “Control Person Distribution

Resolution”).

Additional details on the voting results are set

out below. For more information on the resolutions and the business

of the Meeting, readers should refer to the Circular, a copy of

which is available under the Company’s profile on SEDAR+ at

www.sedarplus.ca.

Election of Directors

369,257,600 votes, or approximately 100% of the

votes cast at the Meeting, were cast in favour of the fixing the

number of directors of the Company at five.

The details of the proxy voting for the election

of the five director nominees are set out below:

|

Nominee |

Votes For |

% For |

Votes Withheld |

% Withheld |

|

Dr. Alexander Dobranowski |

369,250,243 |

99.99 |

% |

8,607 |

0.002 |

% |

|

Kingsley Ward |

368,163,113 |

99.70 |

% |

1,095,737 |

0.297 |

% |

|

Anthony Lacavera |

368,163,113 |

99.70 |

% |

1,095,737 |

0.297 |

% |

|

Bashar Al-Rehany |

368,163,113 |

99.70 |

% |

1,095,737 |

0.297 |

% |

|

Dr. Robert Francis |

368,163,113 |

99.70 |

% |

1,095,737 |

0.297 |

% |

The Company confirms that Dr. Grail and Dr.

Christodoulou, the former Co-Chairs of the Company, did not stand

for re-election at the Meeting this year. MCI would like to

sincerely extend its gratitude to Dr. Grail and Dr. Christodoulou

for their many valuable contributions to the Company during their

tenure as directors, founders and Co-Chairs, and wish them great

success in their future endeavours.

Ratification of Equity Incentive Plan

368,160,068 votes, or approximately 99.70% of

the votes cast at the Meeting, were cast in favour of the Equity

Incentive Plan Resolution.

Option Amendments

348,113,908 votes, or approximately 99.67% of

the votes cast at the Meeting, were cast in favour of the Option

Amendment Resolution, after excluding 20,003,160 votes associated

with shares of the Company held or controlled, directly or

indirectly, by Dr. Alexander Dobranowski and Mr. Scott Nirenberski,

each of whom has an interest in the options to be amended

The implementation of the option amendments

remains subject to the discretion of the Board, who may decide to

postpone or altogether forgo these actions in their sole

discretion.

Strategic Transaction Approvals

369,256,300 votes, or approximately 99.99% of

the votes cast at the Meeting, were cast in favour of the

Transaction Approval Resolution.

54,596,860 votes, or approximately 99.99% of the

votes cast at the Meeting, were cast in favour of the Change of

Control Resolution, after excluding 314,659,440 votes associated

with shares of the Company held or controlled, directly or

indirectly, by Dr. Grail and Dr. Christodoulou.

While the Transaction has been approved by the

Shareholders of the Company and the Company continues to work

diligently with its representatives, counterparties and

stakeholders to satisfy the conditions to closing the Transaction,

there can be no assurance at this time that the Transaction will be

completed on the terms, conditions or timelines that have been

proposed or at all. Trading in the Company’s securities in

anticipation of completion of the Transaction should be considered

highly speculative. The Company will provide further updates on the

status of the Transaction in due course.

Name Change and Amendments to Class B Multiple

Voting Shares

369,256,393 votes, or approximately 99.99% of

the votes cast at the Meeting, were cast in favour of approving the

Name Change Resolution.

54,594,258 votes or, approximately 99.99% of the

votes cast at the Meeting, were cast in favour of the Class B

Multiple Voting Share Terms Resolution, after excluding 314,659,440

votes associated with shares of the Company held or controlled,

directly or indirectly, by Dr. Grail and Dr. Christodoulou. This

resolution required approval on a class-by-class basis, with each

class of shareholder voting separately. The votes cast in favour of

the Class B Multiple Voting Share Terms Resolution consisted of

12,594,264 votes of Class A Subordinate Voting Shares, representing

99.96% of the votes cast by holders of Class A Subordinate Voting

Shares at the Meeting, after excluding 32,659,434 votes associated

with shares of the Company held or controlled, directly or

indirectly, by Dr. Grail and Dr. Christodoulou, and 41,999,994

votes of Class B Multiple Voting Shares, representing 100% of the

votes cast by the holders of Class B Multiple Voting Shares at the

Meeting, after excluding 282,000,006 votes associated with shares

of the Company held or controlled, directly or indirectly, by Dr.

Grail and Dr. Christodoulou.

The implementation of the name change and the

amendment to the share terms of the Company remain subject to the

discretion of the Board, who may decide to postpone or altogether

forgo these actions in their sole discretion.

Share Consolidation369,254,905 votes, or

approximately 99.99% of the votes cast at the Meeting, were cast in

favour of approving the Share Consolidation Resolution.

The implementation of the share consolidation

remains subject to the discretion of the Board, who may decide to

postpone or altogether forgo these actions in their sole

discretion. At this time, the Company does not anticipate

completing the share consolidation in advance of completion of the

Transaction. An update on the status of the share consolidation, if

any, will be provided by the Company in due course.

Control Person Distribution Resolution

54,594,258 votes, or approximately 99.99% of the

votes cast at the Meeting, were cast in favour of the Control

Person Distribution Resolution, after excluding 314,659,440 votes

associated with shares of the Company held or controlled, directly

or indirectly, by Dr. Grail and Dr. Christodoulou.

About MCI

MCI is a healthcare technology company focused

on empowering patients and doctors with advanced technologies and

data-driven clinical insights to increase access, improve quality,

and reduce healthcare costs. Led by a proven management team of

doctors and experienced executives, MCI remains focused on

executing a strategy centered around acquiring technology and

health services that complement the company’s current roadmap. For

more information, visit mcionehealth.com.

For media enquiries please

contact:

Nolan Reeds | nolan@mcionehealth.com

Forward Looking Statements

Certain statements in this press release,

constitute “forward-looking information” and "forward looking

statements" (collectively, "forward looking statements") within the

meaning of applicable Canadian securities laws and are based on

assumptions, expectations, estimates and projections as of the date

of this press release. Forward-looking statements include

statements with respect to the implementation of the matters of

business passed at the Meeting and management's discretion to

proceed with such matters, including the anticipated completion of

the Transaction and its various elements and the terms on which the

Transaction will be completed. The words "implement", "remains",

decide", "postpone", "forgo", "anticipate", "complete", "increase",

"reduce", "beyond", "amend", "facilitate", "determine", "to make",

“subject to” or variations of such words and phrases or statements

that certain future conditions, actions, events or results “will”,

“may”, “could”, “would”, “should”, “might” or “can”, or negative

versions thereof, “occur”, “continue” or “be achieved”, and other

similar expressions, identify forward-looking statements.

Forward-looking statements are necessarily based upon management’s

perceptions of historical trends, current conditions and expected

future developments, as well as a number of specific factors and

assumptions that, while considered reasonable by MCI as of the date

of such statements, are outside of MCI's control and are inherently

subject to significant business, economic and competitive

uncertainties and contingencies which could result in the

forward-looking statements ultimately being entirely or partially

incorrect or untrue. Forward looking statements contained in this

press release are based on various assumptions, including, but not

limited to, the following: MCI’s ability to satisfy any conditions

precedent and complete the Transaction; MCI’s ability to obtain the

necessary Toronto Stock Exchange and regulatory approvals required

for the completion of the Transaction; MCI’s ability to complete

the Transaction or to complete it on the terms described above;

MCI’s ability to maintain its relationships and to successfully

integrate its business with WELL; MCI's ability to amend the

options for Class A Subordinate Voting Shares held by certain

insiders of the Company; MCI's ability to implement a consolidation

of the Company's Class A Subordinate Voting Shares and Class B

Multiple Voting Shares; MCI's ability to file articles of amendment

to amend the terms applicable to its Class B Multiple Voting

Shares; MCI's ability to effect a name change of the Company; the

ability of certain control persons of the Company to grant a call

option in respect of the Transaction and to make one or more

distributions of their respective Class A Subordinate Voting

Shares; the availability of working capital and sources of

liquidity; MCI’s ability to continue to operate as a going concern;

MCI’s ability to achieve its growth and revenue strategies; the

demand for MCI's products and fluctuations in future revenues; the

availability of future business ventures, commercial arrangements

and acquisition targets or opportunities and MCI’s ability to

consummate them and to effectively integrate future acquisition

targets into its platform; the effects of competition in the

industry; the requirement for increasingly innovative product

solutions and service offerings; trends in customer growth; the

stability of general economic and market conditions; currency

exchange rates and interest rates; MCI's ability to comply with

applicable laws and regulations; MCI's continued compliance with

third party intellectual property rights; and that the risk factors

noted below, collectively, do not have a material impact on MCI's

business, operations, revenues and/or results. By their nature,

forward-looking statements are subject to inherent risks and

uncertainties that may be general or specific and which give rise

to the possibility that expectations, forecasts, predictions,

projections or conclusions will not prove to be accurate, that

assumptions may not be correct, and that objectives, strategic

goals and priorities will not be achieved.

Known and unknown risk factors, many of which

are beyond the control of MCI, could cause the actual results of

MCI to differ materially from the results, performance,

achievements or developments expressed or implied by such

forward-looking statements. Such risk factors include but are not

limited to those factors which are discussed under the section

entitled “Risk Factors” in MCI's annual information form dated

March 31, 2023, which is available under MCI's SEDAR+ profile at

www.sedarplus.ca. The risk factors are not intended to represent a

complete list of the factors that could affect MCI and the reader

is cautioned to consider these and other factors, uncertainties and

potential events carefully and not to put undue reliance on

forward-looking statements. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Forward-looking statements are

provided for the purpose of providing information about

management’s expectations and plans relating to the future. MCI

disclaims any intention or obligation to update or revise any

forward-looking statements whether as a result of new information,

future events or otherwise, or to explain any material difference

between subsequent actual events and such forward-looking

statements, except to the extent required by applicable law. All of

the forward-looking statements contained in this press release are

qualified by these cautionary statements.

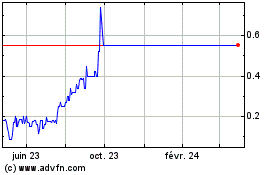

MCI Onehealth Technologies (TSX:DRDR)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

MCI Onehealth Technologies (TSX:DRDR)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025