D2L Inc. (“

D2L” or the “

Company”)

(TSX: DTOL) today announced the closing of its initial public

offering of Subordinate Voting Shares (the

“

Offering”). The Offering consists of a treasury

offering of 5,489,757 Subordinate Voting Shares by D2L and a

secondary offering of 3,335,243 Subordinate Voting Shares by the

Desire2Learn Employee Stock Trust as a selling shareholder, in each

case at a price of $17.00 per Subordinate Voting Share, for total

gross proceeds of $150,025,000 ($93,325,869 to D2L and $56,699,131

to the Desire2Learn Employee Stock Trust).

D2L expects to use the net proceeds from the treasury portion of

the Offering to strengthen its financial position and pursue its

growth strategies. The net proceeds of the secondary offering will

be used by the Desire2Learn Employee Stock Trust to satisfy tax

liabilities arising on the distribution of shares by the Trust, and

to repay the balance of a shareholder loan advanced by D2L to a

holding company controlled by John Baker.

D2L’s Subordinate Voting Shares will begin trading today on the

Toronto Stock Exchange under the symbol "DTOL".“This is an exciting

milestone — it will mark the end of the beginning and the start of

our next chapter of enabling the future of work and learning,” said

John Baker, President and Chief Executive Officer of D2L. “I want

to thank all of our employees, customers, and partners for their

support. Together, we are committed to building the innovations

that make it easier to learn — and helping people to achieve more

than they dreamed possible.”

“For more than 20 years, D2L has evolved to help transform lives

through the power of its learning platform,” said J. Ian Giffen,

Lead Director of the D2L Board. “Today, D2L is stepping into its

next phase of growth as a public company and extending its global

leadership in learning. We are excited for D2L to trade on the

Toronto Stock Exchange and exemplify the inspiration and maturity

of world-class Canadian technology companies.”

TD Securities Inc. and BMO Capital Markets are acting as co-lead

underwriters and joint bookrunners for the Offering, together with

Canaccord Genuity Corp., Raymond James Ltd., RBC Capital Markets,

National Bank Financial Inc. and Eight Capital, as underwriters

(collectively, the “Underwriters”).

The Underwriters have also been granted an over-allotment option

(the “Over-Allotment Option”) to purchase up to an

additional 1,323,750 Subordinate Voting Shares from D2L at a price

of $17.00 per share for additional gross proceeds to D2L of

$22,503,750 if the Over-Allotment Option is exercised in full. The

Over-Allotment Option can be exercised, in whole or in part, at any

time for a period of 30 days from today.

In connection with the Offering, D2L completed a series of

transactions pursuant to which its share capital was reorganized

into outstanding Subordinate Voting Shares and Multiple Voting

Shares (the “Pre-Closing Reorganization”).

Immediately before giving effect to the Pre-Closing Reorganization

(and prior to the Offering), John Baker exercised control or

direction over shares in the capital of D2L representing

approximately 53.2% of the total issued and outstanding shares and

approximately 66.7% of the total voting power attached to the

Company’s securities. As a result of the Pre-Closing

Reorganization, John Baker became entitled to an additional 488,293

Subordinate Voting Shares. Upon closing of the Offering, John Baker

owned directly and indirectly through 2416535 Ontario Inc., an

aggregate of 27,390,588 Multiple Voting Shares (representing 100%

of the issued and outstanding Multiple Voting Shares) and 488,293

Subordinate Voting Shares (representing approximately 52.7% of

issued and outstanding Subordinate Voting Shares assuming all

Multiple Voting Shares had been exchanged for Subordinate Voting

Shares) representing, in aggregate, approximately 91.6% of the

total voting power attached to the Company’s securities. John

Baker’s address c/o D2L, is as follows: 151 Charles Street West,

Suite 400, Kitchener, Ontario, N2G 1H6.

Immediately before giving effect to the Pre-Closing

Reorganization (and prior to the Offering), NewView Capital Fund I,

L.P. beneficially owned or exercised control or direction over

5,880,001 Series A Preferred Shares in the capital of D2L

representing approximately 11.4% of the total issued and

outstanding shares and 14.3% of the total voting power attached to

the Company’s securities. Upon closing of the Offering, NewView

Capital Fund I, L.P. beneficially owned or exercised control or

direction over 5,880,001 Subordinate Voting Shares representing

approximately 11.1% of the total issued and outstanding shares or

23.1% of issued and outstanding Subordinate Voting Shares, and

approximately 2.0% of the total voting power attached to the

Company’s securities. NewView Capital Fund I, L.P.’s address is

1201 Howard Ave, Suite 101, Burlingame, California, USA, 94010.

Immediately before giving effect to the Pre-Closing

Reorganization (and prior to the Offering), OMERS Ventures LP

beneficially owned or exercised control or direction over 3,529,412

Series A Preferred Shares and 470,588 Series B Preferred Shares in

the capital of D2L representing, in aggregate, approximately 7.8%

of the total issued and outstanding shares and 9.7% of the total

voting power attached to the Company’s securities. Upon closing of

the Offering, OMERS Ventures LP beneficially owned or exercised

control or direction over 4,000,000 Subordinate Voting Shares

representing approximately 7.6% of the total issued and outstanding

shares or approximately 15.7% of the issued and outstanding

Subordinate Voting Shares, and approximately 1.3% of the total

voting power attached to the Company’s securities. OMERS Ventures

LP’s address is 900-100 Adelaide Street West, Toronto, Ontario, M5H

0E2.

John Baker (and 2416535 Ontario Inc.), NewView Capital Fund I,

L.P. and OMERS Ventures LP are not joint actors, each hold the

Company’s securities for investment purposes and may purchase,

hold, vote, trade, dispose or otherwise deal in the securities of

the Company, in such manner as each deems advisable from time to

time, subject to applicable laws and the terms of the Company’s

articles and of the registration rights agreement and the lock up

agreements entered into by each of such shareholders, as well as

the coattail agreement entered into by Mr. Baker (and 2416535

Ontario Inc.), each as described in the final long form prospectus

dated October 27, 2021 in respect of the Offering.

For further information and to obtain a copy of the early

warning reports to be filed under applicable Canadian securities

laws in connection with the foregoing matters, please see the

Company’s profile on SEDAR at www.sedar.com.

No securities regulatory authority has either approved or

disapproved of the contents of this news release. The subordinate

voting shares have not been and will not be registered under the

United States Securities Act of 1933, as amended (the “U.S.

Securities Act“), or any state securities laws.

Accordingly, the subordinate voting shares may not be offered or

sold within the United States unless registered under the U.S.

Securities Act and applicable state securities laws or pursuant to

exemptions from the registration requirements of the U.S.

Securities Act and applicable state securities laws. This news

release does not constitute an offer to sell or a solicitation of

an offer to buy any securities of D2L in any jurisdiction in which

such offer, solicitation or sale would be unlawful.

ABOUT D2LD2L is transforming the way the world

learns – helping learners of all ages achieve more than they

dreamed possible. Working closely with clients all over the world,

D2L is supporting millions of people learning online and in person.

Our more than 1,000 global employees are dedicated to making the

best learning products to leave the world better than where they

found it. Learn more about D2L for K-12, higher education and

businesses at www.D2L.com.

Forward-Looking Statements

This news release may contain forward-looking information within

the meaning of applicable securities legislation, which reflects

the Company's current expectations regarding future events.

Forward-looking information is based on a number of assumptions and

is subject to a number of risks and uncertainties, many of which

are beyond the Company's control. Such risks and uncertainties

include, but are not limited to, the factors discussed under "Risk

Factors" in D2L’s final long form prospectus dated October 27, 2021

filed under D2L’s profile on SEDAR at www.sedar.com. Actual results

could differ materially from those projected herein. D2L does not

undertake any obligation to update such forward-looking

information, whether as a result of new information, future events

or otherwise, except as expressly required under applicable

securities laws.

INVESTOR RELATIONS CONTACTCraig

ArmitageIR@D2L.com

MEDIA CONTACTTory WaldronPR@D2L.com

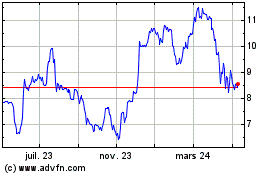

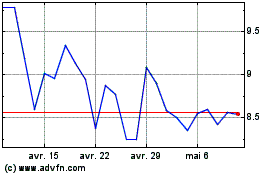

D2L (TSX:DTOL)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

D2L (TSX:DTOL)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024