Newmont Mining Corporation (NYSE: NEM) (Newmont or the Company)

today announced that, in connection with the previously announced

offers to exchange (each, an “Exchange Offer” and, collectively,

the “Exchange Offers”) any and all outstanding notes issued by

Goldcorp Inc. (NYSE: GG, TSX: G) (“Goldcorp”) (the “Existing

Goldcorp Notes”) for (1) up to $2,000,000,000 aggregate principal

amount of new notes to be issued by Newmont (the “New Newmont

Notes”) and (2) cash, and related consent solicitations (each, a

“Consent Solicitation” and, collectively, the “Consent

Solicitations”) to adopt certain proposed amendments to each of the

indentures governing the Existing Goldcorp Notes (the “Existing

Goldcorp Indentures Amendments”), Newmont has received tenders with

respect to the aggregate principal amounts of Existing Goldcorp

Notes set forth below, which constitute the requisite number of

consents to adopt the Existing Goldcorp Indentures Amendments with

respect to each of the three outstanding series of the Existing

Goldcorp Notes that are subject to the Exchange Offers and the

Consent Solicitations. Goldcorp intends to enter into a

supplemental indenture with the trustee for the Existing Goldcorp

Notes to implement the Existing Goldcorp Indentures Amendments (the

“Supplemental Indenture”) on or prior to the settlement date of the

Exchange Offers and the Consent Solicitations.

Withdrawal rights for the Exchange Offers and the Consent

Solicitations expired as of 5:00 p.m., New York City time, on March

28, 2019 (the “Withdrawal Deadline”). As of the Withdrawal

Deadline, the following principal amounts of each series of the

Existing Goldcorp Notes have been validly tendered and not validly

withdrawn (and consents thereby validly delivered and not validly

revoked):

Title of Series / CUSIP Number of Aggregate

Principal Existing Goldcorp Notes Tendered as of

Existing Goldcorp Notes Amount Outstanding

Withdrawal Deadline Principal Amount

Percentage 3.625% Notes due 2021 / 380956 AF9 $550,000,000

471,602,000 85.75% 3.700% Notes due 2023 / 380956 AD4

$1,000,000,000 809,245,000 80.92% 5.450% Notes due 2044 / 380956

AE2 $450,000,000 443,494,000 98.55%

Holders who validly tendered (and did not validly withdraw)

their Existing Goldcorp Notes at or prior to 5:00 p.m., New York

City time, on March 28, 2019, will be eligible to receive $1,000

principal amount of corresponding New Newmont Notes and $1.00 in

cash, or the Total Exchange Consideration, which includes an early

tender premium of $30 principal amount of corresponding New Newmont

Notes and $1.00 in cash (the “Early Tender Premium”), for each

$1,000 principal amount of the Existing Goldcorp Notes accepted for

exchange on the settlement date. Holders who validly tender their

Existing Goldcorp Notes after the Early Tender Date but prior to

the Expiration Date, will not be eligible to receive the applicable

Early Tender Premium and, accordingly, will only be eligible to

receive $970 principal amount of corresponding New Newmont Notes,

or the Exchange Consideration, for each $1,000 principal amount of

the Existing Goldcorp Notes accepted for exchange on the settlement

date.

The Exchange Offers and the Consent Solicitations are being made

pursuant to the terms and subject to the conditions set forth in

the offering memorandum and consent solicitation statement, dated

March 15, 2019 (the “Offering Memorandum and Consent Solicitation

Statement”), and accompanying letter of transmittal and consent

(the “Letter of Transmittal and Consent”). The terms of the

Exchange Offers and the Consent Solicitations remain as set forth

in the Offering Memorandum and Consent Solicitation Statement and

the Letter of Transmittal and Consent.

The Exchange Offers, the Consent Solicitations and the

effectiveness of the Supplemental Indenture are conditioned upon

the consummation of the proposed arrangement (the “Arrangement”)

between Newmont and Goldcorp pursuant to the Arrangement Agreement,

dated as of January 14, 2019, as amended by the First Amendment to

the Arrangement Agreement, dated as of February 19, 2019 (as may be

further amended, supplemented or otherwise modified from time to

time, the “Arrangement Agreement”), pursuant to which Newmont will

acquire all of the outstanding common shares of Goldcorp in

exchange for newly issued shares of Newmont’s common stock and cash

consideration.

The Exchange Offers and the Consent Solicitations will expire at

9:00 a.m., New York City time, on April 12, 2019, unless extended

(the “Expiration Date”). The settlement date is expected to be

promptly after the Expiration Date. Newmont reserves the right to

terminate, withdraw, amend or extend the Exchange Offers and the

Consent Solicitations in its sole discretion.

Documents relating to the Exchange Offers and the Consent

Solicitations have been and will only be distributed to eligible

holders of Existing Goldcorp Notes who complete and return an

eligibility form confirming that they are either (a) a “Qualified

Institutional Buyer,” as that term is defined in Rule 144A under

the Securities Act of 1933, as amended (the “Securities Act”), or

(b) a person that is outside the “United States” and is (i) not a

“U.S. person,” as those terms are defined in Rule 902 under the

Securities Act and (ii) a “non-U.S. qualified offeree” (as defined

in the Offering Memorandum and Consent Solicitation Statement). In

addition, if the eligible holder of Existing Goldcorp Notes is a

resident of Canada, such eligible holder must also certify that it

is an “accredited investor,” as such term is defined in National

Instrument 45-106—Prospectus Exemptions or Section 73.3(1) of the

Securities Act (Ontario), as applicable, and is a “permitted

client,” as such term is defined in National Instrument

31-103—Registration Requirements, Exemptions and Ongoing Registrant

Obligations. The complete terms and conditions of the Exchange

Offers and the Consent Solicitations are described in the Offering

Memorandum and Consent Solicitation Statement and the Letter of

Transmittal and Consent, copies of which may be obtained by

contacting Global Bondholder Services Corporation, the exchange

agent and the information agent in connection with the Exchange

Offers and the Consent Solicitations, at (866) 807-2200 (toll free)

or (212) 430-3774 (banks and brokers). The eligibility form is

available electronically at

http://gbsc-usa.com/eligibility/newmont.

This press release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, or the

solicitation of tenders or consents with respect to, any security.

No offer, solicitation, purchase or sale will be made in any

jurisdiction in which such an offer, solicitation, purchase or sale

would be unlawful. The Exchange Offers and the Consent

Solicitations are being made solely pursuant to the Offering

Memorandum and Consent Solicitation Statement and the Letter of

Transmittal and Consent and only to such persons and in such

jurisdictions as is permitted under applicable law.

The New Newmont Notes have not been and will not be registered

under the Securities Act or any state or foreign securities laws.

Therefore, the New Newmont Notes may not be offered or sold absent

registration or an applicable exemption from the registration

requirements of the Securities Act and any applicable state

securities laws or applicable foreign securities laws.

About Newmont

Newmont is a leading gold and copper producer. Newmont’s

operations are primarily in the United States, Australia, Ghana,

Peru and Suriname. Newmont is the only gold producer listed in the

S&P 500 Index and was named the mining industry leader by the

Dow Jones Sustainability World Index in 2015, 2016, 2017 and 2018.

Newmont is an industry leader in value creation, supported by its

leading technical, environmental, social and safety performance.

Newmont was founded in 1921 and has been publicly traded since

1925.

About Goldcorp

Goldcorp is a senior gold producer focused on responsible mining

practices with safe, low-cost production from a high-quality

portfolio of mines.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act and Section 21E of

the Securities Exchange Act of 1934, as amended, which are intended

to be covered by the safe harbor created by such sections and other

applicable laws and “forward-looking information” within the

meaning of applicable Canadian securities laws. Where a

forward-looking statement expresses or implies an expectation or

belief as to future events or results, such expectation or belief

is expressed in good faith and believed to have a reasonable basis.

However, such statements are subject to risks, uncertainties and

other factors, which could cause actual results to differ

materially from future results expressed, projected or implied by

the forward-looking statements. Forward-looking statements often

address our expected future business and financial performance and

financial condition, and often contain words such as “anticipate,”

“intend,” “plan,” “will,” “would,” “estimate,” “expect,” “believe,”

“target,” “indicative,” “preliminary” or “potential.”

Forward-looking statements may include, without limitation,

statements relating to the Arrangement and the expected terms,

timing and closing of the Arrangement, including receipt of

required approvals and satisfaction of other customary closing

conditions and expected benefits and opportunities of the

Arrangement, including in connection with integration and value

creation. Estimates or expectations of future events or results are

based upon certain assumptions, which may prove to be incorrect.

Such assumptions, include, but are not limited to: (i) there

being no significant change to current geotechnical, metallurgical,

hydrological and other physical conditions; (ii) permitting,

development, operations and expansion of Newmont’s and Goldcorp’s

operations and projects being consistent with current expectations

and mine plans, including, without limitation, receipt of export

approvals; (iii) political developments in any jurisdiction in

which Newmont and Goldcorp operate being consistent with its

current expectations; (iv) certain exchange rate assumptions

for the Australian dollar or the Canadian dollar to the U.S.

dollar, as well as other exchange rates being approximately

consistent with current levels; (v) certain price assumptions

for gold, copper, silver, zinc, lead and oil; (vi) prices for

key supplies being approximately consistent with current levels;

(vii) the accuracy of current mineral reserve, mineral

resource and mineralized material estimates; and (viii) other

planning assumptions. Risks relating to forward-looking statements

in regard to Newmont and Goldcorp’s business and future performance

may include, but are not limited to, gold and other metals price

volatility, currency fluctuations, operational risks, increased

production costs and variances in ore grade or recovery rates from

those assumed in mining plans, political risk, community relations,

conflict resolution governmental regulation and judicial outcomes

and other risks. In addition, material risks that could cause

actual results to differ from forward-looking statements include:

(i) the inherent uncertainty associated with financial or other

projections; (ii) the prompt and effective integration of Newmont’s

and Goldcorp’s businesses and the ability to achieve the

anticipated synergies and value-creation contemplated by the

Arrangement; (iii) the risk associated with Newmont’s and

Goldcorp’s ability to obtain the approval of the Arrangement by

their respective shareholders required to consummate the

Arrangement and the timing of the consummation of the Arrangement,

including the risk that the conditions to the Arrangement are not

satisfied on a timely basis or at all and the failure of the

Arrangement to close for any other reason; (iv) the risk that a

consent or authorization that may be required for the Arrangement

is not obtained or is obtained subject to conditions that are not

anticipated; (v) the outcome of any legal proceedings that may be

instituted against the parties and others related to the

Arrangement Agreement; (vi) unanticipated difficulties or

expenditures relating to the Arrangement, the response of business

partners and retention as a result of the announcement and pendency

of the Arrangement; (vii) potential volatility in the price of

Newmont common stock due to the Arrangement; (viii) the anticipated

size of the markets and continued demand for Newmont’s and

Goldcorp’s resources and the impact of competitive responses to the

announcement of the Arrangement; and (ix) the diversion of

management time on transaction-related issues. For a more detailed

discussion of such risks and other factors, see Newmont’s Annual

Report on Form 10-K for the year ended December 31, 2018 filed

with the Securities and Exchange Commission (the “SEC”) as well as

the Newmont’s other filings with the SEC, available on the SEC’s

website or www.newmont.com, Goldcorp’s most recent annual

information form as well as Goldcorp’s other filings made with

Canadian securities regulatory authorities and available on SEDAR,

on the SEC’s website or www.goldcorp.com. Newmont is not affirming

or adopting any statements or reports attributed to Goldcorp

(including prior mineral reserve and resource declaration) in this

press release or made by Goldcorp outside of this press release.

Goldcorp is not affirming or adopting any statements or reports

attributed to Newmont (including prior mineral reserve and resource

declaration) in this press release or made by Newmont outside of

this press release. Newmont and Goldcorp do not undertake any

obligation to communicate publicly revisions to any

“forward-looking statement,” including, without limitation,

outlook, to reflect events or circumstances after the date of this

press release or to reflect the occurrence of unanticipated events,

except as may be required under applicable securities laws.

Investors should not assume that any lack of update to a previously

issued “forward-looking statement” constitutes a reaffirmation of

that statement. Continued reliance on “forward-looking statements”

is at investors’ own risk.

Additional Information about the Arrangement and Where to

Find It

This press release is not intended to and does not constitute an

offer to sell or the solicitation of an offer to subscribe for or

buy or an invitation to purchase or subscribe for any securities or

the solicitation of any vote or approval in any jurisdiction, nor

shall there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law. This press release

is being made in respect of the Arrangement involving Newmont and

Goldcorp pursuant to the terms of an Arrangement Agreement and may

be deemed to be soliciting material relating to the Arrangement. In

connection with the Arrangement, Newmont filed a proxy statement

relating to a special meeting of its stockholders with the SEC on

March 11, 2019. Additionally, Newmont has filed and will file other

relevant materials in connection with the Arrangement with the SEC.

Security holders of Newmont are urged to read the proxy statement

regarding the Arrangement and any other relevant materials

carefully in their entirety when they become available before

making any voting or investment decision with respect to the

Arrangement because they contain and will contain important

information about the Arrangement and the parties thereto. The

definitive proxy statement was mailed to Newmont’s stockholders on

March 14, 2019. Stockholders of Newmont are able to obtain a copy

of the proxy statement, the filings with the SEC that will be

incorporated by reference into the proxy statement as well as other

filings containing information about the Arrangement and the

parties thereto made by Newmont with the SEC free of charge at the

SEC’s website at www.sec.gov, on Newmont’s website at

www.newmont.com/investor-relations/default.aspx or by contacting

the Company’s Investor Relations department at

jessica.largent@newmont.com or by calling (303) 837-5484. Copies of

the documents filed with the SEC by Goldcorp are available free of

charge at the SEC’s website at www.sec.gov.

Participants in the Proposed Arrangement Solicitation

Newmont and its directors, its executive officers, members of

its management, its employees and other persons, under the SEC

rules, may be deemed to be participants in the solicitation of

proxies of Newmont’s stockholders in connection with the

Arrangement. Investors and security holders may obtain more

detailed information regarding the names, affiliations and

interests of certain of Newmont’s executive officers and directors

in the solicitation by reading Newmont’s Annual Report on Form 10-K

for the year ended December 31, 2018 filed with the SEC on February

21, 2019, its proxy statement relating to its 2018 Annual Meeting

of Stockholders filed with the SEC on March 9, 2018 and other

relevant materials filed with the SEC when they become available.

Additional information regarding the interests of such potential

participants in the solicitation of proxies in connection with the

Arrangement is set forth in the proxy statement relating to the

transaction filed with the SEC on March 11, 2019 and mailed to

stockholders on March 14, 2019. Additional information concerning

Goldcorp’s executive officers and directors is set forth in

Goldcorp’s Annual Report on Form 40-F for the year ended December

31, 2018 filed with the SEC on March 28, 2019, its management

information circular relating to its 2018 Annual Meeting of

Stockholders filed with the SEC on March 16, 2018 and other

relevant materials filed with the SEC when they become

available.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190328006002/en/

Media ContactOmar Jabara,

303.837.5114omar.jabara@newmont.comInvestor

ContactJessica Largent,

303.837.5484jessica.largent@newmont.com

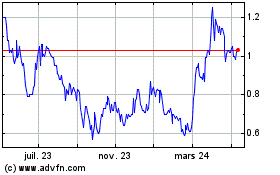

Augusta Gold (TSX:G)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

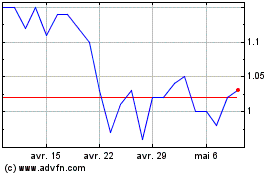

Augusta Gold (TSX:G)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024