Energy Fuels Inc. Announces Filing of Preliminary Short Form Prospectus

28 Février 2011 - 12:00PM

Marketwired Canada

THIS NEWS RELEASE IS INTENDED FOR DISTRIBUTION IN CANADA ONLY AND IS NOT

INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR DISSEMINATION IN

THE UNITED STATES

Energy Fuels Inc. (TSX:EFR) ("Energy Fuels" or the "Company"), an advanced

uranium and vanadium development company, announced today that it has filed a

preliminary short form prospectus in connection with a best efforts offering

(the "Offering") of units (each, a "Unit") in the capital of Energy Fuels. Each

Unit consists of one common share (a "Common Share") of the Company and one-half

of one Common Share purchase warrant (each whole warrant, a "Warrant"). The

Offering is being made through a syndicate of agents led by Dundee Securities

Ltd. and including Haywood Securities Inc., Scotia Capital Inc., Versant

Partners Inc., Cormark Securities Inc. and Toll Cross Securities Inc.

(collectively, the "Agents"). The Company has granted an over-allotment option

(the "Over-Allotment Option") to the Agents, pursuant to which the Agents may

purchase, for a period of 30 days following the closing of this Offering,

additional Units (the "Over-Allotment Units"), in a maximum number equal to 15%

of the number of Units sold pursuant to the Offering.

Final pricing and determination of the number of Units to be sold pursuant to

the Offering will be determined in the context of the market prior to the filing

of the final short form prospectus in respect of the Offering. The Units will be

offered in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba

and Ontario, Canada by way of a short form prospectus.

In consideration for the services to be rendered by the Agents under the

Offering, the Agents will receive a cash commission of 7% of the gross proceeds

of the Offering (including any Units issued as a result of the exercise of the

Over-Allotment Option). The Agents will also receive non transferable

compensation warrants (the "Compensation Warrants") entitling the Agents to

purchase, in the aggregate, that number of Common Shares that is equal to 7% of

the aggregate number of Units and Over-Allotment Units sold pursuant to the

Offering.

The Company intends to use the net proceeds of the Offering to fund ongoing

exploration and mine development activities at the Whirlwind and Energy Queen

Mines, expansion of mineral resources at currently controlled properties through

additional drilling and technical report preparation, continued Colorado Plateau

property acquisition, detailed final design engineering for the proposed Pinon

Ridge Mill, and for general working capital purposes.

Closing of the Offering is subject to certain conditions including, but not

limited to, the execution of a definitive agency agreement with the Agents,

receipt of all necessary regulatory and stock exchange approvals including the

receipt of listing approval by the Toronto Stock Exchange ("TSX") for: (i) the

Common Shares included in the Units and the Over-Allotment Units, and (ii) the

Common Shares issuable pursuant to the exercise of the Warrants included in the

Units, the Warrants included in the Over-Allotment Units and the Compensation

Warrants. Successful listing of such Common Shares will be subject to the

Company fulfilling all of the listing requirements of the TSX.

The securities have not been and will not be registered under the U.S.

Securities Act of 1933, as amended, or under any U.S. state securities laws and

may not be offered or sold in the United States, absent registration or an

applicable exemption from the registration requirements of the U.S. Securities

Act and applicable U.S. state securities laws. This news release does not

constitute an offer to sell or the solicitation of an offer to buy nor will

there be any sale of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

About Energy Fuels: Energy Fuels Inc. is a uranium and vanadium mineral

development company actively rehabilitating and developing formerly producing

mines. With more than 38,000 acres of highly prospective uranium and vanadium

property located in the states of Colorado, Utah, Arizona, Wyoming, and New

Mexico, and exploration properties in Saskatchewan's Athabasca Basin totaling

approximately 32,000 additional acres, the Company has a full pipeline of

additional development prospects. Energy Fuels, through its wholly-owned

Colorado subsidiary, Energy Fuels Resources Corporation and its British Columbia

subsidiary, Magnum Uranium Corp., has assembled this property portfolio along

with a first class management team, including highly skilled technical mining

and milling professionals based in Lakewood and Naturita, Colorado and Kanab,

Utah.

This news release contains certain forward-looking statements and

forward-looking information . All statements, other than statements of

historical fact, included herein are forward-looking statements and

forward-looking information that involve various risks and uncertainties. There

can be no assurance that such statements will prove to be accurate, and actual

results and future events could differ materially from those anticipated in such

statements. Important factors that could cause actual results to differ

materially from the Company's expectations are disclosed in the Company's

documents filed from time-to-time with the British Columbia, Alberta, Manitoba,

Saskatchewan and Ontario provincial securities regulatory authorities.

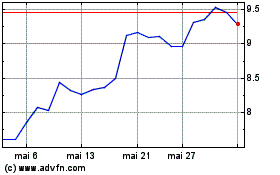

Energy Fuels (TSX:EFR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Energy Fuels (TSX:EFR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024