Energy Fuels Announces $22 Million Bought Deal

26 Juin 2012 - 10:09PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Energy Fuels Inc. (the "Company") (TSX:EFR) is pleased to announce that it has

entered into an agreement with Dundee Securities Ltd. and Scotiabank as co-lead

underwriters (the "Lead Underwriters") on behalf of a syndicate of underwriters

including National Bank Financial Inc., Haywood Securities Inc. and Versant

Partners Inc. (the "Underwriters") under which the Underwriters have agreed to

purchase, on a bought deal basis, 22,000 floating-rate convertible unsecured

subordinated debentures (the "Debentures") at a price per Debenture of $1,000

for total gross proceeds of $22,000,000 (the "Offering"). The Underwriters have

been granted the option (the "Option") to sell up to an additional 15% of the

Offering, exercisable in whole or in part at any time up to 30 days following

the closing of the Offering which is scheduled for on or about July 24, 2012

(the "Closing Date").

The Debentures will mature on June 30, 2017 (the "Maturity Date") and will bear

interest, accruing, calculated and payable semi-annually in arrears on June 30

and December 31 of each year, at a fluctuating rate, of not less than 8.5% and

not more than 13.5%, dependent on the simple average of the Ux Weekly Indicator

(Spot Price) published by the Ux Consulting Company, LLC (the "UxC U308 Weekly

Indicator Price") during the applicable semi-annual period (or such shorter

period of time, if applicable) according to the table below:

----------------------------------------------

UxC U3O8 Weekly Annual

Indicator Price (in US$) Interest Rate

Up to $54.99 8.50%

$55.00 - $59.99 9.00%

$60.00 - $64.99 9.50%

$65.00 - $69.99 10.00%

$70.00 - $74.99 10.50%

$75.00 - $79.99 11.00%

$80.00 - $84.99 11.50%

$85.00 - $89.99 12.00%

$90.00 - $94.99 12.50%

$95.00 - $99.99 13.00%

$100 and above 13.50%

----------------------------------------------

The first interest payment date is December 31, 2012, and will consist of

interest accrued from and including the Closing Date calculated in accordance

with the above table based on the simple average of the UxC U308 Weekly

Indicator Price during the stub interest payment period.

The Debentures will be convertible at the holder's option into common shares

("Common Shares") of the Company at any time prior to the close of business on

the earlier of the Maturity Date and the business day immediately preceding the

date fixed for redemption of the Debentures at a conversion price of $0.30 per

Common Share (the "Conversion Price"), being a ratio of 3,333.33 Common Shares

per $1,000 principal amount of Debentures.

The Debentures will rank subordinate in right of payment of principal and

interest to all present and future senior obligations of the Company and will

rank pari-passu to all present and future unsecured indebtedness.

The Debentures will be offered by way of a short form prospectus in all

provinces in Canada. The Company agrees that the Underwriters may distribute the

Debentures in the United States by private placement to "qualified institutional

buyers" as defined in Rule 144A, and such other jurisdictions as may be agreed

upon by the Company and the Underwriters.

The Company intends to use the net proceeds of the Offering for mine development

of the Company's existing properties, permitting of the Sheep Mountain Project,

and working capital.

About Energy Fuels

Energy Fuels Inc. is a uranium and vanadium mineral development company. The

Company recently acquired Titan Uranium Inc., including the Sheep Mountain

Project in the Crooks Gap District of Wyoming. The Company is in the process of

acquiring the U.S. mining division of Denison Mines Corp. which is anticipated

to close on June 29, 2012.

With about 61,000 acres of highly prospective uranium and vanadium properties

located in the states of Colorado, Utah, Arizona, Wyoming, and New Mexico, and

exploration properties in Saskatchewan's Athabasca Basin totalling approximately

32,000 additional acres, the Company has a full pipeline of additional

development prospects. Energy Fuels, through its wholly-owned subsidiaries,

Energy Fuels Resources Corporation, Titan Uranium Inc., and Magnum Uranium

Corp., has assembled this property portfolio along with a first class management

team, including highly skilled technical mining and milling professionals based

in Lakewood and Naturita, Colorado and Kanab, Utah.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this news release, including any information

relating to the Arrangement Agreement and completion of the Transaction between

Energy Fuels and Denison and any other statements regarding Energy Fuels' and

Denison's future expectations, beliefs, goals or prospects constitute

forward-looking information within the meaning of applicable securities

legislation (collectively, "forward-looking statements"). All statements in this

news release that are not statements of historical fact (including statements

containing the words "expects", "does not expect", "plans", "anticipates", "does

not anticipate", "believes", "intends", "estimates", "estimates", "projects",

"potential", "scheduled", "forecast", "budget" and similar expressions) should

be considered forward-looking statements. All such forward-looking statements

are subject to important risk factors and uncertainties, many of which are

beyond Energy Fuels' and Denison's ability to control or predict. A number of

important factors could cause actual results or events to differ materially from

those indicated or implied by such forward-looking statements, including without

limitation: the parties' ability to consummate the Transaction, including the

receipt of shareholder approval, court approval or the regulatory approvals

required for the Transaction may not be obtained on the terms expected or on the

anticipated schedule; the parties' ability to meet expectations regarding the

timing, completion and accounting and tax treatments of the Transaction; the

volatility of the international marketplace; and other risk factors as described

in Energy Fuels' and Denison's most recent annual information forms and annual

and quarterly financial reports.

Energy Fuels and Denison assume no obligation to update the information in this

communication, except as otherwise required by law. Additional information

identifying risks and uncertainties is contained in Energy Fuels' and Denison's

respective filings with the various provincial securities commissions which are

available online at www.sedar.com. Forward-looking statements are provided for

the purpose of providing information about the current expectations, beliefs and

plans of the management of each of Energy Fuels and Denison relating to the

future. Readers are cautioned that such statements may not be appropriate for

other purposes. Readers are also cautioned not to place undue reliance on these

forward-looking statements, that speak only as of the date hereof.

This news release and the information contained herein does not constitute an

offer of securities for sale in the United Sates. The securities have not been

and will not be registered under the United States Securities Act of 1933, as

amended, and may not be offered or sold in the United States absent registration

or an applicable exemption from such registration requirements.

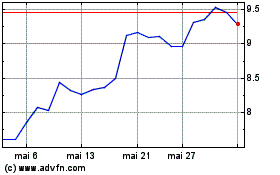

Energy Fuels (TSX:EFR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Energy Fuels (TSX:EFR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024