Energy Fuels Inc. (TSX:EFR)(OTCQX:EFRFD) ("Energy Fuels" or the "Company")

announced that today it is filing its financial results for the three and twelve

months ended September 30, 2013. The Company's Quarterly Consolidated Financial

Statements, along with Management's Discussion and Analysis, will be filed on

the System for Electronic Document Analysis and Retrieval ("SEDAR") and may be

viewed at www.sedar.com. Unless noted otherwise, all dollar amounts are in US

dollars.

As more fully described below, readers should be advised that the Company has

changed its fiscal year end from September 30 to December 31. The Company also

completed a consolidation of its common shares, effective November 5, 2013, on

the basis of 50 pre-consolidation shares for each post-consolidation share. As

of November 4, 2013, immediately prior to the 50-for-1 share consolidation,

there were 981,110,441 common shares issued and outstanding (19,622,209 on a

post-consolidation basis). All share amounts in this press release are shown on

a pre-consolidation basis, followed by the post-consolidation amount in

parenthesis. All per share amounts are shown on a post-consolidation basis.

Selected Summary Financial Information:

----------------------------------------------------------------------------

As at As at

September 30, September 30,

$000's 2013 2012

----------------------------------------------------------------------------

Financial Position:

Working Capital $ 32,496 $ 41,934

Property, plant and equipment $ 104,549 $ 119,524

Total assets $ 185,539 $ 223,844

Total long-term liabilities $ 36,177 $ 37,921

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months Twelve months

ended ended

September 30, September 30,

$000, except per share data 2013 2013

----------------------------------------------------------------------------

Results of Operations:

Total revenues $ 24,504 $ 72,472

Net loss for the period $ (70,472) $ (83,950)

Basic & diluted net loss per share $ (4.30) $ (5.76)

----------------------------------------------------------------------------

Impairment Charge for the Three Months ended September 30, 2013

As a result of the drop in both the U3O8 spot and term prices from July 1, 2013

through September 30, 2013, and the Company's expectation to place the Pinenut

mine on stand-by in July 2014, the Company tested its plant, property and

equipment for impairment and recognized an impairment loss of $60.26 million.

Financial and Operational Highlights for the Three Months ended September 30, 2013:

-- Generated cash flow from operations of $5.05 million and $7.03 million

for the 3 and 12 months ended September 30, 2013 respectively

-- Sold 256,667 pounds of U3O8, pursuant to term contracts at an average

realized price of $55.83 per pound.

-- Sold an additional 200,000 pounds of U3O8 to an existing term contract

customer at an average price of $40.25 per pound. This sale was

completed at a premium to the spot market at the time, as the Company

provided the customer with a discount on portions of its long-term

contract deliveries in the years 2015 through 2017.

-- Sold 156,447 pounds of V2O5 at an average realized price of $5.53 per

pound, and 105,232 pounds of ferro vanadium at an average price of

$11.40 per pound.

-- Production at the White Mesa Mill totaled 180,000 pounds of U3O8, all of

which was sourced from alternate feed materials. There was no production

of V2O5.

-- As of September 30, 2013, the Company had working capital of $32.5

million, including cash and cash equivalents of $12.4 million, trade and

other receivables of $9.8 million, marketable securities of $0.3 million

and 426,000 pounds of uranium concentrate inventory which, based on spot

market prices as of September 30, 2013, had a market value of $14.9

million (although the Company has no intention of selling such uranium

concentrates on the spot market). These working capital and cash amounts

do not include the proceeds of the bought deal common share offering

completed on October 16, 2013 (see Corporate Highlights since the End of

the Three Months ended September 30, 2013).

Corporate Highlights for the Three Months ended September 30, 2013:

On August 30, 2013, Energy Fuels acquired, by way of a plan of arrangement (the

"Arrangement"), all of the issued and outstanding shares of Strathmore Minerals

Corp. ("Strathmore"). Under the Arrangement, Strathmore shareholders received

1.47 common shares (0.0294 common shares on a post-consolidation basis) of

Energy Fuels for each common share of Strathmore held. In total, Energy Fuels

issued 186,420,938 common shares under the Arrangement (3,728,419 common shares

on a post-consolidation basis). Through its acquisition of Strathmore, Energy

Fuels acquired a number of mineral properties, including a 60% interest in the

Roca Honda uranium project in New Mexico, one of the largest and highest grade

uranium development projects in the U.S. The Company believes that significant

synergies could be achieved by shipping Roca Honda's U3O8 resources to the

Company's White Mesa Mill. Sumitomo Corporation of Japan holds the other 40%

interest in Roca Honda. The Company also acquired the Gas Hills uranium project

in Wyoming, which was previously being developed in a strategic venture with

Korea Electric Power Corporation. Energy Fuels believes that synergies can be

achieved by combining aspects of the Gas Hills Project with the Company's Sheep

Mountain Project, located only 28 miles away. In addition, the Company acquired

the Juniper Ridge uranium project in Wyoming. The Company is evaluating

developing the Juniper Ridge Project as a stand-alone uranium project or as part

of a regional uranium project with Sheep Mountain and/or Gas Hills.

Corporate Highlights since the End of the Three Months ended September 30, 2013:

-- On October 16, 2013, the Company completed a bought deal public offering

(the "Offering") of 31,250,000 common shares (625,000 common shares on a

post-consolidation basis) at a price of Cdn$0.16 (Cdn$8.00 on a post-

consolidation basis) per share for aggregate gross proceeds of Cdn$5.0

million.

-- In order to facilitate a listing of the Company's common shares on a

recognized US stock exchange, the Company completed a consolidation of

its common shares on the basis of 50 pre-consolidation shares for each

post-consolidation share. Approval of the consolidation was provided by

the shareholders of the Company at a special meeting of shareholders

held on October 30, 2013. The common shares of Energy Fuels began

trading on the Toronto Stock Exchange on a post-consolidation basis on

November 5, 2013.

-- On November 4, 2013, the Company decided to place shaft-sinking

activities on standby at the Canyon mine due to market conditions, and

to simplify and lessen the expense of current litigation at the mine. As

a result of this decision, the Company agreed to maintain such

activities on standby until the earlier of a decision by the Arizona

District Court on the merits of the current litigation, or December 31,

2014.

-- On November 5, 2013, the Company submitted an application to list its

common shares on a recognized US stock exchange. The Company believes

that such a listing will provide better access to US institutional and

retail investors, increased trading liquidity in terms of value traded,

decreased shareholder transaction costs, decreased share price

volatility, and will highlight the Company's strategic position within

the United States.

-- The Company changed its fiscal year end from September 30 to December

31, to better align its year-end with its major uranium customers,

certain of its major subsidiaries and industry peers. The Company

expects to report its annual results for the period beginning on October

1, 2012 and ending on December 31, 2013 ("FY-2013") on or before March

31, 2014.

Energy Fuels' Outlook for the Three Months Ended December 31, 2013 and the

Fiscal Year Ended December 31, 2014 ("FY-2014")

Since July 1, 2013, the spot price of uranium has dropped from $39.65 per lb. to

its current price of $35.35 per lb., and the long term price has dropped from

$57.00 per lb. to $50.00 per pound (see Market Outlook for the Three Months

ended December 31, 2013 & FY-2014 below). Energy Fuels believes that the current

price of U3O8 is below the average economic cost to produce U3O8 from currently

operating uranium mines around the world, and is clearly well below the average

economic cost to develop and produce from new uranium mines which will be

required to fuel the projected growth in nuclear power plants globally. This

drop in uranium prices has adversely impacted uranium production and development

plans globally (as discussed below in the Market Outlook for the Three Months

ended December 31, 2013 & FY-2014). As a result, Energy Fuels expects a very

meaningful increase in the spot price in the future, since medium- to long term

demand fundamentals remain strong, while the supply required to fulfill this

demand is generally constrained in the current uranium price environment.

Energy Fuels has U3O8 term supply contracts in place with average realized sales

prices projected to be $58.42 per pound U3O8 in FY-2014. This represents a 65%

premium to the current spot price of $35.35 per pound. In addition, as of

September 30, 2013, Energy Fuels holds 426,000 pounds of U3O8 in its inventory.

The Company is also able to purchase U3O8 in the spot market for sale into one

of these contracts, which, along with Energy Fuels' significant U3O8

inventories, provides the Company with operational flexibility with respect to

how it can meet its contract delivery requirements. The Company intends to make

spot purchases for delivery under that contract, which will enable the Company

to reduce its required near-term U3O8 production. This will allow the Company to

place its Pinenut mine on stand-by in July 2014 and to discontinue current U3O8

production at the White Mesa Mill beginning in August 2014 until the latter half

of 2015, at which time the Mill is expected to re-commence processing alternate

feed materials.

This strategy of replacing produced U3O8 with purchased U3O8 for deliveries

under this particular contract creates value for Energy Fuels by positioning the

Company to purchase U3O8 at prices lower than its production cost. This strategy

will also extend the life of mine plan at the Pinenut mine into the future by

preserving its U3O8 resources, reduce operational risk associated with

production operations and enable the Company to implement significant cost

cutting measures (see the Company's updated outlook for the three months ended

December 31, 2013 and FY-2014 for additional details on the Company's production

expectations).

At the same time, Energy Fuels will continue to position itself to realize the

economic benefits of anticipated improvements in the price of U3O8, through

select development and permitting expenditures and care and maintenance

activities. Energy Fuels has a number of projects with large U3O8 resources

including the Henry Mountains complex and the Roca Honda uranium project, which,

in a higher U3O8 price environment, have the potential to provide large,

base-load quantities of resources that could enable the White Mesa Mill to

produce U3O8 with greater operating efficiency. In addition, the Company has

extensive U3O8 resources in Wyoming for which it is evaluating a co-development

strategy that it hopes will result in a second large, stand-alone production

center. The Company intends to continue permitting activities on all of these

projects.

As outlined below, Energy Fuels provides the following updated outlook for the

three months ended December 31, 2013 and FY-2014. The Company intends to closely

monitor U3O8 prices, and may change operating plans under actual or expected

market conditions, as necessary. Accordingly, the outlook provided herein may

differ materially from actual results:

-- Uranium Sales for the three months ended December 31, 2013: The Company

does not have any uranium deliveries scheduled during the three months

ended December 31, 2013, and therefore does not expect any sales during

the quarter.

-- FY-2014 Uranium Sales: The Company forecasts FY-2014 sales to be

approximately 800,000 pounds of U3O8, all of which will be sold into

existing long-term contracts and of which 300,000 pounds is expected to

be purchased in the spot market as opposed to being produced at the

White Mesa Mill. Energy Fuels expects to earn an average realized price

of $58.42 per pound of U3O8 during FY-2014. This average realized price

per pound is not subject to any decrease resulting from declines in

future U3O8 spot and/or term prices as a result of minimum floor prices

within the Company's contract portfolio. Also, one contract has no

ceiling price. The other two contracts have certain ceiling prices which

begin to take effect if either the spot or long-term prices exceed

$90.00 per pound for one of the contracts, and if the long term price

exceeds $120.00 per pound for the other contract. This would allow the

Company to capture a significant portion of any significant improvements

in price over the remaining terms of these contracts.

-- Production for the three months ended December 31, 2013: The Company

expects to produce approximately 100,000 pounds of U3O8 during the three

months ended December 31, 2013 from alternate feed sources.

-- Production for FY-2014: The Company expects to produce approximately

400,000 to 500,000 pounds of U3O8 during FY-2014, from both conventional

ore (250,000 to 350,000 pounds) and alternate feed sources (150,000

pounds). Conventional ore processing is expected to resume during the

second quarter of FY-2014 to process ore mined through the middle of FY-

2014 from the Arizona 1 and Pinenut mines.

-- Mining Activities for the three months ended December 31, 2013: Mining

at the Arizona 1 and Pinenut mines is expected to continue during the

three months ended December 31, 2013.

-- FY-2014 Mining Activities: Subject to the results of additional

underground drilling, mining at the Arizona 1 mine is expected to cease

in early FY-2014 due to the depletion of its known resources. Mining at

the Pinenut mine is expected to continue into the middle of FY-2014, at

which point the mine is expected to be placed on care and maintenance.

Re-starting mining activities at Pinenut would be evaluated in the

context of business and market conditions, including the U3O8 price

environment.

-- Project Development for the three months ended December 31, 2013: During

the three months ended December 31, 2013, the Company expects permitting

activities to total approximately $0.6 million, primarily at the Sheep

Mountain, Roca Honda and Henry Mountains projects.

-- FY-2014 Project Development: During FY-2014, the Company expects

permitting activities to total approximately $1.3 million, primarily at

the Sheep Mountain, Roca Honda and Henry Mountains projects.

Market Outlook for the Three Months ended December 31, 2013 & FY-2014:

Similar to recent quarters, near- to medium-term uncertainty continues to lead

to weakness in the uranium market. As a result, contracted volumes have remained

low with little impetus on buyers or sellers to enter into new transactions.

According to price data from The Ux Consulting Company, LLC ("Ux"), the spot

price of uranium dropped $4.65 per lb., from $39.65 per pound at the end of the

prior quarter to $35.00 per pound on September 30, 2013. The Ux long-term price

indicator dropped $7.00 per pound from $57.00 per pound to $50.00 per pound

during the same period. The current Ux spot and long-term prices are $35.35 and

$50.00, respectively. The continued shutdown of Japanese reactors, operational

issues and scheduled shutdowns in Asia and the U.S., and the resulting build-up

in inventories are largely responsible for the continued market weakness.

The Company continues to believe that the anticipated restart of the Japanese

reactors will be an important catalyst to the market. To date, five utilities

have applied to the Japanese Regulatory Authority for the restart of fourteen

reactors. However until these (or other) catalysts occur, uranium markets will

remain uncertain.

In spite of the current uncertainty, long-term demand fundamentals in the

uranium sector remain strong. In fact, the fundamentals may be slightly stronger

than in the previous quarter. The World Nuclear Association now reports that

there are 70 nuclear reactors under construction in 13 countries, led by China

with 30 units under construction. The 70 reactors under construction represent

an increase of two units from the prior quarter. In addition, there are 487

nuclear reactors planned or proposed around the World. This represents an

increase of nine units from the prior quarter. The 70 reactors under

construction are expected to require over 100 million pounds of U3O8 for initial

cores and an additional 35 million pounds of U3O8 annually once they are in

operation.

Although long-term fundamentals remain strong, Energy Fuels believes near-to

medium-term uncertainty could lead to continued sluggishness in the uranium

market. Yet, recently announced production decreases and project deferrals may

provide further impetus for improvements in the price of uranium. Energy Fuels

recently announced the deferral of development at the Canyon Mine in Arizona, in

addition to the planned deferral of production at the Pinenut mine beginning in

the latter half of FY-2014 mentioned above. Uranium Energy Corp. recently

announced its intent to reduce mining operations at its Palangana ISR uranium

project in south Texas. Kazatomprom has announced that it will halt plans to

expand uranium production in Kazakhstan, and is projecting that annual output

from its Kazakh operations may experience uranium output reductions in 2014, the

first such reduction since expansion began earlier in the decade. Russia's

Atomredmetzoloto, including its wholly-owned Uranium One division, recently

announced that the Honeymoon project in Australia will be placed on care and

maintenance. In addition, they recently announced that they have ceased

well-field development at their Willow Creek project in Wyoming, and it has been

reported that they are ceasing all investment in new projects in Russia and

abroad and are placing a number of projects on standby. Many analysts believe a

number of other projects around the World are likely operating at a loss in the

current market environment. Energy Fuels expects additional project

cancellations and deferrals may be announced in the coming months. However, as

Japan begins to restart their reactor fleet and new nuclear units come online

worldwide, the supply of uranium for new and existing nuclear units may become

less certain, providing additional stimulus to potential increases in the price

of uranium.

Energy Fuels believes it is well positioned to respond to improved uranium

prices and to execute the Company's business plan.

Stephen P. Antony, P.E., President & CEO of Energy Fuels, is a Qualified Person

as defined by National Instrument 43-101 and has reviewed and approved the

technical disclosure contained in this document.

About Energy Fuels: Energy Fuels is currently America's largest conventional

uranium producer, expected to supply approximately 25% of the uranium produced

in the U.S. in 2013. Energy Fuels operates the White Mesa Mill, which is the

only conventional uranium mill currently operating in the U.S. The mill is

capable of processing 2,000 tons per day of uranium ore. Energy Fuels has

projects located throughout the Western U.S., including producing mines and

mineral properties in various stages of permitting and development. The

Company's common shares are listed on the Toronto Stock Exchange under the

trading symbol "EFR" and on the OTCQX under the trading symbol "EFRFD".

Cautionary Note Regarding Forward-Looking Statements: This news release contains

certain "Forward-Looking Information" and "Forward-Looking Statements" within

the meaning of applicable Canadian and United States securities legislation,

which may include, but is not limited to, statements with respect to the future

financial or operating performance of the Company and its projects and with

respect to the market outlook. Generally, these forward-looking statements can

be identified by the use of forward-looking terminology such as "plans",

"expects" "does not expect", "is expected", "is likely", "budget" "scheduled",

"estimates", "forecasts", "intends", "anticipates", "does not anticipate", or

"believes", or variations of such words and phrases, or state that certain

actions, events or results "may", "could", "would", "might" or "will be taken",

"occur", "be achieved" or "have the potential to". All statements, other than

statements of historical fact, herein are considered to be forward-looking

statements. Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results, performance

or achievements of the Company to be materially different from any future

results, performance or achievements express or implied by the forward-looking

statements. Factors that could cause actual results to differ materially from

those anticipated in these forward-looking statements are described under the

caption "Risk Factors" in the Company's Annual Information Form dated December

20, 2012, which is available for review on the System for Electronic Document

Analysis and Retrieval at www.sedar.com, and may also include the possibility

that the listing on the recognized U.S. stock exchange is not approved.

Forward-looking statements contained herein are made as of the date of this news

release, and the Company disclaims, other than as required by law, any

obligation to update any forward-looking statements whether as a result of new

information, results, future events, circumstances, or if management's estimates

or opinions should change, or otherwise. There can be no assurance that

forward-looking statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in such statements.

Accordingly, the reader is cautioned not to place undue reliance on

forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Energy Fuels Inc.

Curtis Moore

Investor Relations

(303) 974-2140 or Toll free: 1-888-864-2125

investorinfo@energyfuels.com

www.energyfuels.com

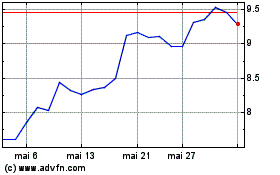

Energy Fuels (TSX:EFR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Energy Fuels (TSX:EFR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024