Will pay $0.88 per share with a record date prior to

completion of Goldcorp acquisition

Newmont Mining Corporation (NYSE: NEM) (Newmont or the Company)

today announced that its Board of Directors declared a one-time

special dividend of $0.88 per share of common stock, conditional

upon approval of the Goldcorp Inc. (NYSE: GG) (TSX: G)

(Goldcorp) transaction. The dividend will be paid to Newmont

shareholders of record as of April 17, 2019 (the record date),

which is prior to closing of the proposed Newmont Goldcorp

combination. The special dividend is conditional upon the approval

by both Newmont’s and Goldcorp’s shareholders of the resolutions to

be considered at their shareholder meetings on April 11 and April

4, 2019, respectively, in connection with the proposed transaction.

The special dividend will be paid, subject to satisfaction of the

conditions, on May 1, 2019. Closing of the Newmont Goldcorp

transaction is expected shortly after the two shareholder special

meetings if shareholders of both companies approve the

resolutions.

The special dividend delivers value to existing Newmont

shareholders with an immediate cash payment for a portion of the

synergy potential arising from the Nevada joint venture announced

with Barrick Gold Corporation (NYSE: GOLD) (TSX: ABX) (Barrick) on

March 11, 2019. The dividend will be paid to the holders of

Newmont’s currently outstanding shares as of the record date, and

not in respect of shares to be issued in connection with the

proposed Newmont Goldcorp transaction.

“We are pleased to make this special dividend payable to

Newmont’s current shareholders in recognition of the potential

synergy value of the Nevada joint venture agreement,” said Gary

Goldberg, Chief Executive Officer. “We have continued to engage

with, and have listened carefully to, our shareholders, and we are

pleased that several of our largest shareholders have expressed

their support for the combination with Goldcorp.”

Newmont also announced today that Mexico’s Competition

Commission approved the combination of Newmont and Goldcorp without

conditions. This follows clearance from the Canadian Competition

Bureau and the Korea Fair Trade Commission in February. Newmont and

Goldcorp continue cooperating with other regulatory agencies to

secure the remaining approvals that are conditions to closing.

The proposed combination with Goldcorp represents a significant

value creation opportunity for Newmont’s shareholders, providing

the combined company’s shareholders with an unmatched portfolio of

world class operations, projects, exploration opportunities,

Reserves and talent. Newmont’s Board of Directors continues to

unanimously support the transaction with Goldcorp.

Immediately upon the closing of this transaction, Newmont

Goldcorp will:

- Be accretive to Newmont’s Net Asset

Value per share by 27 percent, and 34 percent accretive to the

Company’s 2020 cash flow per share;i

- Begin delivering a combined $365

million in expected annual pre-tax synergies, supply chain

efficiencies and Full Potential improvements representing the

opportunity to create $4.4 billion in Net Present Value

(pre-tax);ii

- Target 6-7 million ounces of

steady-state gold production over a decades-long time

horizon;i

- Have the largest gold Reserves and

Resources in the gold sector, including on a per share basis;

- Be located in favorable mining

jurisdictions and prolific gold districts on four continents;

- Deliver the highest dividend among

senior gold producers;iii

- Offer financial flexibility and an

investment-grade balance sheet to advance the most promising

projects generating a targeted Internal Rate of Return (IRR) of at

least 15 percent;iv

- Feature a deep bench of accomplished

business leaders and high-performing technical teams and other

talent with extensive mining industry experience; and

- Maintain industry leadership in

environmental, social and governance performance.

As required by the terms of the Newmont/Goldcorp Arrangement

Agreement, Newmont sought and secured Goldcorp’s consent for the

payment of this special dividend.

About Newmont

Newmont is a leading gold and copper producer. The Company’s

operations are primarily in the United States, Australia, Ghana,

Peru and Suriname. Newmont is the only gold producer listed in the

S&P 500 Index and was named the mining industry leader by the

Dow Jones Sustainability World Index in 2015, 2016, 2017 and 2018.

The Company is an industry leader in value creation, supported by

its leading technical, environmental, social and safety

performance. Newmont was founded in 1921 and has been publicly

traded since 1925.

Cautionary Statement Regarding Forward-Looking

Statements:

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws and

“forward-looking information” within the meaning of applicable

Canadian securities laws. Where a forward-looking statement

expresses or implies an expectation or belief as to future events

or results, such expectation or belief is expressed in good faith

and believed to have a reasonable basis. However, such statements

are subject to risks, uncertainties and other factors, which could

cause actual results to differ materially from future results

expressed, projected or implied by the forward-looking statements.

Forward-looking statements often address our expected future

business and financial performance and financial condition, and

often contain words such as “anticipate,” “intend,” “plan,” “will,”

“would,” “estimate,” “expect,” “believe,” “target,” “indicative,”

“preliminary,” or “potential.” Forward-looking statements in this

press release may include, without limitation: (i) statements

relating to Newmont’s planned acquisition of Goldcorp (the

“proposed transaction”) and the expected terms, timing and closing

of the proposed transaction, including receipt of required

approvals and satisfaction of other customary closing conditions;

(ii) estimates of future production and sales, including expected

annual production range; (iii) estimates of future costs applicable

to sales and all-in sustaining costs; (iv) expectations regarding

accretion; (v) estimates of future capital expenditures; (vi)

estimates of future cost reductions, efficiencies and synergies,

including, without limitation, G&A savings, supply chain

efficiencies, full potential improvement, integration opportunities

and other improvements and savings; (vii) expectations regarding

future exploration and the development, growth and potential of

Newmont’s and Goldcorp’s operations, project pipeline and

investments, including, without limitation, project returns,

expected average IRR, schedule, decision dates, mine life,

commercial start, first production, capital average production,

average costs and upside potential; (viii) expectations regarding

future investments or divestitures; (ix) expectations of future

dividends and returns to stockholders, including, statements

regarding Newmont’s special dividend, including its record date and

payment date; (x) expectations of future free cash flow generation,

liquidity, balance sheet strength and credit ratings; (xi)

expectations of future equity and enterprise value; (xii)

expectations of future plans and benefits; (xiii) expectations

regarding future mineralization, including, without limitation,

expectations regarding reserves and resources, grade and

recoveries; (xiv) estimates of future closure costs and

liabilities; and (xv) the possible joint venture in Nevada,

including the potential synergies, value creation and benefits

thereof. Estimates or expectations of future events or results are

based upon certain assumptions, which may prove to be incorrect.

Such assumptions, include, but are not limited to: (i) there being

no significant change to current geotechnical, metallurgical,

hydrological and other physical conditions; (ii) permitting,

development, operations and expansion of Newmont’s and Goldcorp’s

operations and projects being consistent with current expectations

and mine plans, including, without limitation, receipt of export

approvals; (iii) political developments in any jurisdiction in

which Newmont and Goldcorp operate being consistent with its

current expectations; (iv) certain exchange rate assumptions for

the Australian dollar or the Canadian dollar to the U.S. dollar, as

well as other exchange rates being approximately consistent with

current levels; (v) certain price assumptions for gold, copper,

silver, zinc, lead and oil; (vi) prices for key supplies being

approximately consistent with current levels; (vii) the accuracy of

current mineral reserve, mineral resource and mineralized material

estimates; (viii) the satisfaction of conditions to the special

dividend payment; and (ix) other planning assumptions. Risks

relating to forward-looking statements in regard to the Newmont’s

and Goldcorp’s business and future performance may include, but are

not limited to, gold and other metals price volatility, currency

fluctuations, operational risks, increased production costs and

variances in ore grade or recovery rates from those assumed in

mining plans, political risk, community relations, conflict

resolution governmental regulation and judicial outcomes and other

risks. In addition, material risks that could cause actual results

to differ from forward-looking statements include: the inherent

uncertainty associated with financial or other projections; the

prompt and effective integration of Newmont’s and Goldcorp’s

businesses and the ability to achieve the anticipated synergies and

value-creation contemplated by the proposed transaction; the risk

associated with Newmont’s and Goldcorp’s ability to obtain the

approval of the proposed transaction by their stockholders required

to consummate the proposed transaction and the timing of the

closing of the proposed transaction, including the risk that the

conditions to the transaction are not satisfied on a timely basis

or at all and the failure of the transaction to close for any other

reason; the risk that a consent or authorization that may be

required for the proposed transaction is not obtained or is

obtained subject to conditions that are not anticipated; the

outcome of any legal proceedings that may be instituted against the

parties and others related to the arrangement agreement;

unanticipated difficulties or expenditures relating to the

transaction, the response of business partners and retention as a

result of the announcement and pendency of the transaction;

potential volatility in the price of Newmont Common Stock due to

the proposed transaction; the anticipated size of the markets and

continued demand for Newmont’s and Goldcorp’s resources and the

impact of competitive responses to the announcement of the

transaction; and the diversion of management time on

transaction-related issues. For a more detailed discussion of such

risks and other factors, see Newmont’s 2018 Annual Report on Form

10-K, filed with the Securities and Exchange Commission (SEC) as

well as the Company’s other SEC filings, available on the SEC

website or www.newmont.com, Goldcorp’s most recent annual

information form as well as Goldcorp’s other filings made with

Canadian securities regulatory authorities and available on SEDAR,

on the SEC website or www.goldcorp.com. Newmont is not affirming or

adopting any statements or reports attributed to Goldcorp

(including prior mineral reserve and resource declaration) in this

press release or made by Goldcorp outside of this press release.

Goldcorp is not affirming or adopting any statements or reports

attributed to Newmont (including prior mineral reserve and resource

declaration) in this press release or made by Newmont outside of

this press release. Newmont and Goldcorp do not undertake any

obligation to release publicly revisions to any “forward-looking

statement,” including, without limitation, outlook, to reflect

events or circumstances after the date of this press release, or to

reflect the occurrence of unanticipated events, except as may be

required under applicable securities laws. Investors should not

assume that any lack of update to a previously issued

“forward-looking statement” constitutes a reaffirmation of that

statement. Continued reliance on “forward-looking statements” is at

investors’ own risk.

Additional information about the proposed transaction and

where to find it

This communication is not intended to and does not constitute an

offer to sell or the solicitation of an offer to subscribe for or

buy or an invitation to purchase or subscribe for any securities or

the solicitation of any vote or approval in any jurisdiction, nor

shall there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law. This communication

is being made in respect of the proposed transaction involving the

Company and Goldcorp pursuant to the terms of an Arrangement

Agreement by and among the Company and Goldcorp and may be deemed

to be soliciting material relating to the proposed transaction. In

connection with the proposed transaction, the Company filed a proxy

statement relating to a special meeting of its stockholders with

the SEC on March 11, 2019. Additionally, the Company filed and will

file other relevant materials in connection with the proposed

transaction with the SEC. Security holders of the Company are urged

to read the proxy statement regarding the proposed transaction and

any other relevant materials carefully in their entirety when they

become available before making any voting or investment decision

with respect to the proposed transaction because they contain and

will contain important information about the proposed transaction

and the parties to the transaction. The definitive proxy statement

was mailed to the Company’s stockholders on March 14, 2019.

Stockholders of the Company are able to obtain a copy of the proxy

statement, the filings with the SEC that have been and will be

incorporated by reference into the proxy statement as well as other

filings containing information about the proposed transaction and

the parties to the transaction made by the Company with the SEC

free of charge at the SEC’s website at www.sec.gov, on the

Company’s website at

www.newmont.com/investor-relations/default.aspx or by contacting

the Company’s Investor Relations department at

jessica.largent@newmont.com or by calling 303-837-5484. Copies of

the documents filed with the SEC by Goldcorp are available free of

charge at the SEC’s website at www.sec.gov.

Participants in the proposed transaction solicitation

The Company and its directors, its executive officers, members

of its management, its employees and other persons, under SEC

rules, may be deemed to be participants in the solicitation of

proxies of the Company’s stockholders in connection with the

proposed transaction. Investors and security holders may obtain

more detailed information regarding the names, affiliations and

interests of certain of the Company’s executive officers and

directors in the solicitation by reading the Company’s 2018 Annual

Report on Form 10-K filed with the SEC on February 21, 2019, its

proxy statement relating to its 2018 Annual Meeting of Stockholders

filed with the SEC on March 9, 2018 and other relevant materials

filed with the SEC when they become available. Additional

information regarding the interests of such potential participants

in the solicitation of proxies in connection with the proposed

transaction are set forth in the proxy statement relating to the

transaction filed with the SEC on March 11, 2019, and mailed to

stockholders March 14, 2019. Additional information concerning

Goldcorp’ executive officers and directors is set forth in its 2017

Annual Report on Form 40-F filed with the SEC on March 23, 2018,

its management information circular relating to its 2018 Annual

Meeting of Stockholders filed with the SEC on March 16, 2018 and

other relevant materials filed with the SEC when they become

available.

i Caution Regarding Projections: Projections used in this

release are considered “forward-looking statements.” See cautionary

statement above regarding forward-looking statements.

Forward-looking information representing post-closing expectations

is inherently uncertain. Estimates such as expected accretion, NAV,

Net Present Value creation, synergies, expected future production,

IRR, financial flexibility and balance sheet strength are

preliminary in nature. There can be no assurance that the proposed

transaction will close or that the forward-looking information will

prove to be accurate.ii Net Present Value (NPV) creation as used in

this release is a management estimate provided for illustrative

purposes, and should not be considered a GAAP or non-GAAP financial

measure. NPV creation represents management’s combined estimate of

pre-tax synergies, supply chain efficiencies and Full Potential

improvements, as a result of the proposed transaction that have

been monetized and projected over a twenty year period for purposes

of the estimation, applying a discount rate of 5 percent. Such

estimates are necessarily imprecise and are based on numerous

judgments and assumptions. Expected NPV creation is a

“forward-looking statement” subject to risks, uncertainties and

other factors which could cause actual value creation to differ

from expected value creation.iii 2019 dividends beyond Q1 2019 have

not yet been approved or declared by the Board of Directors.

Management’s expectations with respect to future dividends or

annualized dividends are “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

which are intended to be covered by the safe harbor created by such

sections and other applicable laws. Investors are cautioned that

such statements with respect to future dividends are non-binding.

The declaration and payment of future dividends remain at the

discretion of the Board of Directors and will be determined based

on Newmont’s financial results, balance sheet strength, cash and

liquidity requirements, future prospects, gold and commodity

prices, and other factors deemed relevant by the Board. The Board

of Directors reserves all powers related to the declaration and

payment of dividends. Consequently, in determining the dividend to

be declared and paid on the common stock of the Company, the Board

of Directors may revise or terminate the payment level at any time

without prior notice. As a result, investors should not place undue

reliance on such statements.iv IRR targets on projects are

calculated using an assumed $1,200 gold price.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190325005212/en/

Media ContactOmar

Jabara303-837-5114omar.jabara@newmont.com

Investor ContactJessica

Largent303-837-5484jessica.largent@newmont.com

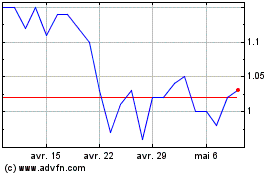

Augusta Gold (TSX:G)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Augusta Gold (TSX:G)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025